Looking For Term Life Insurance

When it comes to financial planning and securing the future for your loved ones, one of the most important decisions you can make is investing in life insurance. Among the various types available, term life insurance stands out as a popular and flexible option. In this comprehensive guide, we will delve into the world of term life insurance, exploring its definition, benefits, and how it can provide peace of mind for you and your family.

Understanding Term Life Insurance

Term life insurance is a type of coverage that offers protection for a specific period, known as the term of the policy. Unlike permanent life insurance policies, which provide coverage for the entirety of the insured’s life, term life insurance focuses on a predetermined time frame. This period can vary, typically ranging from 10 to 30 years, depending on the policy and the needs of the policyholder.

The core principle of term life insurance is straightforward: you pay a premium during the term of the policy, and in return, your beneficiaries receive a specified sum (known as the death benefit) in the event of your passing within that term. This benefit can provide crucial financial support to your loved ones, covering expenses such as funeral costs, outstanding debts, or even ongoing living expenses.

Key Characteristics of Term Life Insurance

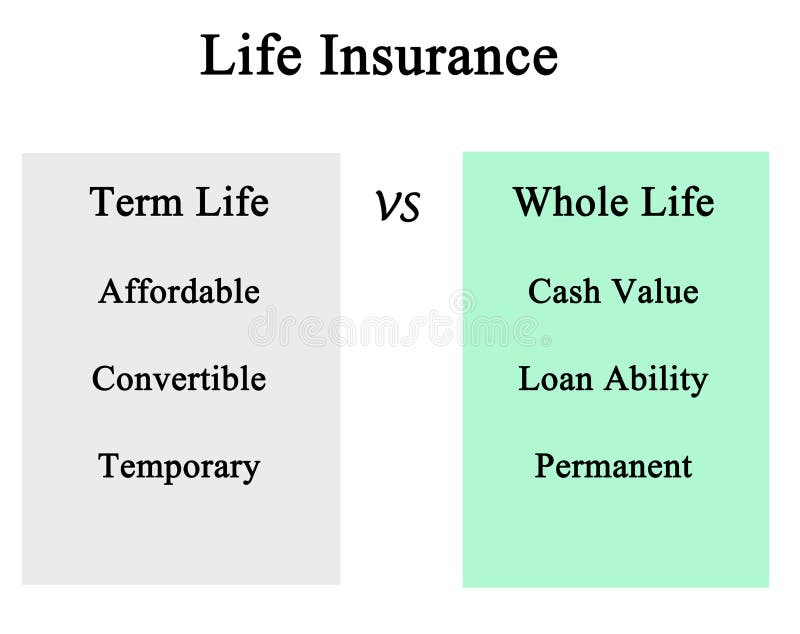

- Affordability: One of the most appealing aspects of term life insurance is its cost-effectiveness. Since the coverage is limited to a specific term, premiums are often significantly lower compared to permanent life insurance policies. This makes it an accessible option for individuals and families seeking financial protection without breaking the bank.

- Flexibility: Term life insurance policies offer a high degree of flexibility. Policyholders can choose the length of the term based on their specific needs and life stages. For instance, young couples starting a family may opt for a 20-year term to cover their children’s education and ensure financial stability during their formative years. On the other hand, older individuals might prefer a shorter term to cover specific financial goals or liabilities.

- Renewability and Convertibility: Many term life insurance policies provide the option to renew or convert the coverage. Renewal allows you to extend the term of your policy, often at a higher premium to account for increased age and potential health changes. Conversion, on the other hand, enables you to switch from a term policy to a permanent life insurance policy without undergoing additional medical examinations or providing evidence of insurability.

Benefits of Term Life Insurance

Term life insurance offers a range of advantages that make it an attractive choice for many individuals and families:

Financial Security for Your Loved Ones

The primary benefit of term life insurance is the financial security it provides to your beneficiaries. In the unfortunate event of your passing, the death benefit can help cover immediate expenses and ensure your loved ones’ long-term financial stability. Whether it’s paying off a mortgage, funding your children’s education, or maintaining their standard of living, term life insurance acts as a safety net.

