Lifetime Cover Insurance

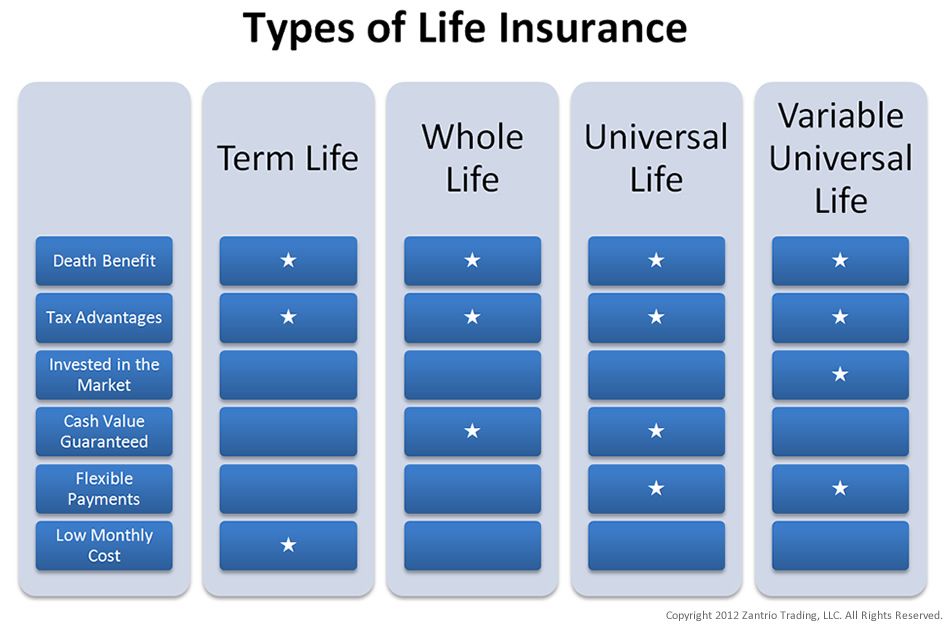

Lifetime cover insurance, also known as permanent life insurance, is a financial tool designed to provide long-term protection and security for individuals and their families. Unlike term life insurance, which offers coverage for a specified period, lifetime cover insurance remains in force for the insured's entire life, offering peace of mind and financial stability.

In today's complex financial landscape, understanding the intricacies of lifetime cover insurance is crucial. This comprehensive guide aims to unravel the benefits, features, and considerations associated with this type of insurance, helping readers make informed decisions about their financial future.

Understanding Lifetime Cover Insurance

Lifetime cover insurance is a unique financial product that combines life insurance coverage with an investment element. It is designed to offer a lifelong safety net, ensuring that the insured’s loved ones are financially protected even in the event of their untimely passing.

The key feature of lifetime cover insurance is its permanent nature. Once the policy is active, it remains in force as long as the premiums are paid, regardless of the insured's age or health status. This provides a sense of security and certainty, knowing that the coverage will be there when needed.

The Investment Component

One of the distinctive aspects of lifetime cover insurance is its investment-linked nature. Alongside the life insurance coverage, policyholders have the option to invest a portion of their premiums in various financial instruments. These investments can accumulate cash value over time, creating a savings component within the policy.

The investment component of lifetime cover insurance offers policyholders the potential for growth and financial flexibility. It allows them to build a substantial savings account, which can be accessed through loans or withdrawals, providing a source of emergency funds or additional financial support.

| Investment Options | Potential Returns |

|---|---|

| Stock Market Funds | High potential for growth, but also higher risk |

| Bond Funds | Moderate returns with lower risk |

| Money Market Funds | Low risk, stable returns |

However, it's important to note that the investment component is not guaranteed, and the returns can vary depending on market conditions. Policyholders should carefully consider their risk tolerance and investment goals when choosing the investment options within their lifetime cover insurance policy.

Premium Payments

Premium payments for lifetime cover insurance can be structured in various ways. Policyholders have the flexibility to choose between paying premiums on a monthly, quarterly, semi-annual, or annual basis. The chosen payment plan will impact the overall cost of the policy and the investment strategy.

Some policies offer the option of fixed premiums, where the payment amount remains the same throughout the policy term. This provides predictability and allows for easier financial planning. On the other hand, flexible premium policies allow policyholders to adjust their payments based on their financial circumstances, providing a level of adaptability.

Benefits of Lifetime Cover Insurance

Lifetime cover insurance offers a range of advantages that make it an attractive option for individuals seeking long-term financial protection and security.

