Low Auto Insurance Rates

Welcome to an in-depth exploration of the fascinating world of auto insurance and the quest for the lowest rates. As an industry expert, I will guide you through the intricate factors that influence insurance costs and provide valuable insights to help you navigate the path to affordable coverage.

Unraveling the Auto Insurance Rate Mystery

Securing the best auto insurance rates is a goal shared by many vehicle owners. The process is complex, as insurance companies consider a myriad of factors when calculating premiums. Understanding these factors is key to unlocking the door to lower rates.

The Influence of Risk Assessment

Insurance companies are in the business of managing risk. They assess various aspects of your life and driving history to determine the likelihood of you making an insurance claim. Here’s a breakdown of the key risk factors:

- Driving Record: A clean driving record is a powerful tool for negotiating lower rates. Insurance companies view safe drivers as less risky, so avoid traffic violations and accidents to keep your premiums down.

- Vehicle Type and Usage: The make, model, and age of your vehicle play a significant role. High-performance cars and luxury vehicles often carry higher insurance costs due to their value and the risk of theft. Additionally, the purpose of your vehicle's usage, such as commuting, leisure, or business, can impact your rates.

- Location and Driving Distance: Your residential location and the distance you typically drive are crucial factors. Areas with high traffic congestion, frequent accidents, or a higher incidence of theft may result in higher insurance rates.

- Age and Gender: Statistical data shows that certain age groups and genders are more likely to be involved in accidents. Young male drivers, for instance, often face higher insurance premiums due to their perceived higher risk.

- Credit Score: Surprisingly, your credit score can affect your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, believing that individuals with lower credit scores are more likely to file claims.

The Power of Comparison and Negotiation

With a solid understanding of the risk factors, you’re equipped to tackle the next step: comparing insurance providers and negotiating rates. Here’s how you can make the most of this process:

- Shop Around: Don't settle for the first insurance quote you receive. Compare rates from multiple providers to identify the best deal. Online comparison tools can be a great starting point.

- Bundling Policies: Consider bundling your auto insurance with other policies, such as home or life insurance. Many providers offer discounts for customers who choose multiple policies.

- Negotiate Discounts: Don't be afraid to negotiate. Insurance providers often have room for flexibility, especially if you're a long-term customer or have a good claims history. Ask about discounts for safe driving, loyalty, or even occupational or educational achievements.

- Review Regularly: Insurance rates can fluctuate, so it's wise to review your policy annually. You may find better deals or discover that your circumstances have changed, warranting a policy update.

Maximizing Savings with Discounts

Insurance companies offer a variety of discounts to attract and retain customers. Here are some common discounts to explore:

- Safe Driver Discount: As mentioned earlier, a clean driving record is a significant advantage. Many providers offer discounts for accident-free periods, so maintaining a safe driving habit pays off.

- Multi-Policy Discount: Bundling multiple insurance policies with the same provider is a great way to save. You might qualify for a discount if you have auto, home, and life insurance with the same company.

- Loyalty Discount: Long-term customers are often rewarded with loyalty discounts. If you've been with the same provider for several years, inquire about potential savings.

- Occupational and Educational Discounts: Certain professions and educational achievements can lead to insurance discounts. Teachers, military personnel, and students with good grades are examples of groups that may qualify for reduced rates.

- Vehicle Safety Features: Modern vehicles with advanced safety features like anti-lock brakes, air bags, and collision avoidance systems often qualify for insurance discounts.

Performance-Based Insurance: A New Frontier

The insurance industry is evolving, and one of the latest innovations is performance-based insurance. This innovative approach to insurance pricing uses telematics technology to monitor your driving behavior and offer rates based on your actual driving habits.

| Performance-Based Insurance Metrics | Description |

|---|---|

| Miles Driven | Some providers offer pay-per-mile insurance, where you pay based on the number of miles driven. |

| Driving Behavior | Telematics devices can track your acceleration, braking, and cornering habits, offering discounts for safe driving. |

| Time of Day | Certain providers offer discounts for driving during off-peak hours when roads are less congested. |

Performance-based insurance provides an opportunity to tailor your insurance rates to your specific driving habits, potentially resulting in significant savings.

