Insurance Life Term

Life insurance is an essential financial tool that provides individuals and their families with a safety net in the face of uncertainty. Among the various types of life insurance policies, term life insurance stands out as a popular and accessible option. This comprehensive guide will delve into the world of insurance, specifically focusing on term life insurance, to help you understand its benefits, features, and how it can be a valuable addition to your financial planning.

Understanding Term Life Insurance

Term life insurance, as the name suggests, is a policy that provides coverage for a specified term or period of time. It is designed to offer financial protection to your loved ones during a defined stage of your life when your income and responsibilities are at their peak. Unlike permanent life insurance policies, which offer coverage for your entire life, term life insurance focuses on providing affordable protection for a limited duration.

Key Characteristics of Term Life Insurance

Term life insurance policies typically offer the following key features:

- Coverage Period: Policies are available for various terms, such as 10, 20, or 30 years. You can choose a term that aligns with your specific needs and financial goals.

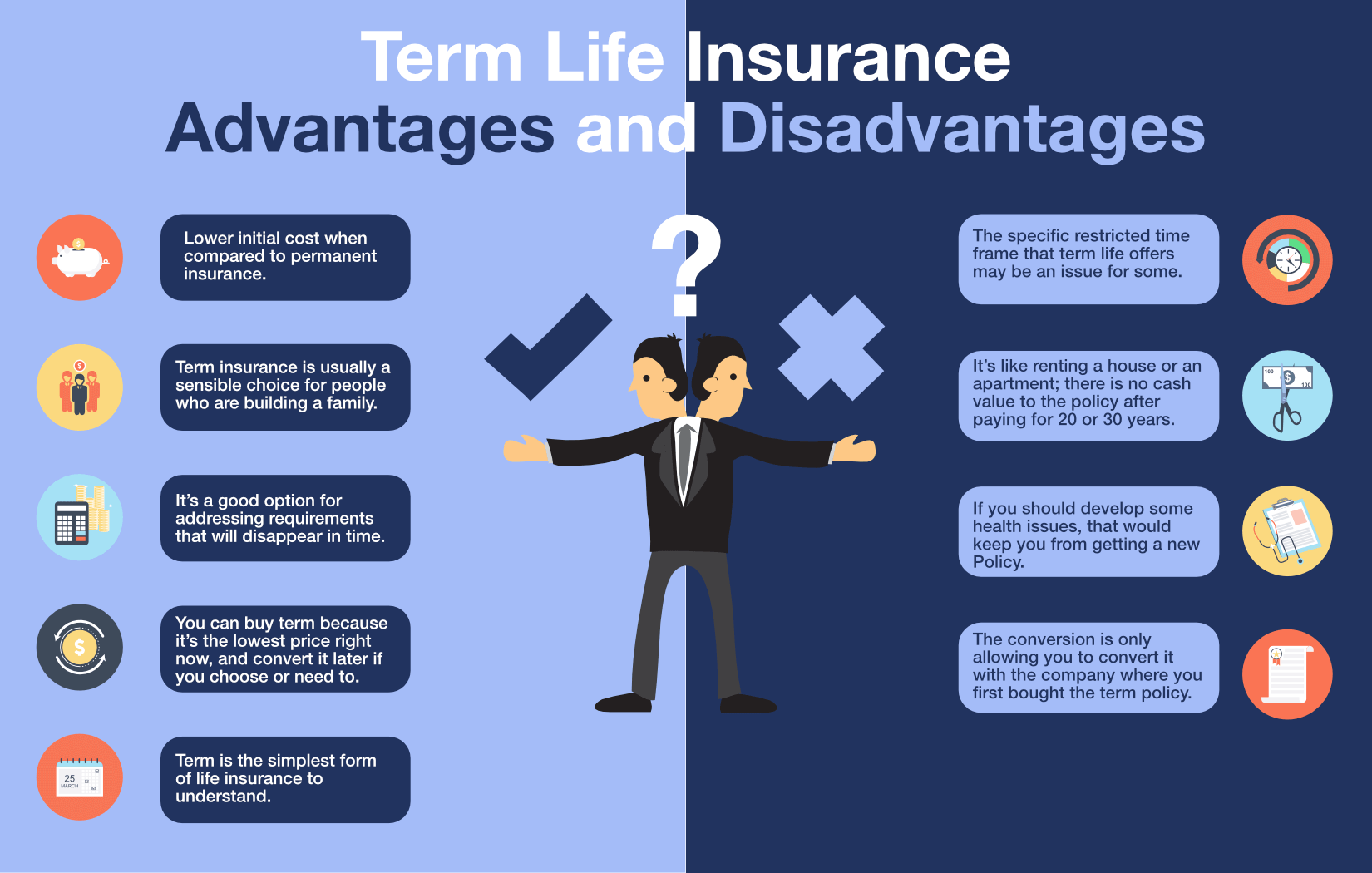

- Affordable Premiums: One of the biggest advantages of term life insurance is its cost-effectiveness. Premiums are generally lower compared to permanent life insurance policies, making it an accessible option for many individuals.

- Level Premiums: Most term life insurance policies offer level premiums, meaning your premium remains the same throughout the policy term, providing budget predictability.

- Death Benefit: In the event of your untimely demise during the policy term, your beneficiaries receive a tax-free lump sum known as the death benefit. This benefit can help cover a range of expenses, including funeral costs, outstanding debts, and daily living expenses.

- Renewability: While term life insurance is designed for a specific period, many policies offer the option to renew or convert to a permanent life insurance policy at the end of the term, ensuring continued coverage.

The Benefits of Term Life Insurance

Term life insurance offers a range of advantages that make it an attractive choice for individuals and families:

1. Financial Security for Your Loved Ones