Lifelong Protection

The most significant benefit of lifetime cover insurance is its lifelong coverage. Unlike term life insurance, which provides coverage for a specific period, lifetime cover insurance remains in force as long as the premiums are paid. This means that the insured can rest assured that their loved ones will be financially protected, regardless of their age or health conditions.

Cash Value Accumulation

The investment component of lifetime cover insurance allows policyholders to build cash value over time. This accumulated cash value can serve as a valuable financial resource, providing flexibility and security. Policyholders can access this cash value through loans or withdrawals, which can be used for various purposes such as funding a child’s education, starting a business, or covering unexpected expenses.

Tax Benefits

Lifetime cover insurance policies often offer tax advantages. The cash value within the policy grows tax-deferred, meaning that the investment gains are not subject to taxes until the funds are withdrawn or the policy is surrendered. This tax-efficient growth can significantly boost the policy’s overall value over time.

Guaranteed Acceptance

Certain lifetime cover insurance policies offer guaranteed acceptance, meaning that individuals can obtain coverage regardless of their health or medical history. This feature is particularly beneficial for individuals with pre-existing conditions or those who have difficulty obtaining traditional life insurance policies.

Considerations and Limitations

While lifetime cover insurance offers numerous benefits, it is essential to consider certain factors and limitations before making a decision.

Cost

Lifetime cover insurance policies tend to be more expensive than term life insurance policies. The permanent nature of the coverage and the investment component contribute to higher premium costs. Policyholders need to carefully assess their financial situation and determine if the long-term benefits of lifetime cover insurance align with their budget and financial goals.

Investment Risk

The investment component of lifetime cover insurance introduces an element of risk. Policyholders should be aware that the performance of their chosen investment options can impact the overall value of their policy. While there is potential for growth, there is also the possibility of losses, especially in volatile markets. It is crucial to understand the risk tolerance associated with the investment strategy and choose options that align with personal financial goals.

Surrender Charges

Lifetime cover insurance policies often come with surrender charges, which are fees imposed if the policy is surrendered or cancelled within a certain period. These charges can significantly impact the policy’s cash value, especially if the policy is surrendered early. Policyholders should carefully review the surrender charges and understand the potential financial implications before making any decisions.

Who Should Consider Lifetime Cover Insurance

Lifetime cover insurance is a suitable option for individuals who seek long-term financial protection and have specific needs and considerations.

Individuals with Long-Term Financial Goals

Those who have long-term financial goals, such as funding their retirement, providing for their family’s future, or leaving a legacy, may find lifetime cover insurance beneficial. The permanent coverage and investment component can help accumulate wealth and ensure financial security over an extended period.

Business Owners

Business owners often have unique financial needs and responsibilities. Lifetime cover insurance can provide a safety net for their business and personal finances. It can help ensure the continuity of the business in the event of the owner’s passing, protect business assets, and provide funds for business expansion or succession planning.

High-Net-Worth Individuals

High-net-worth individuals with significant assets and financial obligations may find lifetime cover insurance appealing. It can help protect their wealth, provide tax-efficient growth, and offer a flexible source of funds for various financial needs, such as estate planning or funding charitable causes.

Conclusion

Lifetime cover insurance is a versatile financial tool that offers lifelong protection and the potential for wealth accumulation. It provides a sense of security and peace of mind, knowing that financial support is available for loved ones, regardless of the insured’s age or health. However, it is essential to carefully consider the costs, investment risks, and surrender charges associated with lifetime cover insurance before making a decision.

By understanding the benefits, features, and considerations of lifetime cover insurance, individuals can make informed choices that align with their financial goals and provide the necessary protection for themselves and their families.

How does lifetime cover insurance differ from term life insurance?

+Lifetime cover insurance, also known as permanent life insurance, provides lifelong coverage as long as premiums are paid. In contrast, term life insurance offers coverage for a specified period, typically 10 to 30 years. Term life insurance is generally more affordable but provides coverage only for the specified term.

What happens if I stop paying premiums for my lifetime cover insurance policy?

+If you stop paying premiums for your lifetime cover insurance policy, the policy will typically enter a grace period. During this period, you have a certain amount of time to make up for missed payments. If you fail to do so, the policy may lapse, and you will lose the coverage and any accumulated cash value.

Can I access the cash value of my lifetime cover insurance policy?

+Yes, you can access the cash value of your lifetime cover insurance policy through loans or withdrawals. However, it’s important to note that loans and withdrawals will reduce the policy’s death benefit and may have tax implications. It’s advisable to consult a financial advisor before making any significant withdrawals or loans.