How To Calculate Home Insurance

Home insurance is an essential aspect of protecting your most valuable asset, your home, and its contents. It provides financial coverage for unexpected events such as natural disasters, theft, or accidental damage. However, determining the right amount of coverage and understanding the calculation process can be a complex task. In this comprehensive guide, we will delve into the world of home insurance, exploring the factors that influence your premium and offering practical tips to ensure you have adequate coverage.

Understanding Home Insurance Premiums

Home insurance premiums are calculated based on a variety of factors, each contributing to the overall cost of your policy. These factors can vary depending on your location, the type of home you own, and the level of coverage you require. Let's break down the key elements that influence your home insurance premium.

1. Location and Risk Factors

One of the primary determinants of your home insurance premium is the location of your property. Insurance companies assess the risk factors associated with different regions, including the likelihood of natural disasters, crime rates, and proximity to emergency services. For instance, areas prone to hurricanes, floods, or wildfires may have higher premiums due to the increased risk of claims.

Additionally, the specific neighborhood and its crime statistics can impact your insurance rates. Neighborhoods with a higher incidence of burglary or vandalism may result in higher premiums, as insurance companies consider these factors when assessing the potential risks associated with insuring your home.

2. Home Value and Reconstruction Cost

The value of your home is a crucial factor in determining your insurance premium. However, it's not just the market value that matters; insurance companies focus on the reconstruction cost, which is the estimated amount required to rebuild your home from the ground up after a catastrophic event. This cost takes into account factors such as the size of your home, the materials used in its construction, and the current cost of labor and materials in your area.

To accurately calculate the reconstruction cost, insurance companies often use specialized software or consult with local contractors to obtain precise estimates. It's important to ensure that your policy covers the full reconstruction cost, as underinsurance can leave you vulnerable in the event of a total loss.

| Region | Average Reconstruction Cost per Square Foot |

|---|---|

| Urban Areas | $200 - $300 |

| Suburban Areas | $150 - $250 |

| Rural Areas | $100 - $200 |

3. Coverage Options and Limits

Home insurance policies offer a range of coverage options, and the choices you make can significantly impact your premium. These options include:

- Dwelling Coverage: This covers the physical structure of your home, including the roof, walls, and permanent fixtures. It is essential to ensure that your dwelling coverage limit aligns with the reconstruction cost to avoid underinsurance.

- Personal Property Coverage: This provides protection for your personal belongings, such as furniture, electronics, and clothing. The limit for personal property coverage should be sufficient to replace all your possessions in the event of a loss.

- Liability Coverage: This protects you from legal claims and lawsuits arising from accidents or injuries that occur on your property. It is crucial to have adequate liability coverage to safeguard your financial well-being.

- Additional Living Expenses: In the event of a covered loss that renders your home uninhabitable, this coverage reimburses you for temporary living expenses, such as hotel stays or rental costs.

4. Deductibles and Policy Features

Deductibles play a significant role in determining your home insurance premium. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, as you are assuming a greater share of the financial responsibility in the event of a claim. However, it's important to choose a deductible that you can comfortably afford.

Additionally, the features and endorsements you add to your policy can impact your premium. For example, if you opt for earthquake or flood insurance (which are often not included in standard policies), it will increase your overall premium. Understanding the available policy features and tailoring them to your specific needs is crucial for finding the right balance between coverage and cost.

Calculating Your Home Insurance Premium

Calculating your home insurance premium involves a combination of factors, and while insurance companies use complex algorithms to determine rates, there are some basic principles you can understand to estimate your costs.

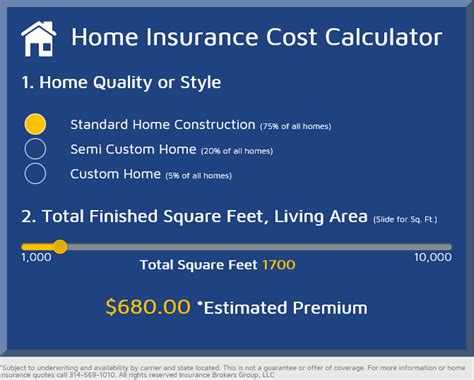

1. Base Premium

The base premium is the starting point for your home insurance policy. It is calculated based on the fundamental characteristics of your home, such as its location, size, and construction type. This base premium provides a foundation for the additional factors that will influence your overall premium.

2. Risk Assessment

Insurance companies assess various risks associated with your home and its surroundings. This risk assessment takes into account factors like crime rates, proximity to fire stations, and the potential for natural disasters. The higher the perceived risk, the higher your premium is likely to be.

