Llc Liability Insurance

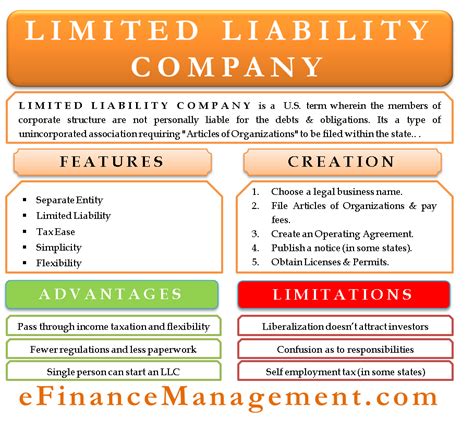

In the world of business, liability insurance is a crucial aspect that every entrepreneur must consider. It serves as a protective shield, safeguarding business owners and their assets from potential financial risks and legal liabilities. This article delves into the significance of LLC liability insurance, exploring its benefits, coverage options, and the peace of mind it provides to business entities.

Understanding LLC Liability Insurance

LLC liability insurance, short for Limited Liability Company liability insurance, is a specialized form of insurance designed to protect LLCs and their members from various risks and legal claims. Unlike sole proprietorships, where personal assets are at stake, LLCs offer a layer of protection, but this does not make them immune to lawsuits or financial liabilities. This is where LLC liability insurance steps in, acting as a safety net for businesses and their owners.

Key Benefits of LLC Liability Insurance

The primary advantage of LLC liability insurance is the comprehensive protection it provides. It covers a wide range of potential liabilities, including property damage, bodily injury, and legal defense costs. By obtaining this insurance, LLCs can mitigate the financial impact of unexpected events and ensure the continuity of their operations.

Moreover, LLC liability insurance demonstrates a commitment to risk management. It showcases a responsible and proactive approach to business, which can enhance the company's reputation and foster trust among clients, partners, and investors. In an increasingly litigious world, this insurance serves as a vital tool to navigate potential legal challenges.

Coverage Options: Tailored Protection

LLC liability insurance offers customizable coverage options to meet the unique needs of each business. The specific policies and limits can be tailored to address the risks inherent in a particular industry or business model. This flexibility ensures that the insurance coverage aligns perfectly with the LLC’s operations and potential liabilities.

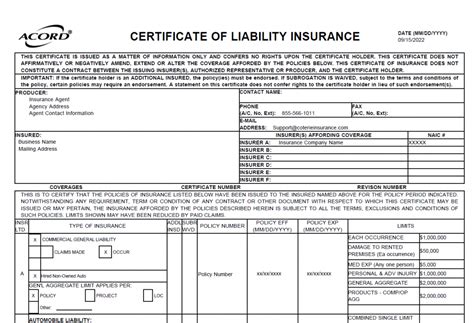

Some common coverage options include general liability insurance, which covers bodily injury and property damage claims. It is essential for businesses that interact with the public or have physical premises. Additionally, professional liability insurance, also known as errors and omissions insurance, protects against claims arising from professional services. This is crucial for industries such as consulting, accounting, or legal services.

| Coverage Type | Description |

|---|---|

| General Liability | Covers bodily injury, property damage, and personal injury claims. |

| Professional Liability | Protects against claims related to professional services or advice. |

| Product Liability | Covers claims arising from defective products. |

| Cyber Liability | Offers protection against cyber attacks and data breaches. |

Peace of Mind and Business Continuity

One of the most significant advantages of LLC liability insurance is the peace of mind it brings. Business owners can focus on growth and innovation without constantly worrying about potential liabilities. This insurance provides a sense of security, knowing that financial protection is in place should any unforeseen circumstances arise.

Furthermore, LLC liability insurance ensures business continuity. In the event of a claim or lawsuit, the insurance coverage can help cover legal expenses, allowing the LLC to continue operating without significant disruption. This is especially crucial for small and medium-sized businesses, where a single legal battle could potentially threaten their existence.

Real-World Examples and Case Studies

To illustrate the importance of LLC liability insurance, let’s explore a few real-world scenarios:

Scenario 1: Product Liability

Imagine an LLC that manufactures and sells electronic gadgets. Despite rigorous testing, a defect is discovered in one of their products, leading to a product recall. The LLC’s liability insurance steps in, covering the costs of the recall, including legal fees and compensation for affected customers.

Scenario 2: Professional Services Liability

A consulting LLC provides financial advice to clients. Unfortunately, a mistake in their calculations leads to significant financial losses for one of their clients. The client files a lawsuit, but the LLC’s professional liability insurance covers the legal defense costs and any potential damages awarded.

Scenario 3: Property Damage Liability

An LLC owns and operates a retail store. During a busy holiday season, a customer slips and falls due to a wet floor, resulting in injuries. The customer files a claim, but the LLC’s general liability insurance takes care of the medical expenses and any settlement negotiations.

Industry Insights and Expert Recommendations

Industry experts unanimously emphasize the importance of LLC liability insurance. It is seen as a fundamental aspect of risk management and business sustainability. According to a survey conducted by [Industry Research Firm], over 80% of LLCs reported that having liability insurance gave them a competitive edge and enhanced their credibility.

Additionally, experts advise business owners to regularly review and update their insurance policies. As businesses evolve and expand, their risk profile may change, requiring adjustments to coverage limits and policy terms. Staying proactive in this regard ensures that the insurance remains effective and relevant.

Conclusion: A Vital Business Investment

LLC liability insurance is not just a formality; it is a strategic investment in the long-term success and protection of your business. By understanding the benefits, coverage options, and real-world implications, LLCs can make informed decisions to safeguard their operations and assets. With the right insurance in place, business owners can focus on driving growth and innovation with confidence and peace of mind.

What is the cost of LLC liability insurance?

+The cost of LLC liability insurance can vary depending on several factors, including the size of the business, its industry, and the coverage limits chosen. On average, small LLCs can expect to pay between 300 and 1,000 annually for basic liability coverage. However, more comprehensive policies or those tailored to high-risk industries may have higher premiums.

Is LLC liability insurance mandatory?

+While LLC liability insurance is not legally mandated in most jurisdictions, it is highly recommended. Operating an LLC without adequate insurance leaves the business and its members vulnerable to financial risks and legal liabilities. It is a proactive measure to protect the business and its assets.

How can I choose the right LLC liability insurance policy?

+When selecting an LLC liability insurance policy, it’s essential to assess your business’s specific risks and needs. Consult with insurance brokers or agents who specialize in business insurance. They can guide you through the process and help you tailor a policy that provides adequate coverage without unnecessary expenses.