The Impact of Technological Advancements

Technology is revolutionizing the auto insurance industry. From telematics to artificial intelligence, these advancements are reshaping the way insurance is priced and delivered.

- Telematics: Telematics devices, often installed in vehicles, provide real-time data on driving behavior. This data is used to calculate insurance rates based on actual driving habits, offering a more personalized insurance experience.

- Artificial Intelligence (AI): AI is being utilized to analyze vast amounts of data, including driving records, accident statistics, and weather patterns, to predict risk and set insurance rates more accurately.

- Connected Cars: Modern vehicles are becoming increasingly connected, with built-in sensors and communication systems. This connectivity provides insurers with more data, allowing for a more precise assessment of risk and, consequently, more accurate insurance rates.

The Future of Auto Insurance: Personalized and Data-Driven

As technology continues to advance, the auto insurance industry is set to become even more personalized and data-driven. Insurers will leverage vast amounts of data to offer tailored insurance products and services. Here’s a glimpse into the future:

- Hyper-Personalized Insurance: Insurance policies will be designed to fit individual needs and driving habits, offering a level of customization that is currently unmatched.

- Real-Time Risk Assessment: With the help of advanced analytics and connected vehicles, insurers will be able to assess risk and adjust rates in real time, providing a more dynamic insurance experience.

- Incentivized Safe Driving: Insurers may introduce reward systems to encourage safe driving behavior, offering discounts or other benefits to drivers who maintain a low-risk profile.

Conclusion: Navigating the Road to Lower Auto Insurance Rates

Securing low auto insurance rates is an achievable goal, and with the right knowledge and strategies, you can navigate the complex world of insurance with confidence. Remember, understanding the risk factors, comparing providers, and exploring discounts are key steps toward finding the best deal.

As the insurance industry continues to evolve, embracing technological advancements and a data-driven approach, the landscape of auto insurance will become increasingly personalized and dynamic. Stay informed, and you'll be well-equipped to make the most of the opportunities that arise.

Frequently Asked Questions

How often should I review my auto insurance policy for potential rate changes or discounts?

+

It’s a good practice to review your auto insurance policy annually or whenever your circumstances change significantly. This allows you to stay up-to-date with the latest rates and discounts, ensuring you’re getting the best value for your insurance.

Are there any specific age groups or professions that consistently receive lower auto insurance rates?

+

While rates can vary based on individual circumstances, certain age groups and professions often receive discounts. For example, mature drivers aged 55 and above may qualify for senior discounts, and professionals like teachers and military personnel often receive occupational discounts.

How can I improve my credit score to potentially lower my auto insurance rates?

+

Improving your credit score can positively impact your auto insurance rates. Focus on paying your bills on time, reducing outstanding debt, and maintaining a good credit utilization ratio. Consider using credit monitoring services to track your progress and make informed financial decisions.

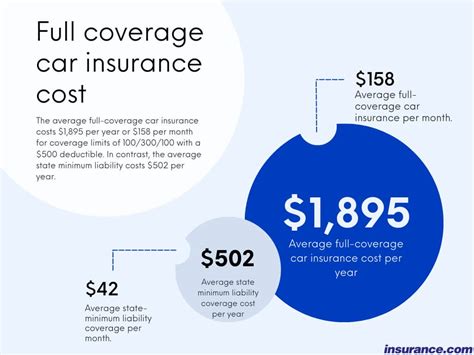

What is the average cost of auto insurance, and how can I estimate my potential savings with performance-based insurance?

+

The average cost of auto insurance varies significantly based on location, driving record, and other factors. Performance-based insurance can offer substantial savings, but the amount varies depending on your driving habits. Many providers offer online tools to estimate your potential savings.