The primary purpose of term life insurance is to provide financial security to your family or dependents in the event of your passing. The death benefit can help cover immediate expenses, such as funeral costs, and long-term financial obligations like mortgage payments, college tuition, or daily living expenses. It ensures your loved ones can maintain their standard of living and achieve their financial goals without the added stress of financial burden.

2. Affordable Protection for Key Life Stages

Term life insurance is particularly beneficial during life stages when your financial responsibilities are at their highest. For instance, if you have young children, a mortgage, or significant debt, term life insurance can provide peace of mind by ensuring your family's financial stability in the event of an unforeseen tragedy. The affordability of term life insurance makes it an accessible way to protect your loved ones during these critical years.

3. Flexibility and Customization

Term life insurance policies offer flexibility to cater to individual needs. You can choose the coverage amount, term length, and even add optional riders to customize your policy. This flexibility allows you to tailor the policy to your specific circumstances and financial goals. Whether you need coverage for a short-term debt obligation or long-term financial protection for your family, term life insurance can be adapted to fit your requirements.

4. Peace of Mind and Stress Reduction

Knowing that your loved ones are financially protected can provide immense peace of mind. Term life insurance removes the burden of financial worries from your shoulders, allowing you to focus on your career, family, and personal goals without the stress of what might happen if the unexpected occurs. It's a proactive step towards ensuring your family's well-being and future financial stability.

How to Choose the Right Term Life Insurance Policy

Selecting the right term life insurance policy involves careful consideration of your unique circumstances and financial goals. Here are some key factors to keep in mind:

1. Determine Your Coverage Needs

Assess your current and future financial obligations to determine the appropriate coverage amount. Consider factors such as outstanding debts, mortgage payments, education expenses, and daily living costs. Ensure that the death benefit is sufficient to cover these expenses and provide financial security for your loved ones.

2. Choose the Right Term Length

Select a term length that aligns with your financial goals and responsibilities. For instance, if you have young children, you might opt for a longer term to ensure coverage until they become financially independent. Conversely, if you have short-term financial obligations, a shorter term might be more suitable.

