Insurance Cost For Motorcycle

Motorcycle enthusiasts know that the thrill of the open road comes with its own set of considerations, one of which is insurance. Understanding the factors that influence insurance costs is crucial for any rider. In this article, we delve into the specifics of motorcycle insurance, exploring the key variables that impact premiums and providing a comprehensive guide to help riders navigate this essential aspect of motorcycle ownership.

Understanding the Basics of Motorcycle Insurance

Motorcycle insurance, much like any other form of vehicle insurance, is a legal requirement in many regions and serves as a vital financial safety net for riders. It provides coverage for a range of scenarios, including accidents, theft, and liability claims. The cost of this coverage varies significantly based on several factors, making it essential for riders to grasp the nuances of these variables.

One of the primary factors influencing insurance costs is the type of motorcycle one owns. Different makes and models of motorcycles carry varying degrees of risk, which insurance companies consider when calculating premiums. For instance, high-performance bikes often command higher insurance rates due to their association with speed and potential for accidents. On the other hand, more modestly powered motorcycles may attract lower premiums.

The rider's age and experience also play a pivotal role in determining insurance costs. Younger riders, particularly those under the age of 25, are often considered high-risk due to their relative lack of experience and higher propensity for accidents. Consequently, insurance companies typically charge higher premiums for this demographic. Conversely, more experienced riders, especially those with a clean driving record, may enjoy more competitive rates as they pose a lower risk to insurers.

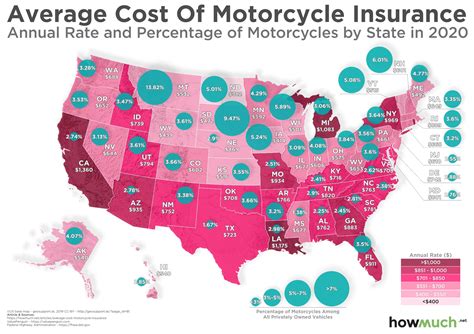

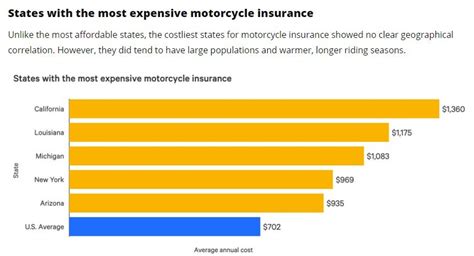

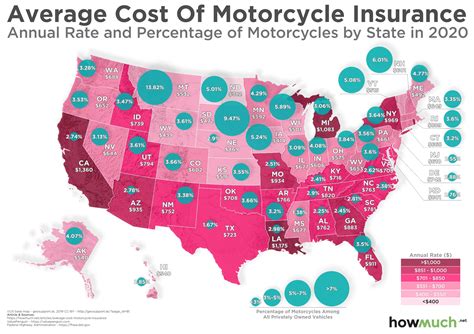

Another significant factor is the location where the motorcycle is primarily ridden and stored. Insurance companies assess the level of risk associated with different geographical areas, taking into account factors like crime rates, traffic conditions, and weather patterns. Areas with higher incidences of motorcycle accidents, thefts, or vandalism may result in higher insurance premiums.

Diving Deeper: Factors Influencing Insurance Costs

Beyond the fundamental factors, several other aspects can influence the cost of motorcycle insurance. These include:

- Coverage Options: The level of coverage one chooses can significantly impact insurance costs. Comprehensive coverage, which includes protection against theft, fire, and other non-accident-related incidents, typically comes at a higher cost compared to liability-only coverage.

- Deductibles: Opting for a higher deductible can reduce insurance premiums. However, it's important to note that this means the rider would have to pay more out of pocket in the event of a claim.

- Safety Features: Motorcycles equipped with advanced safety features like anti-lock brakes or stability control systems may qualify for insurance discounts, as these features can help reduce the risk of accidents.

- Usage: The frequency and purpose of motorcycle use can also affect insurance costs. Riders who use their bikes primarily for leisure or occasional commuting may pay less than those who rely on their motorcycles for daily transportation or long-distance travel.

Additionally, some insurance companies offer discounts for riders who complete motorcycle safety courses or have multiple vehicles insured with the same provider. It's always worth exploring these options to potentially reduce insurance costs.

