Is Tricare Private Insurance

Tricare, formerly known as the Civilian Health and Medical Program of the Uniformed Services (CHAMPUS), is a comprehensive health care program tailored specifically for active-duty service members, retirees, and their respective families. This specialized insurance plan is not a traditional private insurance scheme but a unique offering designed by the United States Department of Defense (DoD) to cater to the distinct needs of the military community.

Understanding Tricare: A Non-Private Insurance Option

Tricare is a federal program, administered by the Defense Health Agency (DHA), which provides health benefits for uniformed service members, their families, and certain former spouses. Unlike private insurance plans, which are purchased on the open market, Tricare is a benefit that individuals in the military community earn through their service or association with active-duty personnel. It is a defined benefit, meaning the coverage and costs are predetermined and standardized across all eligible beneficiaries.

Key Differences from Private Insurance

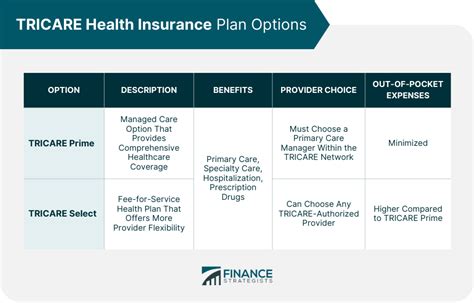

- Eligibility Criteria: While private insurance plans typically cater to a wide range of individuals based on age, health status, and personal preferences, Tricare’s eligibility is restricted to military personnel, retirees, and their dependents. This eligibility is a significant departure from the open enrollment nature of most private insurance plans.

- Cost Structure: Tricare’s cost structure is considerably different from private insurance. It is often more affordable than private insurance, especially for those who have served for an extended period or those who are currently on active duty. However, the cost-sharing arrangements, including copayments and deductibles, can vary based on the specific Tricare plan an individual is enrolled in.

- Coverage and Benefits: Tricare provides an extensive range of health care services, including medical, dental, and vision care, as well as pharmacy benefits. However, the coverage can vary based on the Tricare plan and the beneficiary’s status (active duty, retired, or dependent). In contrast, private insurance plans offer a more customizable approach to coverage, allowing individuals to select the level of coverage they desire and can afford.

Tricare’s Administrative Process

Tricare operates under a unique administrative process. The Defense Health Agency (DHA) contracts with private insurance companies to manage the health benefits of Tricare beneficiaries. These companies, known as Tricare Managed Care Support Contractors (MCSCs), are responsible for managing the day-to-day operations of the program, including processing claims, managing provider networks, and overseeing the quality of care provided to beneficiaries.

Despite the involvement of private insurance companies, Tricare remains distinct from private insurance in its structure, eligibility, and the manner in which it is administered. It is a federally-funded program with a specific mission to support the health and well-being of the military community.

| Comparison Aspect | Tricare | Private Insurance |

|---|---|---|

| Eligibility | Restricted to military personnel, retirees, and dependents | Open to a wide range of individuals based on age, health status, etc. |

| Cost Structure | Standardized, often more affordable for military community | Customizable, prices vary based on coverage and individual health status |

| Coverage | Extensive, includes medical, dental, vision, and pharmacy benefits | Varies based on plan and individual needs |

| Administration | Federally-funded, managed by private insurance companies | Fully private, administered and funded by insurance companies |

In Summary

Tricare is a vital health care program that provides essential services to those who have dedicated their lives to serving the nation. While it shares some administrative similarities with private insurance, given the involvement of private insurance companies, Tricare’s unique eligibility criteria, cost structure, and coverage make it a distinct offering in the health insurance landscape. Understanding these differences is crucial for individuals navigating the complex world of health insurance, especially those with ties to the military community.

Can Tricare be used in conjunction with private insurance?

+In certain situations, Tricare can be used as a secondary payer alongside private insurance. This is known as the “Two-Plan Rule” and typically applies when a beneficiary is eligible for both Tricare and private insurance. In such cases, Tricare covers expenses not covered by private insurance, and vice versa.

How does Tricare’s cost structure benefit military families?

+Tricare’s cost structure is often more affordable for military families, especially those with active-duty members. This is because Tricare is partially funded by the government and military pay, which helps keep costs down. Additionally, certain Tricare plans have no or low premiums, making it an attractive option for military families.

What happens if I move out of the country while on Tricare?

+Tricare coverage is typically limited to the United States and its territories. However, certain plans, like Tricare Select, offer limited coverage for emergency and non-routine care when beneficiaries are temporarily outside the United States. For long-term international moves, beneficiaries may need to explore other insurance options.