Mn State Insurance

Welcome to a comprehensive guide on Minnesota State Insurance, designed to provide an in-depth analysis of the insurance landscape in the Land of 10,000 Lakes. This article will delve into the unique aspects of insurance policies and regulations within the state, offering valuable insights for residents and businesses alike.

Minnesota, with its diverse geography and vibrant economy, presents a dynamic insurance market. From the bustling cities of Minneapolis and Saint Paul to the picturesque shores of Lake Superior, understanding the state's insurance requirements and options is essential for financial security and peace of mind.

Understanding Minnesota’s Insurance Landscape

The insurance sector in Minnesota is characterized by a robust regulatory framework aimed at protecting consumers and promoting a stable market. The Minnesota Department of Commerce, specifically the Insurance Division, plays a pivotal role in overseeing and enforcing insurance laws and regulations.

One of the key aspects of Minnesota's insurance landscape is the state-mandated minimum coverage requirements. These requirements ensure that all vehicle owners have a basic level of insurance to cover potential liabilities arising from accidents. The state's minimum coverage includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

For instance, the bodily injury liability coverage in Minnesota has a minimum limit of $30,000 per person and $60,000 per accident. This means that, in the event of an accident where you are at fault, your insurance will cover up to $30,000 for injuries to one person and a maximum of $60,000 for all injuries sustained in the accident.

Unique Features of Minnesota’s Insurance Market

Minnesota boasts a unique insurance environment with several distinctive features. One notable aspect is the state’s commitment to making insurance more accessible and affordable. The Minnesota Comprehensive Health Association (MCHA), for example, provides a risk pool for individuals with pre-existing conditions, ensuring they can obtain health insurance coverage despite their medical history.

Furthermore, Minnesota has implemented consumer-friendly regulations that enhance policyholder rights. These include stringent rules on timely claim handling, fair settlement practices, and transparent policy disclosures. Insurers operating in the state must adhere to these regulations, ensuring a higher level of protection for consumers.

| Insurance Type | Key Features |

|---|---|

| Auto Insurance | No-fault system, PIP coverage, SR-22 requirement for high-risk drivers. |

| Homeowners Insurance | Wind and hail coverage, Ordinance or Law coverage for older homes. |

| Health Insurance | MCHA for high-risk individuals, Essential Health Benefits coverage. |

Insurance Options for Minnesota Residents

Minnesota residents have a range of insurance options to choose from, depending on their specific needs and circumstances. Here’s an overview of the primary insurance types and their coverage options.

Auto Insurance

Vehicle ownership in Minnesota comes with the responsibility of purchasing auto insurance. The state’s auto insurance market offers a wide range of coverage options to protect drivers against various risks. Key coverage types include:

- Liability Coverage: Covers damages caused to others in an accident, as mentioned earlier, with minimum limits set by the state.

- Collision Coverage: Optional coverage that pays for repairs or replacement of your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision incidents such as theft, vandalism, and natural disasters.

- Personal Injury Protection (PIP): Provides coverage for medical expenses, lost wages, and other related costs, regardless of fault.

Minnesota's auto insurance market is competitive, with numerous insurers offering tailored policies. Factors such as driving history, vehicle type, and location play a significant role in determining premiums. It's advisable to compare quotes from multiple insurers to find the best coverage at the most affordable price.

Homeowners Insurance

For homeowners in Minnesota, insurance is crucial to protect against various risks, including fire, theft, and natural disasters. The state’s homeowners insurance market offers comprehensive coverage options, with policies typically covering the following:

- Dwelling Coverage: Protects the physical structure of your home against perils such as fire, wind, and hail.

- Personal Property Coverage: Covers the contents of your home, including furniture, electronics, and clothing.

- Liability Coverage: Provides protection if someone is injured on your property or if you’re held responsible for an injury that occurs off your property.

- Additional Living Expenses (ALE): Covers the cost of temporary housing and other living expenses if your home becomes uninhabitable due to a covered loss.

Minnesota's diverse geography, with its mix of urban, suburban, and rural areas, can impact the cost and availability of homeowners insurance. Factors such as the age of the home, its construction materials, and the proximity to fire hydrants and emergency services can influence premiums. It's essential to review your policy annually to ensure it aligns with your current needs and circumstances.

Health Insurance

Access to quality healthcare is a priority for many Minnesotans, and health insurance plays a crucial role in ensuring this access. The state’s health insurance market offers a variety of plans, including:

- Individual and Family Plans: These plans are purchased directly by individuals or families and can be customized to meet specific healthcare needs.

- Employer-Sponsored Plans: Many employers in Minnesota offer health insurance benefits as part of their compensation packages, providing coverage for employees and their families.

- Medicaid and MinnesotaCare: These government-sponsored programs provide health coverage for low-income individuals and families, ensuring access to essential healthcare services.

Minnesota has also implemented the Minnesota Individual Health Plan (MIHP), which provides affordable health insurance options for individuals who don't qualify for Medicaid or MinnesotaCare. The MIHP offers a range of plans with varying deductibles and out-of-pocket maximums, allowing individuals to choose a plan that best fits their healthcare needs and budget.

