Lowest Insurance

Insurance, a financial safeguard against life's uncertainties, is a vital aspect of personal and business planning. While insurance policies offer essential protection, the cost can sometimes be a significant concern for individuals and businesses alike. The quest for the lowest insurance rates often involves a careful balance between coverage needs and financial considerations. In this comprehensive guide, we delve into the world of insurance, exploring the factors that influence premiums, the strategies to obtain the most competitive rates, and the importance of customization to meet specific needs.

Understanding the Landscape of Insurance

The insurance industry is vast and diverse, catering to a myriad of needs and risks. From auto insurance to health insurance, home insurance, and business insurance, the options can be overwhelming. Each type of insurance serves a unique purpose, providing financial protection against specific risks. For instance, auto insurance safeguards against the financial consequences of accidents, while health insurance covers medical expenses, and home insurance protects against property damage and loss.

However, the challenge lies in finding the right coverage at the most affordable rates. Insurance premiums are influenced by a complex interplay of factors, including the type of coverage, the level of risk associated with the insured, and the insurance company's assessment of that risk. This risk assessment is a critical component of insurance underwriting, where insurance companies evaluate the likelihood of a claim being made and set premiums accordingly.

Factors Influencing Insurance Premiums

-

Type of Insurance: Different types of insurance come with varying levels of risk and complexity. For example, health insurance premiums can be influenced by factors such as age, pre-existing conditions, and lifestyle choices, while auto insurance rates may depend on driving history, vehicle type, and location.

-

Risk Assessment: Insurance companies employ sophisticated risk assessment models to determine premiums. These models consider a wide range of factors, including historical data, statistical analysis, and individual circumstances. For instance, a young driver with a history of accidents may face higher auto insurance premiums due to the perceived higher risk.

-

Coverage Limits and Deductibles: The level of coverage and the deductible amount chosen can significantly impact insurance premiums. Higher coverage limits often result in higher premiums, while opting for a higher deductible can reduce the premium but increase the out-of-pocket expenses in the event of a claim.

-

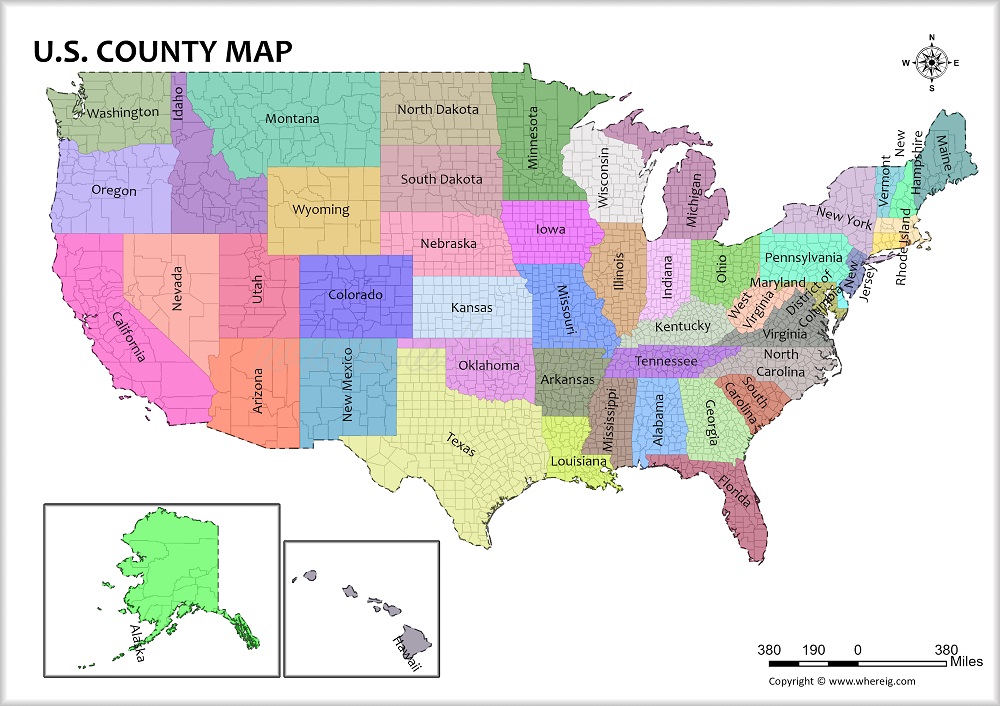

Location and Personal Circumstances: Insurance rates can vary based on geographical location. Factors such as crime rates, natural disaster risks, and population density can influence premiums. Additionally, personal circumstances like marital status, occupation, and credit history may also be considered in the underwriting process.

