Medicare Supplemental Health Insurance

Medicare Supplemental Health Insurance, often referred to as Medigap, plays a crucial role in enhancing the coverage provided by Original Medicare. As the healthcare landscape evolves, understanding the intricacies of Medigap becomes increasingly essential for seniors and individuals with disabilities. This comprehensive guide aims to delve into the world of Medicare Supplemental Health Insurance, exploring its benefits, coverage, and how it can complement Original Medicare to provide comprehensive healthcare protection.

Unraveling Medicare Supplemental Health Insurance: An Essential Guide

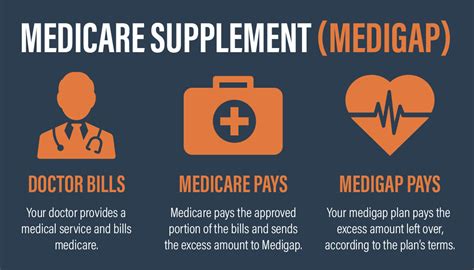

Medicare Supplemental Health Insurance, or Medigap, is a set of standardized insurance plans designed to fill the gaps left by Original Medicare, which includes Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). These supplemental plans, offered by private insurance companies, cover various out-of-pocket costs that Original Medicare may not, such as deductibles, coinsurance, and copayments.

The need for Medigap arises from the limitations of Original Medicare, which often leaves enrollees with significant expenses, particularly in the form of deductibles and coinsurance. For instance, under Original Medicare, you might be responsible for 20% of the Medicare-approved amount for most doctor services and an annual deductible of $2,404 for Part B services in 2024. Medigap plans step in to provide coverage for these expenses, offering a more comprehensive and financially secure healthcare experience.

One of the key advantages of Medigap is its simplicity. These plans are standardized, meaning that Plan A offered by one insurance company will provide the same benefits as Plan A offered by another company. This standardization makes it easier for individuals to compare plans and choose the one that best suits their needs and budget.

Understanding the Medigap Coverage Options

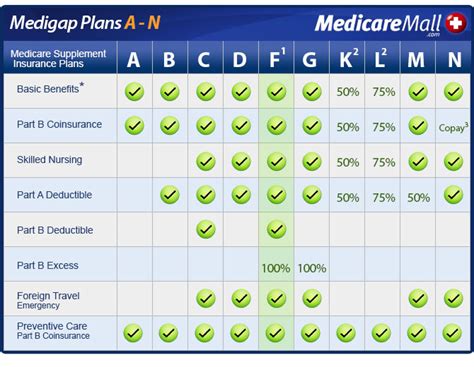

Medicare offers a total of ten standardized Medigap plans, denoted by the letters A, B, C, D, F, G, K, L, M, and N. Each plan offers a unique set of benefits, providing coverage for specific out-of-pocket expenses. For example, Plan F covers all Medicare Part A and Part B deductibles, as well as coinsurance and copayments, making it one of the most comprehensive plans available. However, it's important to note that Plan F and Plan C will no longer be available for new beneficiaries as of January 1, 2020, as these plans cover the Medicare Part B deductible, which CMS aims to phase out.

Other plans, like Plan G, cover similar benefits to Plan F but without covering the Medicare Part B deductible. Plan N, on the other hand, provides a more cost-effective option, covering all Part A deductibles and a portion of Part B coinsurance but with some additional cost-sharing requirements.

| Medigap Plan | Coverage Highlights |

|---|---|

| Plan A | Covers Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. |

| Plan B | Offers the same benefits as Plan A, plus coverage for Medicare Part B coinsurance or copayments. |

| Plan C | A comprehensive plan covering Part A coinsurance, all Part B coinsurance or copayments, and the first 3 pints of blood each year. |

| Plan D | Similar to Plan C, but with the addition of coverage for Part A deductible. |

| Plan F | The most comprehensive plan, covering all Part A and Part B deductibles, coinsurance, and copayments, as well as the first 3 pints of blood each year. |

| Plan G | A popular choice, offering the same benefits as Plan F except for the Medicare Part B deductible. |

| Plan K | Provides coverage for Part A coinsurance and hospital costs, but only at 50% initially, increasing to 100% after the beneficiary has paid a total of $6,350 out-of-pocket in a benefit period. |

