Medical Insurance Open Enrollment

The annual open enrollment period for medical insurance is a critical time for individuals and families to review, select, and enroll in health coverage plans. This period offers a unique opportunity to make informed decisions about healthcare coverage, ensuring access to essential medical services and financial protection. As we delve into the intricacies of open enrollment, we'll uncover the key considerations, the importance of timely action, and the potential consequences of missing this crucial window.

Understanding Open Enrollment

Open enrollment is a designated period, typically lasting several weeks, during which individuals can enroll in health insurance plans, make changes to their existing coverage, or switch to new plans. This period is governed by strict timelines, and missing the deadline can result in significant implications for one’s healthcare access and financial stability.

Eligibility and Timeline

Eligibility for open enrollment is generally universal, allowing all individuals, regardless of their current insurance status, to explore and select new coverage options. The timeline for open enrollment varies depending on the region and the specific insurance marketplace. For instance, the federal Health Insurance Marketplace in the United States usually operates with a defined open enrollment period, often from November to December, allowing individuals to enroll or make changes to their plans for the upcoming year.

It's crucial to stay informed about the exact dates for open enrollment, as failing to meet the deadline can result in being locked into the same plan for another year or even facing a lack of coverage altogether.

Key Considerations During Open Enrollment

- Reviewing Current Coverage: The first step is to assess the adequacy of your current insurance plan. Consider factors such as the scope of coverage, premium costs, deductibles, and out-of-pocket expenses. Evaluate whether your plan meets your healthcare needs and financial goals.

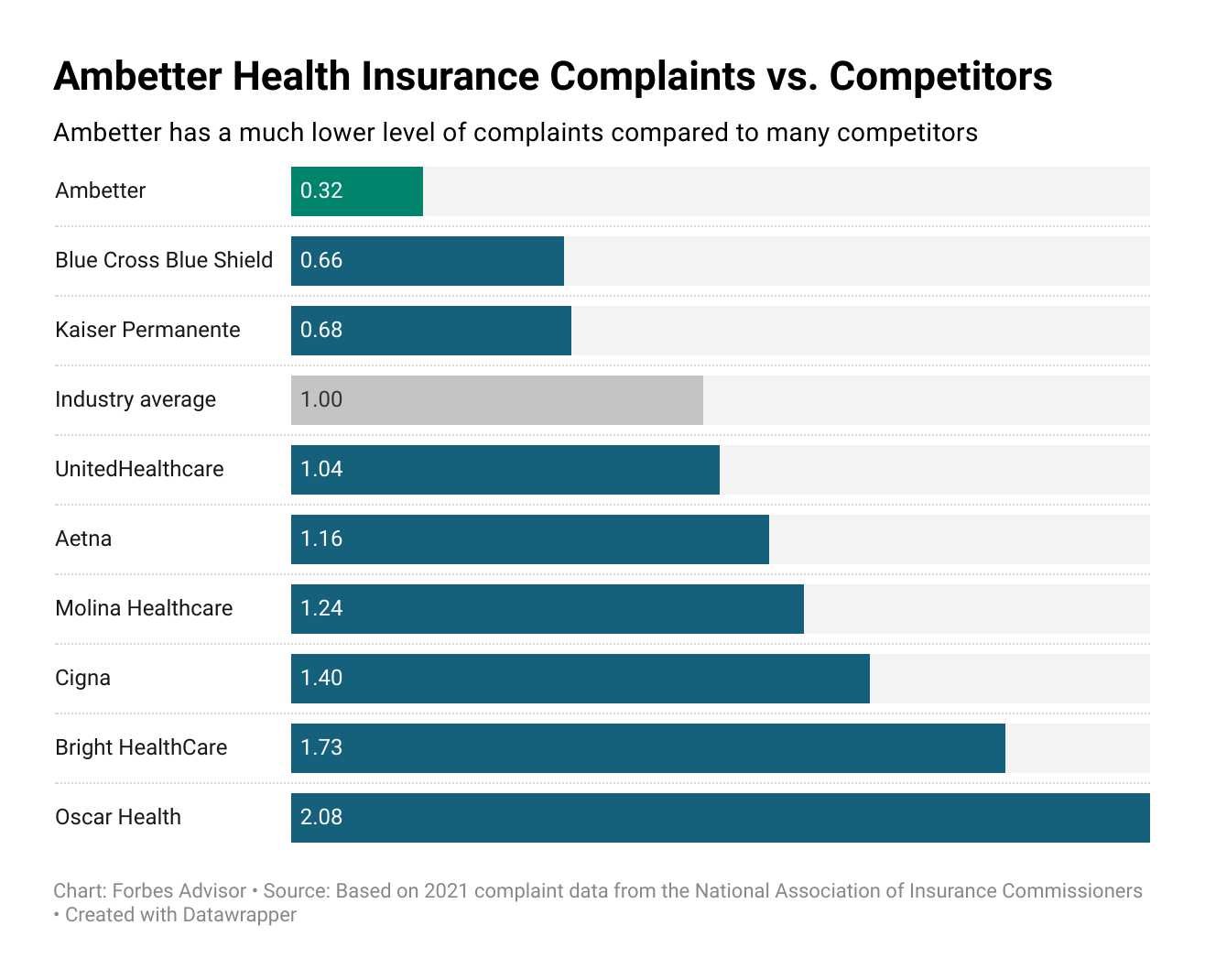

- Exploring Alternative Plans: Open enrollment provides an opportunity to compare a range of insurance plans. Research and compare different options based on factors like provider networks, prescription drug coverage, and additional benefits like dental or vision care.

