Insurance For Car Rental

When it comes to car rental, understanding the various insurance options is crucial to ensure a stress-free and protected experience. Whether you're a frequent traveler or an occasional car renter, navigating the world of insurance policies can be complex. This comprehensive guide aims to shed light on the different types of insurance coverage available for car rentals, offering expert insights and practical advice to help you make informed decisions.

The Importance of Insurance for Car Rentals

Renting a car provides freedom and flexibility, especially when exploring new destinations. However, it also comes with certain risks and liabilities. Insurance plays a vital role in mitigating these risks and offering financial protection in case of accidents, theft, or other unforeseen events. By familiarizing yourself with the insurance options, you can make smart choices to safeguard your rental experience and your wallet.

Types of Insurance Coverage for Car Rentals

When renting a car, you'll encounter various insurance terms and policies. Let's break down the most common types of insurance coverage and their implications:

1. Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW)

Collision Damage Waiver (CDW), also known as Loss Damage Waiver (LDW), is a fundamental insurance coverage for car rentals. It waives your responsibility for any damage to the rental car in the event of an accident. CDW/LDW policies vary between rental companies and countries, but they generally cover the cost of repairs or replacements for damages caused to the rental vehicle.

For example, let's say you're on a road trip and accidentally scratch the side of the rental car while parking. With a comprehensive CDW/LDW policy, you'd be protected from paying out-of-pocket for those repairs. However, it's essential to review the terms carefully, as some policies may have exclusions or deductibles that could impact your coverage.

2. Liability Insurance

Liability insurance is crucial to protect you from financial losses in case you cause damage to a third party's property or injuries to others during an accident. This coverage ensures that you're not personally liable for these damages. Most rental companies include basic liability insurance in their rental packages, but it's important to check the limits and coverage extent to ensure adequate protection.

Imagine you're driving a rental car and unfortunately collide with another vehicle, causing significant damage. With adequate liability insurance, you can rest assured that the costs of repairing the other vehicle and any medical expenses for injured parties will be covered, up to the policy limits.

3. Personal Accident Insurance (PAI) and Personal Effects Coverage (PEC)

Personal Accident Insurance (PAI) provides coverage for you and your passengers in the event of an accident. It offers financial support for medical expenses, disability, and even death benefits. Personal Effects Coverage (PEC), on the other hand, protects your personal belongings carried in the rental car from theft or damage.

For instance, if you're involved in an accident and suffer injuries, PAI can help cover your medical bills and provide compensation for any temporary disability. Similarly, if your laptop or camera is stolen from the rental car, PEC would compensate you for the loss.

4. Super Collision Damage Waiver (SCDW)

Super Collision Damage Waiver (SCDW) is an enhanced version of CDW/LDW. It offers additional protection by reducing or eliminating the deductible amount you would typically have to pay in the event of an accident. SCDW is especially beneficial if you want comprehensive coverage and peace of mind while renting a car.

Consider a scenario where you rent a luxury sports car and, despite your best efforts, damage the vehicle in a minor collision. With SCDW, you wouldn't have to worry about paying a large deductible, as this policy would cover the full cost of repairs, ensuring you're not left with unexpected expenses.

5. Third-Party Insurance

Third-party insurance is essential when renting a car abroad, particularly in countries where it is a legal requirement. This coverage protects you from liability claims made by third parties in the event of an accident. It's crucial to ensure you have adequate third-party insurance when driving in unfamiliar territories.

When traveling internationally and renting a car, third-party insurance becomes even more critical. For instance, if you're involved in an accident while driving in a foreign country, this insurance will cover the costs of repairing the other party's vehicle and any associated legal fees, ensuring you're not personally responsible for these expenses.

Factors to Consider When Choosing Insurance Coverage

Selecting the right insurance coverage for your car rental depends on various factors. Here are some key considerations to keep in mind:

1. Personal Liability and Financial Responsibility

Assess your personal liability and financial capacity to handle potential damages. If you have significant assets or high net worth, opting for comprehensive insurance coverage is advisable to protect your finances.

