Insurance Oklahoma

Insurance is a vital aspect of financial planning and risk management, and it plays a significant role in the lives of individuals and businesses across Oklahoma. With a diverse range of policies and providers, understanding the insurance landscape in this state is crucial for making informed decisions. This comprehensive guide will delve into the world of insurance in Oklahoma, exploring the unique challenges, opportunities, and strategies specific to this region.

The Importance of Insurance in Oklahoma

Oklahoma, known for its vibrant culture, thriving industries, and diverse landscapes, presents a unique set of insurance considerations. From severe weather events like tornadoes and thunderstorms to the need for comprehensive health coverage, Oklahomans face a range of risks that necessitate thoughtful insurance planning.

For businesses, the state's dynamic economy, characterized by a mix of agriculture, energy, and technology sectors, requires tailored insurance solutions. From crop insurance for farmers to liability coverage for tech startups, the insurance needs are as varied as the industries themselves.

Navigating Oklahoma’s Insurance Market

The insurance market in Oklahoma is regulated by the Oklahoma Insurance Department, which ensures compliance with state laws and protects consumer rights. Understanding the regulatory environment is crucial for both consumers and insurance providers operating within the state.

One of the key challenges in Oklahoma's insurance market is the prevalence of natural disasters. With its location in Tornado Alley, the state experiences frequent severe weather events. As a result, property insurance, particularly for homeowners and businesses, becomes a critical consideration. Insurance providers in Oklahoma offer specialized coverage options to mitigate the risks associated with these events.

Key Insurance Types in Oklahoma

Oklahoma residents and businesses have access to a wide range of insurance products, each tailored to specific needs. Here’s a breakdown of some of the most common insurance types in the state:

- Homeowners Insurance: Given the risk of severe weather, homeowners insurance is a necessity in Oklahoma. Policies typically cover damage caused by tornadoes, hail, and other natural disasters. Additional coverage options, such as flood insurance, may also be recommended.

- Auto Insurance: Oklahoma law requires all drivers to carry liability insurance. However, given the state's extensive highway network and the potential for accidents, comprehensive and collision coverage are often recommended to protect vehicles from damage.

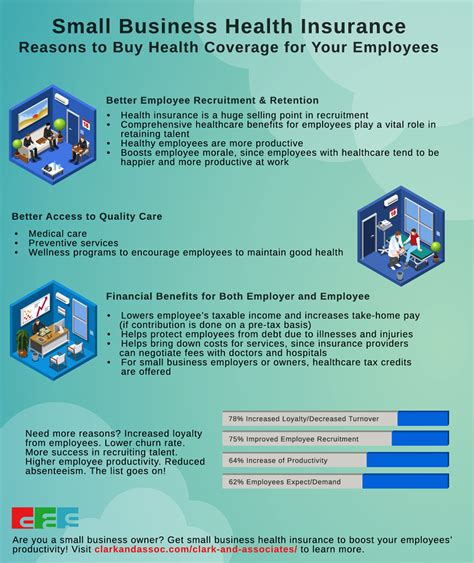

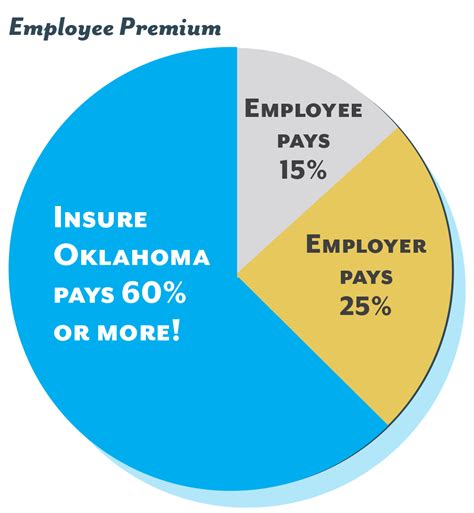

- Health Insurance: Access to quality healthcare is a priority for Oklahomans. The state's insurance market offers a range of health insurance plans, including individual and family policies, as well as employer-sponsored group plans. Navigating the Affordable Care Act (ACA) marketplace is also an important consideration for many residents.

- Life Insurance: Life insurance provides financial protection for loved ones in the event of a policyholder's death. With a range of term and permanent life insurance options, Oklahomans can choose coverage that aligns with their specific needs and budgets.

- Business Insurance: From general liability to professional liability and workers' compensation, business insurance is essential for Oklahoma's diverse range of industries. These policies help protect companies from financial losses due to accidents, lawsuits, and employee injuries.