Regulatory Framework and Consumer Protection

Minnesota’s insurance market is governed by a comprehensive regulatory framework designed to protect consumers and ensure a stable insurance environment. The Minnesota Department of Commerce, through its Insurance Division, is responsible for enforcing insurance laws and regulations. This includes overseeing the licensing and supervision of insurance companies, agents, and brokers operating in the state.

The Insurance Division plays a crucial role in ensuring fair and transparent practices within the insurance industry. It reviews and approves insurance rates, forms, and policies to ensure they comply with state laws and are in the best interest of consumers. The division also investigates consumer complaints and takes action against insurers and agents who engage in unfair or deceptive practices.

Consumer Rights and Protections

Minnesota residents have a range of rights and protections when it comes to insurance. These include the right to:

- Receive timely and accurate information about insurance policies, including coverage details, exclusions, and premiums.

- File complaints with the Insurance Division if they believe they have been treated unfairly or if they have concerns about their insurance coverage.

- Access independent reviews of insurance companies’ financial stability and consumer complaint records through the Insurance Division’s website.

- Understand their policy and have their questions answered by their insurance agent or company.

Minnesota's insurance laws also include prohibitions against certain unfair practices, such as:

- Discrimination: Insurers cannot refuse to provide coverage or charge higher premiums based on factors such as race, gender, religion, or marital status.

- Misrepresentation: Insurance companies and agents are prohibited from providing false or misleading information about coverage or policy terms.

- Unfair claim handling: Insurers must process claims promptly and fairly, and cannot deny valid claims without a reasonable basis.

The Future of Insurance in Minnesota

The insurance landscape in Minnesota is continuously evolving to meet the changing needs of residents and businesses. As technology advances and consumer expectations shift, the state's insurance market is adapting to provide innovative solutions and enhanced protection.

Emerging Trends and Innovations

One notable trend in Minnesota’s insurance sector is the increasing adoption of digital technologies and online platforms. Insurers are leveraging digital tools to streamline processes, enhance customer service, and offer more convenient options for policyholders. This includes online policy management, digital claim filing, and real-time communication channels.

Additionally, Minnesota's insurance market is seeing a rise in specialized insurance products to address unique risks. For instance, with the state's thriving tech industry, insurers are offering cyber insurance to protect businesses against data breaches and cyber attacks. Similarly, as renewable energy initiatives gain traction, insurers are developing green energy insurance products to cover risks associated with renewable energy projects.

The state is also exploring innovative risk-sharing models, such as parametric insurance, which provides rapid payouts based on predefined triggers rather than traditional claim assessments. This approach can be particularly beneficial in industries like agriculture, where crop losses due to weather events can be quickly and efficiently addressed.

Challenges and Opportunities

While Minnesota’s insurance market is thriving, it also faces certain challenges. One key challenge is keeping insurance affordable, especially in light of rising healthcare costs and natural disaster risks. The state’s insurance regulators and industry stakeholders are actively working to address this issue by promoting competition, encouraging preventive healthcare measures, and exploring innovative risk management strategies.

Another challenge is adapting to changing consumer preferences and expectations. With the rise of digital technologies, consumers now expect a seamless and personalized insurance experience. Insurers in Minnesota are investing in digital transformation to meet these expectations, offering mobile apps, chatbots, and personalized insurance recommendations.

Despite these challenges, Minnesota's insurance market presents significant opportunities. The state's diverse economy, with its mix of industries and thriving startups, offers insurers a wide range of potential customers. Additionally, the state's commitment to innovation and sustainability creates opportunities for insurers to develop cutting-edge products and services that cater to the unique needs of Minnesota's businesses and residents.

What are the penalties for driving without insurance in Minnesota?

+Driving without insurance in Minnesota can result in significant penalties. If caught, you may face a fine of up to $500 and have your license suspended for 30 days. Repeat offenders can face even stiffer penalties, including longer license suspensions and increased fines.

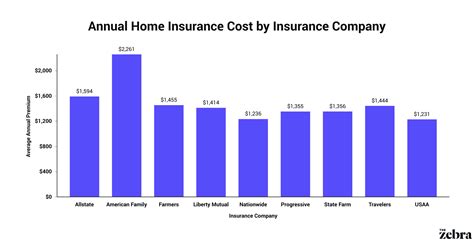

How can I find the best homeowners insurance rate in Minnesota?

+To find the best homeowners insurance rate in Minnesota, it’s advisable to shop around and compare quotes from multiple insurers. Factors such as your home’s location, age, and construction materials can impact premiums. Additionally, consider bundling your homeowners insurance with other policies, such as auto insurance, to potentially save on overall costs.

What is the role of the Minnesota Department of Commerce in regulating insurance?

+The Minnesota Department of Commerce, through its Insurance Division, is responsible for regulating the insurance industry in the state. This includes licensing and supervising insurance companies, agents, and brokers, as well as reviewing and approving insurance rates, forms, and policies to ensure compliance with state laws and consumer protection.