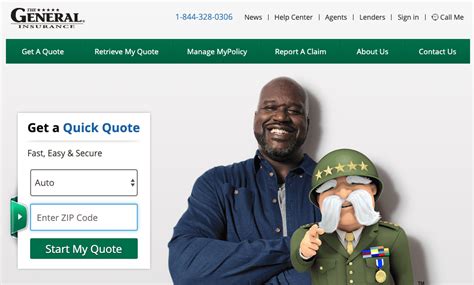

Insurance Quotes The General

Welcome to a comprehensive exploration of The General, a renowned insurance provider, and its unique approach to offering insurance quotes. In an industry often known for its complexities and fine print, The General has carved a niche for itself with its straightforward and transparent quoting process. This article will delve into the specifics of how The General operates, shedding light on its quote generation process, the factors it considers, and the benefits it brings to customers. By understanding The General's approach, readers will gain valuable insights into the world of insurance and how to navigate it with confidence.

Understanding The General’s Insurance Quoting Process

The General Insurance, a subsidiary of Calibex Insurance Group, is a leading provider of auto insurance across the United States. With a focus on providing straightforward and affordable coverage, The General has developed a quoting process that is both efficient and tailored to the individual needs of its customers.

The journey towards obtaining an insurance quote from The General begins with a simple online form or a phone call to their customer service team. Here, potential customers provide basic information about themselves, their vehicles, and their driving history. This initial step sets the foundation for a personalized quote, as The General's system takes into account various factors to offer an accurate and competitive insurance rate.

One of the key strengths of The General's quoting process lies in its ability to cater to a diverse range of drivers. Whether you're a first-time driver, a seasoned professional, or someone with a less-than-perfect driving record, The General strives to offer coverage that meets your specific needs. By considering factors such as age, gender, location, vehicle type, and driving history, their quoting system generates tailored quotes that reflect the unique circumstances of each individual.

The Role of Technology in The General’s Quoting Process

At the heart of The General’s quoting system is a sophisticated technology platform that utilizes advanced algorithms and data analytics. This technology plays a crucial role in ensuring the accuracy and efficiency of the quoting process. By analyzing vast amounts of data and applying complex calculations, The General’s system can provide precise quotes that reflect the true cost of insurance coverage for each customer.

One of the notable features of The General's technology is its ability to continuously learn and adapt. The system incorporates machine learning algorithms that enable it to analyze patterns and trends in insurance data. This allows The General to stay ahead of the curve, making adjustments to its quoting process as market conditions and customer needs evolve. As a result, customers can trust that they are receiving up-to-date and relevant quotes that reflect the current insurance landscape.

Furthermore, The General's technology platform also enhances the customer experience by providing a seamless and user-friendly interface. The online quoting process is designed to be intuitive and straightforward, allowing customers to input their information quickly and easily. The system guides users through a step-by-step process, ensuring that all relevant details are captured and considered in the quote generation.

| Feature | Description |

|---|---|

| Real-Time Quoting | The General's system provides instant quotes, ensuring customers receive accurate rates without delay. |

| Data Security | Advanced encryption and security measures protect customer data during the quoting process. |

| Customizable Coverage | The system allows customers to tailor their insurance plans, offering flexibility and personalized options. |

The use of technology not only benefits customers but also streamlines internal operations for The General. The automated quoting system reduces the need for extensive manual processing, allowing the company to allocate resources more efficiently. This, in turn, contributes to The General's ability to offer competitive rates and provide excellent customer service.

Factors Considered in The General’s Insurance Quotes

When generating insurance quotes, The General takes into account a multitude of factors to ensure the accuracy and fairness of its rates. These factors can be broadly categorized into personal, vehicle-related, and location-specific considerations.

On the personal side, The General evaluates aspects such as age, gender, and driving history. Younger drivers, for instance, may face higher premiums due to their statistically higher risk of accidents. Conversely, mature drivers with clean records often benefit from more affordable rates. Gender, while no longer a primary factor in determining rates, can still play a role in certain states or for specific coverage types.

