Insurance For Phones

In today's fast-paced and technologically advanced world, smartphones have become an integral part of our daily lives. These devices, with their advanced features and capabilities, have revolutionized communication, entertainment, and productivity. However, with great power comes great vulnerability. Phones, especially smartphones, are susceptible to a wide range of risks and potential damages, from accidental drops and liquid spills to theft and even hardware failures. These incidents can result in significant financial losses for individuals, often catching them off guard and leaving them with costly repair or replacement bills.

This is where phone insurance steps in as a crucial safeguard, offering a layer of protection and peace of mind to phone owners. In this comprehensive guide, we will delve into the world of phone insurance, exploring its intricacies, benefits, and how it can be a valuable investment for smartphone users. We will analyze the various coverage options, the claims process, and the potential savings it can provide. By the end of this article, you will have a thorough understanding of phone insurance and be equipped to make informed decisions about protecting your valuable devices.

Understanding the Importance of Phone Insurance

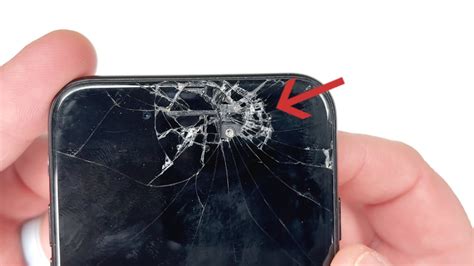

Phone insurance is a specialized form of coverage designed to protect smartphone users from unexpected and costly repairs or replacements. Given the high cost of modern smartphones, even a minor incident can result in a substantial financial burden. For instance, a cracked screen, a common occurrence, can cost hundreds of dollars to repair or replace. With phone insurance, policyholders can mitigate these costs and ensure their devices are protected against a wide range of potential damages.

The significance of phone insurance extends beyond the financial aspect. Smartphones store vast amounts of personal and sensitive data, from contacts and photos to passwords and financial information. In the event of theft or loss, phone insurance can provide coverage for these irreplaceable data, ensuring that policyholders can quickly recover or replace their devices without losing critical information.

Types of Phone Insurance and Their Coverage

Phone insurance policies can vary significantly depending on the provider and the specific plan chosen. Understanding the different types of coverage is essential to make an informed decision and ensure your device is adequately protected.

Standard Phone Insurance Plans

Standard phone insurance plans typically offer coverage for accidental damage, including cracked screens, liquid damage, and mechanical or electrical breakdowns. These plans often have a deductible, which is the amount the policyholder must pay out-of-pocket before the insurance coverage kicks in. For example, if your phone’s repair cost is 300 and your deductible is 50, you will be responsible for paying the 50 deductible, and the insurance provider will cover the remaining 250.

| Coverage Type | Description |

|---|---|

| Accidental Damage | Covers physical damage to the phone, such as cracked screens, bent bodies, or broken buttons. |

| Liquid Damage | Protects against water or liquid damage, including immersion or spills. |

| Mechanical/Electrical Breakdowns | Covers internal component failures, such as battery issues, charging port malfunctions, or camera problems. |

Comprehensive Phone Insurance Plans

Comprehensive phone insurance plans offer a higher level of protection, typically including all the coverages provided by standard plans, plus additional benefits. These plans often cover theft, loss, and malicious damage, providing a more holistic protection for smartphone users. In the event of theft or loss, comprehensive plans may also include a temporary replacement device, ensuring you stay connected while your primary device is being replaced.

| Coverage Type | Description |

|---|---|

| Theft | Covers the cost of a new phone if your device is stolen, provided you report the theft to the police and the insurance provider. |

| Loss | Protects against the cost of a new phone if you misplace your device, typically requiring a police report and proof of ownership. |

| Malicious Damage | Covers damage caused by vandalism or other intentional acts, including damage from riots or civil unrest. |

The Claims Process: What to Expect

When an insured incident occurs, the claims process is straightforward and designed to be as hassle-free as possible. Here’s a step-by-step guide to help you navigate the process:

- Report the Incident: As soon as possible after the incident, report the damage, loss, or theft to your insurance provider. Most providers have dedicated customer support lines or online portals for reporting claims.

- Gather Documentation: Depending on the nature of the claim, you may need to provide supporting documentation. This could include photos of the damage, a police report for theft or loss, or proof of ownership.

- Submit the Claim: After gathering the necessary documentation, submit your claim to the insurance provider. This can be done online, over the phone, or via email, depending on the provider's preferred method.

- Claim Assessment: The insurance provider will assess your claim to ensure it meets the policy's terms and conditions. This process may involve additional questions or requests for further documentation.

- Approval or Denial: Once the assessment is complete, the insurance provider will notify you of the claim's outcome. If approved, they will guide you through the next steps, which may include arranging for repairs or providing a replacement device.

Saving Money with Phone Insurance

One of the primary benefits of phone insurance is the potential for significant cost savings. Here’s how phone insurance can save you money:

Avoid Out-of-Pocket Repairs

Phone insurance can help you avoid costly out-of-pocket repairs. For example, a cracked screen repair can cost upwards of $200, while phone insurance may only require a small deductible, typically much lower than the repair cost.

Reduced Replacement Costs

In the event of theft or loss, phone insurance can cover the cost of a new device, often at a significantly lower price than purchasing a new phone outright. This can result in substantial savings, especially for high-end smartphones.

Peace of Mind

Phone insurance provides peace of mind, knowing that your device is protected against a wide range of potential damages. This can be especially valuable for those who rely heavily on their smartphones for work, communication, or personal use.

Choosing the Right Phone Insurance Provider

When selecting a phone insurance provider, it’s crucial to choose a reputable and reliable company. Consider the following factors:

- Coverage Options: Ensure the provider offers the type of coverage you require, whether it's a standard or comprehensive plan.

- Deductibles and Premiums: Compare deductibles and premiums to find a plan that fits your budget and provides adequate coverage.

- Claims Process: Research the provider's claims process to ensure it is straightforward and customer-friendly.

- Reputation: Check online reviews and ratings to gauge the provider's reputation and customer satisfaction.

- Exclusions: Carefully review the policy's exclusions to ensure you understand what is not covered.

Conclusion: Securing Your Smartphone Investment

Phone insurance is a vital investment for anyone who relies on their smartphone for work, communication, or entertainment. With the potential for accidental damage, theft, or loss, phone insurance provides a layer of protection and peace of mind. By understanding the different types of coverage, the claims process, and the potential savings, you can make an informed decision and ensure your valuable device is adequately protected.

Frequently Asked Questions

Can I insure a second-hand phone?

+Yes, many insurance providers offer coverage for second-hand phones, provided they meet certain criteria, such as being in good working condition and having a valid proof of purchase.

What happens if I change my phone during the insurance term?

+If you upgrade or change your phone during the insurance term, you will typically need to update your policy to reflect the new device. This may involve a change in premiums or coverage limits, depending on the provider and the plan.

Are there any exclusions or limitations to phone insurance coverage?

+Yes, phone insurance policies often have exclusions and limitations. Common exclusions include cosmetic damage, intentional damage, and pre-existing conditions. It’s important to review the policy’s terms and conditions to understand what is and isn’t covered.