Choosing the Right Insurance Provider

With numerous insurance providers operating in Oklahoma, selecting the right one can be a daunting task. Here are some factors to consider when making your choice:

- Financial Strength: Look for insurance companies with a strong financial rating. This ensures they have the resources to pay out claims, even in the event of a large-scale disaster.

- Coverage Options: Compare the range of coverage options offered by different providers. Ensure that the policies align with your specific needs, whether it's comprehensive homeowners insurance or specialized coverage for your business.

- Customer Service: Excellent customer service is crucial when dealing with insurance providers. Consider factors like response time, claim processing efficiency, and overall satisfaction ratings from existing customers.

- Discounts and Bundling: Many insurance companies offer discounts for bundling multiple policies, such as combining auto and homeowners insurance. These discounts can significantly reduce your overall insurance costs.

Strategies for Effective Insurance Management

Managing your insurance portfolio effectively is key to ensuring you have the right coverage at the right price. Here are some strategies to consider:

Regular Policy Reviews

Insurance needs can change over time, whether due to life events, changes in personal or business circumstances, or shifts in the insurance market. Regularly reviewing your policies ensures they remain up-to-date and adequately cover your current needs.

Understanding Your Coverage

Take the time to thoroughly understand your insurance policies. This includes reading the fine print, asking questions, and seeking clarification on any terms or conditions you don’t fully grasp. A clear understanding of your coverage ensures you know exactly what is and isn’t covered in the event of a claim.

Comparative Shopping

Don’t settle for the first insurance quote you receive. Comparative shopping allows you to explore different options and find the best combination of coverage and price. Online insurance marketplaces and comparison websites can be valuable tools in this process.

Bundling and Multi-Policy Discounts

Many insurance providers offer discounts when you bundle multiple policies, such as auto and home insurance, or when you maintain multiple policies with the same provider. These discounts can lead to significant savings, so it’s worth exploring your options.

The Future of Insurance in Oklahoma

As Oklahoma continues to evolve and face new challenges, the insurance landscape will also adapt. The increasing frequency and severity of natural disasters, coupled with the ongoing digital transformation of the insurance industry, will shape the future of insurance in the state.

In the coming years, we can expect to see insurance providers in Oklahoma offering more innovative and tailored coverage options. This may include the development of specialized policies for emerging industries, as well as the integration of technology to enhance the customer experience and streamline claim processes.

Additionally, the ongoing debate around healthcare reform and the future of the Affordable Care Act will continue to influence the health insurance landscape in Oklahoma. Residents and businesses will need to stay informed and adapt their insurance strategies accordingly.

The Role of Technology

Technology is poised to play a significant role in the future of insurance in Oklahoma. From the use of artificial intelligence for faster claim processing to the adoption of telematics in auto insurance for more accurate risk assessment, technological advancements will shape the efficiency and effectiveness of the insurance industry.

Furthermore, the rise of insurtech startups is bringing new, innovative insurance solutions to the market. These companies often leverage technology to offer more affordable and accessible coverage options, disrupting the traditional insurance landscape.

Conclusion

Insurance in Oklahoma is a complex and dynamic landscape, shaped by the state’s unique challenges and opportunities. By understanding the various insurance types, navigating the market effectively, and implementing strategic management techniques, Oklahomans can ensure they have the coverage they need at a price they can afford.

As the insurance industry continues to evolve, staying informed and adapting to changing circumstances will be crucial. Whether it's staying up-to-date with regulatory changes, embracing technological advancements, or seeking out innovative insurance solutions, Oklahomans can navigate the insurance landscape with confidence and peace of mind.

What are the mandatory insurance requirements in Oklahoma?

+In Oklahoma, the state requires all drivers to carry liability insurance, which covers bodily injury and property damage caused in an accident. Additionally, while not mandatory, uninsured/underinsured motorist coverage is highly recommended to protect yourself from drivers who lack sufficient insurance.

How can I find affordable insurance options in Oklahoma?

+Comparative shopping is key to finding affordable insurance. Utilize online comparison tools, and don’t hesitate to seek out quotes from multiple providers. Additionally, consider bundling policies and exploring discounts offered by insurance companies.

What should I do if I’m not satisfied with my current insurance provider?

+If you’re unhappy with your current insurance provider, it’s worth exploring your options. Research alternative providers, compare coverage and pricing, and consider switching to a company that better aligns with your needs. Ensure you understand any potential penalties or fees associated with canceling your existing policy.