Affordable Protection

As mentioned earlier, the affordability of term life insurance is a significant advantage. With lower premiums compared to permanent life insurance, it allows individuals with varying financial backgrounds to access crucial coverage. This makes it an ideal option for those who may not have the means to invest in more comprehensive policies but still want to ensure their family’s future.

Customizable Coverage

Term life insurance policies can be tailored to fit your unique needs. You can choose the term length, the amount of coverage (death benefit), and even add optional riders to enhance your policy. This customization ensures that your coverage aligns perfectly with your current life situation and financial goals.

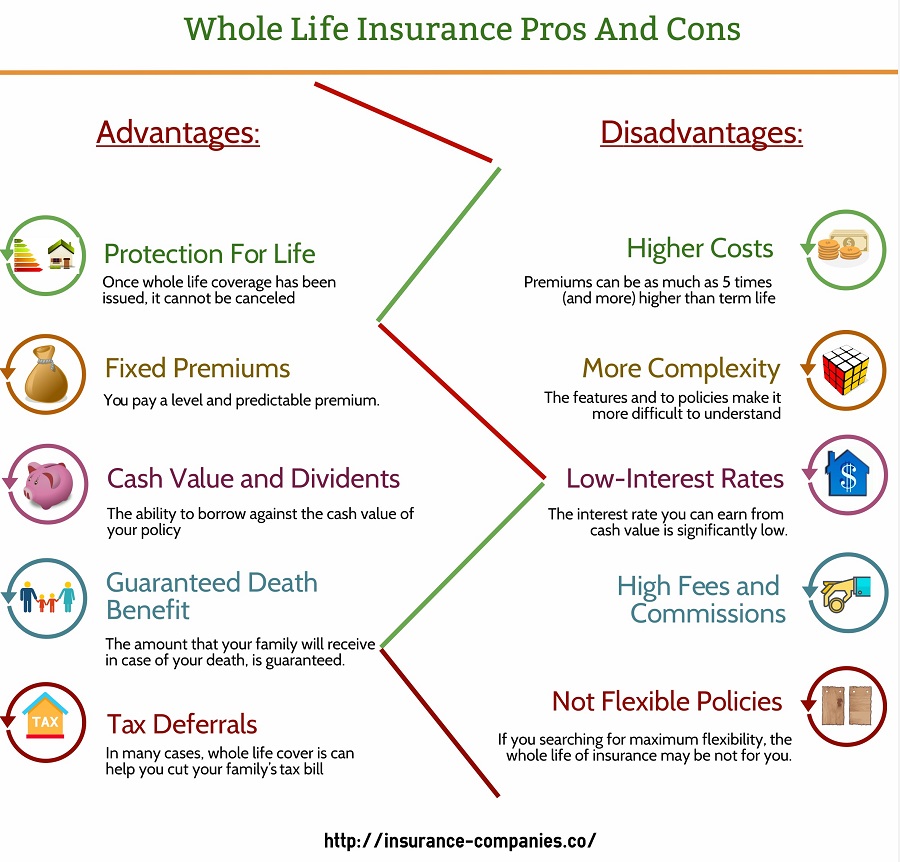

No Cash Value Accumulation

Unlike permanent life insurance, term life insurance does not accumulate cash value. This means that your premiums go directly towards providing coverage, making it a straightforward and efficient financial tool. While some may see the absence of cash value as a drawback, it ensures that your premiums are used solely for the purpose of protection, without the complexities of managing an investment component.

How to Choose the Right Term Life Insurance Policy

Selecting the appropriate term life insurance policy involves careful consideration of several factors. Here are some key aspects to keep in mind:

Assess Your Needs

Before choosing a policy, take the time to evaluate your specific needs. Consider factors such as your age, financial obligations, and future goals. Are you looking to cover mortgage payments, provide for your children’s education, or simply ensure a comfortable standard of living for your family in your absence? Understanding your needs will help guide your decision-making process.

Determine the Term Length

The term length of your policy is a crucial consideration. Opting for a longer term may provide more extensive coverage, but it also comes with higher premiums. Conversely, a shorter term can be more affordable but may not offer sufficient protection for your long-term goals. Assess your life stage, financial commitments, and the duration for which you anticipate needing coverage.

