How To Get Landlord Insurance

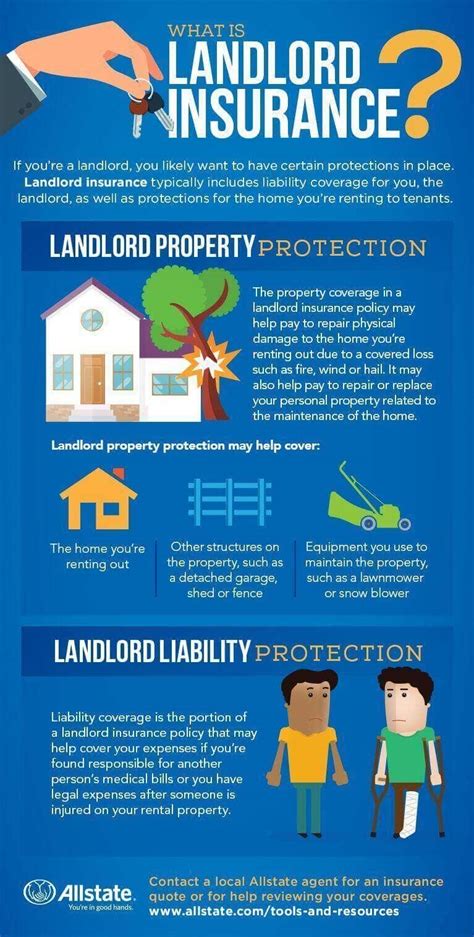

Landlord insurance is an essential safeguard for property owners who rent out their real estate assets. It provides comprehensive protection against various risks and liabilities associated with rental properties. Whether you're a seasoned landlord or new to the rental market, understanding the steps to obtain adequate insurance coverage is crucial to protect your investment and manage potential risks effectively.

Understanding Landlord Insurance

Landlord insurance is a specialized type of property insurance tailored to the unique needs of rental property owners. It goes beyond standard homeowners’ insurance, offering broader coverage to address the specific challenges and liabilities that come with renting out real estate.

This insurance policy typically covers a range of potential risks, including damage to the property structure, loss of rental income due to unforeseen circumstances, and liability claims arising from tenant injuries or property damage caused by tenants. It's designed to provide financial protection and peace of mind for landlords, ensuring they can navigate the complexities of property management with confidence.

Assessing Your Insurance Needs

Before diving into the process of obtaining landlord insurance, it’s crucial to assess your specific needs and the unique characteristics of your rental property. This step is essential to ensure you acquire the right coverage and avoid unnecessary expenses.

Property Value and Replacement Costs

Start by determining the actual cash value and replacement cost of your rental property. This involves assessing the current market value of the real estate, considering factors such as location, size, and condition. Accurate valuation is critical for obtaining sufficient coverage to rebuild or repair your property in the event of a covered loss.

| Property Type | Actual Cash Value | Replacement Cost |

|---|---|---|

| Single-Family Home | $300,000 | $350,000 |

| Condominium | $250,000 | $280,000 |

| Multi-Family Unit | $400,000 | $450,000 |

Coverage Requirements

Evaluate the specific coverage requirements for your rental property. Consider the type of tenants you typically attract, the local rental market, and any unique risks associated with your location. For instance, if your property is in an area prone to natural disasters like hurricanes or earthquakes, you’ll want to ensure your policy includes coverage for such events.

- Liability Coverage: Protects against tenant injuries, property damage claims, and other legal liabilities.

- Rental Income Protection: Covers lost rental income due to damage or uninhabitable conditions.

- Building Coverage: Provides financial assistance for repairing or rebuilding the property structure.

- Personal Property Coverage: Covers personal belongings within the rental unit, such as appliances or furniture.

Researching Insurance Providers

With a clear understanding of your insurance needs, the next step is to research and compare insurance providers to find the best fit for your rental property.

