Individual Medical Insurance Plans

In today's dynamic healthcare landscape, having access to quality medical insurance is more crucial than ever. With the rising costs of healthcare services and the ever-evolving needs of individuals, understanding the intricacies of individual medical insurance plans is essential. This article aims to provide an in-depth analysis of these plans, shedding light on their benefits, features, and how they can be tailored to meet specific healthcare requirements.

Understanding Individual Medical Insurance Plans

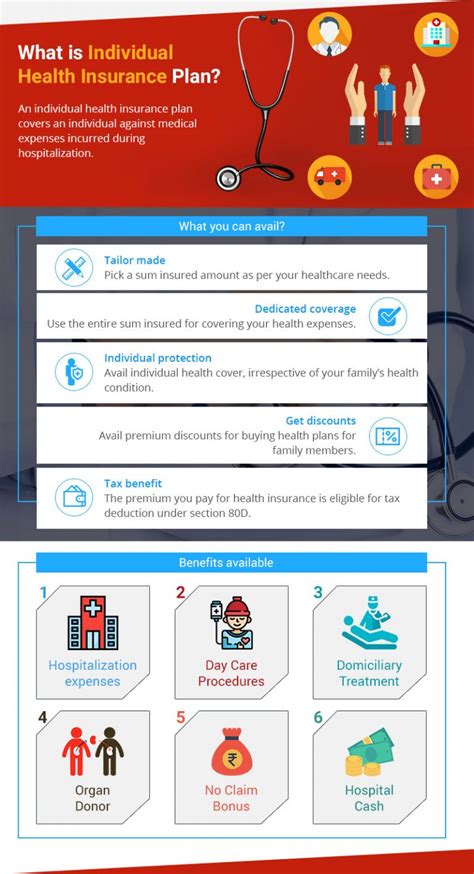

Individual medical insurance plans, often referred to as private health insurance or personal health insurance, are policies designed to cover the healthcare needs of individuals and their families. Unlike group health insurance plans offered by employers, these plans are purchased directly by individuals from insurance providers, offering a flexible and customizable approach to healthcare coverage.

The primary purpose of individual medical insurance is to provide financial protection against unexpected medical expenses. These plans can cover a wide range of services, including hospital stays, doctor visits, prescription medications, diagnostic tests, and even specialized treatments. With the right plan, individuals can access quality healthcare without bearing the full financial burden themselves.

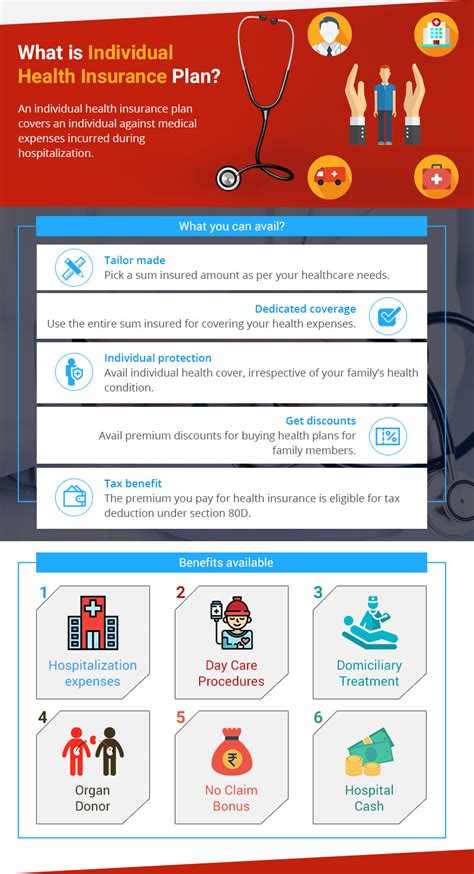

Key Features of Individual Medical Insurance Plans

Here are some of the standout features that make individual medical insurance plans a viable option for many:

- Customizable Coverage: One of the biggest advantages is the ability to tailor the plan to personal needs. Whether you require extensive coverage for chronic conditions or prefer a more basic plan for routine care, the flexibility is there.

- No Network Restrictions: Unlike some group plans, individual medical insurance often allows you to choose your healthcare providers, giving you more freedom in selecting doctors and facilities.

- Pre-Existing Condition Coverage: While this varies by plan and provider, many individual policies offer coverage for pre-existing conditions, ensuring that ongoing health issues are not excluded from your plan.

- Preventive Care: Many plans include coverage for preventive services like annual check-ups, vaccinations, and screenings, promoting early detection and proactive health management.

- Portability: Since these plans are not tied to an employer, they can be taken with you if you change jobs or move to a different location, providing continuous coverage.

