Infinity Auto Insurance Phone Number

In today's fast-paced world, having reliable auto insurance is crucial to protect yourself and your vehicle. Infinity Auto Insurance is a well-known name in the industry, offering comprehensive coverage options to meet the diverse needs of drivers across the United States. As a trusted provider, Infinity Auto Insurance understands the importance of easy accessibility and exceptional customer service. This article aims to provide you with all the essential information about Infinity Auto Insurance, including their contact details, the services they offer, and how to navigate their customer support channels.

Contacting Infinity Auto Insurance

When it comes to reaching out to Infinity Auto Insurance, having the right contact information is key. Infinity Auto Insurance provides multiple avenues for customers to get in touch with their representatives. Here’s a breakdown of the different ways you can contact them:

Phone Number

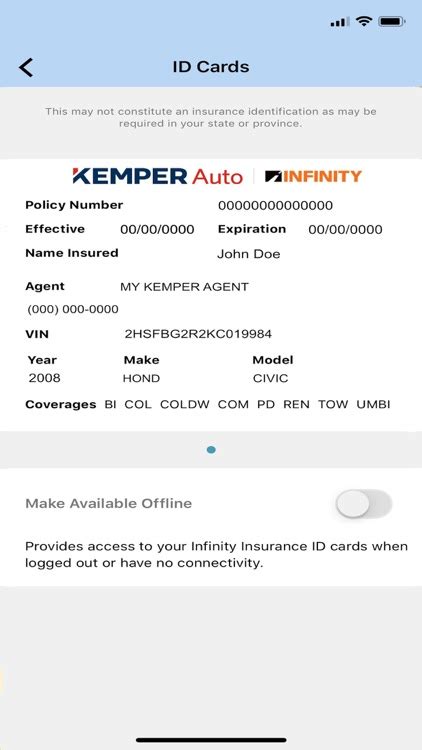

The primary method of contact for Infinity Auto Insurance is through their toll-free phone number: 1-800-INFINITY (1-800-463-4646). This number is accessible 24 hours a day, 7 days a week, ensuring that customers can reach out whenever they need assistance. Whether you’re looking to purchase a new policy, make changes to an existing one, or file a claim, this phone number is your direct line to Infinity’s dedicated customer support team.

Additional Contact Information

In addition to the toll-free number, Infinity Auto Insurance provides alternative contact methods for those who prefer other means of communication. Here are some additional ways to get in touch with them:

- Email: Customers can send an email to support@infinityauto.com for inquiries or to request assistance. Infinity's customer support team aims to respond to emails within 24 business hours.

- Live Chat: Infinity Auto Insurance offers a live chat feature on their website. This real-time chat option allows customers to connect with a representative instantly, making it convenient for quick questions or to initiate the process of purchasing a policy.

- Mailing Address: For those who prefer traditional mail, Infinity Auto Insurance's corporate headquarters address is: Infinity Insurance Company, 175 West Jackson Boulevard, Suite 1900, Chicago, IL 60604. This address can be used for sending correspondence, policy documents, or any other written communication.

Services Offered by Infinity Auto Insurance

Infinity Auto Insurance is dedicated to providing a wide range of services to meet the diverse needs of its customers. Here’s an overview of some of the key services they offer:

Auto Insurance Coverage

At the core of Infinity’s business is their comprehensive auto insurance coverage. They offer a variety of plans tailored to different driving needs and budgets. These plans typically include liability coverage, collision coverage, comprehensive coverage, and additional options such as personal injury protection (PIP) and uninsured/underinsured motorist coverage.

Additional Insurance Products

In addition to auto insurance, Infinity Auto Insurance also provides other insurance products to protect their customers in various aspects of life. These include:

- Homeowners Insurance: Infinity offers insurance policies to protect homeowners against damages to their property and liability claims. These policies can be customized to cover a wide range of scenarios, providing peace of mind for homeowners.

- Renters Insurance: For individuals who rent their homes, Infinity's renters insurance policies provide coverage for personal belongings and liability. This protection ensures that renters are not left vulnerable in the event of theft, damage, or accidents.

- Motorcycle Insurance: Infinity understands the unique needs of motorcycle owners and offers specialized insurance policies. These policies cover motorcycles, scooters, and even custom bikes, providing protection against accidents and theft.

- Commercial Auto Insurance: Infinity also caters to business owners with their commercial auto insurance policies. These policies cover a wide range of commercial vehicles, including trucks, vans, and trailers, ensuring that businesses can operate with the necessary protection.

