John Hancock Insurance Company

The John Hancock Insurance Company, a well-known name in the insurance industry, has a rich history and a wide range of offerings. With a focus on innovation and customer-centric approaches, this company has established itself as a trusted provider of financial protection and services. In this article, we delve into the world of John Hancock, exploring its origins, key milestones, product offerings, and its impact on the insurance landscape.

A Legacy of Innovation: The John Hancock Story

John Hancock, officially known as John Hancock Financial Services, has its roots firmly planted in the late 19th century. The company was founded in 1862 as the John Hancock Mutual Life Insurance Company, named after the prominent American patriot and first signer of the Declaration of Independence, John Hancock.

Since its inception, the company has been synonymous with innovation and a forward-thinking approach. Over the years, John Hancock has pioneered numerous advancements in the insurance industry, shaping the way policies are designed and delivered. From being one of the first life insurance companies to offer adjustable life insurance policies in the 1970s to embracing digital technologies for streamlined customer experiences, the company has consistently pushed the boundaries of what insurance can be.

Headquartered in Boston, Massachusetts, John Hancock operates across the United States and has a significant presence in the Canadian market through its subsidiary, John Hancock Life Insurance Company (Canada). The company's global reach and diverse portfolio of products have made it a key player in the insurance and financial services arena.

Key Milestones and Industry Leadership

John Hancock’s journey is marked by several notable milestones that have solidified its position as an industry leader:

- 1862: The company is founded, offering life insurance policies to individuals and families.

- 1972: John Hancock introduces the industry's first adjustable life insurance policy, providing customers with greater flexibility and control over their coverage.

- 1986: The company expands its reach by acquiring the New England Mutual Life Insurance Company, solidifying its position as a major player in the life insurance market.

- 2000: John Hancock embraces the digital age, becoming one of the first insurance companies to offer online policy management and quotes.

- 2013: The company partners with leading technology providers to launch innovative wearable technology-based insurance plans, rewarding customers for healthy lifestyle choices.

These milestones demonstrate John Hancock's commitment to staying ahead of the curve and delivering cutting-edge solutions to its customers.

Product Offerings: A Comprehensive Financial Protection Suite

John Hancock offers a comprehensive range of insurance and financial services products designed to meet the diverse needs of its customers. The company’s product portfolio includes:

Life Insurance

John Hancock’s life insurance policies are tailored to provide financial protection and peace of mind to individuals and their families. The company offers a wide array of life insurance options, including:

- Term Life Insurance: Providing coverage for a specific period, typically 10, 20, or 30 years, with affordable premiums.

- Whole Life Insurance: Offering lifelong coverage with cash value accumulation, allowing policyholders to build savings alongside protection.

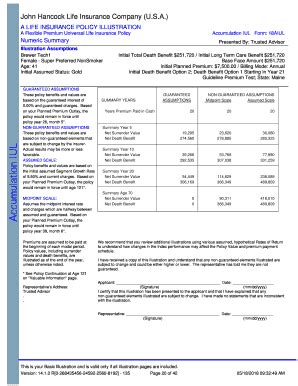

- Universal Life Insurance: A flexible policy that combines protection and savings, with adjustable premiums and death benefits.

- Variable Life Insurance: Offering investment options within the policy, allowing policyholders to customize their coverage and potential returns.

Health Insurance

In addition to life insurance, John Hancock also provides health insurance solutions to help individuals and families manage their healthcare expenses. The company’s health insurance offerings include:

- Individual Health Insurance: Comprehensive coverage plans designed for individuals and their families, offering a range of benefits and network options.

- Group Health Insurance: Tailored plans for employers to provide healthcare coverage to their employees, often with additional perks and discounts.

- Medicare Supplement Insurance: Plans designed to cover the gaps in Medicare coverage, ensuring individuals have comprehensive healthcare protection during retirement.

Annuities and Retirement Planning

John Hancock’s retirement planning solutions are designed to help individuals secure their financial future. The company offers a variety of annuity products, including:

- Fixed Annuities: Providing guaranteed income for life or a specific period, with a fixed interest rate.

- Variable Annuities: Offering the potential for higher returns through investment options, with a balance of risk and reward.

- Indexed Annuities: Combining the stability of fixed annuities with the growth potential of variable annuities, providing a middle ground for investors.

Long-Term Care Insurance

Recognizing the importance of long-term care planning, John Hancock offers policies to cover the costs associated with extended care needs. Their long-term care insurance plans provide coverage for:

- Home health care

- Assisted living facilities

- Nursing home care

- Adult day care

These policies help individuals maintain their independence and quality of life as they age, providing financial support for essential care services.

Investment and Wealth Management

John Hancock’s wealth management services are tailored to help individuals and businesses grow and protect their assets. The company offers a range of investment options, including:

- Mutual Funds: A diverse selection of funds to meet various investment goals and risk tolerances.

- Managed Accounts: Personalized investment strategies designed and managed by John Hancock's experts.

- 529 College Savings Plans: Tax-advantaged plans to help families save for their children's education expenses.

