How To Cancel Car Insurance Progressive

When you're looking to cancel your car insurance policy with Progressive, it's important to understand the process and the potential implications. Progressive is a well-known insurance provider, offering a range of coverage options. However, circumstances may arise where you need to terminate your policy. This guide will walk you through the steps to cancel your Progressive car insurance, providing a comprehensive and detailed overview.

The Progressive Cancellation Process

Canceling your Progressive car insurance policy is a straightforward process, but it’s essential to follow the correct steps to ensure a smooth transition. Here’s a step-by-step guide to help you navigate through the cancellation procedure.

Step 1: Review Your Policy and Coverage

Before initiating the cancellation process, it’s crucial to review your existing Progressive car insurance policy. Take note of the following details:

- Policy Number: Locate your policy number, which serves as a unique identifier for your insurance coverage.

- Coverage Details: Understand the extent of your current coverage, including liability limits, deductibles, and any additional endorsements.

- Renewal Date: Check when your policy is set to renew. This information will help you determine if any refunds are due.

Step 2: Gather Relevant Information

To ensure a seamless cancellation, gather the necessary information beforehand. This includes:

- Personal Details: Have your name, date of birth, and contact information readily available.

- Vehicle Information: Note down the make, model, and year of your vehicle, as well as the Vehicle Identification Number (VIN) if possible.

- Payment History: Review your payment records to ensure all premiums have been paid up to date.

Step 3: Contact Progressive

Progressive offers multiple channels for policyholders to reach out and request a cancellation. You can choose the method that suits you best:

- Phone Call: Dial the Progressive customer service number at 1-800-PROGRESSIVE (1-800-776-4774). Representatives are available 24⁄7 to assist with your cancellation request.

- Online Form: Visit the Progressive website and navigate to the Contact Us section. Fill out the online form, providing your policy details and the reason for cancellation.

- Email: Send an email to customercare@progressive.com, including your policy number and a brief explanation of your cancellation request.

Step 4: Initiate the Cancellation

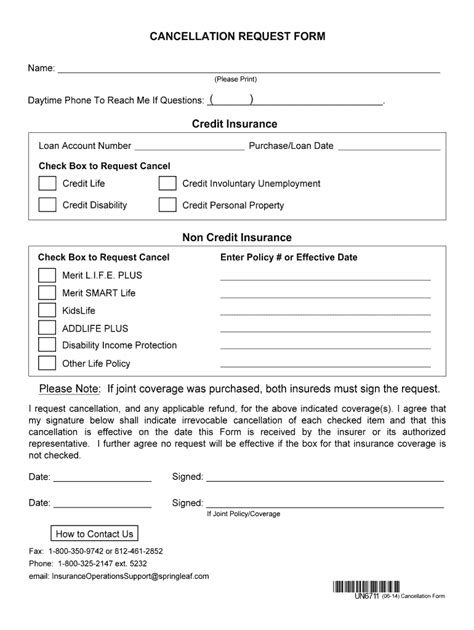

When contacting Progressive, be prepared to provide the following information:

- Reason for Cancellation: Explain why you wish to cancel your policy. Progressive may offer alternative solutions or provide additional information to assist you.

- Effective Date: Specify the date you want the cancellation to take effect. This is particularly important if you have a new insurance policy lined up.

- Proof of Other Insurance: If you have secured a new insurance policy, provide Progressive with the details, including the insurer’s name and policy number.

Step 5: Receive Confirmation and Refund (if applicable)

Once Progressive processes your cancellation request, you will receive a confirmation. This confirmation will outline the effective date of the cancellation and any applicable refunds.

Progressive operates on a pro-rata basis, meaning you’ll receive a refund for the unused portion of your premium. The amount of the refund will depend on your policy term and the date of cancellation.

For example, if you have a 6-month policy and cancel after 3 months, you’ll be entitled to a refund for the remaining 3 months of coverage.

Potential Implications and Considerations

Canceling your Progressive car insurance policy may have certain implications, and it’s important to be aware of them before proceeding.

Fees and Penalties

Progressive typically does not charge cancellation fees. However, if you have a loan or lease on your vehicle, the financial institution may require you to maintain insurance coverage. In such cases, canceling your policy could result in additional fees or penalties.