| Plan L | Similar to Plan K, but covers Part A coinsurance and hospital costs at 75% initially, increasing to 100% after the beneficiary has paid $2,540 out-of-pocket in a benefit period. |

| Plan M | Covers Part A coinsurance and hospital costs, Part B coinsurance or copayments, and the first 3 pints of blood each year. However, it does not cover the Medicare Part A deductible. |

| Plan N | A cost-effective plan, covering Part A coinsurance and hospital costs, Part B coinsurance or copayments (except for a $20 copayment for some office visits and a $50 copayment for emergency room visits that don't result in admission), and the first 3 pints of blood each year. |

The Enrollment Process and Considerations

When enrolling in a Medigap plan, it's important to be mindful of the timing. You have a Medigap Open Enrollment Period when you first become eligible for Medicare Part A and Part B. This period starts the month you turn 65 (or start receiving Medicare benefits) and lasts for 6 months. During this time, you can enroll in any Medigap plan available in your state without undergoing a medical underwriting process, which means the insurance company cannot refuse to sell you a policy or charge you more due to your health status.

After the Medigap Open Enrollment Period, you may still be able to purchase a Medigap policy, but the insurance company can refuse to sell you a policy or charge you more due to your health status. It's also important to note that you cannot have both a Medicare Advantage Plan (Part C) and a Medigap plan at the same time.

Medigap and Prescription Drug Coverage

Medigap plans do not typically cover prescription drugs. If you're interested in prescription drug coverage, you'll need to enroll in a Medicare Part D plan, either as a standalone prescription drug plan or as part of a Medicare Advantage Plan (Part C) that includes prescription drug coverage. It's important to note that you can have both a Medigap plan and a Medicare Part D plan, but you cannot have a Medigap plan and a Medicare Advantage Plan (Part C) that includes prescription drug coverage.

The Future of Medigap

The landscape of Medicare Supplemental Health Insurance is constantly evolving. While Plan F and Plan C are no longer available for new beneficiaries, there's a push towards more standardized and affordable options. Plan G, for instance, is becoming increasingly popular due to its comprehensive coverage and competitive pricing. Additionally, there's a growing emphasis on making Medigap plans more accessible to those with pre-existing conditions, ensuring that all beneficiaries have access to affordable and comprehensive healthcare.

In conclusion, Medicare Supplemental Health Insurance, or Medigap, is an essential component of a robust healthcare plan for seniors and individuals with disabilities. By understanding the different Medigap plans and their coverage options, individuals can make informed decisions to ensure they have the financial protection they need when it comes to their healthcare. Remember, choosing the right Medigap plan is a crucial step towards achieving peace of mind and ensuring access to quality healthcare services.

Can I have both a Medigap plan and a Medicare Advantage Plan (Part C)?

+

No, you cannot have both a Medigap plan and a Medicare Advantage Plan (Part C) at the same time. These plans are designed to be mutually exclusive, and enrolling in one automatically makes you ineligible for the other.

Are there any Medigap plans that cover prescription drugs?

+

No, Medigap plans do not typically cover prescription drugs. If you need prescription drug coverage, you’ll need to enroll in a separate Medicare Part D plan or choose a Medicare Advantage Plan (Part C) that includes prescription drug coverage.

What happens if I miss the Medigap Open Enrollment Period?

+

If you miss the Medigap Open Enrollment Period, you may still be able to purchase a Medigap plan, but the insurance company can refuse to sell you a policy or charge you more due to your health status. It’s always best to enroll during the Open Enrollment Period to ensure the best possible rates and coverage options.

Can I switch Medigap plans after enrolling?

+

Yes, you can switch Medigap plans, but there are some important considerations. You may be subject to medical underwriting, and the insurance company can refuse to sell you a new policy or charge you more due to your health status. Additionally, you may have to pay a penalty if you switch plans outside of your Medigap Open Enrollment Period.

How can I find the best Medigap plan for my needs?

+

To find the best Medigap plan for your needs, it’s recommended to consult with a licensed insurance agent or a trusted financial advisor. They can help you evaluate your healthcare needs and financial situation to choose a plan that provides the right balance of coverage and cost.