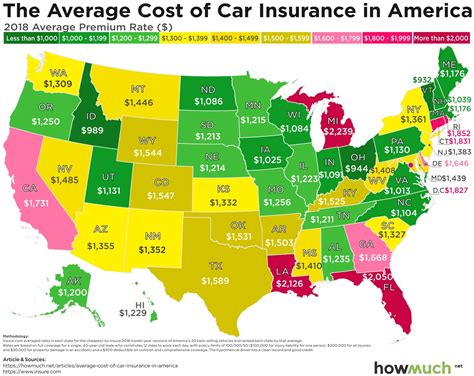

Most Affordable Auto Insurance In Florida

Florida, known for its sunny skies and vibrant culture, also presents unique challenges when it comes to finding affordable auto insurance. With a diverse range of factors influencing rates, from its coastal location to a diverse driving population, securing the most cost-effective coverage requires a strategic approach. This guide aims to empower Florida drivers with the knowledge to navigate the state's insurance landscape and identify the best value options.

Understanding the Florida Auto Insurance Market

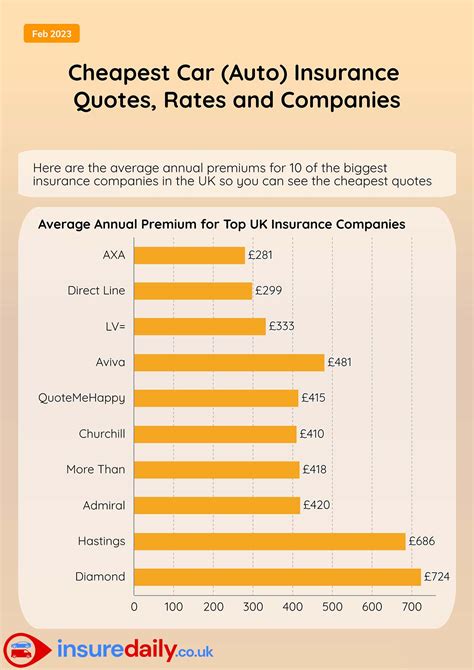

Florida’s auto insurance market is renowned for its competitiveness, making it an ideal environment for drivers seeking value. However, the diversity of providers and coverage options can make comparison a daunting task. Here’s a comprehensive breakdown to simplify the process and highlight the most affordable choices.

Key Considerations for Cost-Effective Coverage

Several critical factors influence the affordability of auto insurance in Florida. These include the provider’s financial strength, their claims processing efficiency, and the specific coverage options they offer. Additionally, the policyholder’s driving history, credit score, and location play significant roles in determining rates. Understanding these influences is essential for identifying the most suitable and cost-effective coverage.

Top Affordable Auto Insurance Providers in Florida

Florida boasts a thriving auto insurance market, with numerous providers competing for customers. Here’s an overview of some of the most cost-effective options available:

- GEICO: With a strong focus on affordability, GEICO consistently offers some of the most competitive rates in Florida. Their online-first approach and extensive discounts make them an attractive choice for budget-conscious drivers.

- Progressive: Known for its innovative pricing strategies, Progressive often provides excellent value for Florida drivers. Their Snapshot program, which uses telematics to track driving behavior, can lead to significant savings for safe drivers.

- State Farm: As one of the largest insurers in the state, State Farm offers a comprehensive range of coverage options. Their competitive rates and strong financial stability make them a reliable choice for many Florida drivers.

- Esurance: Esurance is renowned for its tech-savvy approach to insurance, offering a seamless online experience and a range of discounts. Their focus on digital efficiency often translates to cost savings for customers.

- USAA: While exclusively serving military members and their families, USAA consistently delivers exceptional value. Their comprehensive coverage and competitive rates make them a top choice for eligible Florida residents.

Coverage Options and Costs

Florida requires all drivers to carry a minimum level of liability coverage. However, to ensure adequate protection, many drivers opt for additional coverage types. Here’s a breakdown of common coverage options and their approximate costs:

| Coverage Type | Average Cost |

|---|---|

| Liability Coverage | $300 - $500 per month |

| Collision Coverage | $100 - $200 per month |

| Comprehensive Coverage | $50 - $100 per month |

| Uninsured Motorist Coverage | $50 - $100 per month |

| Personal Injury Protection (PIP) | $100 - $200 per month |

It's important to note that these costs can vary significantly based on individual circumstances and the provider chosen. Consulting with multiple insurers and comparing quotes is essential to identify the most affordable coverage for your specific needs.

