Least Expensive Car Insurance Companies

When it comes to car insurance, one of the primary concerns for many drivers is finding coverage that offers the best value for their money. In an industry known for its complexity and varying rates, identifying the least expensive car insurance companies can be a daunting task. This comprehensive guide aims to shed light on the factors that influence insurance costs and highlight some of the most affordable options available, providing valuable insights for budget-conscious drivers.

Understanding Car Insurance Costs

The cost of car insurance can vary significantly depending on numerous factors. These include the driver’s age, gender, driving history, and location. Additionally, the type of vehicle, its make and model, and the coverage level desired all play a crucial role in determining insurance premiums.

To illustrate, consider the case of a young adult driver residing in an urban area with a history of minor traffic violations. This driver might find that their insurance premiums are higher compared to an experienced driver living in a rural area with a clean record. This variation is a result of the perceived risk associated with different driver profiles, which insurance companies use to calculate premiums.

Factors Influencing Insurance Costs

- Age and Gender: Younger drivers, particularly males, often face higher insurance premiums due to their perceived riskiness on the road. As drivers gain experience and reach more mature ages, insurance costs generally decrease.

- Driving Record: A clean driving record can significantly lower insurance costs. On the other hand, violations, accidents, and DUI convictions can lead to substantial increases in insurance premiums.

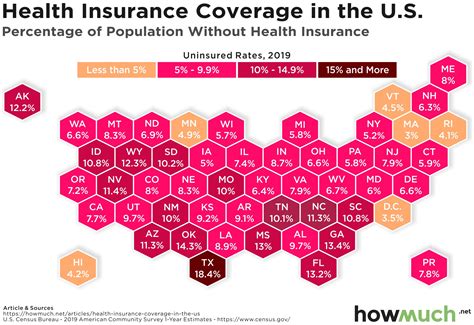

- Location: The area where a driver resides and operates their vehicle can impact insurance costs. Urban areas with higher populations and a greater incidence of accidents and thefts tend to have higher insurance rates.

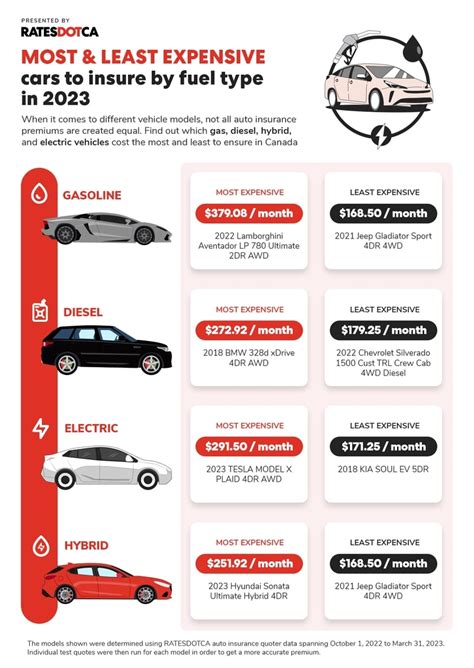

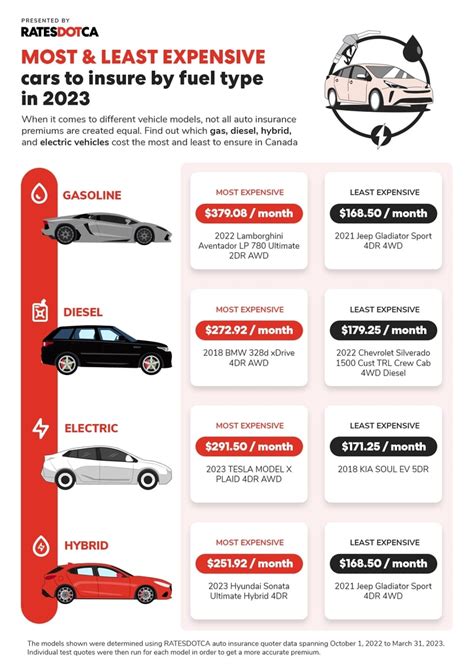

- Vehicle Type: The make, model, and year of a vehicle can influence insurance costs. Sports cars and luxury vehicles, for instance, are often more expensive to insure due to their higher repair and replacement costs.

- Coverage Level: The level of coverage desired, including liability, collision, comprehensive, and additional optional coverages, directly affects insurance premiums. More extensive coverage typically results in higher costs.

Least Expensive Car Insurance Companies

Identifying the least expensive car insurance companies requires a careful examination of various providers and their offerings. While it’s important to note that insurance costs can vary significantly based on individual circumstances, several companies consistently offer competitive rates and comprehensive coverage.

