Insurance Cost Per Month

The cost of insurance is a significant consideration for individuals and businesses alike, impacting financial planning and overall economic stability. While the exact insurance cost per month can vary widely based on numerous factors, understanding the average costs, the factors influencing them, and strategies to optimize these expenses is crucial for effective financial management.

Understanding Insurance Cost Per Month

Insurance costs per month are determined by a complex interplay of individual circumstances, policy features, and external economic factors. These costs can be influenced by factors such as the type of insurance (e.g., health, auto, life, or property), the coverage limits and deductibles chosen, the insured’s age, health status, and location, and even external events like natural disasters or economic fluctuations.

For instance, consider the case of health insurance. The average monthly premium for an individual health insurance plan in the United States was approximately $452 in 2021, according to the Kaiser Family Foundation. However, this average masks significant variations. Premiums can range from a few hundred dollars per month for basic coverage to over $1,000 for more comprehensive plans, depending on the individual's age, health status, and the specific benefits included in the policy.

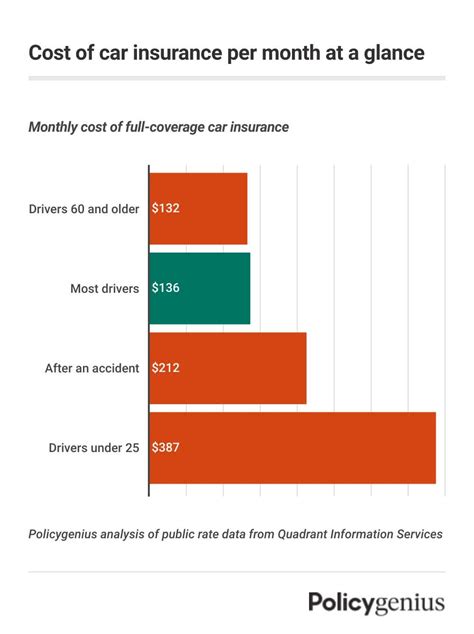

Similarly, auto insurance costs can vary greatly. The average monthly premium for auto insurance in the U.S. was around $115 in 2021, but this average can be misleading. Factors such as the insured's driving record, the make and model of the vehicle, and the location where the vehicle is primarily driven can significantly impact the cost. For example, a safe driver with a clean record might pay significantly less than the average, while someone with a history of accidents or violations could pay considerably more.

Factors Influencing Insurance Costs

Type of Insurance

The type of insurance being purchased is a primary determinant of cost. Different types of insurance policies cover distinct risks and have varying levels of demand and regulation, which can impact their average monthly costs. For instance, life insurance policies can have premiums that are influenced by the insured’s age, health, and lifestyle, with costs generally increasing with age. On the other hand, property insurance costs can be influenced by the value of the property being insured, its location, and the likelihood of natural disasters in the area.

Coverage and Deductibles

The level of coverage and the deductible chosen can significantly affect insurance costs. Generally, policies with higher coverage limits and lower deductibles tend to be more expensive, as they provide more extensive protection. For example, a health insurance policy with a high coverage limit and a low deductible will typically cost more than a policy with lower coverage and a higher deductible. Similarly, an auto insurance policy with comprehensive and collision coverage, which provides protection for a wide range of incidents, will generally be more expensive than a policy that only covers liability.

Individual Characteristics

Individual characteristics, such as age, health status, and location, play a significant role in determining insurance costs. For instance, younger individuals often pay less for health insurance, as they are generally healthier and less likely to require extensive medical care. However, as they age, their premiums typically increase to reflect the increased likelihood of health issues. Similarly, in the case of auto insurance, younger drivers, especially those under 25, often pay higher premiums due to their perceived higher risk of accidents.

Economic and External Factors

Insurance costs can also be influenced by broader economic factors and external events. For example, in the wake of a natural disaster like a hurricane or earthquake, property insurance costs in affected areas may increase due to the higher risk of claims. Similarly, changes in healthcare regulations or economic downturns can impact the cost of health insurance, as insurers adjust their premiums to account for changes in demand or potential increases in claims.

