Looking For Car Insurance

When it comes to car insurance, choosing the right coverage can be a daunting task. With numerous options and variables to consider, it's essential to have a comprehensive understanding of the process to make an informed decision. This guide aims to provide you with expert insights and practical tips to navigate the world of car insurance, ensuring you find the best coverage tailored to your needs.

Understanding Car Insurance: An Overview

Car insurance is a contract between you and an insurance provider. It offers financial protection against various potential risks and liabilities associated with owning and operating a motor vehicle. The primary goal of car insurance is to provide coverage for expenses arising from accidents, theft, vandalism, and other unexpected events. It is a legal requirement in most countries and states, ensuring drivers are financially responsible for any damage or injury caused by their vehicles.

The car insurance market is diverse, with numerous providers offering a wide range of coverage options. These options are typically categorized into three main types: liability insurance, collision insurance, and comprehensive insurance. Liability insurance covers the cost of damage or injury you cause to others. Collision insurance covers damage to your own vehicle in case of an accident, regardless of fault. Comprehensive insurance, on the other hand, covers non-collision incidents such as theft, fire, vandalism, and natural disasters.

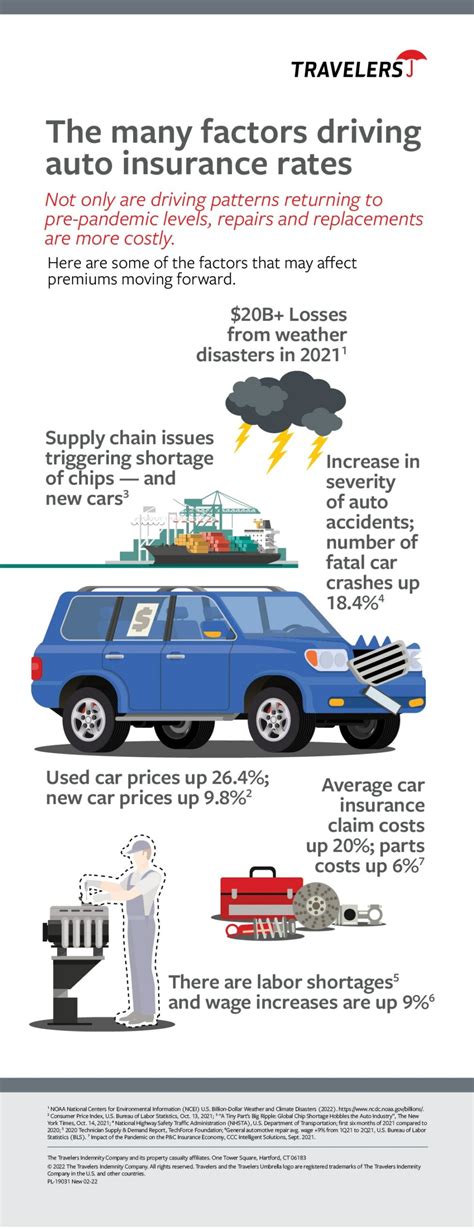

Factors Influencing Car Insurance Premiums

The cost of car insurance, known as the premium, is determined by several factors. These factors are used by insurance companies to assess the risk associated with insuring a particular driver and vehicle. Understanding these factors can help you make informed decisions and potentially reduce your insurance costs.

Driver’s Profile

Your driving history plays a significant role in determining your insurance premium. Insurance companies consider factors such as your age, gender, driving record, and the number of years you’ve been driving. Young drivers and those with a history of accidents or traffic violations may be considered higher-risk and face higher premiums. On the other hand, experienced drivers with a clean record often enjoy lower rates.

Vehicle Details

The type of vehicle you own and its usage are crucial factors. Insurance premiums for sports cars and luxury vehicles tend to be higher due to their higher repair and replacement costs. Similarly, vehicles used for business purposes or driven frequently may incur higher premiums. On the other hand, vehicles with advanced safety features and those that are less expensive to repair or replace may result in lower insurance costs.

Location and Usage

Your geographical location and the purpose of your vehicle’s usage can also impact your insurance rates. Areas with higher crime rates or a history of frequent accidents may result in higher premiums. Additionally, if your vehicle is used primarily for commuting or business purposes, you may face higher costs compared to occasional drivers.

Coverage Options and Deductibles

The level of coverage you choose and the associated deductibles can significantly affect your premium. Higher coverage limits and lower deductibles generally result in higher premiums. However, it’s important to strike a balance between coverage and cost, ensuring you have adequate protection without paying excessive amounts.

Comparing Car Insurance Quotes

Obtaining multiple car insurance quotes is essential to finding the best deal. By comparing quotes from different providers, you can identify the most competitive rates and coverage options available. Here are some steps to guide you through the comparison process:

Research Insurance Providers

Start by researching reputable insurance companies in your area. Consider their financial stability, customer satisfaction ratings, and the range of coverage options they offer. Online reviews and ratings can provide valuable insights into the experiences of other customers.

Gather Necessary Information

To obtain accurate quotes, gather all the necessary information about your vehicle, driving history, and personal details. This includes your vehicle’s make, model, year, and mileage. Additionally, have your driving record and any relevant documents handy to provide accurate information to insurance providers.