Compare Premiums and Coverage

Research and compare different term life insurance policies to find the best fit for your budget and coverage needs. Premiums can vary significantly between insurers, so it’s essential to shop around and consider multiple options. Additionally, review the policy’s fine print to understand the coverage limits, exclusions, and any potential riders that may be beneficial for your situation.

Consider Your Health and Lifestyle

Your health and lifestyle can impact the cost and availability of term life insurance. Insurers consider factors such as your medical history, smoking status, and hazardous hobbies when determining premiums. Being honest about your health and lifestyle during the application process is crucial, as misrepresenting information can lead to policy denial or even voiding of coverage.

Renewal and Conversion Options

Understanding the renewal and conversion options offered by different insurers is vital. Some policies may provide more favorable terms for renewal or conversion, ensuring that you can maintain coverage even if your health status changes or if you decide to switch from term to permanent life insurance.

Performance Analysis and Real-World Examples

To better understand the impact and effectiveness of term life insurance, let’s examine a few real-world scenarios and explore how this type of coverage has made a difference:

Protecting a Young Family

John and Sarah, a young couple with two children, opted for a 20-year term life insurance policy. John, the primary breadwinner, wanted to ensure that his family would be financially secure in the event of his untimely passing. The policy provided a substantial death benefit, covering their mortgage, children’s education funds, and daily living expenses. This allowed Sarah to focus on raising their children without the added stress of financial worries.

Supporting Retirement Goals

Emily, approaching retirement age, decided to purchase a 10-year term life insurance policy to support her retirement planning. With her children grown and financially independent, Emily’s primary concern was ensuring that her retirement savings would be sufficient to cover her expenses. The term life insurance policy provided an additional layer of security, giving her peace of mind that her financial goals would not be derailed by unexpected medical issues or other expenses.

Covering Business Partnerships

David and Michael, business partners, recognized the importance of protecting their partnership in the event of an unforeseen tragedy. They chose a 30-year term life insurance policy with a substantial death benefit. This policy ensured that if one partner passed away, the surviving partner would have the financial means to buy out the deceased partner’s share of the business, maintaining stability and continuity for their joint venture.

Evidence-Based Future Implications

Term life insurance plays a crucial role in financial planning, and its impact extends beyond the present. Here’s how term life insurance can influence your future:

Long-Term Financial Stability

By investing in term life insurance, you provide a safety net for your loved ones, ensuring their financial stability over the long term. The death benefit can cover a range of expenses, from immediate costs to long-term goals, helping your family maintain their standard of living and achieve their aspirations.

Peace of Mind

Knowing that your family is protected in the event of your passing brings invaluable peace of mind. Term life insurance allows you to focus on your career, relationships, and personal goals without the constant worry of financial uncertainty. It empowers you to live your life to the fullest, knowing that your loved ones’ future is secure.

Flexibility for Changing Needs

Term life insurance’s flexibility is a significant advantage. As your life circumstances evolve, you can adjust your coverage accordingly. Whether it’s extending the term, increasing the death benefit, or converting to a permanent life insurance policy, term life insurance provides the adaptability needed to align with your changing needs and goals.

| Term Length | Average Premium (Annual) |

|---|---|

| 10 Years | $350 |

| 20 Years | $520 |

| 30 Years | $780 |

How much does term life insurance cost on average?

+The cost of term life insurance varies depending on several factors, including your age, health, and the coverage amount. On average, a 30-year-old non-smoker can expect to pay around 20 to 30 per month for a $500,000 policy. However, premiums can be significantly higher or lower based on individual circumstances.

Can I get term life insurance if I have pre-existing health conditions?

+Yes, individuals with pre-existing health conditions can still obtain term life insurance. However, the premiums may be higher, and you may undergo a more comprehensive medical evaluation. It’s important to disclose all relevant health information accurately during the application process.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage will expire, and you will no longer be insured. However, depending on the policy, you may have the option to renew or convert the policy. Renewal typically involves paying higher premiums due to increased age, while conversion allows you to switch to a permanent life insurance policy without additional health evaluations.