How To Change My Health Insurance

Are you considering a change in your health insurance plan? Whether you're looking for better coverage, more affordable premiums, or a provider that aligns with your specific healthcare needs, making a switch can be a daunting task. However, with the right information and a strategic approach, you can successfully navigate the process and find the perfect health insurance plan for you and your family.

In this comprehensive guide, we will delve into the world of health insurance, offering expert advice and insights to help you make an informed decision. From understanding your current plan to researching alternatives and executing a smooth transition, we've got you covered. So, let's embark on this journey together and explore the steps to changing your health insurance.

Understanding Your Current Health Insurance Plan

Before diving into the process of changing your health insurance, it's crucial to have a thorough understanding of your existing plan. Take the time to review your policy documents and familiarize yourself with the key components.

Start by identifying the type of plan you have, such as an HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), or an EPO (Exclusive Provider Organization). Each type offers different coverage options and provider networks, so understanding these distinctions is essential.

Examine the following aspects of your current plan:

- Coverage Details: What services are covered, and are there any exclusions or limitations? Look into the scope of coverage for medical, surgical, and prescription drug benefits.

- Network Providers: Determine if your current plan has a restricted network or allows for out-of-network care. Identify the healthcare providers and facilities that are included in your network.

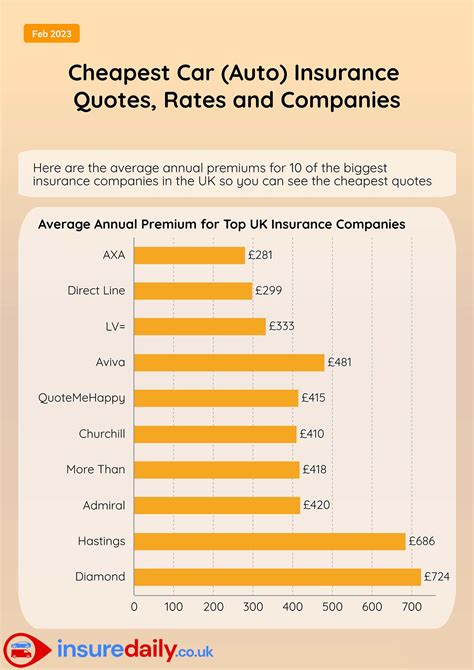

- Premiums and Out-of-Pocket Costs: Review the monthly premium amounts and any additional out-of-pocket expenses, such as deductibles, copayments, and coinsurance. Understand how these costs impact your overall healthcare expenses.

- Benefits and Perks: Explore the additional benefits offered by your plan, such as wellness programs, telemedicine services, or dental and vision coverage. These perks can significantly enhance your healthcare experience.

- Plan Restrictions and Requirements: Be aware of any restrictions, such as prior authorization requirements or step therapy protocols. Understanding these restrictions will help you anticipate potential challenges when seeking care.

By thoroughly understanding your current health insurance plan, you'll be better equipped to identify areas where you may require improved coverage or cost-effectiveness. This knowledge will guide your decision-making process as you explore alternative options.

Researching Alternative Health Insurance Plans

Once you have a clear understanding of your current plan, it's time to embark on the research phase to explore alternative health insurance options. This step is crucial to finding a plan that aligns with your specific needs and preferences.

Begin by identifying your key requirements and priorities. Consider factors such as the following:

- Healthcare Needs: Assess your current and anticipated healthcare needs. Do you have any pre-existing conditions or chronic illnesses that require specialized care? Consider the type and frequency of medical services you typically utilize.

- Preferred Providers: Identify the healthcare providers and facilities you prefer or have a history with. Ensure that your preferred doctors and hospitals are included in the network of potential alternative plans.

- Coverage and Benefits: Evaluate the coverage and benefits offered by different plans. Look for plans that provide comprehensive coverage for your specific healthcare needs, including prescription drugs, mental health services, and specialty care.

- Cost and Affordability: Compare the premiums, deductibles, and out-of-pocket expenses of alternative plans. Assess your financial situation and determine how different plans may impact your budget. Consider any subsidies or tax credits you may be eligible for.

- Plan Networks and Accessibility: Examine the provider networks of alternative plans. Assess the accessibility and proximity of in-network healthcare facilities and providers. Consider whether the plan offers a sufficient number of choices to meet your healthcare needs.

- Customer Reviews and Reputation: Research the reputation and customer satisfaction ratings of the insurance companies offering the plans you're considering. Read reviews and seek recommendations from friends, family, or online communities to gain insights into the quality of service and claim handling processes.

As you research alternative health insurance plans, utilize online resources, insurance brokers, and government websites to gather comprehensive information. Compare multiple plans side by side to identify the best fit for your needs. Remember, the goal is to find a plan that offers the coverage, cost-effectiveness, and network accessibility that align with your healthcare journey.

Evaluating the Transition Process

Now that you've identified a potential alternative health insurance plan, it's important to carefully evaluate the transition process to ensure a smooth and seamless experience. A well-planned transition can minimize disruptions to your healthcare coverage and prevent any unnecessary complications.

Here are some key factors to consider when evaluating the transition process:

- Enrollment Periods and Deadlines: Understand the enrollment periods and deadlines for your current and prospective health insurance plans. Ensure that you're aware of any special enrollment periods or open enrollment windows. Plan your transition accordingly to avoid gaps in coverage.

- Portability of Benefits: Determine if your current plan allows for the portability of benefits, such as any accrued wellness incentives or rewards. Explore whether these benefits can be transferred to your new plan, maximizing the value of your healthcare investments.

- Continuity of Care: Assess the impact of the transition on your ongoing medical treatments and prescriptions. Ensure that your new plan covers any existing conditions and provides access to the same healthcare providers or specialists you've been seeing. Coordinate with your doctors to facilitate a smooth transfer of medical records.

