How To Buy Auto Insurance

Navigating the World of Auto Insurance: A Comprehensive Guide

Purchasing auto insurance is an essential step for any vehicle owner, but it can be a complex and sometimes daunting process. With a myriad of options, terms, and policies available, it's crucial to understand the ins and outs of auto insurance to make an informed decision. This guide aims to demystify the process, providing a comprehensive overview to help you navigate the world of auto insurance with confidence.

Auto insurance is a contract between you and the insurance company, designed to protect you against financial loss in the event of an accident or other vehicle-related damages. It's a legal requirement in most countries and states, ensuring that drivers can cover the costs of potential accidents and protect themselves and others on the road. Understanding the different types of coverage, the factors influencing premiums, and the claims process is key to making the right choices for your specific needs.

Understanding the Basics of Auto Insurance

At its core, auto insurance is a financial safeguard against various risks associated with vehicle ownership and operation. It covers a range of potential incidents, from minor fender-benders to severe accidents, ensuring that you have the means to repair or replace your vehicle, cover medical expenses, and compensate for any liabilities arising from an accident.

Types of Auto Insurance Coverage

Auto insurance policies typically offer a range of coverage options, each designed to address specific risks. These include:

- Liability Coverage: This is the most basic and mandatory type of auto insurance. It covers the costs if you're found at fault for an accident, including injuries to others and damage to their property. Liability coverage is typically divided into two parts: bodily injury liability and property damage liability.

- Collision Coverage: This type of insurance covers the cost of repairing or replacing your vehicle after an accident, regardless of who is at fault. It is an optional coverage, but it's recommended for vehicle owners with loans or leases, as it provides protection against the financial burden of accidents.

- Comprehensive Coverage: Comprehensive insurance provides protection against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. Like collision coverage, it's optional but highly recommended to safeguard your vehicle from unforeseen circumstances.

- Medical Payments or Personal Injury Protection (PIP): These coverages help pay for the medical expenses of you and your passengers, regardless of who is at fault in an accident. Medical payments coverage is typically limited to a specified amount, while PIP may cover a wider range of expenses, including lost wages and funeral costs.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who either has no insurance or doesn't have enough insurance to cover the damages. It ensures that you're not left financially burdened by the actions of others.

Each of these coverage types has its own set of benefits and limitations, and the specific details can vary between insurance providers. It's important to understand these nuances to tailor your policy to your individual needs.

Factors Affecting Auto Insurance Premiums

The cost of your auto insurance policy, known as the premium, is influenced by a variety of factors. These can include:

- Your Driving Record: Insurance companies assess your driving history to determine your risk level. A clean driving record with no accidents or violations typically results in lower premiums, while a history of accidents or traffic violations can increase your rates.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary use (e.g., personal, business, or pleasure), can impact your premium. Sports cars and luxury vehicles often carry higher premiums due to their increased repair costs, while vehicles used for business purposes may require additional coverage.

- Location and Mileage: Where you live and how much you drive can also affect your premium. Urban areas with higher populations and more traffic typically have higher insurance rates, and driving more miles annually may increase your premium as well.

- Age and Gender: Statistically, younger drivers and males under 25 are considered higher-risk groups and often pay higher premiums. As you age and gain more driving experience, your premiums may decrease.

- Credit Score: In many states, insurance companies are allowed to consider your credit score when determining your premium. A higher credit score can lead to lower insurance rates, as it's seen as an indicator of financial responsibility.

- Discounts and Bundles: Many insurance companies offer discounts for various reasons, such as safe driving records, vehicle safety features, multi-policy bundles (e.g., combining auto and home insurance), or even loyalty discounts for long-term customers.

Understanding these factors can help you make informed choices when selecting your auto insurance policy and potentially negotiate better rates.

The Process of Buying Auto Insurance

Step 1: Research and Compare

The first step in buying auto insurance is to conduct thorough research. Compare different insurance providers and their offerings to find the best fit for your needs. Consider factors like the coverage types and limits, the reputation of the insurance company, their customer service, and their financial stability.

Utilize online resources, such as insurance comparison websites and consumer reviews, to gather information about various providers. Check their financial ratings from reputable agencies like Standard & Poor's or Moody's to ensure they're a stable choice for long-term coverage.

Step 2: Obtain Quotes

Once you've narrowed down your options, request quotes from multiple insurance companies. A quote provides an estimated cost for your insurance policy based on the information you provide. It's important to ensure that each quote includes the same coverage types and limits so you can make an accurate comparison.

When obtaining quotes, be as accurate as possible about your driving history, vehicle details, and personal information. Misrepresenting yourself or your vehicle can lead to issues down the line, potentially affecting your coverage or causing an increase in premiums.