Tips for Lowering Your Auto Insurance Costs

While selecting an affordable provider is a critical step, there are additional strategies to further reduce your auto insurance costs in Florida. Here are some expert tips to consider:

- Shop Around Regularly: Auto insurance rates can fluctuate, so it's beneficial to periodically review your coverage and compare quotes from different providers. This ensures you're always getting the best deal available.

- Utilize Discounts: Most insurers offer a range of discounts, including those for safe driving, multi-policy bundles, and membership in certain organizations. Be sure to ask your provider about available discounts and take advantage of those that apply to you.

- Increase Your Deductible: Opting for a higher deductible can lead to significant savings on your premium. However, it's essential to ensure you can afford the higher out-of-pocket expense in the event of a claim.

- Improve Your Credit Score: Many insurers use credit-based insurance scores to determine rates. Improving your credit score can lead to lower premiums, so it's a good idea to review your credit report and take steps to enhance your score if needed.

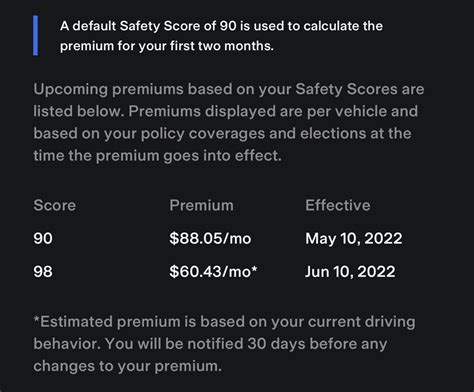

- Consider Usage-Based Insurance: Usage-based insurance, such as Progressive's Snapshot program, uses telematics to track your driving behavior and reward safe driving with lower premiums. This can be an excellent option for drivers with a clean record.

The Future of Affordable Auto Insurance in Florida

The auto insurance landscape in Florida is continually evolving, with new providers and technologies shaping the market. As the state’s population grows and diversifies, insurers are adapting to meet the changing needs and expectations of drivers. Here’s a glimpse into the future of affordable auto insurance in Florida:

Emerging Technologies and Their Impact

The rapid advancement of technology is transforming the insurance industry. In Florida, this includes the increasing adoption of telematics and usage-based insurance programs. These technologies allow insurers to more accurately assess individual risk profiles, leading to fairer and more personalized pricing.

Regulatory Changes and Their Implications

Florida’s insurance regulations are subject to periodic review and adjustment. Upcoming changes, such as the potential modification of personal injury protection (PIP) requirements, could significantly impact the cost and availability of auto insurance in the state. Staying informed about these regulatory developments is essential for Florida drivers to ensure they remain adequately covered.

Market Trends and Their Influence

The Florida auto insurance market is highly competitive, with a diverse range of providers vying for customers. This competition often leads to innovative pricing strategies and the introduction of new coverage options. Keeping an eye on market trends can help drivers identify emerging value propositions and make more informed choices.

Conclusion

Securing the most affordable auto insurance in Florida requires a combination of research, comparison, and strategic planning. By understanding the key factors influencing rates and leveraging the insights and tips provided in this guide, Florida drivers can navigate the state’s competitive insurance market with confidence. With the right approach, finding cost-effective coverage that meets your specific needs is well within reach.

How often should I review my auto insurance policy to ensure I’m getting the best rate?

+

It’s a good practice to review your auto insurance policy annually, or whenever you experience a significant life event that may impact your coverage needs or eligibility for discounts. This ensures you’re always getting the best value and staying adequately protected.

Are there any specific discounts I should be aware of when shopping for auto insurance in Florida?

+

Yes, Florida insurers offer a variety of discounts, including those for safe driving, multi-policy bundles, and membership in certain organizations. Be sure to ask your provider about available discounts and consider if any apply to your circumstances.

How does my credit score impact my auto insurance rates in Florida?

+

In Florida, insurers use credit-based insurance scores to determine rates. A higher credit score can lead to lower premiums, so it’s beneficial to maintain a good credit score to ensure you’re getting the best rates available.

What are some common mistakes to avoid when shopping for auto insurance in Florida?

+

Some common mistakes include selecting the first quote you receive without comparing alternatives, not asking about available discounts, and neglecting to review your policy regularly. Taking the time to compare quotes, understand your coverage options, and stay informed about potential savings can help you avoid these pitfalls.