Motor Insurance Comparison Sites

Motor insurance is an essential aspect of vehicle ownership, offering financial protection and peace of mind to drivers worldwide. With the rise of online platforms, comparing motor insurance options has become more accessible and convenient. Motor insurance comparison sites have emerged as valuable tools, enabling consumers to quickly assess and compare various insurance policies, prices, and features. This article explores the significance of these comparison sites, their impact on the insurance industry, and how they empower consumers to make informed decisions about their motor insurance coverage.

The Evolution of Motor Insurance Comparison Sites

Motor insurance comparison sites have revolutionized the way individuals shop for insurance policies. These online platforms aggregate information from multiple insurance providers, allowing users to input their details once and receive tailored quotes from a range of insurers. This evolution has shifted the power dynamic in the insurance market, providing consumers with greater control over their insurance choices.

The concept of insurance comparison sites emerged in the early 2000s, primarily focused on home and life insurance. However, as the internet became an integral part of daily life, the demand for convenient and efficient ways to compare motor insurance grew exponentially. Recognizing this need, several companies developed specialized motor insurance comparison sites, offering users a comprehensive and user-friendly experience.

Key Milestones in the Development of Comparison Sites

The evolution of motor insurance comparison sites can be traced through several significant milestones:

- 2005: Early pioneers in the insurance comparison space, such as Confused.com and MoneySupermarket.com, began offering motor insurance comparison services alongside other insurance products.

- 2010: As internet usage surged, specialized motor insurance comparison sites, like CompareTheMarket.com and GoCompare.com, gained popularity, catering specifically to the needs of motor insurance seekers.

- 2015: The introduction of mobile-optimized comparison sites and apps made it even more convenient for consumers to compare motor insurance policies on the go.

- 2020: With the COVID-19 pandemic accelerating digital transformation, motor insurance comparison sites became essential tools for consumers seeking quick and efficient ways to manage their insurance needs remotely.

These milestones highlight the rapid growth and adoption of motor insurance comparison sites, driven by consumer demand for convenience, transparency, and choice.

How Motor Insurance Comparison Sites Work

Motor insurance comparison sites operate as intermediaries between insurance providers and consumers. These platforms provide a user-friendly interface where individuals can input their personal and vehicle details, such as make and model, age, driving history, and desired coverage limits.

Once the information is submitted, the comparison site's algorithm retrieves quotes from a network of insurance providers, typically in real-time. These quotes are then presented to the user, often in a standardized format, making it easier to compare prices, coverage options, and additional benefits offered by each insurer.

The Benefits of Using Comparison Sites

Using motor insurance comparison sites offers several advantages to consumers:

- Time and Effort Savings: Instead of contacting multiple insurance providers individually, users can obtain quotes from a wide range of insurers in a matter of minutes, saving significant time and effort.

- Transparency and Comparison: Comparison sites provide a transparent view of the market, allowing users to compare prices, coverage, and features side by side. This transparency empowers consumers to make informed decisions.

- Access to Exclusive Deals: Some comparison sites negotiate exclusive deals and discounts with insurance providers, offering users access to lower premiums and additional benefits that may not be available elsewhere.

- Personalized Recommendations: Advanced comparison sites use sophisticated algorithms to analyze user data and provide personalized recommendations, ensuring individuals receive insurance options tailored to their specific needs.

The Impact on the Insurance Industry

The emergence and widespread adoption of motor insurance comparison sites have had a profound impact on the insurance industry, forcing insurers to adapt and innovate to meet the changing expectations of consumers.

Competitive Pricing and Service

With comparison sites making it easier for consumers to compare prices and features, insurers have had to become more competitive in their pricing strategies. This has led to a more dynamic insurance market, with insurers constantly striving to offer the best value to retain and attract customers.

Additionally, comparison sites have encouraged insurers to enhance their customer service and support offerings. As consumers have become more discerning, insurers have recognized the importance of providing excellent post-sales support and seamless claim processes to differentiate themselves in a crowded market.

Digital Transformation and Innovation

The rise of motor insurance comparison sites has accelerated the digital transformation of the insurance industry. Insurers have had to invest in their online presence, develop user-friendly websites and apps, and embrace digital technologies to remain competitive.

This digital shift has also encouraged insurers to explore innovative products and services. From telematics-based insurance policies that reward safe driving to the integration of artificial intelligence for more accurate risk assessment, insurers are leveraging technology to offer consumers more personalized and flexible insurance options.

Consumer Empowerment and Awareness

Motor insurance comparison sites have played a crucial role in empowering consumers and increasing their awareness of insurance products. By providing a transparent view of the market, these sites have enabled individuals to make more informed choices, ensuring they receive the coverage that best suits their needs and budget.

