Insurance Quote Life

Life insurance is an essential financial tool that provides individuals and their families with peace of mind and security. Obtaining an insurance quote for life coverage is a crucial step in ensuring you have adequate protection for your loved ones and financial interests. This comprehensive guide will delve into the world of life insurance quotes, offering expert insights and a detailed analysis to help you make informed decisions.

Understanding Life Insurance Quotes

Life insurance quotes are estimates provided by insurance companies to help individuals understand the potential cost of their life insurance policy. These quotes are based on a variety of factors, including the applicant's age, health status, lifestyle, and the desired coverage amount. It is a vital step in the process of securing life insurance, as it allows individuals to compare different policies, understand their financial commitment, and make adjustments if needed.

The quote process typically begins with a thorough evaluation of the applicant's personal details and medical history. This information is then used to assess the individual's risk profile, which directly influences the quoted premium. It is important to note that life insurance quotes are not set in stone; they are estimates that can change based on further assessment and the final application process.

Key Factors Influencing Life Insurance Quotes

Several factors play a significant role in determining life insurance quotes. These include:

- Age: Generally, younger individuals are offered lower premiums as they are statistically less likely to make a claim. As one ages, the risk of health issues increases, leading to higher premiums.

- Health Status: The applicant's current and past health conditions are carefully evaluated. Pre-existing conditions or a history of serious illnesses can result in higher premiums or even declined applications.

- Lifestyle Choices: Activities such as smoking, extreme sports participation, or hazardous occupations can impact the quote. Insurance companies assess these factors to determine the individual's risk level.

- Coverage Amount: The desired coverage amount directly affects the premium. Higher coverage typically leads to higher premiums, ensuring sufficient financial protection for beneficiaries.

- Policy Type: There are various types of life insurance policies, such as term life and whole life insurance. Each type has different cost structures and benefits, influencing the quoted premium.

It is crucial to provide accurate and honest information during the quote process to ensure a fair assessment of your risk profile. Misrepresentation can lead to claim denials or policy cancellations.

The Process of Obtaining a Life Insurance Quote

Securing a life insurance quote involves a series of steps. Here is a breakdown of the typical process:

Step 1: Research and Comparison

Begin by researching different insurance providers and the types of policies they offer. Compare the features, benefits, and costs of various policies to understand which ones align with your needs and budget.

Step 2: Provide Personal Information

Once you've identified potential insurers, you will be required to provide personal details, such as your name, date of birth, contact information, and sometimes, basic health information. This initial information is used to generate an estimated quote.

Step 3: Health Assessment

The next step involves a more detailed health assessment. This may include completing a medical questionnaire, undergoing a medical exam (in some cases), and providing access to your medical records. The insurer uses this information to assess your risk level and provide an accurate quote.

Step 4: Receive and Review the Quote

After the insurer has processed your application, you will receive a quote. This quote will outline the proposed premium, coverage amount, policy term, and any additional benefits or riders. It is essential to carefully review the quote, ensuring all details are accurate and meet your expectations.

Step 5: Adjustments and Finalization

If you are satisfied with the quote, you can proceed to finalize the application and purchase the policy. However, if the quote does not align with your expectations, you can request adjustments. This may involve increasing or decreasing the coverage amount, changing the policy term, or opting for a different type of policy.

It is advisable to seek the guidance of a financial advisor or insurance broker during this process, as they can provide expert advice tailored to your specific circumstances.

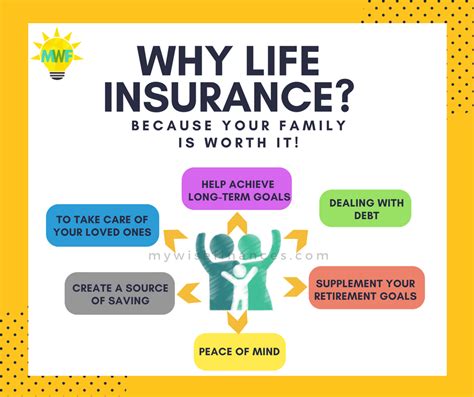

The Benefits of Life Insurance

Life insurance offers numerous benefits that extend beyond financial protection. Here are some key advantages:

- Financial Security: Life insurance provides a lump-sum payment to your beneficiaries upon your death, ensuring they have the means to maintain their lifestyle and cover expenses such as mortgages, education costs, and daily living expenses.

