Kaiser Insurance Cost

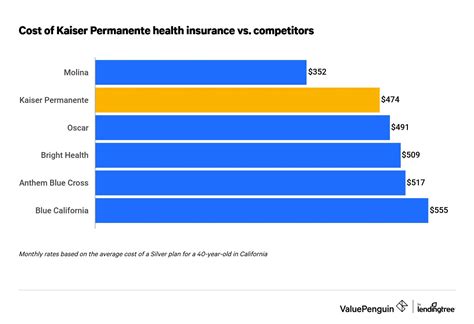

Kaiser Permanente, often referred to as Kaiser, is a well-known healthcare organization in the United States that offers a range of health insurance plans. The cost of Kaiser insurance can vary significantly based on several factors, including the type of plan, the region, and the individual's specific healthcare needs. Understanding the costs associated with Kaiser insurance is crucial for individuals and families seeking comprehensive healthcare coverage.

Understanding Kaiser Insurance Costs

Kaiser Permanente operates as an integrated healthcare system, which means it provides both health insurance plans and medical services through its network of hospitals, medical centers, and healthcare professionals. This unique model allows Kaiser to offer a seamless and coordinated healthcare experience to its members.

The cost of Kaiser insurance can be broken down into several components, including premiums, deductibles, copayments, and out-of-pocket maximums. These elements contribute to the overall financial responsibility an individual or family assumes when enrolling in a Kaiser health plan.

Premiums

Premiums are the regular payments made by the insured individual or family to maintain their health insurance coverage. Kaiser insurance premiums can vary based on the type of plan, the region, and the specific coverage options chosen. Generally, premiums are paid on a monthly or annual basis.

For instance, let's consider the Kaiser Permanente Premium Plan. This plan offers a comprehensive range of healthcare services and typically comes with a higher premium cost. On the other hand, the Kaiser Permanente Value Plan provides more cost-effective coverage with slightly limited benefits and a lower premium.

| Plan Type | Average Monthly Premium |

|---|---|

| Kaiser Permanente Premium Plan | $500 - $800 |

| Kaiser Permanente Value Plan | $350 - $550 |

Please note that these premium ranges are approximate and can vary based on individual circumstances and the specific region. It's essential to obtain personalized quotes to determine the exact cost for your situation.

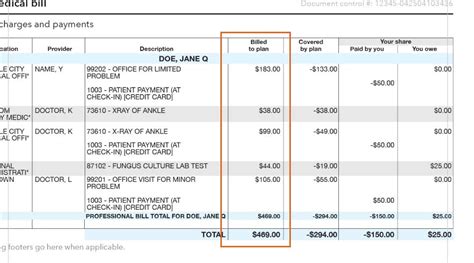

Deductibles and Copayments

Deductibles and copayments are additional cost components associated with Kaiser insurance plans. A deductible is the amount an insured individual must pay out of pocket before the insurance coverage kicks in. Copayments, on the other hand, are fixed amounts paid by the insured for specific healthcare services, such as doctor visits or prescription medications.

The Kaiser Permanente Premium Plan, for example, may have a higher deductible but offer lower copayments for various services. In contrast, the Value Plan might have a lower deductible but higher copayments.

| Plan Type | Average Deductible | Average Copayment |

|---|---|---|

| Kaiser Permanente Premium Plan | $1,500 - $2,000 | $20 - $40 |

| Kaiser Permanente Value Plan | $500 - $1,000 | $30 - $50 |

These are approximate averages, and actual deductibles and copayments can vary depending on the specific plan and region.

Out-of-Pocket Maximums

The out-of-pocket maximum is the maximum amount an insured individual or family will have to pay in a given year for covered healthcare services. Once the out-of-pocket maximum is reached, the insurance plan covers 100% of the costs for covered services for the remainder of the year.

For instance, the Kaiser Permanente Premium Plan may have a higher out-of-pocket maximum of $6,000, while the Value Plan could have a lower maximum of $4,000. This means that individuals enrolled in the Premium Plan would have to pay more out of pocket before reaching their maximum, but once reached, all covered services are fully covered.

Factors Affecting Kaiser Insurance Costs

Several factors can influence the cost of Kaiser insurance plans, making it essential to carefully consider these aspects when choosing a plan that aligns with your healthcare needs and budget.

Type of Plan

Kaiser offers a variety of health insurance plans, each designed to cater to different needs and budgets. The type of plan you choose will directly impact your insurance costs. For instance, Kaiser’s HMO (Health Maintenance Organization) plans typically have lower premiums but may have more limited provider networks.

On the other hand, PPO (Preferred Provider Organization) plans offer more flexibility in choosing healthcare providers but often come with higher premiums. Understanding the trade-offs between these plan types is crucial for making an informed decision.

Region and State

Kaiser insurance costs can vary significantly based on the region and state in which you reside. Healthcare costs, including the cost of medical services and insurance, can differ across different areas of the country. Additionally, state-specific regulations and requirements can influence the pricing of health insurance plans.

For example, states with higher healthcare costs or stricter regulations may have higher insurance premiums. It's important to research the specific costs associated with Kaiser insurance in your region to get an accurate estimate.

