Insurance Small Business Cost

Insurance is an essential aspect of running a small business, providing protection and financial security against various risks and uncertainties. For small business owners, understanding the costs associated with insurance coverage is crucial for effective financial planning and management. The insurance landscape for small businesses can be complex, with various factors influencing the overall cost. This article aims to delve into the world of insurance for small businesses, exploring the key factors that impact costs, providing real-world examples, and offering valuable insights to help entrepreneurs navigate this critical aspect of their operations.

Unraveling the Insurance Landscape for Small Businesses

Small business insurance is a multifaceted concept, offering a range of coverage options tailored to the unique needs of small enterprises. From general liability insurance to specialized policies for specific industries, the options can be vast. However, the primary goal remains the same: to safeguard businesses against financial losses arising from unexpected events.

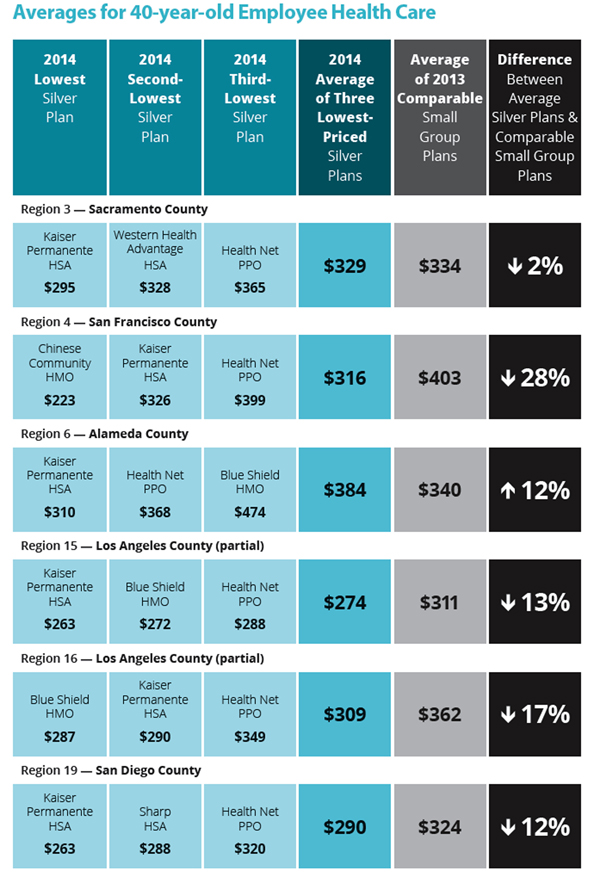

The cost of insurance for small businesses is influenced by a myriad of factors, each playing a significant role in determining the overall premium. These factors include the nature of the business, its size, location, and the specific coverage needs. Additionally, the claims history and risk management practices of the business can impact insurance costs. Let's explore these elements in more detail to gain a comprehensive understanding of the insurance landscape for small businesses.

Nature and Size of the Business

The nature of a small business is a key determinant of its insurance costs. Different industries carry varying levels of risk, which directly influence the premium. For instance, a construction business faces higher risks due to the potential for accidents and property damage, resulting in higher insurance premiums compared to a consulting firm.

| Industry | Average Annual Premium |

|---|---|

| Construction | $5,000 - $10,000 |

| Retail | $3,000 - $6,000 |

| Professional Services | $2,000 - $4,000 |

Furthermore, the size of the business, often measured by revenue or number of employees, also affects insurance costs. Larger businesses generally face higher premiums due to the increased scale of operations and potential risks. However, economies of scale can sometimes mitigate these costs.