- Network Compatibility: Verify that your preferred healthcare providers and facilities are included in the network of your prospective plan. If you have specific healthcare needs, ensure that the new plan offers a compatible network to support those requirements.

- Claim Submission and Processing: Familiarize yourself with the claim submission process of your new plan. Understand the requirements for filing claims, including any necessary documentation and timelines. Ensure that the claim processing turnaround time aligns with your expectations.

- Customer Support and Assistance: Evaluate the level of customer support offered by the insurance company. Assess their responsiveness, availability, and resources for resolving queries or addressing concerns. Consider reaching out to the customer support team to gauge their level of service.

By thoroughly evaluating the transition process, you can anticipate potential challenges and take proactive measures to ensure a smooth and stress-free experience. A well-planned transition will not only provide peace of mind but also facilitate a seamless continuation of your healthcare journey with minimal disruptions.

Executing a Successful Transition

Congratulations! You've completed the research and evaluation stages, and now it's time to execute the transition to your new health insurance plan. This final step requires careful planning and attention to detail to ensure a seamless and stress-free process.

Here are some essential steps to guide you through a successful transition:

Step 1: Initiate the Enrollment Process

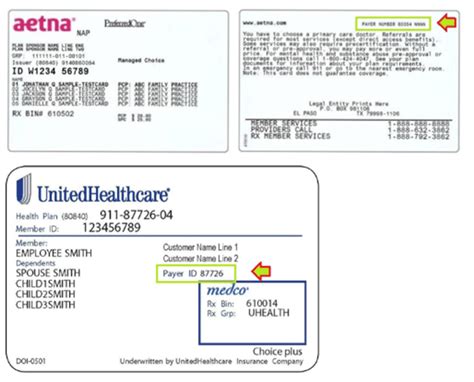

Contact the insurance company or your designated insurance broker to initiate the enrollment process for your new health insurance plan. Provide them with the necessary personal and demographic information, including your name, date of birth, and social security number. Ensure that you have all the required documents and information ready to expedite the enrollment process.

Step 2: Review and Compare Plan Details

Take the time to thoroughly review the plan details and compare them with your current health insurance plan. Pay close attention to coverage limits, provider networks, prescription drug benefits, and any additional perks or discounts offered. Ensure that the new plan aligns with your healthcare needs and preferences.

Step 3: Confirm Coverage Dates

Verify the effective date of your new health insurance coverage. Ensure that there are no gaps in coverage between your current plan and the new one. If there is a lapse in coverage, explore options to bridge the gap, such as short-term health insurance or temporary coverage extensions.

Step 4: Update Healthcare Providers

Inform your healthcare providers, including your primary care physician, specialists, and any other medical professionals you regularly see, about the change in your health insurance plan. Provide them with the necessary information, such as the new insurance company's name, policy number, and any required authorizations or referrals.

Step 5: Transfer Medical Records

Coordinate with your current healthcare providers to transfer your medical records to the new insurance company or your designated healthcare team. Ensure that all relevant medical history, test results, and prescriptions are accurately transferred to facilitate a smooth continuation of care.

Step 6: Understand Claim Submission Procedures

Familiarize yourself with the claim submission procedures of your new health insurance plan. Understand the process for filing claims, including any necessary forms, documentation, and timelines. Ensure that you have access to the required resources and support to navigate the claim submission process efficiently.

Step 7: Maintain Communication

Stay in regular communication with your insurance company, healthcare providers, and any relevant parties involved in the transition process. Address any questions or concerns promptly and ensure that all parties are aligned and working together to facilitate a seamless transition.

By following these steps and maintaining a proactive approach, you can execute a successful transition to your new health insurance plan. Remember, a well-executed transition ensures a smooth continuation of your healthcare coverage and provides peace of mind as you embark on your new healthcare journey.

Frequently Asked Questions

Can I change my health insurance plan anytime I want?

+Generally, health insurance plans have specific enrollment periods. Open enrollment typically occurs once a year, allowing you to make changes or select a new plan. However, there may be special enrollment periods triggered by life events such as losing job-based coverage, getting married, or having a baby. It's important to understand these timelines to ensure a smooth transition.

What happens if I have pre-existing conditions when changing plans?

+Under the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. However, there may be waiting periods or exclusions for certain conditions. It's essential to review the new plan's coverage details to understand how pre-existing conditions are handled.

How do I choose the right health insurance plan for my family?

+Consider your family's specific healthcare needs, including any ongoing medical conditions or regular prescriptions. Look for plans that offer comprehensive coverage, including specialist care and prescription drug benefits. Evaluate the cost-effectiveness of the plan, taking into account premiums, deductibles, and out-of-pocket expenses. Research the plan's provider network to ensure access to preferred healthcare providers.

Are there any penalties for switching health insurance plans?

+There are typically no penalties for switching health insurance plans during open enrollment or special enrollment periods. However, if you terminate your coverage outside of these periods without qualifying for a special enrollment, you may face tax penalties or other consequences. It's important to understand the rules and timelines to avoid any unexpected fees.

Can I keep my current doctors when changing insurance plans?

+Whether you can keep your current doctors when changing insurance plans depends on whether they are in-network with your new plan. It's crucial to verify the provider network of your new plan and ensure that your preferred doctors are included. If not, you may need to find new in-network providers or explore out-of-network options, which may come with additional costs.

Remember, changing your health insurance plan is a significant decision that requires careful consideration and planning. By understanding your current plan, researching alternatives, evaluating the transition process, and executing a successful switch, you can ensure that you and your loved ones have the coverage and care you need. Stay informed, ask questions, and seek professional guidance when needed to navigate the complexities of health insurance with confidence.