Strategies for Securing the Lowest Insurance Rates

Navigating the insurance landscape to find the lowest rates requires a combination of research, understanding, and strategic decision-making. Here are some key strategies to consider when seeking the most competitive insurance premiums.

Shop Around and Compare Quotes

One of the most effective ways to find the lowest insurance rates is to shop around and compare quotes from multiple insurance providers. Each insurance company has its own underwriting guidelines and risk assessment models, which can result in varying premium quotes for the same coverage. By obtaining multiple quotes, individuals and businesses can identify the most affordable options.

Online insurance comparison platforms can be a valuable tool in this process. These platforms allow users to input their specific needs and circumstances, and then generate a list of tailored quotes from various insurers. This not only saves time but also provides a comprehensive view of the market, enabling informed decisions.

Understand Your Coverage Needs

Before seeking insurance, it’s crucial to understand your specific coverage needs. Assess the risks you face and the financial protection you require. For example, if you own a business, consider the potential liabilities and risks associated with your industry. A comprehensive understanding of your needs will help you choose the right insurance coverage and avoid overpaying for unnecessary features.

Additionally, review your existing insurance policies regularly. Life circumstances and needs can change over time, and your insurance coverage should reflect those changes. Regular policy reviews ensure that you're not paying for outdated or unnecessary coverage.

Explore Discounts and Bundling Options

Insurance companies often offer discounts and bundling options to attract and retain customers. Discounts can be provided for a range of reasons, including safe driving records, multiple policies with the same insurer, or loyalty programs. Bundling multiple insurance policies, such as auto and home insurance, can also lead to significant savings.

Research and inquire about the discounts and bundling options available with different insurers. Some companies may offer discounts for specific professions, while others may have loyalty programs that reward long-term customers with reduced premiums. Taking advantage of these opportunities can help lower your overall insurance costs.

Consider High Deductibles and Coverage Limits

The relationship between deductibles, coverage limits, and insurance premiums is a delicate balance. While higher deductibles can lead to lower premiums, it’s essential to choose a deductible amount that you’re comfortable paying out-of-pocket in the event of a claim. Similarly, higher coverage limits can provide greater financial protection but may result in increased premiums.

Assess your financial situation and risk tolerance when deciding on deductibles and coverage limits. If you're confident in your ability to cover higher out-of-pocket expenses, opting for a higher deductible can be a strategic move to reduce premiums. However, it's crucial to ensure that the coverage limits are adequate to protect your assets and financial well-being.

Customizing Insurance for Your Specific Needs

Finding the lowest insurance rates is only part of the equation. It’s equally important to ensure that the insurance coverage aligns with your specific needs and circumstances. Customizing your insurance policy to meet your unique requirements is a critical aspect of effective financial planning.

Tailoring Coverage to Your Circumstances

Insurance policies are not one-size-fits-all. Your specific circumstances, such as your age, health status, occupation, and location, can influence the risks you face and the insurance coverage you require. Tailor your insurance policy to reflect these unique factors.

For instance, if you're a young professional with a tight budget, you may opt for a higher deductible on your health insurance to reduce premiums. However, if you have a family with young children, you might prioritize comprehensive coverage with lower deductibles to ensure financial protection in the event of unexpected medical expenses.

Review and Update Policies Regularly

Insurance needs can change over time as your life circumstances evolve. Regularly reviewing and updating your insurance policies is essential to ensure that your coverage remains adequate and cost-effective. Life events such as marriage, the birth of a child, purchasing a new home, or starting a business can all impact your insurance needs.

Stay proactive by periodically assessing your insurance coverage. Review your policies annually or whenever a significant life change occurs. This ensures that your insurance remains relevant and provides the protection you require without unnecessary costs.

The Role of Insurance Brokers and Advisors

Navigating the insurance landscape and customizing policies to meet specific needs can be complex. This is where the expertise of insurance brokers and advisors becomes invaluable. These professionals have in-depth knowledge of the insurance market and can provide personalized guidance to help individuals and businesses find the most suitable and affordable coverage.

