Insurance Broker Home Insurance

Welcome to a comprehensive guide on home insurance, a vital aspect of protecting one's most valuable asset. In today's world, where unforeseen events can strike at any moment, having adequate home insurance is not just a wise choice but an essential safeguard. This article will delve deep into the world of insurance brokerage, specifically focusing on home insurance policies. We will explore the intricate details, provide expert insights, and offer valuable advice to help you navigate this critical aspect of financial planning.

Understanding Home Insurance: A Comprehensive Overview

Home insurance, often referred to as homeowner’s insurance, is a contract between an insurance provider and a homeowner. It’s designed to protect the policyholder against financial losses and liabilities arising from unexpected events that may damage their home or its contents. These events can range from natural disasters like floods and earthquakes to human-induced incidents such as theft or vandalism.

The primary purpose of home insurance is to offer financial security and peace of mind. It ensures that in the face of unforeseen circumstances, the homeowner is not left with a devastating financial burden. This protection extends beyond the physical structure of the home to include personal belongings, additional living expenses, and even liability coverage in case someone gets injured on the property.

Key Components of Home Insurance Policies

Home insurance policies are intricate, tailored to the unique needs of each homeowner. Here are some of the key components that make up a typical home insurance policy:

- Dwelling Coverage: This covers the physical structure of the home, including the walls, roof, and foundation. It provides protection against damage caused by perils outlined in the policy, which often include fire, lightning, windstorms, and more.

- Personal Property Coverage: This component safeguards the homeowner’s personal belongings, such as furniture, appliances, clothing, and electronics. It reimburses the policyholder for losses or damages to these items, up to the policy limits.

- Liability Coverage: Home insurance policies also include liability coverage, which protects the homeowner if someone is injured on their property or if their actions result in property damage elsewhere. This coverage can be vital in protecting the homeowner’s financial well-being in such situations.

- Additional Living Expenses: In the event that a home becomes uninhabitable due to an insured peril, this coverage provides for additional living expenses, such as hotel stays and restaurant meals, until the home is repaired or rebuilt.

- Loss of Use Coverage: Similar to additional living expenses, this coverage reimburses the homeowner for any necessary expenses incurred due to a covered loss, such as relocating temporarily.

- Medical Payments Coverage: This coverage provides for the medical expenses of individuals injured on the insured property, regardless of fault. It offers a quick and straightforward way to cover medical bills without going through the lengthy process of establishing liability.

Each of these components can be customized to fit the specific needs and circumstances of the homeowner. Insurance brokers play a crucial role in helping individuals understand these components and tailor their policies to provide the best possible coverage.

The Role of Insurance Brokers in Home Insurance

Insurance brokers are professionals who act as intermediaries between insurance companies and clients. They are licensed and trained to offer unbiased advice and assistance in selecting the most suitable insurance products, including home insurance policies.

Expert Guidance and Advice

One of the primary benefits of working with an insurance broker is their expert guidance. They possess in-depth knowledge of the insurance industry and the various policies available. Brokers can assess a client’s unique needs and circumstances, providing personalized recommendations for the most comprehensive and cost-effective home insurance coverage.

Brokers stay updated with the latest industry developments, including changes in coverage options, policy terms, and pricing. They can advise clients on the most advantageous policies, ensuring they receive the best value for their insurance premium.

Tailored Policy Solutions

Every homeowner’s situation is unique. An insurance broker can tailor a home insurance policy to fit these specific needs. Whether it’s a high-value home, a historic property, or a residence with specialized features, brokers can work with insurance companies to create customized policies that offer the right level of protection.

For instance, a homeowner with valuable art or jewelry may require additional coverage beyond the standard personal property limits. An insurance broker can help secure valuable articles coverage, which provides the necessary protection for these high-value items.

Risk Assessment and Mitigation

Insurance brokers are skilled at conducting risk assessments. They can identify potential risks and vulnerabilities associated with a homeowner’s property and advise on ways to mitigate these risks. This may involve suggesting improvements to the property, such as installing a security system or upgrading plumbing to reduce the risk of water damage.

By reducing the likelihood of claims, homeowners can often enjoy lower insurance premiums. Brokers can also advise on home improvement projects that not only enhance the property's value but also lower insurance costs.

Claims Assistance and Advocacy

When a claim needs to be filed, insurance brokers step in to provide valuable assistance. They can guide homeowners through the claims process, ensuring all necessary steps are taken to receive a fair and timely settlement. Brokers act as advocates for their clients, ensuring their interests are protected and that they receive the full benefits outlined in their policy.

In complex or disputed claims, brokers can negotiate with insurance companies on behalf of their clients, aiming to reach a satisfactory resolution. Their experience and knowledge of the insurance industry can be invaluable during these challenging times.

The Benefits of Working with an Insurance Broker

Engaging the services of an insurance broker offers numerous advantages when it comes to home insurance.

Personalized Service

Brokers provide a level of personalized service that is often lacking when dealing directly with insurance companies. They take the time to understand a client’s specific needs, concerns, and goals, tailoring their advice and recommendations accordingly. This personalized approach ensures that homeowners receive insurance coverage that is truly suited to their unique circumstances.

Time and Effort Savings

Navigating the complex world of insurance can be time-consuming and confusing. Insurance brokers handle the heavy lifting, researching and comparing policies from multiple insurers to find the best fit for their clients. They save homeowners the time and effort of sifting through numerous insurance options, allowing them to focus on other important aspects of their lives.

Cost Savings

Insurance brokers can often negotiate better rates and terms with insurance companies. They have established relationships with various insurers and can leverage these connections to secure competitive pricing and additional benefits for their clients. By working with a broker, homeowners can potentially save a significant amount on their insurance premiums.

