Insurance Companies For Car

The world of car insurance can be a complex maze, with numerous companies offering a wide range of policies and coverage options. Navigating this landscape can be a daunting task for any driver, especially when you consider the potential financial risks and legal obligations involved. This comprehensive guide aims to shed light on the key players in the car insurance industry, providing an in-depth analysis of their offerings, reputation, and unique selling points. By understanding the nuances of each insurance provider, you can make an informed decision and choose the best coverage for your needs.

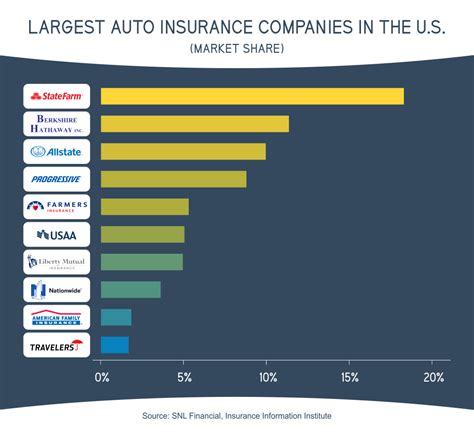

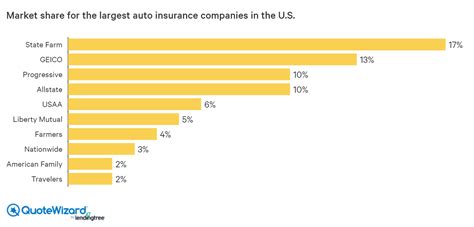

Understanding the Landscape: Key Players in Car Insurance

The car insurance market is a competitive arena, with a variety of companies vying for your business. Here, we delve into some of the most prominent players, exploring their history, specialty services, and customer satisfaction ratings.

State Farm: A Household Name in Insurance

State Farm is a stalwart in the insurance industry, offering a comprehensive range of policies to cater to diverse needs. Founded in 1922, this company has a rich history and a solid reputation for customer service. With a focus on auto, home, and life insurance, State Farm has consistently ranked highly in customer satisfaction surveys, thanks to its efficient claims process and personalized service.

One of State Farm's unique offerings is its Drive Safe & Save program, which utilizes telematics technology to monitor driving behavior. This innovative approach rewards safe drivers with discounts, providing an incentive to maintain safe driving habits. State Farm also offers a Steer Clear program for young drivers, providing educational resources and potential discounts for those who complete the program.

State Farm's comprehensive coverage options include:

- Liability Coverage: Covers bodily injury and property damage liability.

- Collision Coverage: Pays for damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision incidents, such as theft, vandalism, and natural disasters.

- Medical Payments Coverage: Provides coverage for medical expenses after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're in an accident with a driver who doesn't have sufficient insurance.

| Key Coverage Option | State Farm |

|---|---|

| Liability Coverage | Comprehensive, customizable limits |

| Collision Coverage | Standard, with option for higher deductibles |

| Comprehensive Coverage | Includes coverage for natural disasters and vandalism |

| Medical Payments Coverage | Available, with varying coverage limits |

| Uninsured/Underinsured Motorist Coverage | Offered, with option for stacking limits |

💡 State Farm's focus on technology and its commitment to customer education make it a popular choice for many drivers. Its telematics program offers a unique way to save on premiums while encouraging safer driving habits.

GEICO: Government Employees and Beyond

Originally founded to provide insurance for government employees, GEICO (Government Employees Insurance Company) has since expanded its reach to cater to a wide range of customers. With a focus on auto insurance, GEICO offers a simple, straightforward approach to coverage.

One of GEICO's standout features is its Military Discount, providing a 15% discount to active duty military personnel, National Guard members, and reservists. This reflects the company's historical ties to the government sector. GEICO also offers a Safe Driver Discount, rewarding customers with clean driving records.

GEICO's coverage options include:

- Liability Coverage: Basic and broad forms available, with varying limits.

