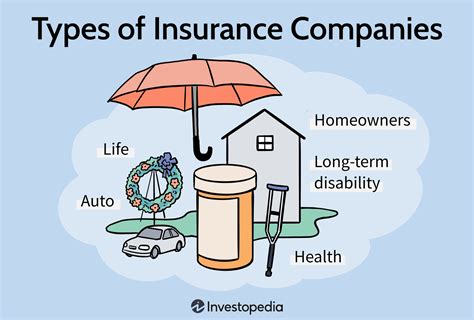

Insurance Type

The insurance industry is vast and multifaceted, offering a wide range of products to protect individuals, businesses, and assets from various risks and uncertainties. One of the key aspects that often confuses people is the different types of insurance available and their specific purposes. In this comprehensive guide, we will delve into the world of insurance, exploring the diverse categories, their unique features, and how they provide financial security and peace of mind.

Understanding the Basics: A Broad Overview

Insurance, at its core, is a financial safeguard against potential losses. It operates on the principle of risk pooling, where a group of individuals or entities contribute premiums to a fund, which is then used to compensate those who suffer losses or damages. This mechanism ensures that the financial burden of an unforeseen event is shared among a large community, making it more manageable for those directly affected.

The insurance market offers a myriad of options, each tailored to address specific risks. These can be broadly categorized into several main types, each with its own set of characteristics and coverage.

Life Insurance: Securing Your Legacy

Life insurance is perhaps one of the most well-known and essential types of insurance. It provides financial protection to the policyholder’s beneficiaries in the event of their death. This type of insurance is particularly crucial for individuals with financial dependents, such as spouses, children, or aging parents.

Term Life Insurance

Term life insurance is a straightforward and cost-effective option. It offers coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policyholder pays a fixed premium, and in the event of their death, the beneficiaries receive a lump-sum payment known as the death benefit. This type of insurance is ideal for those seeking temporary coverage, such as covering a mortgage or providing for children’s education.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for the policyholder’s entire life. It combines a death benefit with a cash value component, which grows over time and can be accessed by the policyholder through loans or withdrawals. This type of insurance is often chosen for its long-term financial security and the potential for tax-advantaged savings.

Key Person Insurance

Key person insurance is a specialized form of life insurance designed for businesses. It provides coverage for individuals who are vital to the company’s success and operations. In the event of the key person’s death, the insurance policy pays out a sum to the business, helping to mitigate financial losses and maintain business continuity.

Health Insurance: Protecting Your Well-being

Health insurance is another vital type of coverage, focusing on providing financial support for medical expenses. With rising healthcare costs, having adequate health insurance is crucial for individuals and families.

Individual Health Insurance

Individual health insurance plans are tailored to meet the specific needs of an individual or a family. These plans cover a range of medical services, including doctor visits, hospital stays, prescription medications, and often include preventive care benefits. The cost of these plans varies based on factors such as age, location, and the level of coverage chosen.

Group Health Insurance

Group health insurance is typically offered through employers as a benefit to their employees. These plans often provide more comprehensive coverage at a lower cost compared to individual plans. The employer usually contributes a portion of the premium, making it an attractive benefit for employees. Group health insurance plans can also include additional perks like dental and vision coverage.

Medicare and Medicaid

Medicare and Medicaid are government-sponsored health insurance programs in the United States. Medicare primarily serves individuals aged 65 and older, as well as those with certain disabilities, providing coverage for hospital stays, doctor visits, and prescription drugs. Medicaid, on the other hand, is a means-tested program that provides health coverage to low-income individuals and families.

Property and Casualty Insurance: Safeguarding Your Belongings

Property and casualty insurance is a broad category that covers a wide range of assets and liabilities. It ensures that individuals and businesses are protected against potential losses related to their properties and possessions.

Homeowners Insurance

Homeowners insurance is a staple for anyone who owns a home. It provides coverage for the structure of the home itself, as well as the personal belongings within it. This type of insurance typically includes liability coverage, which protects the homeowner if someone is injured on their property. It also often covers additional living expenses if the home becomes uninhabitable due to a covered event.

Renters Insurance

Renters insurance is designed for individuals who rent their living space. It provides coverage for personal belongings and liability protection, ensuring that renters are not financially burdened if their possessions are damaged or stolen. Renters insurance is particularly important as it does not typically come with a rental agreement and must be obtained separately.

