Autos Insurance

Welcome to this in-depth exploration of the world of Autos Insurance, a critical component of the automotive industry and a topic that impacts millions of vehicle owners worldwide. Autos Insurance is a vital aspect of responsible car ownership, offering protection and peace of mind to drivers and their passengers. In this article, we will delve into the intricacies of this essential insurance type, its importance, and how it functions in the real world. By the end, you'll have a comprehensive understanding of Autos Insurance and its role in ensuring a safe and secure driving experience.

Understanding Autos Insurance: The Basics

Autos Insurance, also known as motor vehicle insurance or simply car insurance, is a contractual agreement between an insurance provider and a vehicle owner. This agreement outlines the coverage and protection offered by the insurance company in the event of an accident, theft, or other unforeseen circumstances related to the insured vehicle. It is a legal requirement in most countries and an essential safeguard for both the vehicle and its occupants.

The primary purpose of Autos Insurance is to provide financial protection and support to policyholders in the face of unexpected events. These events can range from minor fender benders to major accidents, natural disasters, or even instances of vandalism. By purchasing an Autos Insurance policy, vehicle owners secure a safety net that can help cover the costs of repairs, medical expenses, and potential legal liabilities.

Key Components of Autos Insurance Policies

Autos Insurance policies are complex documents that outline the specific coverage, exclusions, and limitations of the insurance plan. Here are some of the critical components that you’ll typically find in an Autos Insurance policy:

- Liability Coverage: This is the most fundamental aspect of any Autos Insurance policy. It covers the policyholder's legal responsibility for bodily injury or property damage to others as a result of an accident involving the insured vehicle.

- Comprehensive Coverage: Also known as other than collision coverage, this type of insurance protects against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Collision Coverage: As the name suggests, collision coverage applies when the insured vehicle is involved in a collision with another vehicle or object. It typically covers the cost of repairs or the replacement value of the vehicle.

- Personal Injury Protection (PIP): PIP coverage provides medical benefits for the policyholder and their passengers, regardless of who is at fault in an accident. It covers medical expenses, lost wages, and other related costs.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder when involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Rental Car Coverage: Some policies offer rental car coverage, which reimburses the policyholder for the cost of renting a vehicle while their insured car is being repaired.

- Roadside Assistance: Many Autos Insurance policies include roadside assistance, providing services like towing, flat tire changes, or battery jump starts.

Each of these components can be tailored to the policyholder's specific needs and preferences, allowing for a customized insurance plan that suits their unique circumstances.

The Process of Obtaining Autos Insurance

Securing Autos Insurance involves a series of steps and considerations. Here’s a simplified breakdown of the process:

1. Research and Comparison

The first step is to research and compare different insurance providers and their offerings. This involves evaluating factors like coverage options, policy terms, customer reviews, and, of course, premium costs. Online comparison tools and insurance brokerages can be invaluable resources during this stage.

2. Understanding Your Needs

It’s essential to assess your specific needs and risks as a vehicle owner. Consider factors like your driving history, the make and model of your vehicle, the average mileage you drive, and any unique circumstances (e.g., living in an area prone to natural disasters). Understanding your needs will help you choose the right coverage and policy limits.

3. Obtaining Quotes

Once you’ve narrowed down your options, it’s time to obtain quotes from insurance providers. These quotes will detail the coverage, deductibles, and premium costs associated with each policy. It’s crucial to carefully review these quotes and ensure you understand all the terms and conditions.

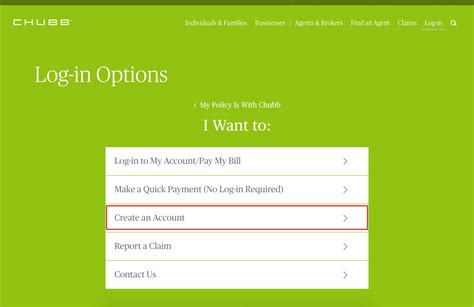

4. Application and Purchase

After selecting the insurance provider and policy that best fit your needs, you’ll complete an application process. This typically involves providing personal and vehicle information, as well as any additional details the insurance company requires. Once your application is approved, you’ll receive your policy documents and can begin enjoying the protection of your Autos Insurance coverage.

The Benefits and Real-World Impact of Autos Insurance

Autos Insurance offers a range of benefits that extend beyond the financial protection it provides. Here’s a closer look at some of the key advantages and real-world impacts of this essential insurance type:

Financial Protection and Peace of Mind

The primary benefit of Autos Insurance is the financial protection it offers. In the event of an accident or other covered event, policyholders can rest assured that their expenses will be covered. This includes not only the cost of repairing or replacing their vehicle but also potential medical bills, legal fees, and other associated costs. Having Autos Insurance provides peace of mind, knowing that you and your passengers are protected in the face of unforeseen circumstances.

Reduced Legal Liability

Autos Insurance policies typically include liability coverage, which protects policyholders from legal liabilities arising from accidents. This coverage is especially crucial in cases where the insured driver is found to be at fault. By having liability coverage, policyholders can avoid potentially devastating financial consequences and the stress of navigating complex legal processes.

Assistance in Emergency Situations

Many Autos Insurance policies include additional benefits like roadside assistance and rental car coverage. These services can be invaluable in emergency situations, providing immediate support and ensuring that policyholders can continue their journey or daily routines with minimal disruption. Whether it’s a flat tire, a dead battery, or a more serious mechanical issue, having these services included in your insurance policy can make a significant difference.