Step 3: Review Policy Details

After receiving quotes, carefully review the policy details provided by each insurance company. Pay attention to the coverage types, limits, deductibles, and any exclusions or limitations. Ensure that you understand the terms and conditions outlined in the policy, as these will dictate what is and isn't covered in the event of an accident.

Consider the reputation and financial stability of the insurance company, as well as their claims handling process. A reputable company with a good track record of prompt and fair claims handling can provide added peace of mind.

Step 4: Choose the Right Coverage

Based on your research, quotes, and policy reviews, select the insurance company and policy that best meets your needs and budget. Remember to consider not only the cost of the premium but also the potential financial protection provided by the policy. It's a balance between affordability and adequate coverage.

Consider adding optional coverages, such as collision or comprehensive insurance, to ensure your vehicle is protected against a wider range of risks. These coverages may increase your premium, but they provide added peace of mind and can save you from significant out-of-pocket expenses in the event of an accident or other covered incident.

Understanding Your Policy and Making Changes

Policy Documents and Key Terms

Once you've purchased your auto insurance policy, familiarize yourself with the policy documents. These documents outline the terms and conditions of your coverage, including the types of coverage, limits, deductibles, and any specific exclusions or limitations. Understanding these details is crucial to ensuring you're adequately protected and to avoid any surprises in the event of a claim.

Key terms to understand include:

- Deductible: This is the amount you must pay out of pocket before your insurance coverage kicks in. A higher deductible typically means lower premiums, but it also means you'll pay more out of pocket in the event of a claim.

- Coverage Limits: These are the maximum amounts your insurance company will pay for specific types of claims. For example, the liability coverage limit specifies the maximum amount the insurer will pay for damages caused to others in an accident for which you're at fault.

- Exclusions: These are specific situations or circumstances that are not covered by your policy. It's important to review these exclusions carefully to understand what is not covered by your insurance.

- Endorsements: These are additions or amendments to your policy that can modify the coverage in some way. Endorsements can be used to add or remove coverage, adjust limits, or change other policy details.

Making Changes to Your Policy

As your life circumstances change, you may need to adjust your auto insurance policy. Common reasons for policy changes include:

- Adding or removing a vehicle from your policy

- Adding or removing a driver (e.g., a newly licensed teen or a family member who no longer drives)

- Moving to a new address

- Changing your marital status

- Adding or removing optional coverages

- Increasing or decreasing your coverage limits

It's important to notify your insurance company of any significant changes to ensure your policy remains up-to-date and accurate. Failure to do so could result in your coverage being voided or your claim being denied.

The Claims Process and Tips for Filing Claims

Understanding the Claims Process

In the event of an accident or other covered incident, you'll need to file a claim with your insurance company. The claims process can vary slightly between insurance providers, but typically involves the following steps:

- Report the Incident: As soon as possible after an accident or other covered event, report the incident to your insurance company. Many insurance companies now offer online or mobile app reporting, but you can also call their customer service hotline.

- Provide Information: When reporting your claim, be prepared to provide details about the incident, including the date, time, location, and any relevant details about what happened. You may also need to provide the names and contact information of any other parties involved, as well as any witnesses.

- Cooperate with the Claims Adjuster: Once you've reported your claim, a claims adjuster from your insurance company will be assigned to handle it. They will review the details of your claim and may contact you for additional information or to discuss the next steps. It's important to cooperate fully with the adjuster to ensure a smooth claims process.

- Estimate and Repair Process: If your vehicle is damaged, the claims adjuster may send you to a preferred repair shop or provide an estimate for repairs. You have the right to choose your own repair shop, but using a preferred shop may result in faster and more efficient repairs.

- Payment and Resolution: Once the repairs are complete or the necessary expenses have been incurred, your insurance company will process the payment. The amount of payment will depend on the coverage limits and deductibles outlined in your policy.

Tips for Filing Claims

To ensure a smooth and successful claims process, consider the following tips:

- Stay Calm and Gather Information: In the immediate aftermath of an accident, it's important to remain calm and gather as much information as possible. Take photos of the scene, including any damage to vehicles, and collect contact information from other parties involved.

- Report the Claim Promptly: Contact your insurance company as soon as possible after the incident to report the claim. Delays in reporting can complicate the claims process and may even lead to a denial of your claim.

- Cooperate with the Claims Adjuster: The claims adjuster is there to help you navigate the claims process and ensure a fair resolution. Cooperate fully with their requests for information and documentation to expedite the process.

- Understand Your Coverage and Limits: Before filing a claim, review your policy documents to understand your coverage and limits. This will help you manage your expectations and ensure that you're taking full advantage of the coverage you've paid for.