Obtain Quotes

Contact multiple insurance providers or use online comparison tools to obtain quotes. Provide the same information to each provider to ensure an accurate comparison. Be sure to ask about any discounts or promotions they offer, as these can significantly reduce your premium.

Analyze Quotes

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional benefits or perks offered. Ensure that the quotes you receive cover all the necessary aspects of your vehicle and driving needs. Consider the reputation and financial stability of the insurance provider, as well as their customer service ratings.

Negotiate and Choose

If you’re satisfied with the quotes you’ve received, consider negotiating with the insurance providers. Some companies may be willing to match or beat a competitor’s offer to secure your business. Once you’ve found the best deal, finalize your insurance policy and ensure you understand all the terms and conditions.

Tips for Lowering Your Car Insurance Costs

While car insurance is a necessary expense, there are ways to potentially reduce your premiums. Here are some strategies to consider:

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to lower your insurance costs. Avoid traffic violations and accidents, as these can significantly increase your premiums. If you have a history of accidents or violations, consider taking defensive driving courses to improve your driving skills and potentially reduce your rates.

Choose a Higher Deductible

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lower your premium. However, it’s important to choose a deductible you can afford in the event of an accident or claim. A higher deductible means you’ll pay more upfront, but it can result in significant savings on your insurance costs.

Explore Discounts

Insurance companies often offer a variety of discounts to attract customers. These discounts can be based on factors such as your age, occupation, educational background, and even your membership in certain organizations. Ask your insurance provider about the discounts they offer and ensure you’re taking advantage of all applicable ones.

Bundle Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts for customers who bundle multiple policies, making it a cost-effective option.

Maintain a Good Credit Score

Your credit score can impact your insurance rates. Insurance companies often use credit-based insurance scores to assess the risk associated with insuring a driver. Maintaining a good credit score can help you secure lower insurance premiums. If you’re unsure about your credit score, consider obtaining a free credit report to understand your financial standing.

Understanding Your Car Insurance Policy

Once you’ve chosen your car insurance policy, it’s crucial to understand the terms and conditions outlined in the policy document. This ensures you know exactly what is covered and what isn’t. Here are some key aspects to review:

Coverage Limits

Review the coverage limits for each aspect of your policy, such as liability, collision, and comprehensive coverage. Ensure these limits are sufficient to cover potential expenses in the event of an accident or other covered incident.

Deductibles and Out-of-Pocket Expenses

Understand the deductibles associated with your policy and the out-of-pocket expenses you may incur in the event of a claim. Be aware of any additional fees or surcharges that may apply.

Exclusions and Limitations

Carefully read through the exclusions and limitations outlined in your policy. These specify situations or events that are not covered by your insurance. Understanding these exclusions can help you make informed decisions and potentially obtain additional coverage if needed.

Renewal and Cancellation Policies

Familiarize yourself with the renewal and cancellation policies outlined in your policy. Understand the notice period required for renewal or cancellation and any potential fees or penalties that may apply.

Filing a Car Insurance Claim

In the unfortunate event of an accident or other covered incident, knowing how to file a car insurance claim is essential. Here’s a step-by-step guide to help you through the process:

Step 1: Report the Incident

As soon as possible after an accident or incident, report it to your insurance company. Provide them with all the necessary details, including the date, time, location, and any relevant information about the other parties involved. Be sure to obtain their contact and insurance information as well.

Step 2: Gather Evidence

Collect evidence related to the incident, such as photographs of the damage, witness statements, and any relevant documentation. This evidence can be crucial in supporting your claim and ensuring a fair settlement.

Step 3: Contact Your Insurance Provider

Contact your insurance provider and inform them of the incident. They will guide you through the claims process and assign an adjuster to handle your case. Provide them with all the necessary information and documentation to support your claim.

Step 4: Cooperate with the Adjuster

Work closely with the assigned adjuster and provide them with any additional information or documentation they may require. Cooperating with the adjuster ensures a smoother claims process and a faster resolution.

Step 5: Understand the Claims Process

Familiarize yourself with the claims process outlined by your insurance provider. Understand the timeline for processing claims, the documentation required, and any potential challenges or delays that may arise.

Conclusion: Making Informed Decisions

Navigating the world of car insurance can be complex, but with the right knowledge and tools, you can make informed decisions. Understanding the factors that influence insurance premiums, comparing quotes, and exploring ways to reduce costs are all crucial steps in finding the best car insurance coverage for your needs. Remember to regularly review and update your insurance policy to ensure it remains adequate and cost-effective.

How often should I review my car insurance policy?

+It is recommended to review your car insurance policy annually or whenever your circumstances change significantly. This allows you to ensure that your coverage remains adequate and that you’re not paying for unnecessary features.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time. However, be aware of any cancellation fees or penalties that may apply. It’s a good idea to compare quotes and research new providers before making the switch.

What should I do if I’m involved in an accident with an uninsured driver?

+If you’re involved in an accident with an uninsured driver, it’s important to contact your insurance provider immediately. They will guide you through the process of filing a claim and help you navigate any legal or financial implications.