The type of vehicle being insured is another critical factor. High-performance sports cars, for example, often attract higher premiums due to their increased likelihood of accidents and the higher cost of repairs. In contrast, more economical vehicles with standard safety features may result in lower insurance costs. The General's system also considers the age and condition of the vehicle, as older cars generally require more frequent repairs and may have higher maintenance costs.

Location is a significant factor in insurance quotes, as it influences the risk level associated with a driver's environment. Areas with higher population densities, busy city centers, or a history of frequent accidents or claims may result in higher premiums. Conversely, rural areas or regions with lower accident rates can lead to more affordable insurance rates. The General's system takes into account these location-specific factors to provide quotes that reflect the true cost of insurance in each area.

The Benefits of Choosing The General for Insurance Quotes

Selecting The General for your insurance needs offers a range of advantages that go beyond just competitive quotes. One of the key benefits is The General’s commitment to transparency and customer satisfaction. Unlike some insurance providers that may hide fees or bury important details in fine print, The General strives to provide clear and concise information throughout the quoting process.

The General's customer-centric approach is evident in its straightforward and easy-to-understand quoting system. Customers can quickly and easily obtain quotes without feeling overwhelmed by complex terminology or hidden costs. This transparency fosters trust and empowers customers to make informed decisions about their insurance coverage.

Additionally, The General's focus on providing personalized quotes means that customers receive insurance plans tailored to their specific needs. Whether you're a cautious driver with an impeccable record or someone with a few traffic violations, The General's system considers your unique circumstances to offer coverage that suits your lifestyle and budget. This level of personalization ensures that customers receive the protection they need without paying for unnecessary coverage.

Another advantage of choosing The General is its dedication to customer service. The company understands that obtaining insurance can be a complex and stressful process, so it aims to provide support and guidance every step of the way. Whether it's answering questions about coverage options, assisting with policy changes, or helping with claims, The General's customer service team is known for its responsiveness and expertise.

The Future of Insurance Quotes with The General

As the insurance industry continues to evolve, The General remains at the forefront of innovation, constantly refining its quoting process to meet the changing needs of its customers. With a focus on technological advancements and data-driven insights, The General is well-positioned to provide even more accurate and personalized quotes in the future.

One area where The General is expected to make significant strides is in the use of telematics. Telematics technology allows insurance providers to collect real-time data on driving behavior, such as acceleration, braking, and cornering. By analyzing this data, The General can offer more precise quotes that reflect an individual's actual driving habits. This technology not only promotes safer driving but also provides an opportunity for customers to potentially lower their insurance premiums by demonstrating responsible driving behavior.

Furthermore, The General is committed to leveraging machine learning and artificial intelligence to enhance its quoting process. These technologies enable the company to analyze vast amounts of data more efficiently, identifying patterns and trends that can influence insurance rates. By continuously refining its algorithms, The General can offer quotes that are not only accurate but also highly competitive in the market.

In addition to technological advancements, The General is also dedicated to expanding its product offerings and partnerships. By collaborating with a diverse range of insurers and service providers, The General can offer customers a broader range of coverage options, ensuring that they can find the right insurance plan to meet their unique needs.

How does The General determine insurance rates for different customers?

+The General’s insurance rates are determined by a variety of factors, including age, gender, driving history, vehicle type, and location. The company uses advanced algorithms and data analytics to generate personalized quotes that reflect the unique circumstances of each customer.

What makes The General’s quoting process different from other insurance providers?

+The General’s quoting process stands out for its focus on transparency, personalization, and technological advancements. The company strives to provide clear and concise information, ensuring customers understand their quotes. Additionally, The General’s sophisticated technology platform allows for accurate and efficient quote generation, taking into account a wide range of factors to offer tailored coverage.

How can I get a quote from The General?

+Obtaining a quote from The General is straightforward. You can visit their website and use the online quoting tool, providing basic information about yourself, your vehicle, and your driving history. Alternatively, you can contact their customer service team via phone to discuss your insurance needs and receive a personalized quote.