Looking For Cheap Insurance

Navigating the complex world of insurance can be a daunting task, especially when you're on a budget. The search for cheap insurance often leads to many questions and considerations. This comprehensive guide aims to shed light on the strategies and best practices for securing insurance coverage at affordable rates, ensuring you get the protection you need without breaking the bank.

Understanding Your Insurance Needs

Before embarking on your quest for cheap insurance, it’s crucial to have a clear understanding of your specific needs. Different types of insurance cater to distinct aspects of your life, from your health and property to your vehicle and even your life itself. Each type of insurance serves a unique purpose and offers varying levels of coverage.

Assessing Your Risk Profile

Every individual has a unique risk profile, influenced by factors such as age, health status, location, and lifestyle choices. Understanding your risk profile is essential as it directly impacts the cost and availability of insurance. For instance, younger individuals may find auto insurance more affordable, while older individuals might benefit from discounts on life insurance.

| Risk Factor | Impact on Insurance |

|---|---|

| Age | Generally, younger individuals pay lower premiums for auto and health insurance, while older individuals may benefit from lower life insurance rates. |

| Health Status | Pre-existing health conditions can increase the cost of health insurance, while a history of healthy habits may lead to discounts. |

| Location | The area you live in can affect the cost of property and auto insurance. High-crime or high-risk areas may result in higher premiums. |

| Lifestyle Choices | Habits like smoking or extreme sports participation can impact the cost of life and health insurance. |

By assessing your risk profile, you can make informed decisions about the type and level of insurance coverage you require. This step is crucial in ensuring you don't overpay for unnecessary coverage or underpay for inadequate protection.

Exploring Cost-Saving Strategies

Once you have a grasp of your insurance needs, it’s time to explore strategies to secure the best value for your money. The insurance market is competitive, and with a bit of research and negotiation, you can often find excellent deals.

Comparing Quotes

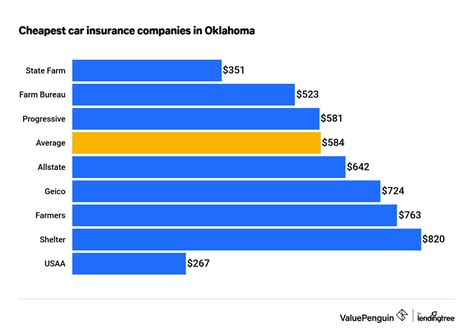

One of the most effective ways to find cheap insurance is by comparing quotes from multiple providers. This process allows you to see the range of prices and coverage options available in the market. Online comparison tools can be particularly useful for this task, as they aggregate quotes from various insurers in one place.

When comparing quotes, pay attention to the fine print. Ensure that the policies offer comparable coverage. For instance, two health insurance plans may have the same premium, but one might have a higher deductible or co-pay, making it more expensive in the long run.

Bundling Your Policies

Many insurance providers offer discounts when you bundle multiple policies with them. For example, you might save money by purchasing your auto and home insurance from the same company. This strategy can be particularly beneficial if you have multiple insurance needs, such as auto, home, and life insurance.

Utilizing Discounts

Insurance companies often provide discounts to certain groups or for specific behaviors. These discounts can significantly reduce your premium. Some common discounts include:

- Loyalty Discounts: Staying with the same insurer for an extended period may earn you a loyalty discount.

- Safe Driver Discounts: If you have a clean driving record, you may be eligible for a safe driver discount on your auto insurance.

- Student Discounts: Many insurers offer discounts to students, especially those with good grades.

- Health-Conscious Discounts: Some health insurance providers offer discounts for maintaining a healthy lifestyle, such as quitting smoking or maintaining a certain BMI.

Increasing Your Deductible

Increasing your deductible, the amount you pay out-of-pocket before your insurance kicks in, can lead to significant savings on your premium. However, this strategy requires careful consideration, as a higher deductible means you’ll have to pay more in the event of a claim.

Leveraging Technology for Savings

In today’s digital age, technology plays a significant role in helping you find cheap insurance. Online resources and apps can provide valuable insights and tools to make the process more efficient and cost-effective.

Using Insurance Apps

Numerous insurance apps are available that can help you manage your policies, track expenses, and even compare quotes. These apps often provide real-time updates on your coverage and can alert you to potential savings opportunities.