State Farm

State Farm is a well-established insurance provider known for its comprehensive coverage options and competitive pricing. They offer a wide range of insurance products, including auto, home, and life insurance. With a focus on customer satisfaction and personalized service, State Farm has built a strong reputation in the insurance industry.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability Only | $550 |

| Full Coverage | $1,200 |

GEICO

GEICO, an acronym for Government Employees Insurance Company, has gained popularity for its low-cost insurance offerings. With a strong online presence and a focus on digital convenience, GEICO provides efficient and affordable insurance solutions to a wide range of drivers.

| Coverage Type | Average Annual Premium |

|---|---|

| Minimum Liability | $400 |

| Full Coverage | $1,050 |

Progressive

Progressive is a leading insurance provider known for its innovative approach to insurance. They offer a wide range of coverage options and have pioneered several unique features, such as their Name Your Price tool, which allows customers to set their desired price range for insurance.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability Only | $600 |

| Full Coverage | $1,350 |

Esurance

Esurance is a modern insurance provider that leverages technology to offer convenient and affordable insurance solutions. With a strong online platform and a focus on digital convenience, Esurance provides efficient and competitive insurance coverage.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability Only | $450 |

| Full Coverage | $1,100 |

USAA

USAA is a unique insurance provider that caters specifically to military personnel, veterans, and their families. With a strong commitment to serving this demographic, USAA offers highly competitive insurance rates and a range of additional benefits.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability Only | $480 |

| Full Coverage | $1,080 |

Comparative Analysis

When comparing the least expensive car insurance companies, it’s essential to consider not only the cost but also the coverage and additional benefits offered. While State Farm, GEICO, Progressive, Esurance, and USAA consistently offer competitive rates, their coverage options and customer service vary.

| Company | Average Annual Premium (Full Coverage) | Coverage Options | Customer Service |

|---|---|---|---|

| State Farm | $1,200 | Comprehensive coverage options, including unique add-ons | Strong network of agents and personalized service |

| GEICO | $1,050 | Wide range of coverage options, including digital convenience features | Efficient online platform and customer support |

| Progressive | $1,350 | Innovative coverage options, including Name Your Price tool | Customer-centric approach and Snapshot program for safe drivers |

| Esurance | $1,100 | Affordable coverage with a focus on digital convenience | Online platform and DriveSense program for telematics-based discounts |

| USAA | $1,080 | Competitive rates and benefits for military personnel and their families | Strong commitment to military community with additional perks |

Performance Analysis and Future Implications

The car insurance industry is continuously evolving, with companies adopting new technologies and business models to stay competitive. As more providers embrace digital transformation, the landscape of car insurance is likely to shift further towards online platforms and innovative coverage options.

The rise of telematics and usage-based insurance programs, such as Progressive's Snapshot and Esurance's DriveSense, is a notable trend. These programs utilize data collected from vehicles to monitor driving behavior, rewarding safe drivers with potential discounts. This shift towards data-driven insurance models could revolutionize the industry, providing more personalized and cost-effective coverage options.

Additionally, the increasing popularity of electric vehicles (EVs) and autonomous driving technologies is expected to have a significant impact on car insurance. As EV adoption grows, insurance companies may need to adjust their coverage options and pricing structures to accommodate the unique needs and risks associated with these vehicles. Similarly, the emergence of autonomous driving technologies could lead to a reduction in accidents and, subsequently, insurance claims, potentially lowering insurance costs over time.

Looking ahead, the car insurance industry is poised for further disruption and innovation. The integration of artificial intelligence, machine learning, and data analytics is likely to enhance risk assessment and claims processing, leading to more efficient and accurate insurance solutions. Furthermore, the emergence of peer-to-peer insurance models and insurance aggregators could provide drivers with even more options and potentially lower costs.

Conclusion

Finding the least expensive car insurance companies involves a careful evaluation of various factors, including cost, coverage, and additional benefits. While State Farm, GEICO, Progressive, Esurance, and USAA consistently offer competitive rates, it’s essential to consider individual circumstances and preferences when choosing an insurance provider. As the car insurance industry continues to evolve, embracing digital technologies and innovative coverage options, drivers can expect more personalized and cost-effective insurance solutions in the future.

Frequently Asked Questions

How do I know if I’m getting a good deal on car insurance?

+

To determine if you’re getting a good deal on car insurance, compare quotes from multiple providers. Consider not only the cost but also the coverage and additional benefits offered. Look for companies that provide comprehensive coverage options, personalized service, and potential discounts based on your driving record or vehicle type.

Are there any factors that can significantly reduce my car insurance costs?

+

Yes, several factors can lead to reduced car insurance costs. Maintaining a clean driving record, choosing a vehicle with lower repair and replacement costs, and opting for higher deductibles can all result in lower premiums. Additionally, taking advantage of discounts offered by insurance providers, such as safe driver discounts or military discounts, can further reduce your insurance costs.

What should I consider when choosing a car insurance company?

+

When choosing a car insurance company, consider factors such as cost, coverage options, customer service, and additional benefits. Look for a provider that offers competitive rates, comprehensive coverage tailored to your needs, and efficient claims processing. Additionally, consider the company’s reputation, financial stability, and any unique features or programs they offer, such as telematics-based discounts or usage-based insurance.

How can I save money on car insurance as a young driver?

+

As a young driver, insurance costs can be higher due to perceived risk. To save money, consider taking advantage of good student discounts offered by some insurance providers. Maintaining a clean driving record and opting for higher deductibles can also reduce premiums. Additionally, exploring group insurance plans through your school or university, if available, can provide cost-effective coverage options.

What are some potential future developments in the car insurance industry?

+

The car insurance industry is expected to undergo significant changes in the future. The increasing adoption of electric vehicles and autonomous driving technologies is likely to impact insurance coverage and costs. Additionally, the integration of artificial intelligence and data analytics is expected to enhance risk assessment and claims processing, leading to more efficient and personalized insurance solutions.