How Much Liability Insurance

Understanding Liability Insurance: Coverage, Limits, and Real-World Examples

Liability insurance is a critical aspect of financial protection, offering a safety net for individuals and businesses against potential risks and lawsuits. In today's complex and dynamic world, understanding the right coverage and limits is essential to ensure you're adequately protected. This comprehensive guide will delve into the world of liability insurance, exploring the key factors that determine the amount of coverage you need and providing real-world examples to illustrate these concepts.

The Basics of Liability Insurance

Liability insurance, often referred to as "third-party insurance," is a type of coverage that protects individuals and businesses from financial losses arising from claims of injury or property damage caused to others. It's a crucial component of any risk management strategy, as it provides a financial buffer against potentially devastating lawsuits.

The principle behind liability insurance is simple: the policyholder pays a premium to the insurer, and in return, the insurer agrees to cover the costs associated with legal liabilities that arise from covered events. These events can range from personal injuries, property damage, or even defamation suits, depending on the type of policy and its specific terms and conditions.

Determining the Right Coverage Limits

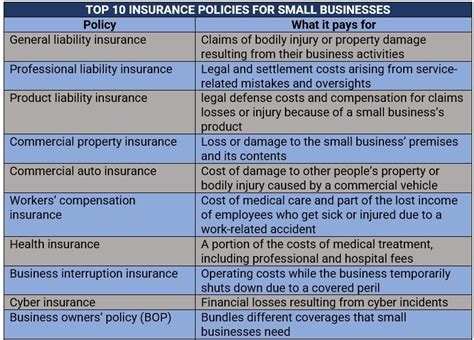

When it comes to liability insurance, one of the most crucial decisions is determining the appropriate coverage limits. These limits dictate the maximum amount an insurer will pay out for a covered claim. Here's a breakdown of the key factors to consider when setting your coverage limits:

Risk Assessment

Conducting a thorough risk assessment is the first step in determining your liability insurance needs. This involves evaluating the potential risks associated with your activities, business operations, or personal circumstances. For instance, if you own a construction company, the risks of workplace accidents or property damage are higher compared to someone working in an office setting.

Consider the following during your risk assessment:

- Nature of Business or Activities: Different industries and activities carry varying levels of risk. For example, manufacturing companies often face higher risks of product liability claims compared to service-based businesses.

- Location: The geographical location of your business or residence can also impact risk. Certain areas may have higher rates of natural disasters or crime, affecting your liability exposure.

- Historical Data: Reviewing past incidents or claims can provide valuable insights into the types of risks you've faced in the past and the potential for future occurrences.

Legal and Regulatory Requirements

Many industries and jurisdictions have specific legal requirements for liability insurance coverage. These requirements are typically set by regulatory bodies to ensure a minimum level of protection for the public. For instance, if you operate a commercial vehicle, you may be required to carry a certain amount of liability insurance to comply with transportation regulations.

It's crucial to understand these legal mandates to ensure you're not only adequately protected but also in compliance with the law.

Financial Capacity and Assets

Your personal or business financial capacity and the value of your assets play a significant role in determining liability insurance limits. The goal is to ensure that your coverage limits are sufficient to protect your financial well-being in the event of a major claim.

Consider the following when evaluating your financial capacity:

- Personal or Business Net Worth: The total value of your assets, including real estate, investments, and business equity, should be considered when setting coverage limits. The idea is to ensure that your insurance coverage can provide adequate protection for your net worth.

- Income Potential: For businesses, the potential for future earnings and growth should be factored in. A rapidly growing business may need higher coverage limits to protect its future financial prospects.

Industry Standards and Best Practices

Consulting industry standards and best practices can provide valuable guidance when determining liability insurance limits. Many industries have established benchmarks for insurance coverage based on their unique risks and legal requirements.

Industry associations and insurance brokers can offer insights into typical coverage limits for businesses in your sector. Following these standards can help ensure you're not underinsured, especially if your industry faces high risks or frequent litigation.

Real-World Examples of Liability Insurance in Action

Understanding liability insurance in the abstract can be challenging. Let's explore some real-world scenarios to illustrate how liability insurance works and the importance of adequate coverage limits.

Scenario 1: Personal Injury on Rental Property

Imagine you own a rental property, and one of your tenants slips and falls on the staircase, sustaining a serious injury. The tenant sues you for medical expenses, pain and suffering, and lost wages, totaling $500,000. If you have liability insurance with a coverage limit of $300,000, the insurer will cover the full amount, and you'll be protected from any financial loss.

However, if your coverage limit is only $100,000, you'll be responsible for the remaining $400,000, which could have severe financial implications for you.

Scenario 2: Product Liability for a Small Business

Consider a small business that manufactures and sells toys. If one of their toys is found to have a design flaw that causes injury to a child, the business could face a product liability lawsuit. The costs of such a lawsuit, including legal fees, medical expenses, and compensation, can quickly add up to millions of dollars.

If the business has liability insurance with a limit of $2 million, the insurer will provide coverage for the full amount of the claim. However, if the coverage limit is lower, the business may face significant financial strain or even bankruptcy.

Scenario 3: Professional Liability for Consultants

Professionals like consultants, accountants, or lawyers often face risks associated with the advice and services they provide. If a client suffers financial losses due to an error or omission in your advice, they may sue for damages.

For instance, an accountant who makes a mistake in a client's tax return, resulting in a large tax penalty, could be held liable. If the client sues for $100,000 in damages, having professional liability insurance with a coverage limit of $200,000 would ensure the claim is fully covered.

The Importance of Regular Review

Liability insurance needs are not static; they can change over time as your business grows, your personal circumstances evolve, or as legal and regulatory requirements shift. It's essential to regularly review and update your liability insurance coverage to ensure it remains adequate and aligned with your current risks.

Working closely with an experienced insurance broker can provide valuable insights and guidance as you navigate the complexities of liability insurance. They can help you stay informed about industry trends, regulatory changes, and best practices, ensuring your coverage remains robust and up-to-date.

Conclusion

Liability insurance is a critical tool for managing financial risks, and understanding how to determine the right coverage limits is essential. By conducting thorough risk assessments, staying informed about legal requirements, and considering your financial capacity and industry standards, you can make informed decisions about your liability insurance coverage.

Remember, liability insurance is not a one-size-fits-all solution, and what works for one individual or business may not be sufficient for another. Stay vigilant, stay informed, and work closely with insurance professionals to ensure your liability insurance provides the protection you need.

Frequently Asked Questions

What happens if my liability insurance claim exceeds my coverage limits?

+

If a liability claim exceeds your coverage limits, you become personally responsible for the excess amount. This can have severe financial consequences, potentially impacting your personal or business finances. It’s crucial to ensure your coverage limits are sufficient to protect your financial well-being.

Can I increase my liability insurance coverage limits after a claim has been made?

+

Increasing your liability insurance coverage limits after a claim has been made can be challenging. Insurers may view this as a sign of increased risk, and they may either decline to increase your limits or do so at a significantly higher premium. It’s generally advisable to review and adjust your coverage limits proactively rather than reactively.

Are there any industries or professions that require higher liability insurance limits?

+

Yes, certain industries and professions face higher risks and are therefore required to carry higher liability insurance limits. For example, medical professionals often require higher limits due to the potential severity of medical malpractice claims. Similarly, construction companies may need higher limits due to the risks associated with workplace accidents and property damage.