Metlife Insurance Policy

MetLife, short for Metropolitan Life Insurance Company, is a well-established insurance provider with a rich history and a global presence. With a focus on innovation and a comprehensive range of insurance products, MetLife has become a trusted name in the industry. This article delves into the intricacies of MetLife's insurance policies, exploring their features, benefits, and impact on policyholders.

A Legacy of Trust: MetLife’s Insurance Policies

MetLife has been a cornerstone of the insurance industry for over a century, offering financial protection and security to individuals and families worldwide. Their insurance policies are meticulously designed to address a wide spectrum of needs, providing peace of mind and long-term financial stability.

Comprehensive Coverage Options

One of the standout features of MetLife’s insurance policies is their breadth of coverage. The company offers a diverse range of products, ensuring that policyholders can find tailored solutions for their specific requirements. Here’s a glimpse into some of the key coverage options:

- Life Insurance: MetLife's life insurance policies provide financial protection to beneficiaries in the event of the policyholder's demise. With various plan options, including term life, whole life, and universal life insurance, individuals can choose coverage that aligns with their needs and budget.

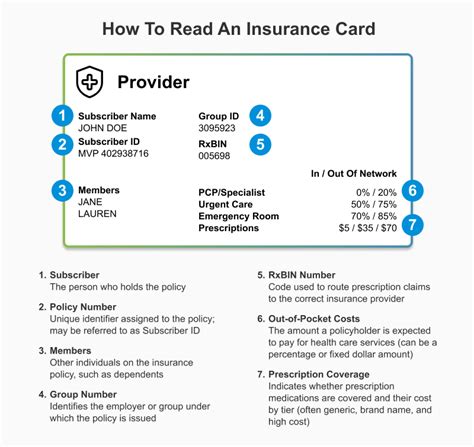

- Health Insurance: MetLife's health insurance plans focus on providing comprehensive medical coverage. Policyholders can access a wide network of healthcare providers, ensuring timely and efficient medical care. These plans often include features like low deductibles, prescription drug coverage, and flexible payment options.

- Disability Insurance: Recognizing the importance of income protection, MetLife offers disability insurance policies. These plans provide financial support if an individual becomes unable to work due to illness or injury, ensuring their financial stability during challenging times.

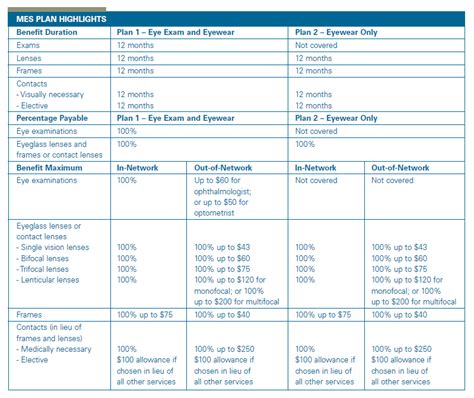

- Dental and Vision Insurance: MetLife understands the significance of oral and vision health. Their dental and vision insurance plans offer coverage for a range of services, from routine check-ups and cleanings to more complex procedures. This comprehensive approach to dental and vision care ensures policyholders can maintain their overall well-being.

- Long-Term Care Insurance: As individuals age, the need for long-term care insurance becomes increasingly relevant. MetLife's policies in this category provide coverage for various care options, including in-home care, assisted living facilities, and nursing homes. This ensures that policyholders can receive the care they need without compromising their financial security.

Tailored Solutions and Customization

MetLife’s commitment to its customers extends beyond offering a wide range of insurance products. The company excels in providing personalized solutions that cater to the unique needs of each policyholder. Here’s how they achieve this level of customization:

- Flexible Policy Terms: MetLife understands that life circumstances can change, and their insurance policies reflect this flexibility. Policyholders can choose policy terms that align with their life stage and goals, whether it's a short-term term life insurance policy or a long-term whole life plan.

- Add-On Benefits: To enhance the value of their insurance policies, MetLife offers a range of add-on benefits. These optional features allow policyholders to customize their coverage further. For instance, life insurance policyholders can opt for additional riders like accelerated death benefits or child riders, providing added protection for their loved ones.