- Debt Repayment: Life insurance can be used to repay outstanding debts, such as personal loans or credit card balances, reducing the financial burden on your loved ones.

- Business Continuity: For business owners, life insurance can ensure the continuity of their business. It can provide funds to buy out a partner's share or cover business expenses, preventing financial disruption.

- Tax Benefits: In many countries, life insurance premiums are tax-deductible, offering a potential financial advantage.

- Peace of Mind: Knowing that your loved ones are financially protected can bring immense peace of mind. Life insurance provides a safety net, ensuring your family's financial stability in the event of your untimely demise.

Choosing the Right Life Insurance Policy

Selecting the appropriate life insurance policy is a critical decision. Consider the following factors when making your choice:

- Coverage Amount: Determine the amount of coverage you need based on your financial obligations and the goals you wish to achieve with the policy. This may include covering outstanding debts, providing an income for your family, or funding your children's education.

- Policy Term: Choose a policy term that aligns with your financial goals and life stage. Term life insurance offers coverage for a specific period, while permanent life insurance, such as whole life or universal life, provides lifelong coverage.

- Rider Options: Riders are additional benefits or features that can be added to your policy. These may include accelerated death benefits, waiver of premium, or critical illness coverage. Consider your specific needs and choose riders that offer the most value.

- Cost and Budget: Evaluate the cost of the policy and ensure it fits within your budget. Remember, life insurance is a long-term commitment, so choose a policy with premiums you can comfortably afford.

