Insurance Companies For Home Insurance

Home insurance is an essential aspect of protecting your most valuable asset, and choosing the right insurance company is crucial to ensure comprehensive coverage and a smooth claims process. With numerous options available in the market, it can be overwhelming for homeowners to navigate through the sea of insurance providers. This comprehensive guide aims to shed light on some of the top insurance companies specializing in home insurance, offering valuable insights to help you make an informed decision.

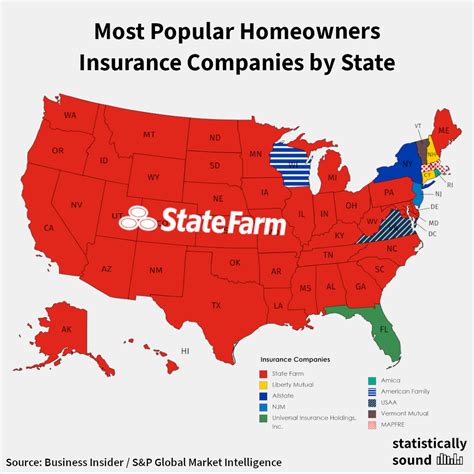

Understanding the Landscape: Key Players in the Home Insurance Market

The home insurance market is diverse, with a range of companies catering to different needs and preferences. While some insurers focus on offering comprehensive coverage, others excel in providing specialized policies for unique home types or locations. Here’s an overview of some prominent insurance companies and their unique selling points.

State Farm: A Trusted Companion for Homeowners

State Farm is a well-established name in the insurance industry, known for its extensive network and personalized approach. With a wide range of coverage options, State Farm caters to homeowners seeking customized plans. Their policies often include unique features like identity restoration coverage, providing an added layer of protection.

One of the standout aspects of State Farm is its commitment to customer service. The company offers 24⁄7 claims assistance, ensuring homeowners can access support whenever needed. Their local agents are readily available to guide policyholders through the claims process, making it a seamless experience.

| Coverage Highlights | State Farm |

|---|---|

| Personal Liability | Up to $100,000 standard, with higher limits available |

| Medical Payments | Covers injuries on your property, up to $1,000 per person |

| Dwelling Coverage | Protects your home's structure, including fixtures and systems |

| Personal Property | Replaces lost or damaged items, with special limits for valuable items |

Allstate: Empowering Homeowners with Innovative Solutions

Allstate is renowned for its innovative approach to insurance, offering a range of digital tools and resources to enhance the homeowner’s experience. From customizable policies to their innovative “Home Assistant” app, Allstate empowers homeowners to take control of their insurance journey.

The company’s “Home Assistant” app is a standout feature, providing policyholders with a digital platform to manage their policies, track claims, and even access emergency services. This level of digital integration makes Allstate a preferred choice for tech-savvy homeowners.

| Allstate's Key Features | Description |

|---|---|

| Customizable Coverage | Allows homeowners to tailor policies to their specific needs |

| "Home Assistant" App | Offers policy management, claims tracking, and emergency services |

| Discounts | Provides savings for bundling policies, safe neighborhoods, and more |

Liberty Mutual: Comprehensive Coverage for Peace of Mind

Liberty Mutual is a leading insurance provider known for its comprehensive coverage options. The company offers a wide range of policies, catering to diverse homeowner needs. From standard home insurance to specialized coverage for high-value homes, Liberty Mutual ensures every homeowner finds the right fit.

One of the standout features of Liberty Mutual is its “Right Track” program, which uses telematics to monitor driving behavior. This innovative approach to auto insurance provides policyholders with discounts based on their driving habits, adding an extra layer of value to their insurance portfolio.

| Liberty Mutual's Coverage Options | Details |

|---|---|

| Standard Home Insurance | Covers dwellings, personal property, and liability |

| High-Value Home Insurance | Tailored for homes with higher reconstruction costs |

| "Right Track" Program | Provides auto insurance discounts based on driving behavior |

USAA: Specialized Insurance for Military Families

USAA stands out as a specialized insurance provider catering exclusively to military families. With a deep understanding of the unique needs and challenges faced by military personnel and their families, USAA offers tailored insurance solutions.

USAA’s home insurance policies are designed to provide comprehensive coverage, with additional benefits like flexible payment options and a dedicated claims team. Their focus on military families ensures that policyholders receive specialized support and guidance.

| USAA's Military-Centric Benefits | Description |

|---|---|

| Discounts | Offers savings for active-duty military, veterans, and their families |

| Flexible Payment Plans | Provides options to accommodate military deployments and transitions |

| Dedicated Claims Team | Ensures a seamless and supportive claims process for military families |

Amica: A Legacy of Excellence in Home Insurance

Amica is a renowned name in the insurance industry, known for its exceptional customer service and financial stability. With a legacy spanning over a century, Amica has established itself as a trusted provider of home insurance.

The company’s commitment to customer satisfaction is evident in its approach to policyholders. Amica offers a range of coverage options, ensuring homeowners can find the right fit. Additionally, their customer service team provides personalized support, guiding policyholders through the insurance process.

| Amica's Customer-Centric Approach | Details |

|---|---|

| A+ Rating from AM Best | Reflects Amica's financial stability and commitment to customer satisfaction |

| Customizable Policies | Allows homeowners to tailor coverage to their specific needs |

| Personalized Support | Offers guidance and assistance throughout the insurance journey |

The Bottom Line: Choosing the Right Home Insurance Provider

Selecting the right home insurance company is a crucial decision that impacts your financial security and peace of mind. Each of the companies highlighted above offers unique advantages, catering to different homeowner needs. From State Farm’s personalized approach to Allstate’s innovative solutions, homeowners have a range of options to choose from.

When deciding on a home insurance provider, it’s essential to consider your specific needs and preferences. Evaluate the coverage options, customer service, and any additional benefits or discounts offered. Additionally, research the company’s reputation and financial stability to ensure they can provide reliable coverage over the long term.

Remember, home insurance is a long-term investment, and choosing a reputable and trusted provider is key to protecting your most valuable asset. By understanding the unique offerings of different insurance companies, you can make an informed decision and secure the right coverage for your home.

Frequently Asked Questions

What factors should I consider when choosing a home insurance company?

+

When selecting a home insurance company, consider factors such as coverage options, customer service reputation, financial stability, and any additional benefits or discounts offered. Evaluate the company’s ability to provide comprehensive coverage for your specific needs and assess their claims handling process to ensure a smooth experience.

Are there any specialized home insurance providers for unique circumstances?

+

Yes, there are specialized home insurance providers catering to unique circumstances. For example, USAA focuses on military families, offering tailored policies and support. Additionally, some insurers offer specialized coverage for high-value homes or unique locations, ensuring comprehensive protection for specific needs.

How can I compare home insurance quotes from different providers?

+

Comparing home insurance quotes can be done through online platforms or by contacting insurance providers directly. Online comparison tools allow you to input your details and receive quotes from multiple providers. Alternatively, you can reach out to individual insurers to request quotes and compare coverage options, prices, and any additional benefits.

What additional benefits or discounts can I expect from home insurance providers?

+

Home insurance providers often offer a range of additional benefits and discounts. This can include multi-policy discounts when bundling home and auto insurance, loyalty discounts for long-term customers, and safety discounts for homes equipped with security systems or located in safe neighborhoods. Some insurers also provide discounts for specific occupations or affiliations.