Insurance Agency

The insurance industry is an integral part of modern society, providing financial protection and peace of mind to individuals, families, and businesses alike. In an ever-changing world filled with uncertainties, the role of insurance agencies becomes increasingly crucial. These entities serve as trusted intermediaries, offering a wide range of coverage options to safeguard against various risks and unexpected events. As the insurance landscape continues to evolve, understanding the key aspects of insurance agencies, their services, and the impact they have on our lives becomes essential.

Navigating the Complex World of Insurance: An Agency’s Perspective

Insurance agencies are specialized businesses that act as brokers or direct providers of insurance policies. They serve as the bridge between insurance companies and policyholders, offering guidance, expertise, and personalized solutions to meet diverse insurance needs. Whether it’s protecting a family’s financial future, ensuring business continuity, or safeguarding valuable assets, insurance agencies play a pivotal role in managing risks and providing security.

The Insurance Agency: A Diverse Range of Services

Insurance agencies offer a comprehensive suite of services designed to cater to various insurance requirements. From basic coverage options like auto, home, and health insurance to more specialized policies for businesses, professionals, and unique risks, agencies provide tailored solutions. Here’s an overview of the key services typically offered by insurance agencies:

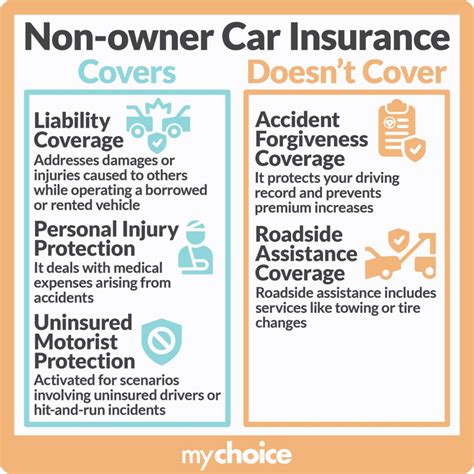

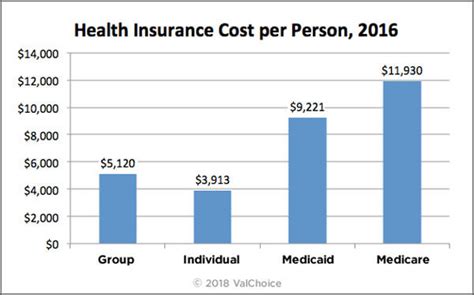

- Personal Insurance: Protecting individuals and families is a cornerstone of insurance agency services. This includes auto insurance, homeowners or renters insurance, life insurance, and health insurance. Agencies help policyholders understand their coverage options, guide them through the claims process, and ensure they have the right protection for their specific needs.

- Business Insurance: Insurance agencies are instrumental in helping businesses mitigate risks and ensure continuity. This encompasses general liability insurance, commercial property insurance, workers' compensation, and professional liability insurance. Agencies work closely with businesses to assess their unique risks and develop comprehensive insurance strategies.

- Specialty Insurance: For unique or niche risks, insurance agencies offer specialty insurance products. This can include coverage for high-value items like jewelry or artwork, cyber liability insurance, pet insurance, and even coverage for specific events or activities.

- Risk Management Consulting: Beyond insurance policies, agencies often provide risk management consulting services. This involves identifying potential risks, implementing strategies to mitigate them, and developing disaster recovery plans. Agencies help businesses and individuals proactively manage risks to minimize potential losses.

- Claims Assistance: When an insured event occurs, insurance agencies are there to guide policyholders through the claims process. They assist with filing claims, provide advice on necessary documentation, and advocate for their clients to ensure fair and timely settlements.

| Insurance Type | Coverage Examples |

|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Personal Injury Protection |

| Homeowners Insurance | Dwelling Coverage, Personal Property, Liability, Additional Living Expenses |

| Life Insurance | Term Life, Whole Life, Universal Life, Accidental Death |

| Health Insurance | Major Medical, Dental, Vision, Prescription Drug Coverage |

| Business Insurance | General Liability, Commercial Property, Workers' Compensation, Business Interruption |

The Impact of Insurance Agencies on Society

Insurance agencies have a profound impact on individuals, businesses, and the broader society. Their role extends beyond simply providing insurance policies; they contribute to economic stability, promote financial security, and enable individuals and businesses to pursue opportunities with confidence. Here’s a deeper look at the societal impact of insurance agencies:

Economic Stability and Growth

Insurance agencies play a crucial role in fostering economic stability and growth. By providing insurance coverage, agencies help mitigate financial risks, allowing individuals and businesses to plan and invest with confidence. This stability encourages economic activity, supports entrepreneurship, and drives innovation. Additionally, insurance agencies contribute to the financial health of communities by managing risks associated with natural disasters, accidents, and other unforeseen events.