Location and Risk Factors

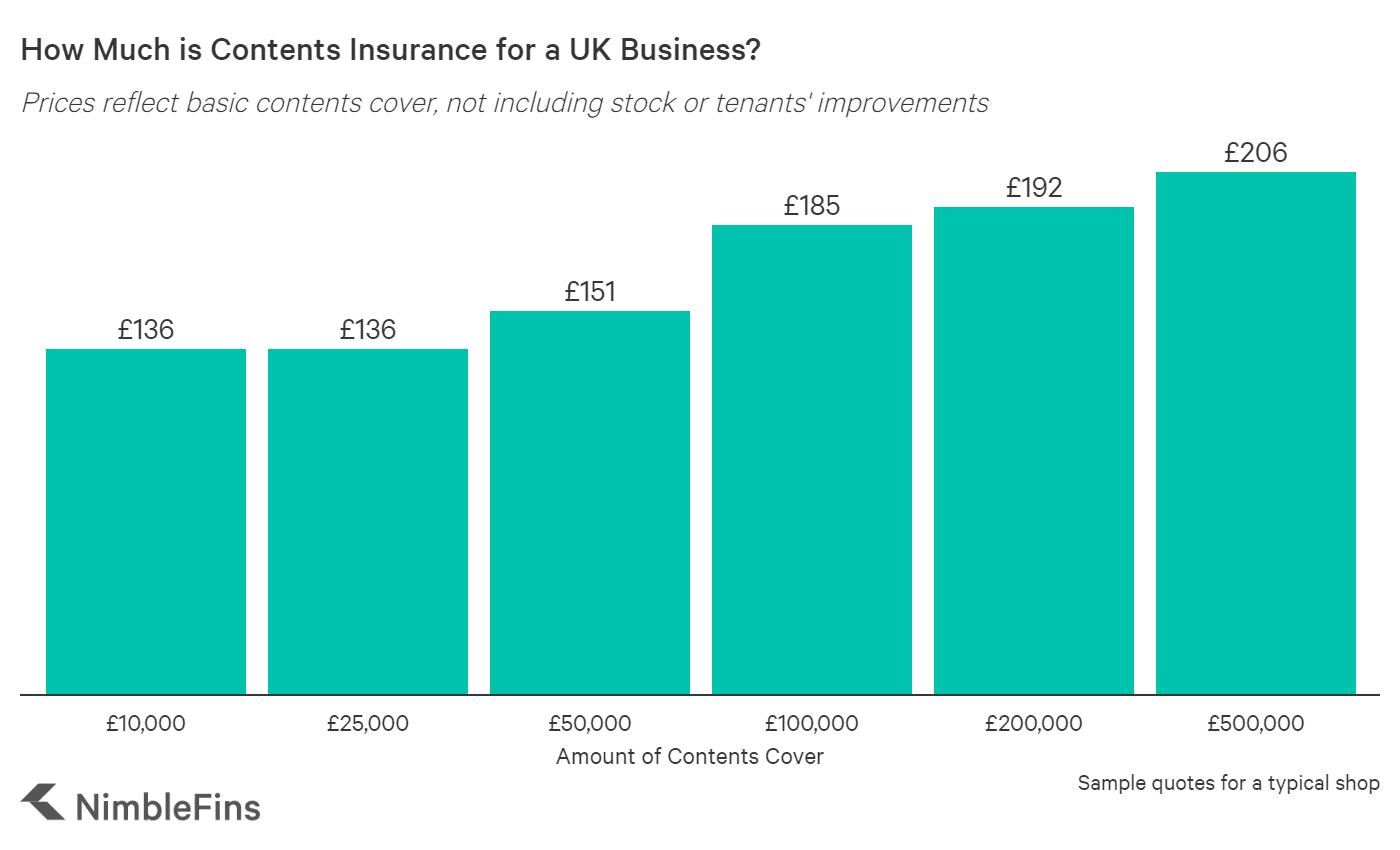

The geographical location of a small business is another critical factor influencing insurance costs. Regions prone to natural disasters like hurricanes or earthquakes often see higher insurance premiums due to the increased risk of property damage. Similarly, areas with high crime rates may have higher premiums for theft or vandalism coverage.

Additionally, the specific risk factors associated with a business's location can impact insurance costs. For example, a small business located in a busy urban area may face higher premiums for liability insurance due to the increased risk of accidents or injuries to customers or employees.

Coverage Needs and Claims History

The specific coverage needs of a small business play a pivotal role in determining insurance costs. Different businesses require different types and levels of coverage based on their unique operations and potential risks. For instance, a business that deals with sensitive customer data may need cyber liability insurance, which can add to the overall premium.

Moreover, a business's claims history can significantly impact future insurance costs. Frequent claims can lead to higher premiums or even difficulties in securing coverage. Insurers often consider a business's claims record when determining premiums, as it indicates the potential for future losses.

Strategies for Managing Insurance Costs

While insurance costs are influenced by various factors beyond a small business owner’s control, there are strategies that can be employed to manage and potentially reduce these expenses. By adopting a proactive approach and implementing effective risk management practices, small businesses can navigate the insurance landscape more affordably.

Risk Management and Mitigation

Implementing robust risk management practices is a fundamental strategy for controlling insurance costs. By identifying and addressing potential risks, small businesses can reduce the likelihood of claims and subsequent premium increases. This involves conducting thorough risk assessments, implementing safety protocols, and training employees on best practices.

For instance, a retail store can reduce the risk of slip and fall accidents by regularly inspecting and maintaining its premises, ensuring clear aisles, and promptly addressing any hazards. Such proactive measures not only prevent accidents but also demonstrate a commitment to safety, which can be favorable to insurers.