Strategies to Optimize Insurance Costs

Compare and Shop Around

One of the most effective strategies to manage insurance costs is to compare quotes from multiple providers. Different insurers may offer significantly different premiums for the same level of coverage, so shopping around can lead to substantial savings. Online comparison tools and insurance brokers can be valuable resources for this purpose.

Consider Higher Deductibles and Lower Coverage Limits

Choosing a policy with a higher deductible and lower coverage limits can reduce monthly premiums. While this strategy may not be suitable for everyone, especially those with significant health issues or high-value assets, it can be a cost-effective option for those who are comfortable with assuming more financial risk.

Explore Discounts and Bundling

Many insurers offer discounts for various reasons, such as good driving records, multiple policies with the same insurer (e.g., bundling auto and home insurance), or safety features in vehicles. Exploring these discounts and taking advantage of them can lead to significant savings over time. Additionally, maintaining a good credit score can also lead to lower insurance rates, as many insurers use credit-based insurance scores to determine premiums.

Stay Informed and Review Policies Regularly

Insurance costs and policies can change over time, so it’s important to stay informed and review your policies regularly. This includes understanding any changes to your coverage, premiums, or deductibles, and comparing them to other available options. Regular reviews can help ensure you’re getting the best value for your insurance dollar and allow you to make informed decisions about your coverage.

The Future of Insurance Costs

The landscape of insurance costs is constantly evolving, influenced by technological advancements, regulatory changes, and societal shifts. One significant trend is the increasing use of telemedicine and digital health services, which could potentially reduce healthcare costs and, in turn, impact health insurance premiums. Additionally, the rise of insurtech companies, which leverage technology to offer innovative insurance products and services, may drive competition and potentially lower costs for consumers.

On the other hand, rising healthcare costs and increasing natural disasters due to climate change could lead to higher insurance premiums in the future. Therefore, staying informed about these trends and being proactive in managing your insurance costs will be crucial for effective financial planning.

| Insurance Type | Average Monthly Cost (2021) |

|---|---|

| Health Insurance | $452 |

| Auto Insurance | $115 |

| Life Insurance | Varies based on age, health, and lifestyle |

| Property Insurance | Varies based on property value and location |

How do I find the best insurance rates for my needs?

+Finding the best insurance rates involves a combination of research, comparison, and understanding your specific needs. Start by identifying the type of insurance you require (e.g., health, auto, home) and the level of coverage you need. Then, use online comparison tools or consult with an insurance broker to compare quotes from multiple providers. Consider factors such as the reputation of the insurer, the specific coverage offered, and any available discounts. Finally, review your policy regularly to ensure it continues to meet your needs and remains competitive in terms of cost.

Can I reduce my insurance costs if I have a good driving record or a healthy lifestyle?

+Yes, insurers often offer discounts for good driving records or healthy lifestyles. For auto insurance, a clean driving record with no accidents or violations can lead to lower premiums. Similarly, for health insurance, maintaining a healthy lifestyle, including regular exercise and a balanced diet, may qualify you for lower rates. Additionally, some insurers offer discounts for using fitness tracking devices or participating in wellness programs. It’s worth inquiring with your insurer about these types of discounts to see if you’re eligible.

What are some common mistakes people make when choosing insurance policies, and how can I avoid them?

+Some common mistakes include choosing a policy solely based on cost without considering the coverage provided, not reviewing policies regularly to ensure they still meet your needs, and failing to shop around and compare quotes from multiple insurers. To avoid these mistakes, take the time to understand your specific insurance needs, compare policies based on both cost and coverage, and regularly review your policies to ensure they remain appropriate for your situation. Additionally, don’t hesitate to ask questions or seek clarification from insurance providers or brokers to ensure you fully understand the policies you’re considering.