- Collision Coverage: Covers damage to your vehicle, with options for deductibles.

- Comprehensive Coverage: Covers non-collision incidents, including natural disasters, theft, and vandalism.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages after an accident.

- Uninsured Motorist Coverage: Protects you if you're involved in an accident with an uninsured driver.

| Key Coverage Option | GEICO |

|---|---|

| Liability Coverage | Basic and broad forms, customizable limits |

| Collision Coverage | Standard, with option for higher deductibles |

| Comprehensive Coverage | Includes coverage for natural disasters and vandalism |

| Personal Injury Protection (PIP) | Offered, with varying coverage limits |

| Uninsured Motorist Coverage | Standard, with option for higher limits |

💡 GEICO's simple, direct approach to insurance makes it a popular choice for many. Its military discount and safe driver rewards are unique offerings that can provide significant savings.

Progressive: The Name in Innovation

Progressive is known for its innovative approach to insurance, offering a range of digital tools and resources to enhance the customer experience. From its early days, Progressive has focused on providing auto insurance with a twist, introducing unique features like its Name Your Price tool, which allows customers to set their desired price range and then find a policy that fits.

Progressive also offers a Snapshot program, which uses telematics to monitor driving behavior. This program provides personalized discounts based on how, when, and where you drive. Additionally, Progressive offers a Multi-Policy Discount, providing savings for customers who bundle their auto insurance with other policies, such as home or renters insurance.

Progressive's coverage options include:

- Liability Coverage: Basic and broad forms, with customizable limits.

- Collision Coverage: Covers damage to your vehicle, with options for deductibles.

- Comprehensive Coverage: Covers non-collision incidents, including natural disasters, theft, and vandalism.

- Medical Payments Coverage: Covers medical expenses after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with an uninsured or underinsured driver.

| Key Coverage Option | Progressive |

|---|---|

| Liability Coverage | Basic and broad forms, customizable limits |

| Collision Coverage | Standard, with option for higher deductibles |

| Comprehensive Coverage | Includes coverage for natural disasters and vandalism |

| Medical Payments Coverage | Offered, with varying coverage limits |

| Uninsured/Underinsured Motorist Coverage | Standard, with option for stacking limits |

💡 Progressive's focus on innovation and its unique pricing tools set it apart in the market. Its Snapshot program offers a personalized approach to insurance, rewarding safe drivers with tailored discounts.

Comparative Analysis: Key Features and Benefits

When comparing car insurance companies, it’s essential to look beyond just the cost of the policy. Each provider offers unique features and benefits that can significantly impact your coverage and overall experience. Here, we analyze some of the key differentiators to help you make an informed choice.

Discounts and Rewards Programs

Insurance companies often offer a range of discounts to attract and retain customers. These can include:

- Safe Driver Discounts: Rewards for maintaining a clean driving record.

- Multi-Policy Discounts: Savings for bundling multiple policies, such as auto and home insurance.

- Telematics Discounts: Incentives for using telematics devices to monitor driving behavior.

- Military Discounts: Special rates for active duty military personnel and veterans.

- Student Discounts: Savings for good students or those enrolled in certain educational programs.

Each company offers a unique combination of these discounts, so it's worth comparing to see which provider can offer the most savings based on your specific circumstances.

Claims Process and Customer Service

In the event of an accident, the claims process can be a make-or-break experience for any insurance customer. A smooth, efficient process can make a difficult situation much more manageable. Here’s a look at how some of the top car insurance companies stack up in terms of claims handling and customer service:

| Company | Claims Process Efficiency | Customer Service Rating |

|---|---|---|

| State Farm | Excellent, with a focus on personalized service | High, consistently ranked among the best |

| GEICO | Streamlined, with a digital-first approach | Good, with a focus on customer satisfaction |

| Progressive | Innovative, with digital tools for quick resolution | High, known for excellent customer support |

💡 The claims process and customer service experience can vary significantly between companies. It's important to choose an insurer with a strong reputation in these areas to ensure a positive experience should you need to make a claim.