- Keep Records and Documentation: Throughout the claims process, keep thorough records and documentation. This includes copies of your policy documents, correspondence with the insurance company, estimates and invoices for repairs or medical expenses, and any other relevant documents.

The Future of Auto Insurance

Emerging Trends and Technologies

The auto insurance industry is constantly evolving, driven by advancements in technology and changing consumer expectations. Here are some key trends shaping the future of auto insurance:

- Telematics and Usage-Based Insurance: Telematics technology allows insurance companies to track driving behavior and offer policies based on how, when, and where you drive. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, uses telematics data to customize premiums based on individual driving habits. This trend is gaining traction as it rewards safe drivers with lower premiums.

- Connected Cars and Data Analytics: With the increasing connectivity of vehicles, insurance companies are leveraging data analytics to gain insights into driving behavior and vehicle performance. This data can be used to offer more personalized insurance policies and services, as well as to improve risk assessment and pricing.

- Artificial Intelligence and Machine Learning: AI and machine learning technologies are being used to automate various aspects of the insurance process, from claim handling and fraud detection to policy underwriting and pricing. These technologies can help insurance companies make more accurate risk assessments and offer more efficient and tailored policies.

- Digital Transformation and Online Services: The rise of digital technologies has led to a shift towards online and mobile insurance services. Insurance companies are investing in digital platforms and apps to offer more convenient and efficient customer experiences, including policy management, claims reporting, and payment options.

The Impact on Consumers

These emerging trends and technologies have significant implications for consumers. On the one hand, they offer the potential for more personalized and affordable insurance policies, particularly for safe and responsible drivers. Usage-based insurance, for example, can reward drivers for their good habits, leading to lower premiums.

Additionally, the increased use of data analytics and digital services can streamline the insurance process, making it more efficient and customer-centric. Policyholders can expect quicker claims processing, more transparent pricing, and easier policy management through online and mobile platforms.

However, there are also potential challenges and considerations. Privacy concerns are a key issue, as the collection and use of personal data raise questions about data protection and security. Consumers must be aware of how their data is being used and have control over its collection and sharing. Additionally, the transition to new technologies and services may require education and adaptation for some consumers, particularly those who are less tech-savvy.

Conclusion: Navigating Auto Insurance with Confidence

Buying auto insurance is a critical step in protecting yourself and others on the road. By understanding the basics of auto insurance, the factors that influence premiums, and the claims process, you can make informed decisions to find the right coverage for your needs. The auto insurance landscape is evolving, driven by technological advancements and changing consumer expectations, offering both opportunities and challenges for policyholders.

As you navigate the world of auto insurance, remember to conduct thorough research, compare policies, and choose a reputable insurance company that aligns with your needs and budget. Stay informed about emerging trends and technologies, and leverage digital tools and resources to simplify the insurance process and maximize the benefits of your coverage. With the right knowledge and tools, you can navigate auto insurance with confidence and peace of mind.

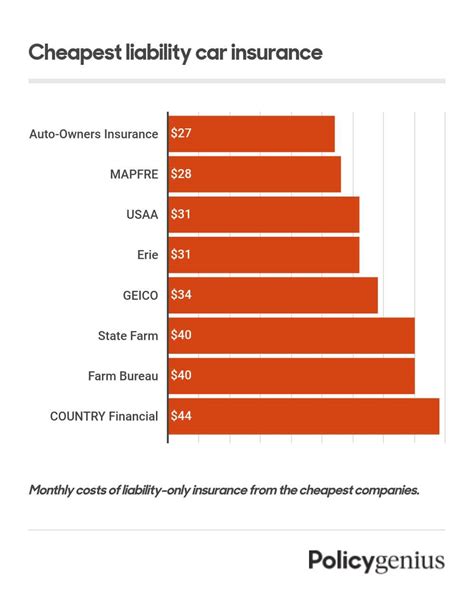

What is the average cost of auto insurance?

+The average cost of auto insurance can vary significantly depending on various factors such as your location, driving record, and the type of vehicle you own. According to recent data, the national average cost of auto insurance in the United States is approximately 1,674 per year. However, this average can range from around 1,000 to over $3,000 annually depending on individual circumstances. It’s important to obtain personalized quotes to get an accurate estimate for your specific situation.

How can I lower my auto insurance premiums?

+There are several strategies you can employ to potentially lower your auto insurance premiums. These include maintaining a clean driving record, shopping around for the best rates, taking advantage of discounts (such as safe driver discounts or multi-policy discounts), increasing your deductible, and reviewing your coverage options to ensure you’re not paying for unnecessary coverages. Additionally, some insurance companies offer discounts for vehicles equipped with safety features or for taking defensive driving courses.