Exploring Online Insurance Markets

Online insurance markets, such as insurance broker platforms, can be a treasure trove of savings. These platforms aggregate policies from various insurers, making it easy to compare and choose the best option for your needs. They often have exclusive deals and discounts that you won’t find elsewhere.

Reading Online Reviews

Online reviews can provide valuable insights into the experiences of other policyholders. By reading reviews, you can get a sense of an insurer’s customer service, claims process, and overall satisfaction levels. This information can help you make an informed decision about which insurer to choose.

The Role of an Insurance Broker

An insurance broker can be a valuable asset in your quest for cheap insurance. Brokers work with multiple insurers and can help you find the best policy for your needs. They have extensive knowledge of the insurance market and can negotiate on your behalf to secure the best rates.

Benefits of Using a Broker

Insurance brokers offer several advantages, including:

- Expertise: Brokers are knowledgeable about the insurance market and can provide valuable advice on the best policies for your needs.

- Negotiation Power: They have established relationships with insurers and can negotiate better rates on your behalf.

- Time-Saving: Brokers can handle the legwork of comparing policies and quotes, saving you time and effort.

- Personalized Service: Brokers can tailor their advice and recommendations to your specific circumstances.

Finding a Reputable Broker

When choosing an insurance broker, it’s essential to find someone reputable and experienced. Here are some tips to help you in your search:

- Look for brokers who are licensed and insured.

- Check online reviews and ratings to gauge their reputation.

- Consider referrals from friends, family, or colleagues.

- Ensure the broker has experience with the type of insurance you're seeking.

Common Misconceptions about Cheap Insurance

When searching for cheap insurance, it’s important to be aware of common misconceptions that can lead to poor decisions. Here are a few myths debunked:

Myth: Cheap Insurance is Always the Best Deal

While finding cheap insurance is a priority, it’s important to remember that the lowest premium doesn’t always equate to the best value. Sometimes, paying a slightly higher premium for better coverage and service can be a wiser decision in the long run.

Myth: All Insurers are the Same

Insurance providers vary widely in their offerings, customer service, and financial stability. It’s crucial to research and compare insurers to ensure you’re getting the best deal.

Myth: I Only Need the Minimum Coverage

While it’s tempting to choose the minimum coverage to save money, this can leave you vulnerable in the event of a major claim. It’s always advisable to review your coverage regularly and ensure it aligns with your current needs.

Future of Cheap Insurance

The insurance industry is continually evolving, and new technologies and trends are shaping the future of cheap insurance. Here’s a glimpse into what we can expect:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior, is becoming increasingly popular in auto insurance. Usage-based insurance, where premiums are based on actual driving behavior, is expected to grow in popularity. This shift could lead to more affordable insurance for safe drivers.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry by enhancing transparency, security, and efficiency. It could streamline processes, reduce administrative costs, and ultimately lead to cheaper insurance premiums.

Artificial Intelligence

AI is already being used in the insurance industry for tasks like fraud detection and claims processing. As AI technology advances, it’s expected to play an even bigger role in improving efficiency and reducing costs, which could benefit policyholders in the form of lower premiums.

Conclusion

Finding cheap insurance is a complex but rewarding process. By understanding your needs, exploring cost-saving strategies, leveraging technology, and working with reputable brokers, you can secure the coverage you need at a price that fits your budget. Remember, the key is to be informed, compare options, and make decisions based on your unique circumstances.

How often should I review my insurance policies?

+It’s recommended to review your insurance policies annually or whenever your circumstances change significantly, such as moving to a new location, getting married, or purchasing a new vehicle.

Can I switch insurers mid-policy term?

+Yes, you can switch insurers at any time. However, you may have to pay a fee or fulfill certain conditions outlined in your policy. It’s always best to read your policy terms carefully before making any changes.

What should I do if I have a claim?

+If you have a claim, contact your insurer as soon as possible. Provide them with all the necessary details and documentation. Follow their instructions and keep records of all communications. Remember, the claims process can vary depending on the type of insurance and the nature of the claim.

How can I improve my chances of getting cheap insurance?

+To improve your chances of getting cheap insurance, maintain a good credit score, drive safely to avoid accidents, and shop around for the best deals. Also, consider bundling your policies and utilizing discounts where possible.