Additional Services and Benefits

Beyond the standard coverage options, many insurance companies offer additional services and benefits to enhance the customer experience. These can include:

- Roadside Assistance: Emergency services for breakdowns, flat tires, or running out of gas.

- Rental Car Coverage: Provides a rental car while your vehicle is being repaired after an accident.

- Accident Forgiveness: A feature that prevents your rates from increasing after your first at-fault accident.

- Pet Injury Coverage: Covers veterinary costs if your pet is injured in an accident.

- Gap Insurance: Covers the difference between your vehicle’s actual cash value and the amount you still owe on your loan.

These additional services can provide significant peace of mind and financial protection in various situations. It's worth considering which of these benefits are most important to you when choosing an insurance provider.

Choosing the Right Car Insurance: A Personalized Approach

The right car insurance policy for you will depend on a variety of factors, including your personal circumstances, driving history, and the type of vehicle you own. Here are some key considerations to guide your decision-making process:

Coverage Needs

Start by evaluating your coverage needs. Consider the value of your vehicle, your financial situation, and your state’s minimum liability requirements. You may also want to consider additional coverage options, such as comprehensive and collision coverage, to protect against theft, vandalism, and accidents.

Budget and Cost

Your budget will play a significant role in your insurance decision. While it’s important to find a policy that provides adequate coverage, you also want to ensure it fits within your financial means. Look for ways to save, such as by taking advantage of discounts or by bundling your auto insurance with other policies.

Company Reputation and Customer Service

The reputation of the insurance company and the quality of its customer service can greatly impact your overall experience. Look for companies with a strong track record of handling claims efficiently and providing excellent customer support. Online reviews and ratings can be a useful tool to gauge customer satisfaction.

Policy Flexibility and Personalization

Some insurance companies offer more flexibility and personalization in their policies than others. If you have specific needs or preferences, such as wanting to bundle multiple policies or customize your coverage, it’s important to choose a provider that can accommodate these requests.

Additional Services and Benefits

As mentioned earlier, many insurance companies offer additional services and benefits beyond standard coverage. These can provide significant value, especially if you frequently encounter situations where these services would be useful. Consider which of these additional benefits are most important to you and choose a provider that offers them.

Conclusion: Empowering Your Car Insurance Decision

Choosing the right car insurance company is a critical decision that can impact your financial well-being and peace of mind. By understanding the key players in the industry, their unique offerings, and the factors that influence your choice, you can make an informed decision that best suits your needs.

Remember, the best insurance policy is one that provides adequate coverage, fits within your budget, and offers a positive customer experience. Take the time to compare options, leverage discounts, and choose a provider that aligns with your personal circumstances and preferences.

What is the average cost of car insurance?

+The average cost of car insurance can vary significantly depending on a range of factors, including your location, driving history, the make and model of your vehicle, and the coverage options you choose. As a rough estimate, the average annual cost for car insurance in the United States is around 1,674, but this can range from under 1,000 to over $3,000 depending on your specific circumstances.

How can I get the best car insurance rates?

+To get the best car insurance rates, it’s important to shop around and compare quotes from multiple providers. You can also take advantage of discounts offered by insurance companies, such as safe driver discounts, multi-policy discounts, or discounts for completing defensive driving courses. Additionally, maintaining a clean driving record, bundling your policies, and increasing your deductible can help lower your insurance costs.

What should I consider when choosing a car insurance company?

+When choosing a car insurance company, consider factors such as their financial stability, customer service reputation, claims handling process, and the range of coverage options and discounts they offer. It’s also important to assess their digital capabilities, such as the availability of mobile apps and online portals for policy management and claims reporting. Finally, consider the overall value they provide, including any additional benefits or services they offer beyond standard coverage.