Age and Health Status

Your age and health status can also impact the cost of your Kaiser insurance plan. In general, younger individuals tend to have lower insurance premiums compared to older adults. Additionally, individuals with pre-existing health conditions or a history of chronic illnesses may face higher premiums or be required to enroll in specific plans designed for their health needs.

Kaiser Permanente takes into account an individual's health status when determining premiums, and this can result in variations in cost. It's important to be transparent about your health history when applying for Kaiser insurance to ensure accurate pricing.

Choosing the Right Kaiser Insurance Plan

Selecting the right Kaiser insurance plan involves careful consideration of your healthcare needs, budget, and personal preferences. Here are some key factors to keep in mind when choosing a Kaiser insurance plan:

- Coverage Needs: Assess your current and potential future healthcare needs. Consider any chronic conditions, regular medications, or specialized treatments you may require. Choose a plan that provides adequate coverage for these needs.

- Budget: Evaluate your financial situation and determine how much you can afford to spend on health insurance premiums, deductibles, and copayments. Compare different Kaiser plans to find one that aligns with your budget.

- Provider Network: Review the provider network associated with each Kaiser plan. Ensure that your preferred healthcare providers, including doctors and specialists, are included in the network. A strong provider network can enhance your access to quality healthcare.

- Prescription Drug Coverage: If you rely on prescription medications, thoroughly review the plan's prescription drug coverage. Some plans may have different tiers or copayments for various medications, so choose a plan that covers your specific medication needs.

- Additional Benefits: Kaiser offers a range of additional benefits, such as wellness programs, telemedicine services, and mental health support. Consider whether these benefits align with your personal healthcare goals and preferences.

It's highly recommended to consult with a licensed insurance agent or a Kaiser representative to discuss your specific circumstances and receive personalized recommendations for Kaiser insurance plans.

Enrolling in Kaiser Insurance

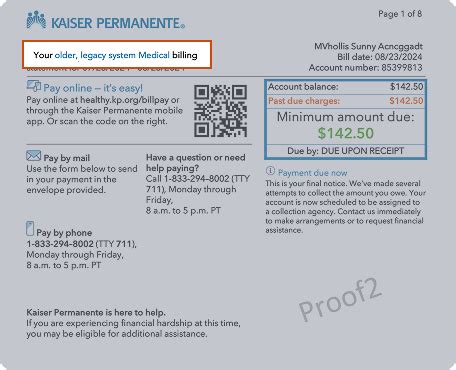

Enrolling in Kaiser insurance typically involves the following steps:

- Research and Compare Plans: Visit the Kaiser Permanente website or contact a Kaiser representative to obtain information about the available plans and their specific details, including premiums, deductibles, and coverage options.

- Determine Eligibility: Review the eligibility criteria for each plan. Some plans may have specific requirements or be targeted towards certain demographics.

- Complete an Application: Fill out an application form, providing accurate and detailed information about your personal and health-related details. This information is essential for determining your insurance costs and coverage.

- Review and Select a Plan: Carefully review the plan options based on your research and eligibility. Choose the plan that best aligns with your healthcare needs and budget.

- Make the Initial Payment: Once you've selected a plan, you'll need to make the initial premium payment to activate your coverage. This payment can usually be made online, over the phone, or through other designated payment methods.

- Receive Your Insurance Card: After completing the enrollment process and making the initial payment, you'll receive your Kaiser insurance card. This card serves as proof of your insurance coverage and should be carried with you at all times.

It's important to note that the enrollment process and requirements may vary depending on your specific situation, such as whether you're enrolling as an individual, as a family, or through an employer-sponsored plan. Be sure to carefully review the enrollment guidelines provided by Kaiser Permanente.

Kaiser Insurance: A Comprehensive Healthcare Solution

Kaiser Permanente has established itself as a leading healthcare organization, offering a comprehensive range of services and insurance plans. By understanding the costs associated with Kaiser insurance and carefully selecting a plan that aligns with your needs, you can access quality healthcare and peace of mind.

With its integrated healthcare system and focus on patient-centered care, Kaiser provides a seamless and coordinated healthcare experience. Whether you're seeking preventive care, specialized treatments, or long-term management of chronic conditions, Kaiser insurance can offer the coverage and support you need.

Remember, choosing the right health insurance plan is a crucial decision that impacts your well-being and financial stability. Take the time to research, compare, and consult with experts to ensure you make an informed choice. Kaiser insurance, with its various plan options and dedicated healthcare professionals, can be a valuable partner in your healthcare journey.

Can I get a personalized quote for Kaiser insurance?

+

Yes, you can obtain a personalized quote for Kaiser insurance by contacting a licensed Kaiser representative or using their online quoting tool. Providing accurate information about your age, health status, and desired coverage will help generate an estimate tailored to your needs.

Are there any discounts or subsidies available for Kaiser insurance plans?

+

Kaiser Permanente offers various discounts and subsidies to make their insurance plans more affordable. These may include discounts for healthy lifestyles, group plans through employers, or subsidies for low-income individuals. Check with Kaiser to explore these options.

What happens if I need to see a specialist outside of the Kaiser network?

+

If you require specialized care from a provider outside of the Kaiser network, you may need to pay additional costs or seek prior authorization. It’s important to review your plan’s out-of-network coverage and consult with Kaiser’s member services to understand the specific requirements and potential costs involved.