Looking For Car Insurance Cheap

Welcome to our comprehensive guide on finding the best and cheapest car insurance options! In today's fast-paced world, having a reliable car insurance policy is essential, but it's also important to ensure that you're getting the best value for your money. This article aims to provide you with expert insights and practical tips to navigate the car insurance market and secure a policy that suits your needs and budget.

Whether you're a seasoned driver or a first-time car owner, understanding the intricacies of car insurance and how to obtain the most affordable rates is crucial. We'll delve into the factors that influence insurance premiums, explore the various types of coverage available, and offer strategies to help you make informed decisions. By the end of this guide, you'll have the knowledge and tools to confidently shop for car insurance, ensuring you get the protection you need at a price that doesn't break the bank.

Understanding Car Insurance Basics

Car insurance is a contract between you, the policyholder, and the insurance company. It provides financial protection in the event of accidents, theft, or other specified incidents involving your vehicle. Understanding the different components of car insurance is key to making informed choices and securing the best deal.

Types of Car Insurance Coverage

There are several types of car insurance coverage to consider, each designed to protect you and your vehicle in different scenarios. The most common types include:

- Liability Coverage: This is the most basic form of car insurance, covering the costs of injuries or damages you cause to others in an accident. It typically includes both bodily injury liability and property damage liability.

- Collision Coverage: Collision coverage pays for the repair or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s an optional coverage but is often required by lenders if you’re financing or leasing your car.

- Comprehensive Coverage: Comprehensive coverage protects against damages caused by non-collision incidents, such as theft, vandalism, weather-related events, or collisions with animals. Like collision coverage, it’s optional but highly recommended.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Each state has its own minimum car insurance requirements, which typically include liability coverage. However, it's important to assess your specific needs and choose a policy that provides adequate coverage for your situation.

Factors Influencing Car Insurance Rates

Insurance companies use a variety of factors to determine your car insurance premium. Understanding these factors can help you make choices that lead to lower rates:

- Driving History: Your driving record plays a significant role in determining your insurance rates. A clean driving history with no accidents or traffic violations can lead to lower premiums. Conversely, multiple violations or accidents can significantly increase your rates.

- Vehicle Type: The make, model, and year of your vehicle can impact your insurance rates. Sports cars and luxury vehicles, for instance, often have higher insurance costs due to their increased repair costs and higher likelihood of theft.

- Age and Gender: Age and gender are factors that insurance companies consider when assessing risk. Young male drivers, in particular, are often associated with higher insurance rates due to their higher risk of accidents.

- Location: The area where you live and park your vehicle can affect your insurance rates. Areas with higher crime rates or a higher frequency of accidents may result in higher premiums.

- Credit Score: Believe it or not, your credit score can influence your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, so maintaining a good credit score can potentially lead to lower premiums.

- Claims History: Filing multiple claims can lead to higher insurance rates, as it indicates a higher risk to the insurance company. Aim to keep your claims history minimal to maintain lower premiums.

Tips for Finding Cheap Car Insurance

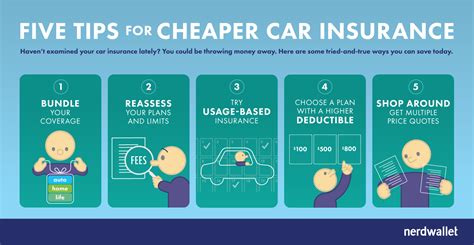

Now that we’ve covered the basics, let’s dive into some practical strategies to help you find the cheapest car insurance options available to you.

Shop Around and Compare Quotes

One of the most effective ways to find cheap car insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so getting quotes from at least three to five insurers is recommended. You can use online comparison tools or contact insurance providers directly to request quotes.

When comparing quotes, ensure that you're comparing apples to apples. This means that the quotes should include the same coverage limits and deductibles so that you can make an accurate comparison. Don't be afraid to negotiate with insurance agents; sometimes, they can offer discounts or better rates if you ask.

Bundle Your Policies

If you have multiple insurance needs, such as car, home, or life insurance, consider bundling your policies with one insurance company. Many providers offer discounts for customers who bundle their policies, as it simplifies their administrative tasks and reduces the risk of losing your business.

Choose Higher Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to lower insurance premiums. However, it’s important to select a deductible amount that you’re comfortable paying if you need to make a claim. Be sure to choose a deductible that won’t strain your finances if the unexpected occurs.

Take Advantage of Discounts

Insurance companies offer a variety of discounts to their customers. Some common discounts include:

- Safe Driver Discounts: If you have a clean driving record, you may be eligible for safe driver discounts.

- Multi-Policy Discounts: As mentioned earlier, bundling your insurance policies can lead to significant savings.

