Liability For Car Insurance

In the realm of personal transportation, one of the most crucial aspects to understand is liability coverage in car insurance policies. This type of insurance is a critical component of any motorist's financial protection, safeguarding them against the potentially devastating costs associated with causing harm to others while driving.

Liability insurance is a legal requirement in most jurisdictions, and it serves as a financial safety net for drivers, protecting them from the risks and costs of lawsuits and claims that may arise from accidents. This comprehensive guide aims to delve deep into the world of liability insurance, exploring its intricacies, importance, and real-world applications.

Understanding Liability Coverage

Liability coverage, a fundamental component of car insurance, is designed to provide financial protection to policyholders in the event they are found legally responsible for causing bodily injury or property damage to others in an automobile accident. It is a vital layer of protection, ensuring that policyholders can meet their financial obligations without facing personal bankruptcy or other severe financial consequences.

This coverage can be divided into two main categories: bodily injury liability and property damage liability. Bodily injury liability covers the costs associated with injuries sustained by others in an accident, including medical expenses, rehabilitation costs, and potential loss of income. Property damage liability, on the other hand, covers the costs to repair or replace property, such as other vehicles, fences, buildings, or personal belongings, damaged in an accident.

Key Components of Liability Insurance

- Bodily Injury Liability Limits: This refers to the maximum amount your insurance company will pay for bodily injury claims per person and per accident. For instance, a policy with limits of 100,000 per person and 300,000 per accident means your insurance will pay up to 100,000 for the injury of one person, and up to 300,000 total for all injuries resulting from the same accident.

- Property Damage Liability Limits: Similar to bodily injury liability, this refers to the maximum amount your insurance will cover for property damage claims. A common limit is 50,000, meaning your insurance will pay up to 50,000 for property damage resulting from an accident.

- Defense Costs: In the event you are sued, your liability insurance will typically cover the cost of hiring a lawyer to defend you in court. This is a crucial benefit, as legal fees can quickly become prohibitively expensive.

The Importance of Adequate Liability Coverage

Ensuring you have adequate liability coverage is paramount for several reasons. Firstly, it’s a legal requirement in most states, and driving without it can result in severe penalties, including fines, license suspension, or even jail time.

Secondly, and more importantly, liability insurance provides crucial financial protection. Automobile accidents can result in staggering costs, particularly if there are serious injuries or significant property damage involved. A single accident can lead to medical bills, lost wages, property repair or replacement costs, and potential legal fees, which can quickly add up to hundreds of thousands of dollars.

Without adequate liability coverage, a driver found at fault could be personally responsible for paying these costs. This could mean liquidating assets, taking out loans, or even filing for bankruptcy. Liability insurance acts as a safeguard, ensuring these financial burdens are manageable and don't lead to personal ruin.

Real-Life Scenarios and the Role of Liability Insurance

Consider the following examples of how liability insurance can make a significant difference in real-world situations:

| Scenario | Potential Costs | Role of Liability Insurance |

|---|---|---|

| You rear-end another vehicle at a stoplight, causing significant damage to their car and minor injuries to the driver and passenger. |

|

Your liability insurance would cover the costs of repairing the other vehicle and any medical expenses and lost wages incurred by the driver and passenger, up to your policy limits. |

| You accidentally drift into oncoming traffic and collide head-on with another vehicle, resulting in serious injuries to the other driver. |

|

In this more severe accident, your liability insurance would again step in to cover the costs, providing financial protection up to your policy limits. However, if the total damages exceed your policy limits, you could be personally liable for the remainder. |

| You strike a pedestrian while driving through a crosswalk, resulting in severe injuries that require extensive medical treatment and long-term rehabilitation. |

|

A pedestrian accident can result in extremely high costs due to the severity of potential injuries. Your liability insurance would cover these costs up to your policy limits, but if the damages exceed this, you could face significant personal financial consequences. |