Insurance brokers and advisors can offer tailored advice based on your unique circumstances. They can help you understand the intricacies of different insurance policies, explain the fine print, and guide you in making informed decisions. Additionally, they often have access to a wide range of insurance providers, enabling them to shop around and negotiate the best rates on your behalf.

Performance Analysis and Future Implications

Securing the lowest insurance rates is not a one-time achievement; it’s an ongoing process that requires regular evaluation and adjustment. By analyzing the performance of your insurance policies and staying informed about market trends, you can make informed decisions to maintain cost-effective coverage.

Performance Analysis and Adjustments

Regularly review the performance of your insurance policies. Assess whether the coverage provided aligns with your current needs and whether the premiums are competitive in the market. If you find that your premiums have increased significantly or your coverage no longer meets your requirements, it may be time to explore alternative options.

Compare your current premiums with those offered by other insurers. If you discover more affordable options, consider switching providers. However, be cautious of making frequent policy changes, as this can sometimes impact your overall insurance costs and coverage in the long run.

Stay Informed About Market Trends

The insurance market is dynamic, and staying informed about market trends and changes is essential. Keep an eye on industry news, regulatory updates, and economic factors that can influence insurance premiums. For instance, changes in healthcare legislation or natural disaster patterns can impact insurance rates.

Subscribing to industry publications, following reputable insurance blogs, and engaging with insurance professionals can provide valuable insights into market trends. This knowledge empowers you to make proactive decisions and adjust your insurance coverage and strategies accordingly.

The Impact of Technological Advancements

Technological advancements are transforming the insurance industry, offering new opportunities for cost-effective coverage. Insurtech, the intersection of insurance and technology, is driving innovation and disrupting traditional insurance models. From digital underwriting to AI-powered risk assessment, technology is streamlining processes and reducing costs.

Insurtech startups are challenging established insurers with innovative business models and data-driven approaches. These companies often offer more competitive rates and tailored coverage options, leveraging technology to enhance the customer experience. Embracing these technological advancements can open doors to more affordable and efficient insurance solutions.

Conclusion

The quest for the lowest insurance rates is a journey that involves understanding the insurance landscape, employing strategic decision-making, and customizing coverage to meet specific needs. By shopping around, comparing quotes, and understanding your coverage requirements, you can find the most competitive premiums. Additionally, exploring discounts, customizing policies, and staying informed about market trends are crucial steps in maintaining cost-effective insurance coverage.

Remember, insurance is a vital component of financial planning, providing protection against life's uncertainties. While the lowest insurance rates are desirable, it's equally important to ensure that your coverage is adequate and tailored to your unique circumstances. By striking the right balance between cost and coverage, you can safeguard your financial well-being and peace of mind.

FAQs

How do I find the lowest insurance rates for my specific needs?

+To find the lowest insurance rates for your specific needs, start by assessing your coverage requirements. Understand the risks you face and the financial protection you require. Then, shop around and compare quotes from multiple insurance providers. Online comparison platforms can be a great tool for this. Additionally, explore discounts and bundling options, and consider adjusting your deductibles and coverage limits to find the best balance between cost and coverage.

What factors influence insurance premiums the most?

+Several factors influence insurance premiums, including the type of insurance, risk assessment, coverage limits, deductibles, and personal circumstances. Each insurance company has its own underwriting guidelines and risk assessment models, which can result in varying premium quotes for the same coverage. Understanding these factors and how they apply to your specific situation is key to finding the lowest rates.

Can I save money on insurance by bundling policies?

+Yes, bundling multiple insurance policies, such as auto and home insurance, can often lead to significant savings. Insurance companies often offer discounts for customers who bundle their policies, as it simplifies administrative processes and reduces acquisition costs. By consolidating your insurance needs with one provider, you can potentially lower your overall premiums.

How often should I review and update my insurance policies?

+It’s recommended to review and update your insurance policies at least once a year or whenever a significant life event occurs. Life events such as marriage, the birth of a child, purchasing a new home, or starting a business can all impact your insurance needs. Regular policy reviews ensure that your coverage remains adequate and cost-effective, reflecting your current circumstances.