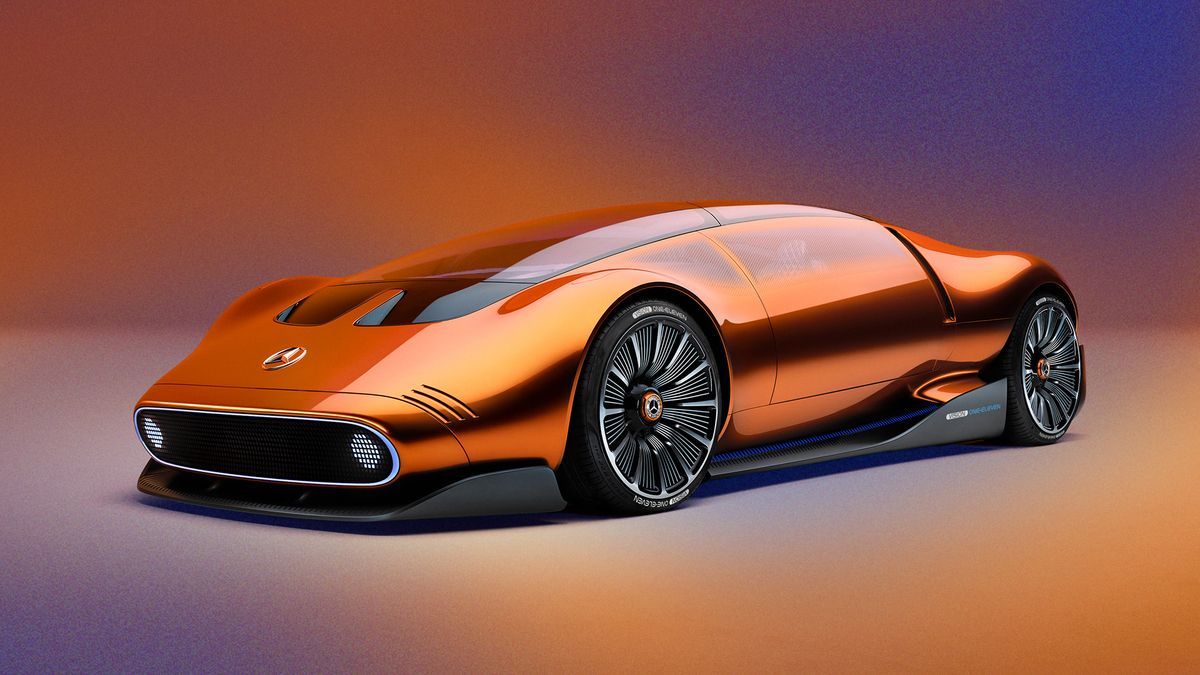

Auto Insurance

Auto insurance is a legal requirement in most countries and provides financial protection in the event of an accident. It covers a range of scenarios, including damage to the insured vehicle, injury to the driver and passengers, and liability for property damage or injuries caused to others. Auto insurance policies can vary widely, with options for comprehensive coverage, collision coverage, and liability-only policies.

Business Insurance: Mitigating Risks for Entrepreneurs

Business insurance is essential for entrepreneurs and small business owners, offering protection against a wide array of risks that can impact a company’s operations and finances.

General Liability Insurance

General liability insurance is a fundamental type of business insurance. It protects the business against claims of bodily injury, property damage, and personal and advertising injury that may occur due to the business’s operations. This type of insurance is crucial for businesses that interact with the public, as it provides a safety net against potential lawsuits.

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance is designed for businesses that provide professional services. It covers the business against claims of negligence, errors, or omissions that may occur in the course of providing these services. This type of insurance is particularly important for industries like consulting, healthcare, and legal services.

Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement for most businesses with employees. It provides coverage for employees who suffer work-related injuries or illnesses, ensuring they receive medical treatment and wage replacement. This type of insurance not only protects employees but also shields the business from potential lawsuits and ensures compliance with labor laws.

Specialized Insurance: Tailored Protection

Beyond the main categories, there are numerous specialized insurance types that cater to unique needs and circumstances.

Travel Insurance

Travel insurance provides coverage for unexpected events that may occur during a trip, such as trip cancellations, medical emergencies, or lost luggage. It offers peace of mind to travelers, ensuring that they are not left with substantial financial losses if their travel plans are disrupted.

Pet Insurance

Pet insurance is designed to cover the costs of veterinary care for pets. With the rising costs of medical treatments for animals, pet insurance can be a valuable asset for pet owners, ensuring they can provide the best care for their furry companions without breaking the bank.

Cyber Insurance

In the digital age, cyber insurance has become increasingly important. It provides coverage for businesses and individuals against cyber risks, such as data breaches, hacking, and cyber extortion. With the ever-evolving threat landscape, cyber insurance is a crucial component of a comprehensive risk management strategy.

Conclusion: Navigating the World of Insurance

The insurance landscape is diverse and complex, offering a myriad of options to protect against an array of risks. From life insurance to safeguard your legacy to health insurance to protect your well-being, and from property insurance to secure your belongings to specialized insurance for unique needs, the right insurance policy can provide invaluable peace of mind. Understanding the different types of insurance and their specific features is crucial in making informed decisions to secure your financial future.

What is the main purpose of insurance?

+

Insurance serves as a financial safeguard against potential losses. It operates on the principle of risk pooling, where a community shares the financial burden of unforeseen events, providing stability and peace of mind.

How do I choose the right type of insurance for my needs?

+

Choosing the right insurance involves assessing your specific risks and needs. Consider factors like your age, health status, financial dependencies, and assets. Consult with insurance professionals to tailor a plan that suits your unique circumstances.

Are there any common misconceptions about insurance?

+

One common misconception is that insurance is a waste of money. However, insurance provides invaluable protection against unforeseen events. Another misconception is that all insurance policies are the same. In reality, policies vary widely, and it’s essential to understand the coverage and limitations of each type.