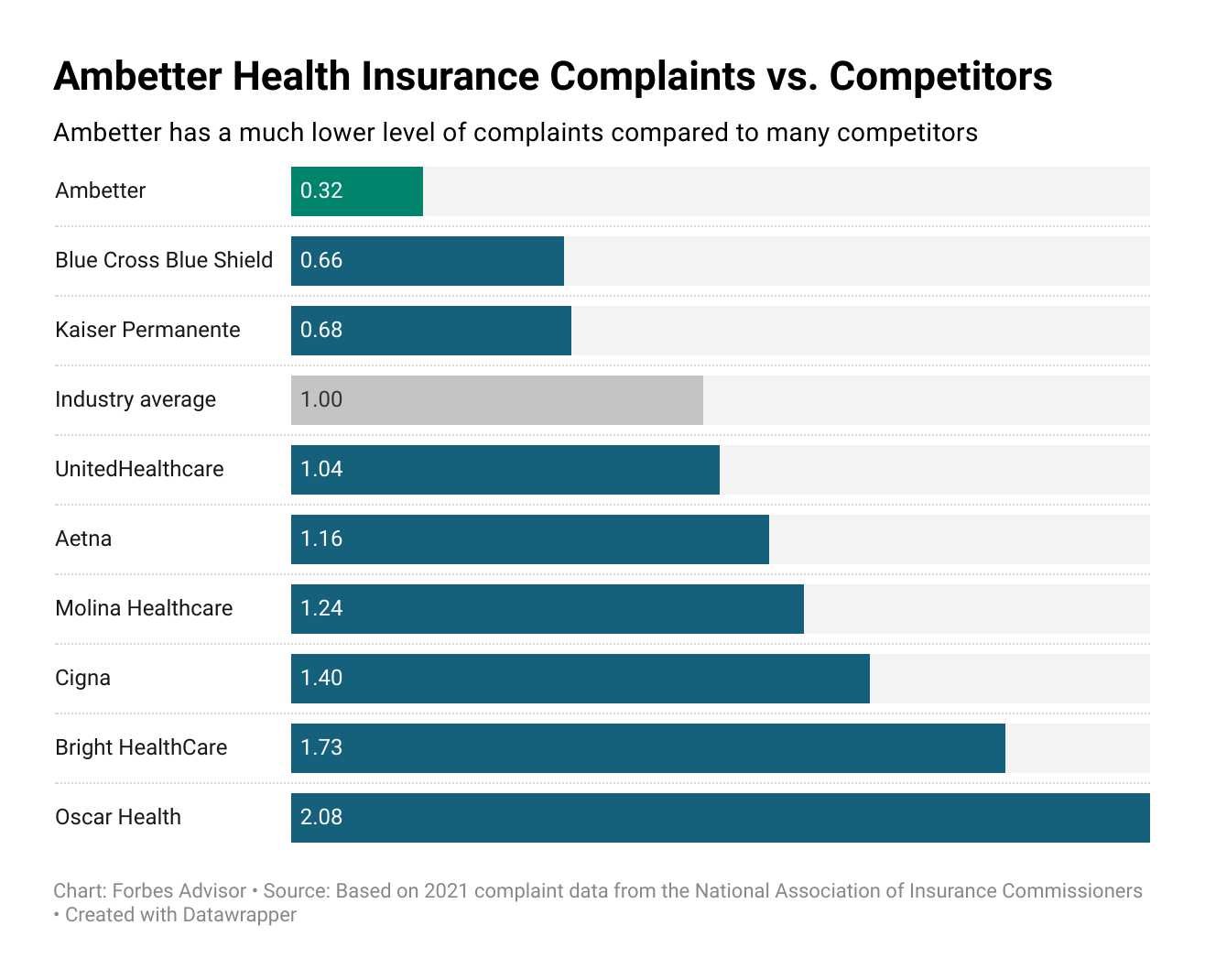

- Company Reputation: Research the insurer's reputation, financial stability, and customer service. A reputable company with a strong financial standing ensures your policy's longevity and provides peace of mind.

Seeking professional advice from a financial planner or insurance broker can greatly assist in making an informed decision.

Performance Analysis and Future Implications

Life insurance policies have shown consistent performance over the years, providing financial stability to countless families. The industry's stability and the growing awareness of the importance of life insurance coverage suggest a positive future for the sector.

However, with the rise of digital technologies and changing consumer preferences, the life insurance industry is also experiencing a shift. Insurers are now offering more flexible and customizable policies, often with online application processes, to cater to the needs of modern consumers.

Furthermore, the introduction of new products, such as indexed universal life insurance and variable universal life insurance, offers policyholders more control over their investments and the potential for higher returns. These innovative products are expected to gain popularity in the coming years.

Despite the advancements, traditional life insurance policies will remain a cornerstone of financial planning, providing essential protection and peace of mind to individuals and their families.

| Policy Type | Average Annual Premium (USD) |

|---|---|

| Term Life Insurance | $500 - $1,500 |

| Whole Life Insurance | $2,000 - $4,000 |

| Universal Life Insurance | $1,500 - $3,000 |

Frequently Asked Questions

Can I get life insurance if I have a pre-existing medical condition?

+Yes, many insurers offer life insurance to individuals with pre-existing conditions. However, the premium may be higher, and the coverage may have certain limitations. It is advisable to disclose all relevant health information during the application process to avoid any issues with claims in the future.

<div class="faq-item">

<div class="faq-question">

<h3>What is the difference between term life and whole life insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Term life insurance provides coverage for a specific period, typically 10 to 30 years. It offers a lower premium but no cash value. On the other hand, whole life insurance provides lifelong coverage and builds cash value over time, offering a potential investment component.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How much life insurance coverage do I need?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The amount of life insurance coverage you need depends on your financial obligations and goals. It is recommended to consider factors such as outstanding debts, income replacement needs, and future expenses like education or retirement. A financial advisor can assist in determining the appropriate coverage amount.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I change my life insurance policy after purchasing it?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can often make changes to your life insurance policy, such as increasing or decreasing the coverage amount, adding or removing riders, or switching to a different policy type. However, any changes may impact your premium and may require additional underwriting.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Is life insurance tax-deductible?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>In many countries, life insurance premiums are tax-deductible. However, the tax treatment may vary based on the policy type and the country's tax laws. It is advisable to consult a tax professional to understand the specific deductions available in your region.</p>

</div>

</div>

</div>