2. Rental Company Policies

Familiarize yourself with the insurance policies offered by the rental company. Compare the terms, deductibles, and coverage limits to ensure you're getting the best value for your money.

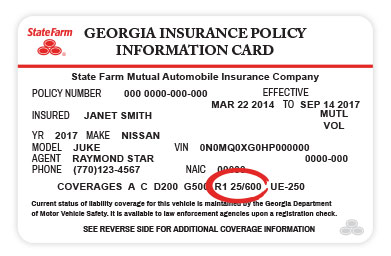

3. Existing Insurance Policies

Check if your existing auto insurance or travel insurance policies provide any coverage for rental cars. Some policies may extend benefits to rental vehicles, reducing the need for additional insurance.

4. Location and Destination

Consider the location and destination of your rental. Certain countries or regions may have specific insurance requirements or unique risks that should be taken into account when choosing coverage.

5. Rental Duration and Frequency

Evaluate the duration of your rental and how frequently you rent cars. If you're a frequent renter, investing in an annual insurance policy may be more cost-effective than purchasing coverage with each rental.

Maximizing Your Insurance Coverage

To make the most of your insurance coverage for car rentals, consider the following strategies:

1. Compare and Negotiate

Shop around and compare insurance rates and policies from different rental companies. Don't hesitate to negotiate with the rental agent to secure the best deal and coverage that suits your needs.

2. Read the Fine Print

Always carefully review the terms and conditions of the insurance policy. Pay attention to exclusions, deductibles, and any additional fees to ensure there are no surprises.

3. Bundle Your Policies

If you frequently rent cars or have multiple insurance needs, consider bundling your policies. This can often result in significant savings and streamlined coverage.

4. Consider Pre-Purchase Options

Some rental companies offer the option to pre-purchase insurance packages online. These packages may provide better rates and terms compared to purchasing insurance at the rental counter.

5. Stay Informed and Up-to-Date

Keep yourself updated on the latest insurance trends and regulations in the car rental industry. This knowledge will empower you to make well-informed decisions and negotiate effectively.

Frequently Asked Questions (FAQ)

What happens if I decline insurance when renting a car?

+Declining insurance when renting a car means you assume full financial responsibility for any damages or accidents. Without insurance, you may be liable for costly repairs, theft, or injury claims. It's essential to carefully consider your financial situation and assess the risks before declining insurance.

Can I use my personal auto insurance for rental cars?

+Some personal auto insurance policies may extend coverage to rental cars, but it's crucial to review your policy terms. Certain restrictions, such as mileage limits or coverage exclusions, may apply. Contact your insurance provider to understand your rental car coverage and any additional requirements.

Are there any alternatives to rental company insurance policies?

+Yes, there are alternative options to rental company insurance policies. Credit card companies often provide rental car insurance as a benefit to their cardholders. Additionally, travel insurance policies may include coverage for rental cars. It's important to carefully review the terms and conditions of these alternatives to ensure adequate protection.

What should I do if I get into an accident with a rental car?

+If you're involved in an accident with a rental car, remain calm and follow these steps: (1) Ensure the safety of yourself and others involved. (2) Contact the police and file a report. (3) Notify the rental company immediately, providing them with the accident details. (4) Document the scene by taking photos and gathering contact information from witnesses. (5) Review your insurance coverage and follow the necessary procedures to file a claim.

Are there any common exclusions or limitations in rental car insurance policies?

+Yes, rental car insurance policies often have exclusions and limitations. Common exclusions include damage caused by racing, off-roading, or driving under the influence. Additionally, policies may have limitations on the types of vehicles covered, the geographic scope of coverage, or the maximum payout for certain claims. It's crucial to review the policy carefully to understand any exclusions or limitations that may apply.

In conclusion, understanding the insurance landscape for car rentals is essential to protect your finances and ensure a worry-free travel experience. By familiarizing yourself with the different types of coverage, considering your personal needs, and making informed decisions, you can navigate the rental process with confidence and peace of mind.