- Loyalty Discounts: Some insurance companies reward customers who have been with them for a certain number of years with loyalty discounts.

- Low Mileage Discounts: If you drive fewer miles per year, you may qualify for low mileage discounts.

- Good Student Discounts: Students who maintain a certain GPA may be eligible for good student discounts.

- Defensive Driving Course Discounts: Completing a defensive driving course can sometimes lead to reduced insurance rates.

It's worth asking your insurance agent about any discounts you may be eligible for. Even if you don't meet the criteria for some discounts, your agent might be able to suggest ways to qualify in the future.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept that allows insurance companies to monitor your driving behavior and adjust your rates accordingly. With usage-based insurance, you might pay lower rates if you drive safely and during off-peak hours. However, if you tend to drive aggressively or during rush hour, your rates could increase.

Maintain a Good Credit Score

As mentioned earlier, your credit score can impact your insurance rates. Maintaining a good credit score can potentially lead to lower insurance premiums. If you have a poor credit score, consider taking steps to improve it, such as paying your bills on time and reducing your debt.

Understanding Your Car Insurance Policy

Once you’ve found a cheap car insurance policy that meets your needs, it’s important to understand the terms and conditions of your policy. Here are some key aspects to consider:

Coverage Limits and Deductibles

Your car insurance policy will specify the coverage limits for each type of coverage you’ve chosen. For example, it will indicate the maximum amount your insurer will pay for bodily injury liability, property damage liability, collision coverage, and comprehensive coverage. It’s important to ensure that your coverage limits are adequate for your needs.

Additionally, your policy will outline your deductibles for collision and comprehensive coverage. Remember that choosing higher deductibles can lead to lower premiums, but it also means you'll pay more out of pocket if you need to make a claim.

Policy Exclusions and Restrictions

Every car insurance policy has exclusions and restrictions. These are specific situations or circumstances that are not covered by your policy. For example, most standard car insurance policies do not cover damage caused by floods or earthquakes. Understanding these exclusions is crucial to avoid any surprises if you need to make a claim.

Policy Add-Ons and Endorsements

Your car insurance policy may also include add-ons or endorsements, which are additional coverages or modifications to your policy. These can include things like rental car coverage, gap insurance, or custom parts and equipment coverage. Consider whether these add-ons are necessary for your situation, as they can increase your insurance premiums.

Making a Car Insurance Claim

In the event of an accident or other covered incident, it’s important to know how to make a car insurance claim. Here’s a step-by-step guide:

Step 1: Contact Your Insurance Company

As soon as possible after the incident, contact your insurance company to report the claim. Most insurers have a 24⁄7 claims hotline, so you can report a claim at any time. Provide as much detail as possible about the incident, including the date, time, location, and any relevant information about the other parties involved.

Step 2: Gather Information

Collect all relevant information about the incident, including photos of the damage, contact information for any witnesses, and details about the other driver’s insurance information. If you’re involved in an accident, be sure to exchange insurance information with the other driver.

Step 3: Cooperate with the Claims Process

Your insurance company will guide you through the claims process, which may involve sending an adjuster to inspect the damage or requesting additional information from you. Cooperate fully with the process and provide any necessary documentation to ensure a smooth and timely resolution.

Step 4: Understand Your Coverage and Deductible

Review your car insurance policy to understand your coverage limits and deductibles. This will help you manage your expectations regarding the payout from your insurance company.

Conclusion: Finding the Right Balance

Finding cheap car insurance doesn’t mean sacrificing quality or coverage. By understanding the factors that influence insurance rates, shopping around for quotes, and taking advantage of discounts and other strategies, you can secure a policy that provides adequate coverage at an affordable price. Remember, car insurance is an important investment to protect your finances and your vehicle, so choose wisely and stay informed.

FAQ

How often should I review my car insurance policy and rates?

+

It’s a good idea to review your car insurance policy and rates at least once a year, or whenever your policy renews. This allows you to assess whether your coverage is still adequate and whether you’re getting the best rate available. You can also review your policy whenever your personal circumstances change, such as getting married, moving to a new location, or buying a new car.

Can I switch car insurance providers mid-policy term?

+

Yes, you can switch car insurance providers at any time. However, be aware that you may incur a fee for canceling your policy early, and you’ll need to ensure that your new policy takes effect immediately to avoid a lapse in coverage. Make sure to compare rates and coverage before making the switch to ensure you’re getting a better deal.

What happens if I fail to make a car insurance payment?

+

If you fail to make a car insurance payment, your policy may be canceled. This can result in a lapse in coverage, which could impact your ability to drive legally and may affect your future insurance rates. Additionally, you may be charged a fee for late or missed payments, and your insurance company may report the missed payment to credit bureaus, which could negatively impact your credit score.