3. Coverage Limits and Deductibles

The coverage limits you choose, such as dwelling coverage, personal property coverage, and liability limits, directly impact your premium. Higher coverage limits typically result in higher premiums, as the insurance company assumes more financial responsibility. Similarly, your deductible choice influences your premium; higher deductibles lead to lower premiums, as you are taking on more financial risk.

4. Discounts and Credits

Insurance companies often offer discounts and credits to encourage safe practices and reduce the likelihood of claims. Some common discounts include:

- Multiple Policy Discounts: Insuring multiple properties or combining home and auto insurance with the same provider can result in significant savings.

- Safety Features Discounts: Installing security systems, fire alarms, or smoke detectors may qualify you for discounts, as these features reduce the risk of theft and fire-related incidents.

- Loyalty Discounts: Staying with the same insurance company for an extended period may earn you loyalty discounts, rewarding your long-term commitment.

Tips for Optimizing Your Home Insurance Premium

Now that we've explored the factors influencing your home insurance premium, let's delve into some practical tips to help you optimize your coverage and potentially reduce your costs:

1. Shop Around and Compare

Insurance rates can vary significantly between providers, so it's essential to shop around and compare quotes. Obtain quotes from multiple insurance companies to ensure you're getting the best value for your money. Online comparison tools can be a valuable resource for this purpose.

2. Bundle Your Policies

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who choose to bundle their policies, providing a cost-effective solution.

3. Increase Your Deductible

As mentioned earlier, increasing your deductible can lead to lower premiums. However, it's crucial to choose a deductible amount that you can comfortably afford in the event of a claim. While a higher deductible may result in savings, it's important to strike a balance between affordability and coverage.

4. Maintain a Good Credit Score

Your credit score is a significant factor in determining your insurance premium. Insurance companies often use credit-based insurance scores to assess the risk associated with insuring you. Maintaining a good credit score can result in lower premiums, as it indicates a lower likelihood of filing claims.

5. Review Your Coverage Regularly

Your home insurance needs may change over time, so it's important to review your coverage annually or whenever significant life changes occur. Factors such as home renovations, additions, or changes in personal property value may require adjustments to your policy. Regularly reviewing your coverage ensures that you maintain adequate protection while avoiding overpaying for unnecessary coverage.

6. Implement Safety Measures

Taking proactive steps to enhance the safety and security of your home can lead to premium discounts. Installing smoke detectors, fire alarms, and security systems not only protects your home but also demonstrates your commitment to preventing losses. Many insurance companies offer discounts for these safety measures, so it's worth investing in them.

7. Understand Exclusions and Limitations

Familiarize yourself with the exclusions and limitations of your home insurance policy. Understanding what is and isn't covered can help you make informed decisions about additional coverage you may need. For example, standard home insurance policies often exclude coverage for natural disasters like floods or earthquakes, so if you live in an area prone to such events, you may need to purchase separate policies.

Frequently Asked Questions

What is the average cost of home insurance?

+

The average cost of home insurance can vary widely depending on factors such as location, home value, and coverage limits. According to industry data, the national average for annual home insurance premiums in the United States is approximately $1,300. However, it’s important to note that this average can fluctuate significantly based on individual circumstances.

How often should I review my home insurance policy?

+

It is recommended to review your home insurance policy annually or whenever significant changes occur in your life. These changes may include home renovations, additions, changes in personal property value, or relocating to a new area. Regular reviews ensure that your coverage remains up-to-date and aligns with your current needs.

Can I negotiate my home insurance premium?

+

While insurance premiums are typically based on standardized rates, there may be room for negotiation in certain situations. If you have a strong relationship with your insurance agent or broker, they may be willing to discuss potential discounts or alternative coverage options that could lower your premium. It’s always worth exploring these options and advocating for yourself to find the best deal.

What factors influence my home insurance deductible?

+

Your home insurance deductible is influenced by several factors, including your coverage limits, the perceived risk associated with your home, and your financial situation. Higher deductibles typically result in lower premiums, as you are assuming more financial responsibility in the event of a claim. It’s important to choose a deductible that you can comfortably afford while considering the potential impact on your coverage costs.

How can I reduce my home insurance premium without compromising coverage?

+

There are several strategies you can employ to reduce your home insurance premium without sacrificing coverage. Some effective approaches include shopping around for quotes from multiple providers, bundling your policies (such as home and auto insurance) with the same company, maintaining a good credit score, and regularly reviewing your coverage to ensure it aligns with your current needs.