Effect on Future Insurance Rates

Canceling your car insurance policy, regardless of the reason, may impact your future insurance rates. Insurance companies consider your insurance history when calculating premiums. A gap in coverage or frequent policy cancellations can be seen as a risk factor, potentially leading to higher rates in the future.

Maintaining Continuous Coverage

It’s generally advisable to maintain continuous car insurance coverage. Gaps in coverage can not only affect your future insurance rates but may also leave you vulnerable in the event of an accident or other unforeseen circumstances.

If you’re canceling your Progressive policy because you’ve sold your vehicle or no longer require insurance, ensure you have alternative coverage in place before initiating the cancellation.

Progressive’s Cancellation Policy

Progressive’s cancellation policy is designed to be flexible and accommodating. They understand that life circumstances can change, and they aim to make the cancellation process as smooth as possible. However, it’s always a good idea to review their official cancellation policy, which can be found on their website, to ensure you understand the terms and conditions.

Canceling Progressive Insurance: A Case Study

To illustrate the cancellation process, let’s consider a hypothetical case study. Meet Sarah, a loyal Progressive customer for the past 5 years.

Sarah’s Story

Sarah recently purchased a new car and decided to explore insurance options. She found a competitive rate with another insurer and wanted to switch her coverage.

Here’s how Sarah canceled her Progressive car insurance policy:

- Reviewed Policy: Sarah logged into her Progressive account and reviewed her current policy details, including coverage limits and renewal date.

- Contacted Progressive: She called the Progressive customer service number and spoke to a representative. She explained her situation and requested a cancellation.

- Provided Information: Sarah gave her policy number, personal details, and the effective date of cancellation. She also informed the representative about her new insurance policy.

- Received Confirmation: Progressive confirmed the cancellation and provided Sarah with a refund for the unused portion of her premium. The refund was directly deposited into her bank account within a week.

Progressive’s Online Cancellation Tool

Progressive understands that not everyone wants to make a phone call to cancel their insurance. To accommodate different preferences, they’ve developed an online cancellation tool.

Here’s how you can use it:

- Log into Your Account: Access your Progressive account online using your username and password.

- Navigate to the Cancellation Page: Look for the Cancel Policy or Manage Coverage section within your account dashboard.

- Provide Required Information: Follow the prompts to enter your policy details, effective date of cancellation, and any additional information requested.

- Review and Confirm: Carefully review the cancellation summary, ensuring all details are accurate. Once satisfied, confirm the cancellation.

Progressive’s Customer Service Excellence

Progressive prides itself on its customer service, and their representatives are trained to handle cancellation requests with professionalism and efficiency. Whether you choose to call, use the online form, or send an email, you can expect a timely response and assistance throughout the cancellation process.

FAQs

Can I cancel my Progressive car insurance policy online?

+Yes, Progressive offers an online cancellation tool. Simply log into your account, navigate to the cancellation section, and follow the prompts to cancel your policy.

Will I receive a refund if I cancel my Progressive policy?

+Yes, Progressive operates on a pro-rata basis, meaning you’ll receive a refund for the unused portion of your premium. The amount of the refund will depend on your policy term and the date of cancellation.

Are there any cancellation fees with Progressive?

+Progressive typically does not charge cancellation fees. However, if you have a loan or lease on your vehicle, the financial institution may have specific requirements regarding insurance coverage, which could result in additional fees or penalties.

What happens if I cancel my Progressive policy and then need insurance again in the future?

+Canceling your car insurance policy may impact your future insurance rates. Progressive, like other insurers, considers your insurance history when calculating premiums. It’s advisable to maintain continuous coverage to avoid potential rate increases.

Can I cancel my Progressive policy if I have a loan or lease on my vehicle?

+Yes, you can cancel your Progressive policy even if you have a loan or lease. However, be aware that the financial institution may require you to maintain insurance coverage. Canceling your policy could result in additional fees or penalties.

Canceling your Progressive car insurance policy is a simple process, but it’s important to be well-informed and prepared. By following the steps outlined above and considering the potential implications, you can navigate the cancellation process with ease. Remember, Progressive’s customer service team is always available to assist and guide you through any queries or concerns you may have.