- Understanding Cost Implications: Carefully review the premium costs, deductibles, and copayments for each plan. Consider your anticipated healthcare needs and choose a plan that offers the best balance between affordability and comprehensive coverage.

- Family Coverage: If you’re enrolling family members, ensure that the plan covers all necessary services, including pediatric care, maternity benefits, and any specialized needs.

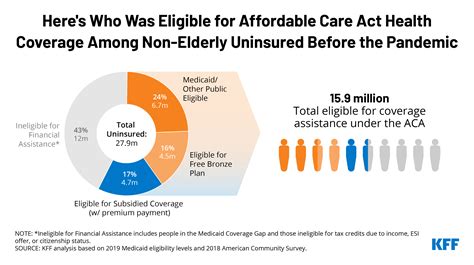

- Tax Credits and Subsidies: Depending on your income and family size, you may be eligible for tax credits or subsidies to reduce the cost of your health insurance premiums. Make sure to verify your eligibility and apply for these benefits during open enrollment.

The Importance of Timely Action

Timeliness is of the essence during open enrollment. Failing to take action within the designated period can have serious consequences, including:

- Limited Coverage Options: After the open enrollment period, you may be unable to change or enroll in a new plan until the next open enrollment unless you qualify for a special enrollment period due to certain life events like marriage, divorce, or the birth of a child.

- Financial Penalties: In some regions, failing to maintain minimum essential coverage can result in tax penalties or fines. These penalties can add up significantly over time.

- Unforeseen Medical Expenses: Without adequate health insurance, unexpected medical emergencies or ongoing healthcare needs can lead to substantial out-of-pocket expenses, potentially causing financial strain.

Maximizing Your Open Enrollment Experience

To make the most of open enrollment, consider the following strategies:

Seek Expert Advice

Navigating the complex world of health insurance can be challenging. Consider consulting with insurance brokers, healthcare advocates, or financial advisors who specialize in health insurance. They can provide personalized guidance based on your unique circumstances and help you choose the most suitable plan.

Utilize Online Tools

Many insurance marketplaces and government websites offer online tools and resources to assist with plan comparisons and enrollment. These tools can help you filter plans based on your specific needs and preferences, making the decision-making process more efficient.

Review Plan Changes

Even if you’re satisfied with your current plan, it’s important to review any changes made by the insurer. These changes could include adjustments to premiums, deductibles, covered services, or provider networks. Understanding these changes can help you determine if your current plan still aligns with your needs.

Explore Discounts and Incentives

Insurers often offer discounts, incentives, or loyalty programs to encourage enrollment or retention. Look out for such opportunities and consider how they might benefit you.

Stay Informed

Keep yourself updated with the latest healthcare regulations, insurance trends, and any changes to your current plan. Being well-informed can empower you to make the best decisions during open enrollment.

| Region | Open Enrollment Period |

|---|---|

| United States (Federal Marketplace) | November 1 - December 15 (for coverage starting January) |

| Canada (Provincial/Territorial Plans) | Varies by province/territory; typically continuous enrollment |

| United Kingdom (NHS) | Continuous enrollment; individuals can enroll at any time |

| Australia (Medicare) | Continuous enrollment; individuals are automatically enrolled |

Frequently Asked Questions

What happens if I miss the open enrollment deadline?

+Missing the open enrollment deadline can have significant implications. You may be unable to change or enroll in a new plan until the next open enrollment period, unless you qualify for a special enrollment period due to certain life events. Additionally, in some regions, you may face tax penalties for not maintaining minimum essential coverage.

Can I change my insurance plan outside of open enrollment?

+In most cases, you can only change your insurance plan during the designated open enrollment period. However, certain life events like marriage, divorce, birth of a child, or loss of existing coverage may qualify you for a special enrollment period, allowing you to make changes outside the regular open enrollment window.

Are there any exceptions to the open enrollment rules?

+Yes, certain life events can trigger a special enrollment period, allowing you to make changes to your insurance plan outside of the regular open enrollment window. These events typically include marriage, divorce, birth or adoption of a child, loss of existing coverage, or moving to a new coverage area. It’s important to review the specific rules and timelines for special enrollment periods in your region.

How do I know if I’m eligible for tax credits or subsidies?

+Eligibility for tax credits or subsidies is typically based on your household income and family size. You can use online calculators or consult with tax professionals or insurance advisors to determine if you qualify. These credits and subsidies can significantly reduce the cost of your health insurance premiums, making coverage more affordable.

What should I do if I’m unsure about which plan to choose?

+If you’re unsure about which plan to choose, consider seeking expert advice from insurance brokers, healthcare advocates, or financial advisors who specialize in health insurance. They can provide personalized guidance based on your unique circumstances and help you navigate the various plan options available.

The annual open enrollment period for medical insurance is a critical opportunity to secure the right healthcare coverage for yourself and your family. By staying informed, taking timely action, and seeking expert guidance when needed, you can make the most of this period to ensure access to essential medical services and financial protection throughout the year.