The Role of Technology in Motorcycle Insurance

Advancements in technology have also begun to play a role in determining insurance costs. Some insurance companies now offer telematics or usage-based insurance programs for motorcycles. These programs use GPS-enabled devices or smartphone apps to track riding behavior, including speed, acceleration, and braking patterns. Riders who exhibit safe driving habits may be rewarded with lower insurance premiums.

Furthermore, the rise of electric motorcycles has prompted insurance companies to reconsider their risk assessments. While electric motorcycles generally offer safer performance characteristics compared to their gasoline-powered counterparts, they also come with unique risks, such as potential battery issues. This has led to some variation in insurance rates for electric motorcycles, with certain models attracting lower premiums due to their advanced safety features and reduced environmental impact.

Real-World Examples and Case Studies

To provide a clearer picture of how these factors influence insurance costs, let’s examine some real-world examples. Consider the following case studies:

| Rider Profile | Insurance Cost |

|---|---|

| 22-year-old rider with a high-performance sports bike | $1,500 annually |

| 45-year-old rider with a classic cruiser and a clean driving record | $800 annually |

| 30-year-old rider with an electric motorcycle in an urban area | $950 annually |

These examples illustrate the impact of factors like age, bike type, and location on insurance costs. The young rider with a high-performance bike faces the highest insurance costs due to their age and the nature of their motorcycle. Conversely, the experienced rider with a classic cruiser enjoys a more affordable premium thanks to their lower risk profile.

The case of the electric motorcycle highlights the evolving landscape of motorcycle insurance. While the insurance cost is slightly higher than that of the classic cruiser, it's important to note that this rider benefits from the environmental advantages and lower maintenance costs associated with electric motorcycles.

Navigating the Insurance Landscape

When it comes to navigating the world of motorcycle insurance, there are several key considerations to keep in mind:

- Compare Quotes: It's always advisable to obtain quotes from multiple insurance providers. This allows riders to compare rates and coverage options, ensuring they get the best value for their money.

- Understand Coverage: Take the time to thoroughly understand the different types of coverage available. This ensures that riders have the right level of protection for their specific needs.

- Bundle Policies: If you have multiple vehicles or policies with the same insurance company, you may be eligible for discounts. Bundling your motorcycle insurance with other policies, such as auto or home insurance, can often lead to significant savings.

- Stay Informed: Keep up-to-date with changes in the insurance landscape, especially regarding advancements in technology and policy offerings. This ensures riders can take advantage of any new opportunities that may reduce their insurance costs.

Conclusion: Empowering Riders with Knowledge

Understanding the factors that influence motorcycle insurance costs is a powerful tool for riders. By being aware of these variables and staying informed about the latest trends and offerings in the insurance market, riders can make more informed decisions when it comes to insuring their motorcycles. Whether it’s choosing the right coverage, exploring safety features, or considering the impact of technology, riders have the ability to navigate the insurance landscape with confidence and secure the best value for their hard-earned dollars.

Frequently Asked Questions

What is the average cost of motorcycle insurance?

+The average cost of motorcycle insurance can vary widely depending on several factors. It can range from a few hundred dollars to over a thousand dollars annually. Factors such as the rider’s age, bike type, location, and coverage options all play a role in determining the final cost.

Are there any ways to reduce motorcycle insurance costs?

+Yes, there are several strategies to potentially reduce insurance costs. These include opting for a higher deductible, taking advantage of safety features on your bike, completing motorcycle safety courses, and bundling your insurance policies with the same provider. Additionally, shopping around and comparing quotes from different insurers can often lead to significant savings.

How does the age of the rider affect insurance costs?

+Age is a significant factor in determining insurance costs. Younger riders, especially those under the age of 25, are often considered high-risk and face higher insurance premiums. As riders gain more experience and maintain a clean driving record, insurance costs typically decrease.

Do all states require motorcycle insurance?

+No, not all states in the US require motorcycle insurance. However, it’s important to note that even in states where it’s not legally mandatory, having insurance provides crucial financial protection in the event of an accident. Additionally, some states may require proof of insurance to register a motorcycle.

Can I get insurance for a custom-built motorcycle?

+Yes, it is possible to insure custom-built motorcycles. However, the process may be more complex, and the insurance rates can vary significantly based on the value and unique features of the custom bike. It’s advisable to consult with an insurance specialist who has experience insuring custom vehicles.