Claims Insurance Meaning

In the intricate world of finance and legal processes, the term "claims insurance" holds significant weight and can have a profound impact on individuals and businesses alike. This comprehensive article will delve into the depths of claims insurance, exploring its various facets, importance, and the intricate mechanisms that underpin it.

Understanding Claims Insurance

Claims insurance, at its core, represents a vital component of the broader insurance ecosystem. It is a specialized branch that focuses on the management and settlement of insurance claims, ensuring policyholders receive the benefits and compensation they are entitled to under their insurance policies.

The journey of a claim begins when an insured individual or entity experiences a loss, damage, or injury covered by their insurance policy. This could range from a minor car accident to a devastating natural disaster, or even a medical emergency. The policyholder then initiates the claims process, often by notifying their insurance provider and providing relevant details and documentation to substantiate their claim.

The insurance company, in turn, evaluates the claim based on the policy terms and conditions. This involves a meticulous assessment of the claim's validity, the extent of the loss or damage, and the applicable coverage limits. The insurer's goal is to ensure a fair and timely settlement, upholding the integrity of the insurance contract while also managing the financial implications for the company.

The Claims Process

The claims process is a critical and often intricate sequence of steps designed to facilitate the resolution of insurance claims. It typically involves the following key stages:

- Claim Initiation: The policyholder notifies the insurance company about their loss or damage, providing initial details and, if applicable, filing a formal claim form.

- Claim Investigation: The insurance company conducts a thorough investigation to gather facts, assess the extent of the loss, and determine the validity of the claim. This may involve site visits, interviews, and the review of relevant documents.

- Claims Assessment: Based on the investigation findings, the insurer assesses the claim's value, taking into account the policy coverage, deductibles, and any applicable exclusions or limitations.

- Claims Settlement: Once the claim is approved, the insurance company processes the payment or arranges for the necessary repairs or replacements. This step ensures the policyholder receives the compensation or benefits outlined in their policy.

- Post-Settlement Services: After the claim is settled, the insurance company may provide additional support, such as assisting with further repairs, offering advice on preventing future losses, or even providing emotional support in the case of traumatic events.

Each stage of the claims process is carefully managed to ensure fairness, efficiency, and compliance with legal and regulatory requirements. Insurance companies employ specialized claims adjusters and investigators who are trained to handle a wide range of claim scenarios, from simple property damage to complex liability cases.

Types of Claims Insurance

Claims insurance covers a diverse range of scenarios and is tailored to different types of insurance policies. Here are some common types of claims insurance:

- Property Claims: These involve damage to or loss of property, such as homes, vehicles, or business assets. Property claims can result from events like fires, storms, theft, or accidental damage.

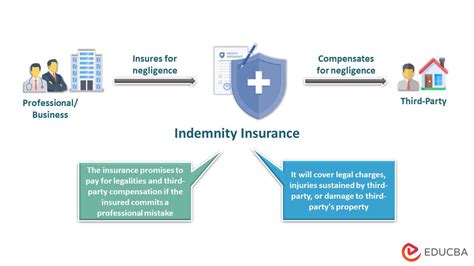

- Liability Claims: Liability insurance covers claims arising from accidental injury or property damage caused by the policyholder. This could include accidents on business premises, product defects, or professional negligence.

- Health and Medical Claims: In health insurance, claims are made for medical expenses incurred due to illness, injury, or treatment. These claims can be complex, especially when dealing with chronic conditions or specialized medical procedures.

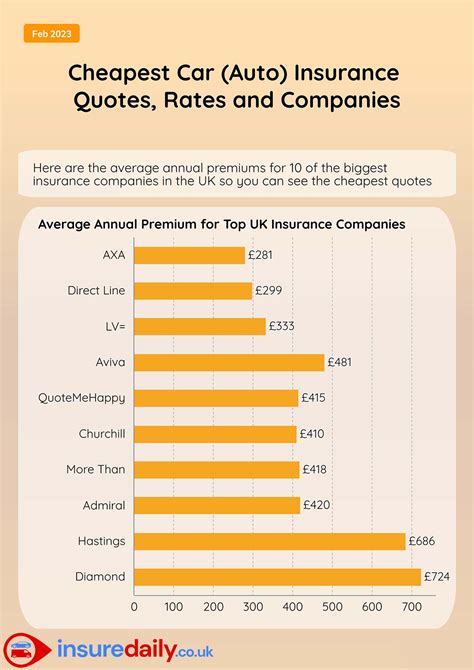

- Auto Insurance Claims: Auto insurance claims are made when a policyholder is involved in a vehicle accident. These claims cover repairs, medical expenses, and liability costs, depending on the nature of the accident and the policy coverage.