With a focus on long-term wealth accumulation and preservation, John Hancock's investment and wealth management solutions provide a comprehensive approach to financial planning.

Customer Experience and Digital Innovation

John Hancock has consistently prioritized the customer experience, investing in digital technologies to streamline policy management and enhance overall satisfaction. The company’s online platform offers a range of features, including:

- Policy management: Customers can view and manage their policies, make payments, and update personal information securely online.

- Claim submission: A user-friendly process for submitting and tracking claims, ensuring timely and efficient resolutions.

- Educational resources: Access to a wealth of information and tools to help customers understand their policies and make informed financial decisions.

- Digital underwriting: Utilizing advanced technologies to streamline the underwriting process, providing faster policy approvals.

John Hancock's embrace of digital innovation has not only improved the customer experience but has also allowed the company to reach a wider audience, making insurance more accessible and convenient.

Community Engagement and Social Responsibility

Beyond its financial services offerings, John Hancock is committed to making a positive impact on the communities it serves. The company’s corporate social responsibility initiatives focus on several key areas:

Environmental Sustainability

John Hancock recognizes the importance of environmental stewardship and has implemented several initiatives to reduce its environmental footprint. The company has committed to:

- Reducing greenhouse gas emissions

- Promoting energy efficiency in its operations

- Encouraging sustainable practices among its employees and partners

Community Investment

John Hancock believes in giving back to the communities where its employees live and work. The company’s community investment programs support a range of causes, including:

- Education and youth development

- Financial literacy and empowerment

- Disaster relief and recovery efforts

Diversity and Inclusion

John Hancock is dedicated to fostering a diverse and inclusive workplace. The company has implemented several programs and initiatives to promote diversity at all levels of the organization, including:

- Diversity recruitment and retention strategies

- Employee resource groups for various diversity dimensions

- Training and development programs focused on diversity and inclusion

Through these initiatives, John Hancock aims to create a culture of inclusivity and ensure that its workforce reflects the diversity of the communities it serves.

Future Outlook and Industry Trends

As the insurance industry continues to evolve, John Hancock remains committed to staying at the forefront of innovation. The company is focused on several key areas to drive future growth and maintain its competitive edge:

Artificial Intelligence and Data Analytics

John Hancock is leveraging advanced technologies like artificial intelligence (AI) and data analytics to enhance its underwriting processes, risk assessment, and customer engagement. By analyzing vast amounts of data, the company can make more accurate predictions and offer personalized solutions to its customers.

Digital Transformation

Continuing its digital transformation journey, John Hancock aims to further streamline its processes and enhance the customer experience. The company is investing in cutting-edge technologies to create a seamless and intuitive online platform, making insurance and financial services more accessible and convenient.

Sustainable Investing

Recognizing the growing importance of sustainable and responsible investing, John Hancock is expanding its range of environmentally and socially responsible investment options. The company is committed to helping investors align their financial goals with their values, offering funds that prioritize sustainability and positive social impact.

Health and Wellness Initiatives

John Hancock is dedicated to promoting health and wellness among its customers. The company is exploring ways to incentivize healthy lifestyle choices, such as offering discounts or rewards for customers who maintain healthy habits. By encouraging preventive care and healthy behaviors, John Hancock aims to reduce healthcare costs and improve overall well-being.

Partnerships and Collaborations

John Hancock understands the value of collaboration and is actively seeking partnerships with technology companies, startups, and industry leaders to stay ahead of the curve. These collaborations allow the company to access innovative solutions and gain insights into emerging trends, ensuring it remains a leader in the insurance space.

Conclusion

John Hancock Insurance Company has a rich history of innovation and a comprehensive suite of financial protection and wealth management solutions. Through its commitment to customer-centric approaches, digital innovation, and social responsibility, the company has solidified its position as a trusted partner for individuals and businesses alike. As the insurance landscape continues to evolve, John Hancock remains focused on driving industry advancements and delivering exceptional value to its customers.

What sets John Hancock apart from other insurance companies?

+John Hancock’s commitment to innovation and customer-centric approaches sets it apart. The company has a long history of pioneering new products and services, such as adjustable life insurance policies and wearable technology-based plans. Additionally, its focus on digital transformation and personalized customer experiences makes it a leading choice for those seeking modern and convenient insurance solutions.

Does John Hancock offer international insurance coverage?

+While John Hancock primarily operates in the United States and Canada, the company does offer certain international insurance products. These products are designed to provide coverage for individuals who have global assets or who frequently travel internationally. John Hancock’s expertise in cross-border insurance solutions ensures that customers receive comprehensive protection, no matter where they are in the world.

How does John Hancock support its customers in times of need?

+John Hancock prioritizes customer support and has a dedicated team of professionals ready to assist policyholders. The company offers a range of resources, including online tools for policy management, easy claim submission processes, and access to a network of healthcare providers for health insurance plans. Additionally, John Hancock’s customer service representatives are available to provide personalized assistance and guidance when needed.