Performance Analysis: Real-World Benefits

Let’s take a closer look at how individual medical insurance plans have impacted real-life scenarios:

| Scenario | Impact |

|---|---|

| Chronic Condition Management | Individual plans often provide coverage for ongoing medications, treatments, and specialist visits, ensuring that individuals with chronic conditions can manage their health effectively without financial strain. |

| Unexpected Hospitalization | In cases of emergency, these plans cover hospital stays, surgeries, and post-operative care, alleviating the financial burden associated with such events. |

| Family Planning and Maternity | Many plans offer maternity coverage, including prenatal care, delivery costs, and postnatal check-ups, making family planning more accessible and affordable. |

| Specialized Treatments | For conditions requiring specialized treatments or procedures, individual medical insurance can provide the necessary coverage, ensuring access to the best possible care. |

Comparative Analysis: Individual vs. Group Health Insurance

When deciding between individual and group health insurance, it’s crucial to understand the differences and choose the option that best aligns with your needs and circumstances.

Group Health Insurance Plans

Group health insurance plans are typically offered by employers as a benefit to their employees. These plans are often more affordable and provide a certain level of standardization in terms of coverage. However, they may not offer the same level of customization as individual plans, and individuals may lose coverage if they leave their job.

Key Differences and Considerations

Here’s a breakdown of some key aspects to consider when comparing individual and group health insurance:

| Aspect | Individual Plans | Group Plans |

|---|---|---|

| Customization | Highly customizable, allowing individuals to tailor coverage to their specific needs. | Generally less customizable, with coverage determined by the employer's plan. |

| Portability | Can be taken with you if you change jobs or move, ensuring continuous coverage. | Coverage is tied to employment, so it may not be portable if you leave the job. |

| Cost | Can be more expensive, especially for those with pre-existing conditions. | Often more affordable due to group discounts, but may have higher premiums for older employees. |

| Network Flexibility | Usually offers more flexibility in choosing healthcare providers. | May have limited provider networks, restricting your choice of doctors and facilities. |

Future Implications and Trends

The landscape of individual medical insurance plans is constantly evolving, influenced by advancements in technology, changing healthcare regulations, and shifting consumer preferences. Here are some key trends and implications to watch for in the coming years:

Digital Transformation

The healthcare industry is undergoing a digital revolution, and individual medical insurance is no exception. Insurance providers are increasingly leveraging technology to enhance the customer experience. This includes digital platforms for plan management, telemedicine integration, and the use of artificial intelligence for streamlined claim processing.

Personalized Healthcare

With the rise of precision medicine and genetic testing, individual medical insurance plans are likely to become even more personalized. Insurance providers may offer tailored coverage based on an individual’s genetic profile, lifestyle factors, and specific health needs, ensuring that plans are truly customized.

Value-Based Care

There is a growing shift towards value-based care models, where healthcare providers are incentivized to deliver high-quality, cost-effective care. This trend is likely to influence individual medical insurance plans, with insurers offering incentives and discounts for individuals who actively manage their health and engage in preventive care.

Expansion of Telemedicine

Telemedicine has seen a surge in popularity, especially in the wake of the COVID-19 pandemic. Individual medical insurance plans are expected to increasingly cover telemedicine services, providing convenient access to healthcare professionals remotely.

Addressing Mental Health

With mental health gaining more recognition and importance, individual medical insurance plans are likely to place a greater emphasis on mental health coverage. This may include expanded coverage for therapy sessions, psychiatric care, and mental health apps or programs.

Conclusion: Empowering Healthcare Choices

Individual medical insurance plans offer a powerful tool for individuals to take control of their healthcare journey. By understanding the intricacies of these plans, from their customizable nature to their real-world benefits, individuals can make informed decisions about their healthcare coverage. As the healthcare landscape continues to evolve, staying informed about the latest trends and implications will be crucial in navigating the world of individual medical insurance.

How do I choose the right individual medical insurance plan for me?

+Choosing the right plan involves assessing your specific healthcare needs and budget. Consider factors like your age, health status, family size, and the types of healthcare services you anticipate needing. Compare plans from different providers, paying attention to coverage details, exclusions, and out-of-pocket costs. It’s often beneficial to seek advice from insurance brokers or financial advisors who can guide you through the process.

Are individual medical insurance plans more expensive than group plans?

+In general, individual plans can be more expensive, especially for those with pre-existing conditions. However, the cost can vary significantly based on factors like age, location, and the level of coverage desired. Group plans often benefit from group discounts, making them more affordable for some. It’s important to compare quotes and assess the value of coverage offered against the cost.

What happens if I have a pre-existing condition? Will I be covered?

+The treatment of pre-existing conditions varies depending on the insurance provider and the specific plan. Some plans may have waiting periods or exclusions for pre-existing conditions, while others may offer full coverage from the start. It’s crucial to carefully review the policy documents and understand the terms regarding pre-existing conditions before purchasing a plan.

Can I switch my individual medical insurance plan if I’m not satisfied?

+Yes, you have the flexibility to switch your individual medical insurance plan. However, it’s important to note that there may be specific open enrollment periods or qualifying events (like a change in family status or loss of other coverage) that allow you to make changes to your plan. Outside of these periods, you may face challenges in switching plans, so it’s best to carefully consider your options before making a decision.