Ongoing Support and Advice

The relationship with an insurance broker doesn’t end once a policy is purchased. Brokers provide ongoing support and advice, reviewing policies regularly to ensure they continue to meet the homeowner’s changing needs. They can also advise on any updates or improvements that may affect the homeowner’s insurance coverage, such as home renovations or changes in personal circumstances.

Objective and Unbiased Advice

Insurance brokers are independent professionals, which means they are not tied to any specific insurance company. This independence allows them to provide objective and unbiased advice, recommending the best policy options without any bias towards a particular insurer. Homeowners can trust that the advice they receive is in their best interests, rather than influenced by the broker’s potential commissions.

Finding the Right Insurance Broker

Selecting the right insurance broker is crucial to ensure you receive the best possible service and advice. Here are some tips to help you find a reputable and reliable broker:

- Research and Reputation: Start by researching potential brokers. Check their credentials, qualifications, and any professional associations they belong to. Read reviews and testimonials from past clients to get an idea of their reputation and the quality of their service.

- Experience: Look for brokers with a solid track record in the insurance industry, particularly those with extensive experience in home insurance. Experienced brokers have likely encountered a wide range of scenarios and can offer valuable insights and advice based on their past experiences.

- Personalized Approach: Choose a broker who takes the time to understand your unique needs and circumstances. A personalized approach ensures that you receive tailored advice and recommendations, rather than a one-size-fits-all solution.

- Communication and Accessibility: Select a broker who communicates effectively and is easily accessible. You should feel comfortable reaching out with questions or concerns, and the broker should respond promptly and professionally.

- Independent Status: As mentioned earlier, an independent broker is not tied to any specific insurance company. This independence allows them to offer unbiased advice and provide a wider range of options, ensuring you receive the best policy for your needs.

The Future of Home Insurance: Emerging Trends and Technologies

The insurance industry is constantly evolving, driven by advancements in technology and changing consumer needs. Here are some emerging trends and technologies that are shaping the future of home insurance:

Telematics and Usage-Based Insurance

Telematics technology is being increasingly used in the insurance industry, particularly in auto insurance. However, it is also finding applications in home insurance. Telematics devices can monitor and collect data on a home’s usage patterns, such as energy consumption, water usage, and even security systems. This data can be used to offer more accurate and personalized insurance rates, as well as provide insights for homeowners to improve their home’s efficiency and security.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming various industries, and insurance is no exception. These technologies are being used to improve the accuracy of risk assessment models, streamline the claims process, and enhance fraud detection. AI-powered chatbots and virtual assistants are also becoming more common, offering 24⁄7 customer support and quick resolution of simple queries.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is being explored for its potential applications in the insurance industry. Blockchain’s decentralized and secure nature can enhance the efficiency and security of insurance transactions. It can streamline processes such as policy issuance, claims management, and even smart contract execution, ensuring transparency and reducing the risk of fraud.

Insurtech Startups

The rise of Insurtech startups is bringing innovation and disruption to the traditional insurance industry. These startups are leveraging technology to offer more efficient, user-friendly, and personalized insurance products. From digital-first insurance companies to those using AI and data analytics to improve risk assessment, Insurtech startups are challenging the status quo and providing new options for homeowners.

Smart Home Integration

The integration of smart home technology with insurance is an emerging trend. Insurance companies are partnering with smart home device manufacturers to offer incentives and discounts to homeowners who install and use these devices. Smart home devices, such as security cameras, smart locks, and water leak detectors, can enhance a home’s security and reduce the risk of losses, leading to potential savings on insurance premiums.

Conclusion: Navigating the World of Home Insurance

Home insurance is a critical aspect of financial planning, offering vital protection against unforeseen events that could cause significant financial loss. Working with an insurance broker can be a valuable asset in navigating the complex world of home insurance. Brokers provide expert guidance, tailored policy solutions, and ongoing support, ensuring homeowners receive the coverage they need at a competitive price.

As the insurance industry continues to evolve, embracing new technologies and trends, homeowners can look forward to more efficient, personalized, and innovative insurance solutions. By staying informed and working with reputable insurance brokers, homeowners can ensure they are adequately protected, no matter what the future may hold.

What is the average cost of home insurance in the US?

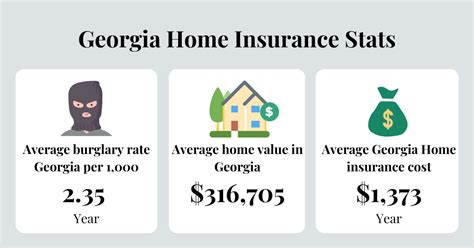

+The average cost of home insurance in the United States varies depending on several factors, including the location, size, and value of the home, as well as the coverage limits and deductibles chosen. According to recent data, the average annual premium for homeowners insurance is around 1,200, but this can range from as low as 500 to over $3,000.

What factors determine home insurance rates?

+Several factors influence home insurance rates, including the location and construction of the home, its age and condition, the coverage limits chosen, the deductibles selected, and the homeowner’s claims history. Other factors may include the presence of certain safety features (like smoke detectors or fire sprinklers), the home’s proximity to fire hydrants and emergency services, and the local crime rate.

What should I do if I need to file a home insurance claim?

+If you need to file a home insurance claim, it’s important to act promptly. First, assess the damage and ensure the safety of your family and pets. Then, contact your insurance broker or company to report the claim. Provide as much detail as possible about the incident and any damage incurred. Take photos or videos of the damage and keep a record of any expenses incurred as a result of the incident. Your broker or insurer will guide you through the claims process, which may involve an inspection and a review of your policy to determine the scope of coverage.