Motor Insurance Coverage

Motor insurance, a cornerstone of the automotive industry, provides crucial financial protection for vehicle owners and drivers. This comprehensive coverage offers peace of mind, ensuring individuals are safeguarded against potential risks and liabilities associated with motor vehicle ownership and operation. The scope of motor insurance extends beyond the vehicle itself, encompassing a wide range of perils and scenarios that can impact vehicle owners and their finances. From accidents and collisions to theft and natural disasters, motor insurance is designed to offer comprehensive protection, mitigating the financial burden that unforeseen events can impose.

The Importance of Motor Insurance

Motor insurance is an essential component of responsible vehicle ownership. It serves as a critical safety net, providing financial security and peace of mind for policyholders. With the potential for costly accidents, vehicle damage, and liability claims, motor insurance plays a pivotal role in safeguarding individuals and their assets. Moreover, it is often a legal requirement in many jurisdictions, underscoring its significance in the automotive realm.

Understanding Motor Insurance Coverage

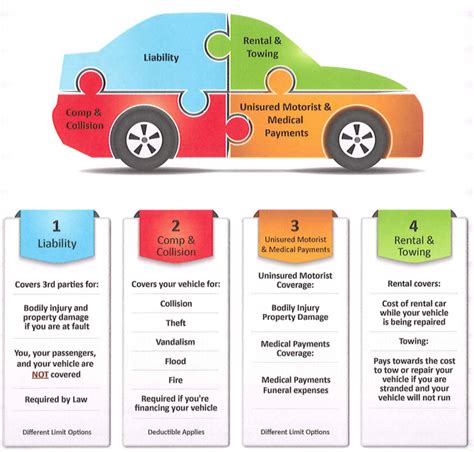

Motor insurance coverage can be tailored to meet the unique needs of individual policyholders. It typically encompasses a range of components, each designed to address specific risks and scenarios. Here’s a detailed breakdown of the key aspects of motor insurance coverage:

Comprehensive Coverage

Comprehensive coverage is the cornerstone of motor insurance, offering protection against a wide array of perils. It covers damages resulting from accidents, collisions, natural disasters, and even vandalism. This aspect of motor insurance is designed to provide a comprehensive safety net, ensuring policyholders are protected against unforeseen events that could result in costly vehicle repairs or replacements.

For instance, consider a scenario where a severe thunderstorm causes a tree branch to fall on your parked vehicle, resulting in extensive damage. Comprehensive coverage would step in to cover the cost of repairs, ensuring you aren't left with a hefty financial burden.

| Peril Covered | Description |

|---|---|

| Accidents | Covers damages arising from collisions with other vehicles or objects. |

| Natural Disasters | Protects against damages caused by natural events like storms, floods, or earthquakes. |

| Vandalism | Provides coverage for intentional damage or destruction of the insured vehicle. |

Collision Coverage

Collision coverage is a critical component of motor insurance, specifically addressing damages resulting from collisions with other vehicles, objects, or even pedestrians. This coverage is designed to protect policyholders from the financial burden of repairing or replacing their vehicles after an accident. It covers a wide range of scenarios, from minor fender benders to more severe accidents, ensuring that policyholders can get back on the road quickly and safely.

Imagine a scenario where you accidentally collide with a guardrail while navigating a sharp turn. Collision coverage would step in to cover the cost of repairing the damage to your vehicle, ensuring you aren't left with unexpected expenses.

Liability Coverage

Liability coverage is a vital aspect of motor insurance, protecting policyholders from the financial repercussions of causing harm or property damage to others while operating their vehicles. This coverage is designed to provide a safety net, ensuring that policyholders are shielded from the potentially devastating financial consequences of accidents or incidents for which they are deemed legally responsible.

For instance, if you inadvertently cause an accident that results in injuries to other individuals or damage to their property, liability coverage would step in to cover the associated costs, including medical expenses, property repairs, and legal fees.

Medical Payments Coverage

Medical payments coverage, often referred to as “med pay,” is a crucial component of motor insurance, providing essential financial support for policyholders and their passengers in the event of an accident. This coverage is designed to cover medical expenses arising from injuries sustained during a covered accident, regardless of who is at fault. It serves as a vital safety net, ensuring that policyholders can access the necessary medical care without being burdened by the financial strain of unexpected medical bills.

Consider a scenario where you and your passengers are involved in an accident, resulting in injuries that require immediate medical attention. Medical payments coverage would step in to cover the cost of emergency room visits, hospital stays, doctor's fees, and other related medical expenses, providing much-needed financial relief during a stressful and challenging time.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is a critical component of motor insurance, providing essential protection for policyholders in the event of an accident involving an uninsured or underinsured driver. This coverage is designed to bridge the gap between the at-fault driver’s insurance coverage and the actual damages sustained by the policyholder, ensuring that they are not left to bear the financial burden of an accident caused by an uninsured or underinsured individual.

Imagine a scenario where you are involved in an accident with a driver who lacks adequate insurance coverage. Uninsured/underinsured motorist coverage would step in to cover the difference between the at-fault driver's policy limits and the actual damages you incurred, ensuring that you are fully compensated for your losses.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is a vital aspect of motor insurance, providing comprehensive coverage for policyholders and their passengers in the event of an accident. This coverage is designed to cover a wide range of medical expenses and lost wages resulting from injuries sustained during a covered accident, regardless of who is at fault. PIP serves as a critical safety net, ensuring that policyholders can access the necessary medical care and financial support during their recovery without facing the added stress of financial strain.