Specialized Insurance Companies

Consider specialized insurance companies that focus specifically on landlord insurance. These providers often offer more comprehensive policies tailored to the unique risks faced by rental property owners. They may provide additional benefits such as flexible payment options, dedicated customer support for landlords, and coverage for unique rental scenarios.

Comparing Policies and Coverage

When comparing policies, pay close attention to the coverage limits, deductibles, and exclusions. Ensure that the policy aligns with your assessed needs and provides sufficient protection for your rental property. Look for policies that offer customizable coverage options to fit your specific circumstances.

| Insurance Provider | Coverage Limits | Deductibles | Exclusions |

|---|---|---|---|

| Landlord Insure | $1,000,000 | $500 | Flood and Earthquake Damage |

| Rental Guardian | $500,000 | $1,000 | Mold and Mildew Damage |

| Landlord Protect | $750,000 | $250 | Pest Infestation |

Obtaining Quotes and Applying for Coverage

Once you’ve identified potential insurance providers, the next step is to obtain quotes and apply for coverage.

Gathering Required Information

To obtain accurate quotes, you’ll need to provide detailed information about your rental property, including its location, size, age, and any unique features. Additionally, be prepared to disclose any previous claims or incidents related to the property. Accurate and transparent information is crucial for obtaining an appropriate quote.

Applying for Coverage

Follow the application process outlined by your chosen insurance provider. This typically involves completing an application form, providing supporting documentation such as property deeds or rental agreements, and potentially undergoing a property inspection. The insurance company will assess your application and offer a policy based on the information provided.

Reviewing and Selecting a Policy

Carefully review the terms and conditions of the offered policy. Ensure that the coverage limits, deductibles, and exclusions align with your assessed needs. Consider the policy’s flexibility and any additional benefits or endorsements that may be available. Choose a policy that provides the best balance of coverage and affordability for your rental property.

Managing Your Landlord Insurance

Once you’ve obtained your landlord insurance policy, it’s important to maintain and manage your coverage effectively to ensure continuous protection for your rental property.

Regular Policy Reviews

Schedule regular reviews of your landlord insurance policy, ideally annually or whenever there are significant changes to your rental property or rental market conditions. This allows you to stay updated on any changes in coverage, premiums, or policy terms and ensure your coverage remains adequate.

Reporting Changes and Updates

Keep your insurance provider informed about any significant changes to your rental property or rental business. This includes renovations, additions, or alterations to the property, as well as changes in tenant demographics or rental income. Timely reporting ensures that your policy remains accurate and provides appropriate coverage for your evolving needs.

Renewal and Policy Adjustments

As your rental business grows and evolves, your insurance needs may change. When it’s time to renew your landlord insurance policy, assess whether your current coverage still aligns with your needs. Consider adjusting coverage limits, deductibles, or adding optional endorsements to ensure you have the right protection in place.

Conclusion

Obtaining landlord insurance is a crucial step in protecting your rental property and managing the risks associated with property ownership. By assessing your insurance needs, researching providers, and carefully reviewing policies, you can secure comprehensive coverage that provides peace of mind and financial protection. Regularly manage and update your policy to stay ahead of any changes and ensure continuous protection for your valuable real estate assets.

Can I get landlord insurance if I own multiple rental properties?

+Yes, many insurance providers offer policies specifically designed for landlords with multiple properties. These policies often provide discounted rates and streamlined coverage management for your entire rental portfolio.

What if I rent out a room in my own home? Do I need landlord insurance?

+In this case, it’s essential to review your homeowners’ insurance policy to ensure it provides adequate coverage for renting out a room. Some policies may automatically extend coverage to rental situations, while others may require an endorsement or separate landlord insurance policy.

How can I lower my landlord insurance premiums?

+There are several ways to potentially reduce your premiums. Consider increasing your deductible, maintaining a good claims history, and exploring multi-policy discounts by bundling your landlord insurance with other insurance policies, such as homeowners’ or auto insurance.