Discounts and Special Programs

Infinity Auto Insurance is committed to making insurance affordable and accessible. They offer a variety of discounts and special programs to help customers save on their insurance premiums. Some of these include:

- Multi-Policy Discount: Customers who bundle their auto insurance with other Infinity insurance products, such as homeowners or renters insurance, can often qualify for significant discounts.

- Safe Driver Discount: Infinity rewards safe driving habits by offering discounts to drivers with clean records. This discount can provide a substantial reduction in insurance premiums.

- Good Student Discount: Young drivers who maintain good grades in school can qualify for a discount on their auto insurance policies, making insurance more affordable for students.

- Loyalty Discount: Infinity values its long-term customers and offers loyalty discounts to those who have maintained their policies with the company for an extended period.

Filing a Claim with Infinity Auto Insurance

In the unfortunate event of an accident or incident, knowing how to file a claim with Infinity Auto Insurance is essential. Here’s a step-by-step guide to help you through the process:

Step 1: Contact Infinity

As soon as an accident occurs, it’s crucial to contact Infinity Auto Insurance. You can reach out to them using the toll-free phone number (1-800-INFINITY) or through their live chat feature on the website. A representative will guide you through the initial steps and gather the necessary details about the incident.

Step 2: Provide Information

During your initial contact, the Infinity representative will ask for specific details about the accident or incident. This information may include the date, time, location, and any relevant parties involved. It’s important to provide accurate and detailed information to ensure a smooth claims process.

Step 3: Document the Incident

After reporting the incident, it’s crucial to document it thoroughly. Take photos of any damage to your vehicle or property, as well as any injuries you or others may have sustained. Gather contact information from any witnesses and note down the details of the other party’s insurance information, if applicable.

Step 4: Submit the Claim

Once you have gathered all the necessary information, you can officially submit your claim to Infinity Auto Insurance. This can be done through their online claims portal, by email, or by mail. Infinity’s representatives will guide you through the submission process and provide any additional forms or documents required.

Step 5: Follow-up and Resolution

After submitting your claim, Infinity’s claims team will review the details and work towards resolving it. They may request further documentation or additional information. It’s important to stay in contact with your Infinity representative and respond promptly to any requests to ensure a timely resolution.

Customer Satisfaction and Reviews

Infinity Auto Insurance prides itself on delivering exceptional customer service and maintaining high customer satisfaction levels. Many customers praise Infinity for their efficient claims process, competitive pricing, and the personalized approach they take to insurance coverage. Here are some real-world reviews from Infinity customers:

| Reviewer | Review |

|---|---|

| John D. | "I've been with Infinity for several years now, and I've always found their customer service to be excellent. They made the claims process hassle-free, and I was impressed by how quickly they resolved my issues." |

| Sarah M. | "Infinity offered me a great rate on my auto insurance, and their online platform made it easy to manage my policy. I had a positive experience, and I appreciate their attention to detail." |

| Robert L. | "I recently switched to Infinity, and I'm glad I did. Their representatives were patient and helped me find the right coverage for my needs. I highly recommend them for their knowledge and customer-centric approach." |

Conclusion

Infinity Auto Insurance is a trusted provider, offering a wide range of insurance products and exceptional customer support. With their 24⁄7 accessibility through the toll-free phone number, live chat, and email, customers can rest assured that they will receive timely assistance. Whether you’re looking for auto insurance, homeowners insurance, or other coverage options, Infinity’s team is dedicated to providing personalized solutions and peace of mind.

Frequently Asked Questions

Can I get a quote for auto insurance from Infinity online?

+Absolutely! Infinity Auto Insurance offers an online quote tool on their website. Simply visit their homepage, click on the “Get a Quote” button, and follow the prompts to receive a personalized quote based on your driving history and needs.

What are the opening hours for Infinity’s customer support phone line?

+Infinity’s customer support phone line is available 24 hours a day, 7 days a week. This means you can reach out to them at any time, even during weekends and holidays, for assistance with your insurance needs.

How long does it typically take for Infinity to process a claim?

+The time it takes for Infinity to process a claim can vary depending on the complexity of the incident and the availability of all necessary information. However, Infinity aims to provide timely resolutions, and many customers report quick and efficient claim processes.

Can I make payments for my Infinity insurance policy online?

+Yes, Infinity Auto Insurance offers online payment options through their secure customer portal. You can log in to your account, select the “Make a Payment” option, and follow the prompts to complete your payment using a credit card, debit card, or electronic funds transfer.

Are there any special discounts available for senior citizens with Infinity Auto Insurance?

+Yes, Infinity Auto Insurance recognizes the responsible driving habits of senior citizens and offers special discounts for those over a certain age. These discounts can help reduce insurance premiums and make coverage more affordable for seniors.