Insurance Aseguranza

In today's world, insurance, or aseguranza as it is known in Spanish, plays a pivotal role in safeguarding individuals, businesses, and communities against unforeseen risks and financial losses. With its complex landscape and evolving nature, understanding the ins and outs of insurance is crucial for making informed decisions and securing a robust financial future.

This comprehensive guide aims to delve deep into the world of insurance, exploring its diverse facets, key components, and the latest industry trends. By the end of this article, you'll have a solid grasp of insurance fundamentals and be equipped with the knowledge to navigate the insurance market confidently.

The Evolution of Insurance: A Historical Perspective

The concept of insurance has its roots in ancient civilizations, where communities came together to share risks and support each other in times of need. From early trade and maritime insurance practices to the emergence of modern insurance companies, the industry has evolved significantly over centuries.

In the 17th century, London's Lloyd's Coffee House became a hub for insurance transactions, setting the stage for the modern insurance market. This era marked the birth of specialized insurance services, catering to diverse needs and risks. The Industrial Revolution further propelled the growth of insurance, as businesses sought protection against emerging risks and potential losses.

The 20th century witnessed significant advancements in insurance, with the introduction of new types of policies, such as life insurance, property insurance, and health insurance. These policies revolutionized the industry, offering comprehensive coverage and peace of mind to individuals and businesses alike.

Key Components of Insurance: Unraveling the Basics

Insurance, at its core, is a complex interplay of various components, each playing a vital role in the overall functioning of the industry. Understanding these fundamental elements is crucial for grasping the mechanics of insurance and making informed choices.

1. Risk Assessment and Management

Risk assessment forms the backbone of the insurance industry. Insurers carefully evaluate potential risks and their impact on individuals and businesses. This process involves analyzing historical data, studying market trends, and employing advanced statistical models to predict and manage risks effectively.

For instance, let's consider property insurance. Insurers assess factors such as location, construction quality, and historical data on natural disasters to determine the risk associated with insuring a particular property. This risk assessment helps set premiums and ensures the sustainability of the insurance provider.

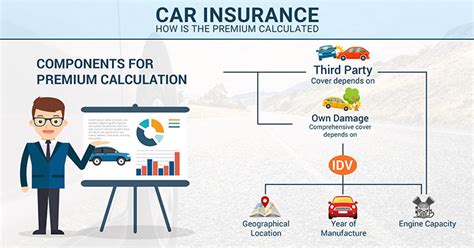

2. Premiums and Policy Coverage

Premiums are the lifeblood of the insurance industry. These are the payments made by policyholders to insurers in exchange for coverage against specific risks. The amount of premium is determined based on the assessed risk, with higher risks often resulting in higher premiums.

Policy coverage, on the other hand, outlines the specific risks and circumstances under which an insurance policy will provide compensation. It defines the scope and limitations of the insurance, ensuring clarity and transparency for policyholders.

For example, a health insurance policy may cover hospitalization costs, doctor's fees, and prescription medications. However, it might exclude certain pre-existing conditions or elective procedures, highlighting the importance of understanding policy coverage.

3. Claims and Settlement

When an insured event occurs, policyholders submit claims to the insurance provider. The claims process involves verifying the legitimacy of the claim, assessing the extent of the loss, and determining the compensation amount.

Efficient claims settlement is a critical aspect of insurance, as it directly impacts customer satisfaction and the insurer's reputation. Insurers invest in robust claims management systems and processes to ensure timely and fair compensation.

| Policy Type | Average Settlement Time |

|---|---|

| Auto Insurance | 2-4 weeks |

| Home Insurance | 3-6 weeks |

| Life Insurance | 6-8 weeks |

Types of Insurance: Navigating the Diverse Landscape

The insurance industry offers a vast array of policies to cater to the diverse needs of individuals and businesses. Each type of insurance serves a specific purpose and provides protection against unique risks.

1. Life Insurance: Securing Your Legacy

Life insurance, or seguro de vida, is a cornerstone of financial planning. It provides a safety net for your loved ones, ensuring they are financially secure in the event of your untimely demise.

There are two primary types of life insurance:

- Term Life Insurance: This policy offers coverage for a specified term, typically 10-30 years. It provides a death benefit to beneficiaries if the insured passes away during the policy term.

- Permanent Life Insurance: This policy provides lifelong coverage and often includes a cash value component, allowing policyholders to build savings alongside their insurance coverage.