- Workers' Compensation Claims: Employers' liability insurance includes workers' compensation, which covers employees' injuries or illnesses sustained at work. These claims can be critical in ensuring employees receive the necessary medical care and compensation.

Each type of claims insurance has its unique challenges and considerations, requiring specialized expertise and processes to handle them effectively.

The Importance of Claims Insurance

Claims insurance plays a pivotal role in the insurance industry and society as a whole. Here are some key reasons why it is of utmost importance:

- Financial Protection: Claims insurance provides a safety net for individuals and businesses, offering financial protection against unforeseen events. It ensures that policyholders can recover from losses and continue their lives or operations without significant financial strain.

- Risk Mitigation: By offering coverage for various risks, claims insurance encourages individuals and businesses to take calculated risks, knowing they have a backup plan in case of adverse events. This promotes innovation and economic growth.

- Social Safety Net: In many cases, claims insurance acts as a vital social safety net, providing support to individuals during challenging times. This is particularly true for health and life insurance, which can cover substantial medical costs and offer financial stability to families.

- Legal Compliance: Insurance companies are legally obligated to handle claims fairly and promptly. Claims insurance ensures that policyholders' rights are protected and that the insurance industry adheres to regulatory standards, building trust and confidence.

- Economic Stability: The efficient management of claims insurance contributes to the overall stability of the insurance industry and the economy. It allows insurance companies to maintain solvency and continue providing coverage to a broad range of individuals and businesses.

Challenges and Future Trends

While claims insurance is a well-established practice, it faces several challenges and is evolving to meet the changing needs of policyholders and the insurance industry. Some key trends and challenges include:

- Digital Transformation: The insurance industry is embracing digital technologies to streamline the claims process. This includes the use of mobile apps for claim initiation, drone technology for damage assessment, and artificial intelligence for faster claim evaluations.

- Data Analytics: Advanced data analytics are being utilized to improve claim handling. By analyzing vast amounts of data, insurance companies can identify patterns, predict claim outcomes, and enhance fraud detection, leading to more efficient and accurate claim settlements.

- Fraud Prevention: Claims insurance is susceptible to fraud, which can significantly impact insurance companies' profitability. Insurance providers are investing in advanced fraud detection systems and collaborating with law enforcement to combat fraudulent claims.

- Regulatory Changes: The insurance industry is subject to constant regulatory changes, and claims insurance practices must adapt to comply with these updates. This includes changes in claim handling procedures, disclosure requirements, and consumer protection regulations.

- Emerging Risks: With the rise of new technologies and changing societal trends, insurance companies must continuously adapt their claims insurance practices to cover emerging risks. This includes risks associated with cyber attacks, autonomous vehicles, and environmental challenges.

The future of claims insurance is shaped by a combination of technological advancements, data-driven insights, and a commitment to continuous improvement. Insurance companies are investing in innovation to enhance the customer experience, streamline processes, and provide faster, more accurate claim settlements.

Conclusion

Claims insurance is a complex yet essential aspect of the insurance industry, providing financial protection and peace of mind to individuals and businesses. By understanding the claims process, the various types of claims insurance, and the importance it holds, we can appreciate the critical role it plays in our lives and the economy. As the insurance landscape continues to evolve, staying abreast of the latest trends and innovations in claims insurance will be key to navigating this dynamic field.

What happens if my insurance claim is denied?

+If your insurance claim is denied, you have the right to appeal the decision. Review the denial letter carefully to understand the reasons for the denial and gather any additional information or documentation that may support your claim. You can then submit an appeal, providing evidence to support your case. It’s advisable to seek legal advice if you feel the denial was unjustified.

How long does it typically take to settle an insurance claim?

+The time it takes to settle an insurance claim can vary widely depending on the type of claim, its complexity, and the insurance company’s processes. Simple claims with clear documentation may be settled within a few days or weeks. More complex claims, especially those involving extensive damage or legal disputes, can take several months or even years to resolve.

Can I choose my own repair shop for my insurance claim?

+In many cases, you have the right to choose your preferred repair shop for your insurance claim. However, some insurance companies may have preferred or approved repair networks, and using these shops can sometimes expedite the claims process. It’s important to check your policy terms and discuss your options with your insurer.