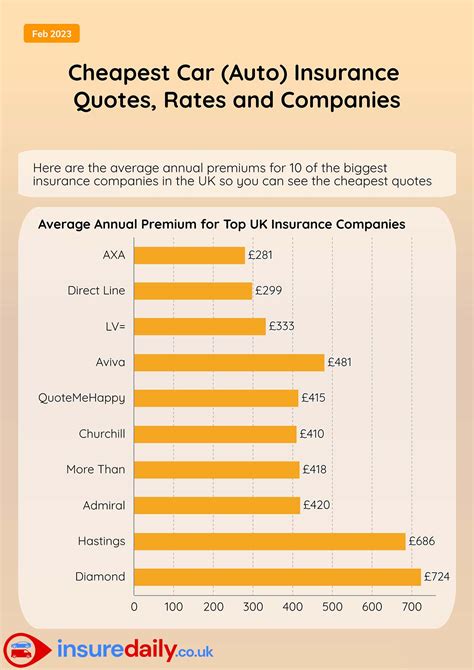

3. Compare Providers and Policies

Shop around and compare different term life insurance policies from multiple providers. Consider factors such as premium costs, policy features, and the financial stability of the insurance company. Look for providers with a strong reputation and a history of prompt claim settlements.

4. Consider Optional Riders

Optional riders are add-ons to your policy that can enhance its benefits. Common riders include accelerated death benefits, waiver of premium, and disability income riders. Evaluate your specific needs and consider adding riders that provide additional protection or peace of mind.

Performance Analysis and Real-World Examples

Term life insurance has proven to be a reliable and effective financial tool for countless individuals and families. Let's take a look at some real-world scenarios and performance data to illustrate its value:

Case Study: Young Family Protection

John and Sarah, a young couple with two small children, decided to purchase a 20-year term life insurance policy. John, the primary breadwinner, chose a coverage amount of $1 million to ensure his family's financial security. The policy's level premiums provided them with peace of mind and allowed them to focus on their growing family without worrying about the financial impact of an untimely death.

Statistical Analysis: Term Life Insurance Claims

According to industry data, term life insurance policies have a high claim settlement ratio. In 2022, the average claim settlement ratio for term life insurance policies was 97.4%, indicating that insurance companies are promptly honoring their commitments. This statistic underscores the reliability and effectiveness of term life insurance as a financial protection tool.

| Year | Claim Settlement Ratio |

|---|---|

| 2022 | 97.4% |

| 2021 | 97.2% |

| 2020 | 96.8% |

Future Implications and Considerations

As you navigate the world of term life insurance, it's essential to consider the long-term implications and plan accordingly:

1. Long-Term Financial Planning

Term life insurance is an integral part of your overall financial plan. Ensure that your coverage and financial strategies evolve as your life stages change. Regularly review and update your policy to reflect any significant life events, such as marriage, the birth of children, or career advancements.

2. Conversion and Renewal Options

Most term life insurance policies offer conversion or renewal options. Understanding these options can be beneficial as you approach the end of your policy term. Converting your policy to a permanent life insurance policy can provide lifelong coverage, while renewing your term policy allows you to continue with the same benefits and coverage amount.

3. Health and Lifestyle Changes

Your health and lifestyle can impact your term life insurance policy. Maintaining a healthy lifestyle and managing any pre-existing conditions can help ensure you remain eligible for favorable premium rates and coverage options. Regular health check-ups and a proactive approach to wellness can be beneficial in this regard.

Frequently Asked Questions (FAQ)

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage simply expires. However, many policies offer the option to renew or convert to a permanent life insurance policy, ensuring continued coverage if desired.

Can I increase my coverage amount during the policy term?

+Yes, some term life insurance policies allow you to increase your coverage amount without undergoing a new medical exam. This feature is known as the "guaranteed insurability" option and can be beneficial if your financial responsibilities increase over time.

Are term life insurance premiums tax-deductible?

+Term life insurance premiums are generally not tax-deductible for most individuals. However, if you have a business and purchase term life insurance as part of a business strategy, the premiums might be tax-deductible. It's best to consult a tax professional for personalized advice.

How does term life insurance compare to permanent life insurance?

+Term life insurance offers affordable coverage for a specific term, making it ideal for individuals with temporary financial needs. Permanent life insurance, on the other hand, provides lifelong coverage and includes a cash value component, making it a more comprehensive financial tool. The choice between the two depends on your specific needs and financial goals.

Term life insurance is a powerful tool that offers financial protection and peace of mind during crucial life stages. By understanding its benefits, features, and how to choose the right policy, you can ensure that your loved ones are taken care of in the event of an unexpected tragedy. Remember, financial planning is an ongoing process, and term life insurance is just one piece of the puzzle. Stay informed, review your coverage regularly, and adapt your financial strategies to meet your evolving needs.