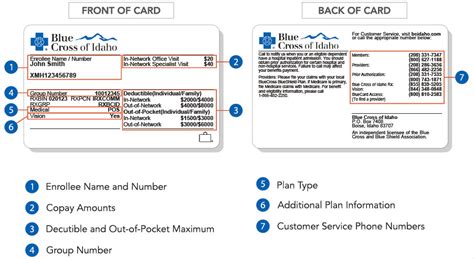

2. Health Insurance: Protecting Your Well-being

Health insurance, or seguro de salud, is vital in today's world, where medical expenses can be exorbitant. It provides coverage for a wide range of healthcare services, including hospitalization, doctor visits, prescription medications, and more.

Key types of health insurance include:

- Individual Health Insurance: Tailored to the needs of individuals and families, this policy offers comprehensive coverage for routine and emergency healthcare expenses.

- Group Health Insurance: Often provided by employers, group health insurance offers cost-effective coverage to employees and their families, with premiums typically shared between the employer and employees.

3. Property Insurance: Safeguarding Your Assets

Property insurance, or seguro de propiedad, protects your assets, including your home, vehicles, and personal belongings, against various risks such as fire, theft, natural disasters, and accidents.

Some common types of property insurance are:

- Homeowners Insurance: This policy covers the structure of your home and your personal belongings. It also provides liability coverage, protecting you against claims arising from accidents on your property.

- Auto Insurance: Auto insurance is mandatory in most countries and provides coverage for your vehicle, including liability, collision, and comprehensive coverage.

The Future of Insurance: Embracing Innovation and Technology

The insurance industry is experiencing a revolution driven by technological advancements and changing consumer expectations. Insurers are embracing innovation to enhance their services, improve customer experiences, and stay ahead in a highly competitive market.

1. Digital Transformation

Digital transformation is at the forefront of the insurance industry's evolution. Insurers are investing in digital platforms and mobile apps to streamline the insurance journey, from policy acquisition to claims settlement.

For instance, policyholders can now purchase insurance policies online, compare quotes, and manage their policies through user-friendly interfaces. Additionally, digital tools enable insurers to offer personalized coverage recommendations based on individual needs and preferences.

2. Data Analytics and AI

Advanced data analytics and artificial intelligence (AI) are transforming the way insurers assess risks and make informed decisions. These technologies enable insurers to process vast amounts of data quickly and accurately, improving risk assessment and pricing models.

AI-powered chatbots and virtual assistants are also enhancing customer service, providing instant support and resolving common queries efficiently.

3. Insurtech Startups

The rise of insurtech startups is reshaping the insurance landscape. These innovative companies are disrupting traditional insurance models with their tech-driven approaches, offering convenient and affordable insurance solutions to consumers.

Insurtech startups often leverage blockchain technology, IoT devices, and machine learning to streamline processes, reduce costs, and provide transparent and efficient insurance services.

Conclusion: Empowering Your Financial Future

Insurance is a powerful tool for safeguarding your financial well-being and protecting what matters most. By understanding the key components of insurance and exploring the diverse range of policies available, you can make informed decisions and secure a robust financial future for yourself and your loved ones.

Stay tuned for more insights and expert advice as we continue to explore the ever-evolving world of insurance.

¿Cómo elegir el tipo adecuado de seguro para mí?

+

Elegir el tipo adecuado de seguro depende de tus necesidades específicas y de los riesgos que deseas cubrir. Considera tus activos, tus responsabilidades financieras, y tus objetivos a largo plazo. Por ejemplo, si tienes una familia, la vida y la salud son de suma importancia. Si tienes un negocio, considera seguros de propiedad y responsabilidad civil. Evalúa tus necesidades y busca asesoramiento profesional para tomar la decisión adecuada.

¿Qué debo hacer en caso de una reclamación de seguro?

+

En caso de una reclamación de seguro, sigue estos pasos: 1) Notifica inmediatamente a tu compañía de seguros sobre la pérdida o el incidente. 2) Recopila toda la información relevante, como fotos, documentos, y declaraciones de testigos. 3) Completa y presenta la documentación requerida para la reclamación. 4) Mantente en contacto con tu compañía de seguros y sigue sus instrucciones para una resolución exitosa.

¿Cómo puedo ahorrar en mis primas de seguro?

+

Hay varias maneras de ahorrar en tus primas de seguro: 1) Compara cotizaciones de diferentes compañías de seguros para encontrar las mejores tarifas. 2) Considera deducibles más altos para reducir las primas. 3) Busca descuentos, como descuentos por lealtad, descuentos por múltiples políticas, o descuentos por seguridad. 4) Mantén un historial de conducción o de reclamaciones limpio, ya que esto puede afectar positivamente tus primas.