New York Life Life Insurance

When it comes to securing your loved ones' future and ensuring financial stability, life insurance plays a pivotal role. Among the myriad of options available, New York Life's life insurance policies have stood the test of time, offering comprehensive coverage and a legacy of trust. In this in-depth exploration, we will delve into the intricacies of New York Life's life insurance offerings, highlighting their unique features, benefits, and the impact they can have on your financial planning.

A Legacy of Financial Protection: New York Life’s Life Insurance Journey

With a rich history dating back to 1845, New York Life has been a stalwart in the life insurance industry, evolving and adapting to meet the changing needs of its policyholders. Over the years, the company has built a reputation for reliability, innovation, and a deep-rooted commitment to its customers. Their life insurance products are designed to provide a safety net, offering peace of mind and a promise of financial security to individuals and families across the nation.

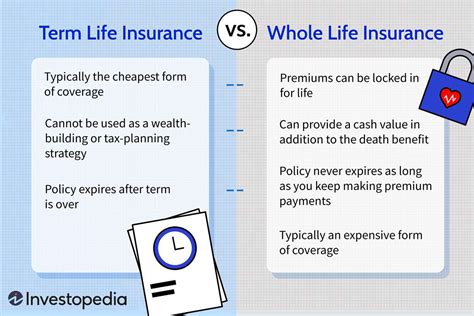

New York Life's life insurance portfolio is diverse, catering to a wide range of needs and life stages. From term life insurance, which provides temporary coverage for a specified period, to permanent life insurance policies that offer lifelong protection and accumulate cash value, their range of options ensures that every policyholder can find a plan that aligns with their financial goals and circumstances.

Unveiling the Benefits: A Comprehensive Look at New York Life’s Life Insurance Policies

New York Life’s life insurance policies are renowned for their comprehensive coverage and added benefits. Here’s an in-depth breakdown of what sets their offerings apart:

Term Life Insurance: Temporary Protection with Maximum Flexibility

Term life insurance is an affordable and flexible option for individuals seeking coverage for a specific period, typically ranging from 10 to 30 years. With New York Life’s term life policies, policyholders can enjoy:

- Customizable Coverage: Choose a term length that aligns with your needs, whether it's covering a mortgage, protecting your children until they become independent, or providing financial support during your working years.

- Affordable Premiums: Term life insurance is known for its cost-effectiveness, making it an accessible option for many. The premiums remain fixed throughout the term, ensuring predictable expenses.

- Renewal Options: As the term nears its end, policyholders have the option to renew their coverage, often at a higher premium to account for increased age and potential health changes.

- Conversion Privileges: New York Life allows policyholders to convert their term life insurance into permanent life insurance, providing an opportunity to transition to lifelong coverage if their financial needs evolve.

Permanent Life Insurance: Lifelong Protection and Cash Value

Permanent life insurance, such as whole life or universal life insurance, offers more than just long-term coverage. These policies accumulate cash value over time, providing additional financial benefits. Here’s a closer look:

- Lifelong Coverage: Permanent life insurance policies ensure that your loved ones are protected for as long as you need, regardless of your age or health status.

- Cash Value Accumulation: A portion of your premium payments goes towards building cash value within the policy. This cash value can be borrowed against, used to pay premiums, or withdrawn tax-free under certain conditions.

- Flexible Premiums: Universal life insurance, in particular, offers flexible premium payments, allowing policyholders to adjust their contributions based on their financial situation.

- Investment Options: Some permanent life insurance policies provide investment opportunities within the cash value, enabling policyholders to potentially grow their savings.

Rider Options: Tailoring Your Policy to Your Unique Needs

New York Life understands that every individual’s financial situation is unique, which is why they offer a range of rider options to customize your life insurance policy. These add-ons can enhance your coverage and provide additional benefits, including:

- Waiver of Premium Rider: This rider waives premium payments if you become disabled, ensuring your policy remains active even if you're unable to work.