Selecting the Right Liability Coverage Limits

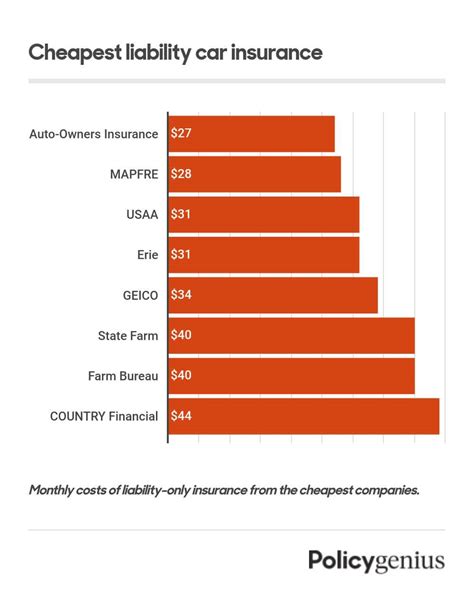

When choosing your liability coverage limits, it’s crucial to strike a balance between ensuring adequate protection and keeping your insurance premiums manageable. The general recommendation is to carry liability limits significantly higher than your state’s minimum requirements.

For instance, if your state's minimum liability requirement is $25,000 for bodily injury per person and $50,000 for bodily injury per accident, you might consider opting for limits of $100,000/$300,000 or even $250,000/$500,000. These higher limits provide a greater safety net, particularly in the event of a severe accident.

Similarly, for property damage liability, while the minimum requirement is often $25,000, it's advisable to opt for a higher limit, such as $50,000 or $100,000. This ensures you're covered for a broader range of potential scenarios, including accidents involving multiple vehicles or significant property damage.

Considerations for High-Risk Drivers

Drivers considered “high-risk” by insurance companies, due to factors like age, driving record, or type of vehicle, may need to consider even higher liability limits. This is because high-risk drivers are more likely to be involved in accidents and may face higher potential costs as a result.

Additionally, high-risk drivers may find that certain insurance companies are unwilling to provide coverage, or may charge extremely high premiums. In such cases, seeking out insurance providers that specialize in high-risk drivers, or considering alternative options like SR-22 insurance, can be beneficial.

Liability Insurance and Legal Protection

One of the often-overlooked benefits of liability insurance is the legal protection it provides. In the event of an accident, your liability insurance policy will typically cover the costs associated with hiring a lawyer to defend you in court, should you be sued.

This is a crucial aspect of liability insurance, as legal fees can quickly become prohibitively expensive. Having the financial backing of your insurance provider ensures you have access to quality legal representation, which can be vital in protecting your rights and minimizing your financial obligations.

Understanding Your Policy’s Legal Coverage

When reviewing your liability insurance policy, pay close attention to the sections detailing legal coverage. This will outline the circumstances under which your insurance provider will provide legal defense and the extent of that coverage.

It's important to note that not all policies provide the same level of legal protection. Some may offer coverage for a limited number of court appearances or a specific dollar amount for legal fees, while others may provide more comprehensive coverage. Understanding these details can help you make an informed decision when choosing your liability insurance policy.

Conclusion: Navigating the Complex World of Liability Insurance

Liability insurance is a critical component of any car insurance policy, providing financial protection and peace of mind to policyholders. By understanding the intricacies of liability coverage, the importance of adequate limits, and the legal protection it affords, drivers can make informed decisions about their insurance coverage.

Remember, while liability insurance is a legal requirement, it's also a vital safeguard against the potentially devastating financial consequences of causing harm to others while driving. Ensuring you have the right coverage limits and understanding your policy's legal protections can help ensure you're fully prepared for the road ahead.

What is the typical range for bodily injury liability limits?

+Bodily injury liability limits typically range from 25,000 to 1,000,000 per person and 50,000 to 3,000,000 per accident. The higher the limits, the more financial protection you have in the event of a severe accident.

Are there any circumstances where my liability insurance may not cover me?

+Yes, there are certain situations where your liability insurance may not provide coverage. This can include driving under the influence, racing, or using your vehicle for illegal purposes. It’s important to review your policy and understand any exclusions or limitations.

How can I determine if my liability coverage is adequate?

+Evaluating your liability coverage involves considering your financial situation, the value of your assets, and the potential risks associated with your driving habits and location. Consulting with an insurance professional can help you assess and ensure you have adequate coverage.