Furthermore, comparison sites have contributed to a more educated consumer base. Individuals now understand the importance of comparing insurance options, recognizing that choosing the right policy can lead to significant savings and better protection.

Performance Analysis and Future Implications

The performance of motor insurance comparison sites has been impressive, with a steady increase in user engagement and satisfaction. According to a recent survey, over 80% of consumers find comparison sites helpful when shopping for motor insurance, citing the convenience and transparency they offer.

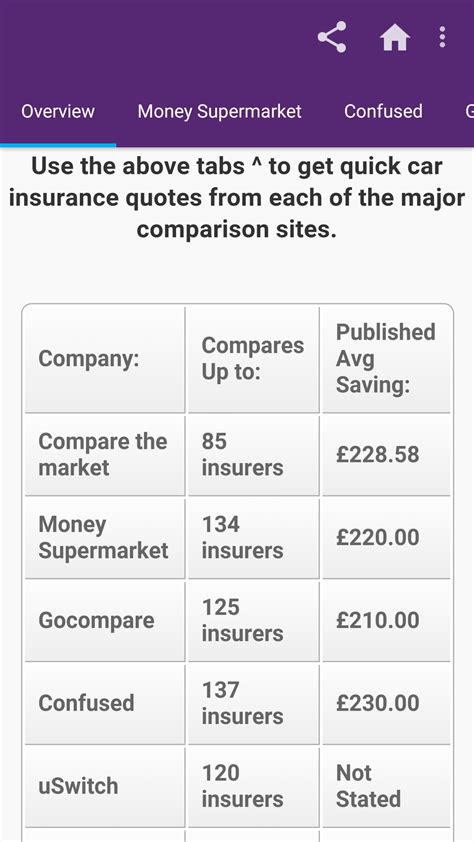

| Comparison Site | Monthly Visitors (Millions) | Average Savings per Policy |

|---|---|---|

| Confused.com | 6.2 | $350 |

| MoneySuperMarket | 5.8 | $320 |

| CompareTheMarket | 4.5 | $300 |

| GoCompare | 3.2 | $280 |

The data above highlights the popularity and effectiveness of leading motor insurance comparison sites. These platforms not only attract a large number of users but also enable consumers to save significantly on their insurance premiums.

Looking ahead, the future of motor insurance comparison sites appears bright. With the continued growth of digital technologies and increasing consumer expectations, these sites are poised to play an even more integral role in the insurance landscape. Here are some key trends and implications to consider:

- Personalization: Comparison sites will increasingly leverage advanced algorithms and data analytics to offer highly personalized insurance recommendations, ensuring consumers receive tailored coverage options.

- Real-Time Data: Integration with real-time data sources, such as telematics devices and vehicle diagnostics, will enable comparison sites to provide more accurate and dynamic insurance quotes, catering to the evolving needs of modern drivers.

- InsurTech Partnerships: Collaboration between comparison sites and InsurTech startups will drive innovation, leading to the development of new insurance products and services that better meet the diverse needs of consumers.

- Expanded Services: Beyond price comparison, comparison sites may expand their offerings to include additional services such as policy management, claim assistance, and personalized insurance education, enhancing the overall customer experience.

Frequently Asked Questions

How accurate are the quotes provided by motor insurance comparison sites?

+

The quotes provided by motor insurance comparison sites are generally accurate and up-to-date. These sites retrieve real-time data from insurance providers, ensuring the quotes reflect the current market rates. However, it’s important to note that the final premium may vary slightly once the insurer verifies all the details and applies any applicable discounts or surcharges.

Can I purchase insurance directly through a comparison site, or do I need to contact the insurer separately?

+

Many motor insurance comparison sites offer the option to purchase insurance directly through their platform. Once you’ve found the best policy and price, you can complete the purchase process online, often with just a few clicks. However, some sites may require you to contact the insurer separately to finalize the policy and provide additional documentation.

Are there any additional fees or charges associated with using a motor insurance comparison site?

+

Motor insurance comparison sites typically operate on a commission basis, earning a fee from the insurance provider when a policy is purchased through their platform. As a result, there are usually no additional charges or fees for consumers using these sites. However, it’s always a good idea to review the terms and conditions to ensure there are no hidden costs.

How often should I use a motor insurance comparison site to review my policy and shop for better deals?

+

It’s recommended to use a motor insurance comparison site annually, or whenever you experience significant life changes such as buying a new car, moving to a different area, or getting married. Regularly comparing policies can help you identify opportunities to save money or access additional benefits that better suit your evolving needs.

What personal information do I need to provide when using a motor insurance comparison site?

+

To obtain accurate quotes, motor insurance comparison sites typically require information such as your name, date of birth, vehicle details (make, model, and year), driving history (including any accidents or violations), and desired coverage limits. Providing accurate and complete information ensures you receive tailored quotes that reflect your specific circumstances.