- Accidental Death Benefit Rider: Provides an additional death benefit if your passing is due to an accident, offering extra financial support for your beneficiaries.

- Long-Term Care Rider: Allows you to access a portion of your death benefit early if you require long-term care, providing financial assistance for caregiving costs.

- Children's Term Rider: Offers temporary term life insurance coverage for your children, ensuring they're protected during their most vulnerable years.

Performance and Financial Strength: New York Life’s Track Record

New York Life’s commitment to financial stability and strong performance is reflected in its ratings and track record. Here’s a glimpse into their financial prowess:

| Rating Agency | Financial Strength Rating |

|---|---|

| AM Best | A++ (Superior) |

| Standard & Poor's | AA+ (Very Strong) |

| Moody's | Aa2 (High Quality) |

| Fitch Ratings | AA+ (Very Strong) |

These top ratings signify New York Life's ability to meet its financial obligations and its commitment to maintaining a strong financial position, providing policyholders with added peace of mind.

The Impact on Your Financial Planning: Why Choose New York Life’s Life Insurance?

New York Life’s life insurance policies are not just about financial protection; they are an integral part of your overall financial planning strategy. Here’s how these policies can make a difference:

Peace of Mind and Financial Security

With a New York Life life insurance policy, you can rest assured that your loved ones will be financially secure in the event of your passing. The death benefit provided can cover a wide range of expenses, including funeral costs, outstanding debts, and ongoing living expenses, ensuring your family’s financial well-being.

Estate Planning and Legacy Building

Life insurance can be a powerful tool in estate planning. The death benefit can be used to pay estate taxes, ensuring your assets are distributed according to your wishes. Additionally, permanent life insurance policies with cash value accumulation can be a strategic way to build and transfer wealth to future generations.

Flexibility and Customization

New York Life’s range of life insurance options and rider choices allow you to tailor your policy to your unique needs. Whether you’re looking for temporary coverage or lifelong protection, and whether you require additional benefits like long-term care coverage, New York Life has a solution to match.

Access to Expert Guidance

When you choose New York Life, you gain access to a team of experienced financial professionals who can guide you through the complexities of life insurance. Their expertise ensures that you make informed decisions, choosing the right policy and riders to align with your financial goals.

The Bottom Line: Why New York Life’s Life Insurance Deserves Your Consideration

New York Life’s life insurance policies offer a comprehensive suite of benefits, from temporary term life insurance to permanent policies with cash value accumulation. With a strong focus on customization and added rider options, their policies can be tailored to meet individual needs. Furthermore, their financial strength and commitment to stability provide policyholders with added confidence, ensuring their financial interests are protected.

As you embark on your journey towards financial security and peace of mind, considering New York Life's life insurance offerings can be a strategic move. Their rich history, diverse range of policies, and commitment to customer satisfaction make them a trusted partner in safeguarding your loved ones' future.

What sets New York Life’s life insurance policies apart from other providers?

+New York Life’s policies stand out for their comprehensive coverage, customizable options, and strong financial stability. Their range of term and permanent life insurance policies, coupled with a variety of rider choices, ensures that policyholders can find a plan that aligns perfectly with their unique financial needs.

How do I choose between term and permanent life insurance?

+The choice between term and permanent life insurance depends on your financial goals and circumstances. Term life insurance is ideal for temporary coverage needs, such as covering a mortgage or providing financial support during specific life stages. Permanent life insurance, on the other hand, offers lifelong protection and the added benefit of cash value accumulation, making it a suitable choice for long-term financial planning and wealth transfer.

Can I customize my New York Life life insurance policy with riders?

+Absolutely! New York Life offers a range of rider options to customize your life insurance policy. These add-ons can provide additional benefits, such as waiver of premium for disability, accidental death benefit, long-term care coverage, and term life insurance for your children. Riders allow you to tailor your policy to your specific needs and enhance your financial protection.