For instance, if you are involved in an accident that results in injuries that prevent you from working for an extended period, PIP would step in to cover your lost wages, ensuring that you can continue to meet your financial obligations while you focus on your recovery.

Rental Car Coverage

Rental car coverage is a valuable addition to motor insurance, providing policyholders with the financial support they need to secure a rental vehicle in the event their insured vehicle is rendered inoperable due to an accident or other covered event. This coverage is designed to bridge the gap between the time it takes to repair or replace the insured vehicle and the policyholder’s need for an alternative means of transportation. It ensures that policyholders can maintain their mobility and continue their daily routines without the added financial burden of renting a vehicle.

Consider a scenario where your vehicle is involved in an accident and requires extensive repairs, rendering it unusable for an extended period. Rental car coverage would step in to cover the cost of renting a comparable vehicle, ensuring that you can continue your daily commute, run errands, and maintain your regular schedule while your insured vehicle is being repaired.

Custom Parts and Equipment Coverage

Custom parts and equipment coverage is a specialized aspect of motor insurance, designed to protect policyholders who have made significant modifications or additions to their vehicles. This coverage is tailored to address the unique needs of individuals who have invested in custom parts, accessories, or equipment, ensuring that these enhancements are adequately insured and protected.

For instance, if you have customized your vehicle with a high-performance engine, unique body kits, or specialized audio equipment, custom parts and equipment coverage would ensure that these modifications are covered in the event of an accident or other covered event. This coverage provides peace of mind, knowing that your investments in enhancing your vehicle are safeguarded.

Roadside Assistance

Roadside assistance is a valuable service included in many motor insurance policies, providing policyholders with essential support in the event of a breakdown or other emergencies while on the road. This coverage is designed to offer peace of mind, ensuring that policyholders have access to prompt and reliable assistance when they need it most. Whether it’s a flat tire, a dead battery, or a vehicle that won’t start, roadside assistance is there to provide a helping hand, getting policyholders back on the road safely and efficiently.

Imagine a scenario where you're traveling on a remote highway and your vehicle suddenly breaks down. With roadside assistance coverage, you can simply make a call and have a team of professionals dispatched to your location. They'll arrive promptly, equipped with the tools and expertise needed to address the issue, whether it's a simple fix or a more complex repair.

Choosing the Right Motor Insurance Policy

Selecting the right motor insurance policy is a crucial decision that requires careful consideration. It’s essential to assess your specific needs, the value of your vehicle, and the risks you’re exposed to on the road. Here are some key factors to keep in mind when choosing a motor insurance policy:

- Coverage Limits: Evaluate the coverage limits offered by different policies. Ensure that the limits align with your needs and provide adequate protection for your vehicle and potential liabilities.

- Deductibles: Consider the deductibles associated with each policy. Higher deductibles can result in lower premiums, but it's important to strike a balance that ensures you can afford the deductible in the event of a claim.

- Additional Coverages: Review the additional coverages offered by different policies. Custom parts and equipment coverage, rental car coverage, and roadside assistance are valuable additions that can enhance your protection and provide added peace of mind.

- Reputation and Financial Stability: Research the reputation and financial stability of the insurance provider. Choosing a reputable insurer ensures that you'll receive reliable and timely support in the event of a claim.

- Discounts and Bundling: Explore opportunities for discounts and bundling. Many insurers offer discounts for safe driving records, loyalty, or when you bundle your motor insurance with other policies, such as home or life insurance.

By carefully evaluating these factors and comparing different motor insurance policies, you can make an informed decision that aligns with your needs and provides the comprehensive protection you require.

Frequently Asked Questions (FAQ)

What is the difference between comprehensive and collision coverage in motor insurance?

+Comprehensive coverage protects against a wide range of perils, including accidents, natural disasters, and vandalism, while collision coverage specifically addresses damages resulting from collisions with other vehicles or objects. Comprehensive coverage offers a broader safety net, while collision coverage is more focused on accident-related damages.

How does liability coverage work in motor insurance?

+Liability coverage protects policyholders from financial losses arising from accidents they cause. It covers damages to other vehicles, property, and injuries to other individuals. It is designed to provide financial protection in the event of legal claims or lawsuits resulting from an accident.

What is the significance of medical payments coverage in motor insurance?

+Medical payments coverage, or “med pay,” is crucial as it covers medical expenses for policyholders and their passengers, regardless of fault. It provides immediate financial support for medical care, ensuring that policyholders can access necessary treatment without delay or financial strain.

Why is uninsured/underinsured motorist coverage important?

+Uninsured/underinsured motorist coverage protects policyholders when involved in an accident with a driver who lacks adequate insurance. It bridges the gap between the at-fault driver’s coverage and the actual damages sustained, ensuring policyholders are fully compensated for their losses.

How does rental car coverage benefit policyholders in motor insurance?

+Rental car coverage provides financial support for policyholders to secure a rental vehicle when their insured vehicle is inoperable due to an accident or other covered event. It ensures continuity of transportation, allowing policyholders to maintain their daily routines without added financial burden.