Encouraging Safe Driving Practices

Autos Insurance can also serve as an incentive for safe driving practices. Policyholders with clean driving records often receive discounts on their premiums, creating a financial incentive to maintain a safe driving history. This not only benefits individual drivers but also contributes to safer roads for everyone.

Case Study: The Impact of Autos Insurance

To illustrate the real-world impact of Autos Insurance, let’s consider a hypothetical case study involving a policyholder named John. John, a diligent driver with a clean record, purchases a comprehensive Autos Insurance policy that includes liability, collision, and comprehensive coverage. Unfortunately, one day while driving home from work, John is involved in a severe accident caused by another driver who runs a red light.

In this scenario, John's Autos Insurance policy proves invaluable. The liability coverage ensures that John is protected from any legal claims or financial liabilities resulting from the accident. The collision coverage covers the extensive repairs needed for his vehicle, and the comprehensive coverage helps with any additional expenses related to the accident, such as medical bills for minor injuries sustained by John and his passengers.

Thanks to his foresight in obtaining comprehensive Autos Insurance coverage, John is able to navigate this challenging situation with minimal financial burden and legal stress. His insurance policy provides the necessary support to get his vehicle repaired and ensures that any medical expenses are covered, allowing him to focus on his recovery and getting back on the road.

The Future of Autos Insurance: Technological Advancements and Innovations

The world of Autos Insurance is evolving rapidly, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of this industry and the exciting developments on the horizon:

1. Telematics and Usage-Based Insurance (UBI)

Telematics technology, which involves the use of sensors and GPS tracking, is transforming the way Autos Insurance is priced and delivered. With UBI, insurance providers can offer policies based on an individual’s actual driving behavior and usage patterns. This innovative approach rewards safe drivers with lower premiums and provides a more personalized insurance experience.

2. Artificial Intelligence (AI) and Machine Learning

AI and machine learning are being leveraged to enhance various aspects of Autos Insurance, from underwriting and pricing to claims processing and fraud detection. These technologies enable insurance providers to make more accurate predictions, streamline processes, and deliver faster, more efficient services to their policyholders.

3. Connected Car Technology

The rise of connected car technology, which allows vehicles to communicate with each other and with infrastructure, presents new opportunities for Autos Insurance. This technology can provide real-time data on driving behavior, vehicle performance, and potential risks, enabling insurance providers to offer even more tailored coverage and services.

4. Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize the Autos Insurance industry by enhancing transparency, security, and efficiency. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate various processes, such as claims processing and policy management, making them faster and more secure.

5. Data Analytics and Predictive Modeling

Advanced data analytics and predictive modeling techniques are being used to identify trends, patterns, and risks in the Autos Insurance landscape. By leveraging big data and sophisticated algorithms, insurance providers can make more informed decisions, improve risk assessment, and offer more accurate and personalized coverage to their policyholders.

Conclusion: The Importance of Autos Insurance in Today’s World

In a world where road accidents and unforeseen events are an unfortunate reality, Autos Insurance stands as a crucial pillar of protection for vehicle owners and their passengers. It provides a safety net that can make all the difference in the face of financial hardship and legal complexities. From offering financial protection and peace of mind to encouraging safe driving practices and leveraging technological advancements, Autos Insurance is an essential component of responsible car ownership.

As we've explored in this article, obtaining the right Autos Insurance policy involves careful research, understanding your unique needs, and making informed decisions. With the right coverage, you can drive with confidence, knowing that you and your loved ones are protected, and that you have the support you need in the event of an accident or other covered event. So, whether you're a seasoned driver or a new car owner, investing in comprehensive Autos Insurance is a wise decision that can pay dividends in the long run.

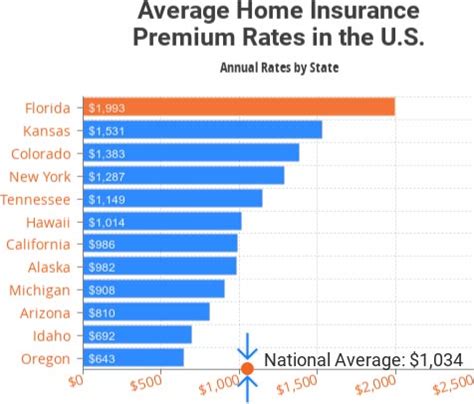

What is the average cost of Autos Insurance?

+

The average cost of Autos Insurance varies widely depending on factors such as location, driving history, and the type of vehicle insured. As a rough estimate, the average annual premium for Autos Insurance in the United States is around $1,674, according to the Insurance Information Institute. However, it’s essential to note that premiums can range from a few hundred dollars to several thousand dollars, so obtaining multiple quotes and comparing policies is crucial to finding the best coverage at the most affordable price.

How can I save money on my Autos Insurance premiums?

+

There are several strategies you can employ to reduce your Autos Insurance premiums. These include maintaining a clean driving record, taking advantage of discounts for safe driving or multiple policies, increasing your deductible, and shopping around for the best rates. Additionally, considering usage-based insurance (UBI) policies, which reward safe driving behavior, can often lead to significant savings.

What should I do if I’m involved in an accident and need to file a claim with my Autos Insurance provider?

+

If you’re involved in an accident, the first step is to ensure the safety of yourself and others involved. Contact the police to report the accident and obtain a police report, which can be valuable when filing your claim. Notify your Autos Insurance provider as soon as possible, and provide them with all the necessary details, including any photographs or witness statements. Your insurance provider will guide you through the claims process, which typically involves assessing the damage, determining fault, and arranging for repairs or compensation.