Bundle Policies and Seek Discounts

Bundling multiple insurance policies with the same insurer can often lead to significant cost savings. Many insurance providers offer discounts when small businesses purchase multiple policies, such as combining general liability, property, and business interruption insurance. This strategy not only simplifies insurance management but also provides a more comprehensive coverage portfolio.

Additionally, small business owners should explore discounts offered by insurers. These can include safety discounts for implementing certain risk mitigation measures, long-term customer loyalty discounts, or discounts for paying premiums annually instead of monthly.

Review and Compare Coverage Options

Regularly reviewing and comparing insurance coverage options is crucial for small businesses. The insurance market is dynamic, and policies can change frequently. By staying informed about the latest offerings and comparing quotes from different insurers, small business owners can identify opportunities for cost savings or improved coverage.

Utilizing online comparison tools and seeking advice from insurance brokers can be invaluable in this process. Brokers, with their expertise and market knowledge, can guide small businesses toward the most suitable and cost-effective insurance solutions.

Foster a Culture of Safety and Awareness

Promoting a culture of safety and risk awareness among employees is an effective strategy for managing insurance costs. Educating employees about potential risks, safety protocols, and the importance of adhering to these protocols can significantly reduce the likelihood of accidents and subsequent claims. This not only benefits the business financially but also fosters a safer and more responsible work environment.

Future Trends and Considerations

The insurance landscape for small businesses is evolving, with new trends and innovations shaping the industry. As technology advances and consumer expectations shift, small business owners must stay informed about these developments to make informed decisions about their insurance coverage.

Rise of Digital Insurance Solutions

The digital transformation of the insurance industry is a significant trend that small businesses should be aware of. Digital insurance platforms and apps are making it easier and more efficient for businesses to purchase and manage their insurance policies. These platforms often offer real-time quotes, streamlined claim processes, and personalized coverage recommendations.

For instance, a small business owner can now use a mobile app to instantly obtain quotes for various insurance policies, compare coverage options, and even purchase the policy with a few clicks. This level of convenience and accessibility can be particularly beneficial for time-pressed entrepreneurs.

Focus on Data-Driven Risk Assessment

Insurers are increasingly leveraging data analytics and machine learning to assess and manage risk more accurately. This shift towards data-driven risk assessment can impact insurance costs for small businesses. By utilizing advanced analytics, insurers can more precisely evaluate a business’s risk profile, leading to more tailored and potentially more affordable insurance offerings.

For example, an insurer may use data from a small business's sales and marketing activities to assess the potential for cyber attacks, helping to determine the appropriate level of cyber liability insurance coverage needed.

Embracing Sustainability and Social Responsibility

The rise of sustainability and social responsibility as core business values is influencing the insurance industry. Insurers are now offering coverage options that cater to businesses with sustainable practices or those committed to social responsibility initiatives. These policies often come with incentives or discounts, rewarding businesses for their positive environmental or social impact.

A small business that prioritizes sustainability, such as by implementing energy-efficient practices or using recycled materials, may qualify for insurance discounts or other incentives. This not only aligns with the business's values but also provides a financial incentive for continuing sustainable practices.

The Impact of Regulatory Changes

Regulatory changes in the insurance industry can have significant implications for small businesses. Changes in insurance laws and regulations can affect the availability, cost, and terms of coverage. It’s crucial for small business owners to stay informed about these changes and understand how they may impact their insurance needs and options.

For instance, a change in state regulations regarding worker's compensation insurance could lead to an increase in premiums or a shift in coverage requirements. Being aware of such changes allows small businesses to proactively adjust their insurance strategies and ensure compliance.

How often should small businesses review their insurance coverage?

+Small businesses should aim to review their insurance coverage at least annually, or whenever there are significant changes to their operations, personnel, or risk profile. Regular reviews ensure that coverage remains adequate and cost-effective.

Can small businesses negotiate their insurance premiums?

+Yes, small businesses can negotiate their insurance premiums, especially when working with independent insurance agents or brokers. Factors such as the business's claims history, safety measures in place, and loyalty to the insurer can be leveraged during negotiations.

What are some common exclusions in small business insurance policies?

+Common exclusions in small business insurance policies may include coverage for intentional acts, certain types of professional liability, and damage caused by earthquakes or floods if specific coverage for these perils is not purchased.

How can small businesses reduce their insurance costs without compromising coverage?

+Small businesses can reduce insurance costs by implementing effective risk management practices, bundling policies, and seeking out discounts. It's also crucial to regularly review coverage to ensure it remains adequate and cost-effective without unnecessary gaps or overlaps.

In conclusion, understanding the insurance landscape and managing costs effectively is a critical aspect of small business management. By staying informed about the factors influencing insurance costs, implementing strategic risk management practices, and keeping abreast of industry trends, small business owners can navigate the insurance realm with confidence and financial prudence.