- Digital Tools and Resources: In today's digital age, MetLife leverages technology to provide policyholders with convenient access to their insurance information. Online portals and mobile apps enable policyholders to manage their policies, make payments, and access important documents quickly and efficiently.

| Policy Type | Key Features |

|---|---|

| Term Life Insurance | Affordable coverage for a specified term; renewable options available. |

| Whole Life Insurance | Lifetime coverage with cash value accumulation; flexible premium payments. |

| Universal Life Insurance | Flexible premium payments and coverage amounts; cash value growth. |

| Health Insurance | Comprehensive medical coverage; low deductibles and prescription benefits. |

| Disability Insurance | Income protection for short-term or long-term disabilities; flexible benefit periods. |

The Impact of MetLife’s Insurance Policies

The influence of MetLife’s insurance policies extends far beyond the company’s immediate customer base. Their comprehensive approach to insurance has had a significant impact on the industry as a whole and has contributed to the financial well-being of countless individuals and families.

Industry Leadership and Innovation

MetLife’s position as a leader in the insurance industry is not merely a result of its longevity but also its commitment to innovation. The company consistently pushes the boundaries of insurance products and services, introducing new features and benefits that enhance the customer experience. Here’s how MetLife’s innovation has shaped the industry:

- Digital Transformation: Recognizing the evolving needs of policyholders, MetLife has invested heavily in digital technologies. Their online platforms and mobile apps have revolutionized the way insurance is accessed and managed, making it more convenient and efficient for customers.

- Product Diversification: MetLife's comprehensive range of insurance products has set a benchmark for the industry. By offering a diverse array of coverage options, the company has ensured that individuals can find insurance solutions that align with their specific needs, whether it's life, health, or long-term care insurance.

- Customer-Centric Approach: MetLife's focus on customization and personalized solutions has inspired other insurance providers to adopt similar strategies. The company's commitment to understanding and addressing the unique needs of its customers has elevated the industry's overall standard of customer service.

Financial Security and Peace of Mind

At its core, insurance is about providing financial security and peace of mind. MetLife’s insurance policies have played a pivotal role in achieving this goal for countless individuals and families. Here’s how MetLife’s policies have made a difference:

- Life Insurance Protection: For policyholders and their loved ones, life insurance provides a safety net. In the event of an untimely demise, MetLife's life insurance policies ensure that beneficiaries receive the financial support they need to navigate life's challenges. This protection brings peace of mind, knowing that their financial future is secure.

- Health Coverage and Well-Being: MetLife's health insurance plans have empowered policyholders to prioritize their health. With comprehensive coverage and access to a wide network of healthcare providers, individuals can focus on preventive care and timely medical treatment. This focus on health and well-being contributes to overall quality of life.

- Income Protection: Disability insurance, offered by MetLife, provides a crucial safety net for policyholders. In the face of unexpected illness or injury, this insurance ensures that individuals can continue to meet their financial obligations. This protection is especially vital for those who rely on their income to support their families and maintain their standard of living.

- Long-Term Care Support: As individuals age, the need for long-term care becomes a reality for many. MetLife's long-term care insurance policies provide a sense of security, ensuring that policyholders can access the care they need without financial strain. This support allows individuals to age gracefully and maintain their independence.

Conclusion: A Legacy of Protection and Peace of Mind

MetLife’s insurance policies stand as a testament to the company’s commitment to providing comprehensive financial protection. Through a diverse range of coverage options, tailored solutions, and a focus on innovation, MetLife has not only served its customers but also shaped the insurance industry as a whole. As policyholders navigate the complexities of life, MetLife’s insurance policies offer a reliable safety net, ensuring peace of mind and financial security for generations to come.

How do I choose the right MetLife insurance policy for my needs?

+Selecting the right MetLife insurance policy depends on your specific needs and financial goals. Consider factors such as your age, health status, income, and long-term objectives. Consult with a MetLife representative or financial advisor to discuss your options and find a policy that provides the coverage and benefits you require.

What sets MetLife’s insurance policies apart from competitors?

+MetLife’s insurance policies stand out for their comprehensive coverage options, flexible customization, and commitment to innovation. The company’s focus on providing tailored solutions and utilizing digital technologies sets it apart, ensuring a seamless and personalized insurance experience for policyholders.

Can I customize my MetLife insurance policy after purchasing it?

+Yes, MetLife understands that life circumstances can change, and they offer flexibility in customizing your insurance policy. Depending on the policy type, you may be able to add or remove certain features, adjust coverage amounts, or change policy terms to better align with your evolving needs.