Financial Security and Peace of Mind

One of the primary benefits of insurance agencies is the financial security and peace of mind they offer. Insurance policies provide a safety net against unexpected expenses, ensuring individuals and families can weather financial storms without significant hardship. For businesses, insurance coverage protects against potential losses, allowing them to focus on growth and long-term success. The assurance of having the right insurance coverage can reduce stress and anxiety, leading to improved overall well-being.

Risk Mitigation and Preparedness

Insurance agencies are instrumental in helping individuals and businesses identify and mitigate risks. Through risk assessments and tailored insurance solutions, agencies empower their clients to prepare for potential challenges. This proactive approach not only minimizes financial losses but also helps individuals and businesses develop resilience and adapt to changing circumstances. By partnering with insurance agencies, clients can focus on their core activities and goals with the knowledge that their risks are effectively managed.

Supporting Communities and Recovery

In times of crisis, insurance agencies play a vital role in supporting communities and facilitating recovery. When natural disasters strike, insurance coverage helps individuals and businesses rebuild their lives and livelihoods. Insurance agencies work closely with policyholders to process claims quickly and efficiently, providing much-needed financial assistance during challenging times. This support is essential for communities to recover, rebuild, and move forward.

Facilitating Access to Opportunities

Insurance agencies also contribute to expanding access to opportunities. By providing insurance coverage for various activities and ventures, agencies enable individuals and businesses to pursue their goals without excessive financial risk. Whether it’s starting a new business, investing in real estate, or engaging in high-risk activities, insurance coverage offers the necessary protection to take calculated risks and explore new possibilities.

The Future of Insurance Agencies: Embracing Innovation and Technology

As the insurance industry continues to evolve, insurance agencies are adapting to meet the changing needs and expectations of their clients. The rise of technology and digital platforms has brought about new opportunities and challenges for agencies. Here’s a glimpse into the future of insurance agencies and how they are embracing innovation:

Digital Transformation

Insurance agencies are increasingly embracing digital transformation to enhance their operations and improve the client experience. This involves adopting advanced technologies such as artificial intelligence, machine learning, and robotic process automation to streamline processes, improve accuracy, and reduce costs. Online platforms and mobile apps are also becoming essential tools for agencies, allowing clients to access policies, file claims, and manage their insurance needs conveniently.

Data-Driven Decision Making

The availability of vast amounts of data and advanced analytics tools is transforming the way insurance agencies operate. By leveraging data-driven insights, agencies can make more informed decisions about risk assessment, pricing, and coverage options. This data-centric approach enables agencies to offer personalized insurance solutions tailored to individual client needs, enhancing client satisfaction and loyalty.

Enhanced Customer Experience

Insurance agencies are focusing on delivering a seamless and personalized customer experience. This involves utilizing digital channels to provide real-time updates, streamlined communication, and efficient claim processing. By leveraging technology to enhance customer service, agencies can build stronger relationships with their clients and ensure their insurance needs are met effectively.

Collaborative Partnerships

Insurance agencies are forming strategic partnerships with technology providers, data analytics firms, and other industry players to stay at the forefront of innovation. These collaborations enable agencies to access cutting-edge tools and expertise, ensuring they can offer the latest insurance solutions and stay competitive in a rapidly changing market.

Emerging Risks and Coverage

As new technologies and industries emerge, insurance agencies are adapting their coverage options to address evolving risks. This includes insurance for emerging technologies like autonomous vehicles, drones, and blockchain, as well as coverage for unique risks associated with the gig economy and remote work. By staying ahead of the curve, insurance agencies can continue to provide relevant and comprehensive protection to their clients.

What are the key benefits of working with an insurance agency instead of directly with an insurance company?

+Insurance agencies offer a range of benefits, including personalized advice, a broader selection of insurance products, and advocacy during the claims process. Agencies act as trusted advisors, helping clients navigate complex insurance options and ensuring they receive the best coverage for their needs.

How do insurance agencies determine the right insurance coverage for their clients?

+Insurance agencies conduct comprehensive risk assessments, taking into account individual or business needs, financial goals, and potential risks. This tailored approach ensures clients receive coverage that aligns with their specific circumstances and provides the necessary protection.

What role do insurance agencies play in supporting businesses during challenging times, such as natural disasters or economic downturns?

+Insurance agencies are instrumental in helping businesses navigate challenging times. They provide guidance on business continuity planning, assist with insurance claims, and offer resources to help businesses recover and rebuild. By partnering with insurance agencies, businesses can focus on their core operations while knowing their risks are effectively managed.

How do insurance agencies stay up-to-date with emerging risks and evolving insurance needs in a rapidly changing world?

+Insurance agencies invest in ongoing professional development and stay connected with industry trends and developments. They collaborate with insurance companies, attend conferences, and leverage technology to access the latest insurance products and coverage options. By staying informed, agencies can provide their clients with the most relevant and up-to-date insurance solutions.