How Much Is Private Health Insurance

The cost of private health insurance can vary significantly depending on several factors, including the country or region, the specific healthcare system in place, the insurance provider, and the type of coverage desired. Understanding the factors that influence these costs is essential for individuals seeking to make informed decisions about their health coverage.

Factors Influencing the Cost of Private Health Insurance

The complexity of health insurance pricing is influenced by a multitude of variables, each playing a crucial role in determining the final cost for policyholders. These factors encompass both individual characteristics and broader market dynamics, creating a unique landscape for health insurance costs.

Individual Factors

Personal attributes significantly impact the cost of private health insurance. Age is a primary factor, with premiums often increasing as individuals grow older due to the higher likelihood of health issues. For instance, a young adult may pay significantly less for health insurance compared to a middle-aged individual.

Additionally, pre-existing medical conditions can lead to higher premiums or even coverage exclusions. Insurers carefully evaluate an applicant's medical history, and conditions like diabetes or heart disease may result in specialized plans with elevated costs.

Lifestyle choices also play a role. Smoking, for example, is a known risk factor for various health complications, leading to higher insurance costs. Similarly, obesity, which is linked to multiple health issues, can influence premium rates.

Market Factors

The broader healthcare market significantly influences insurance costs. In regions with high healthcare costs, insurance premiums tend to be higher. This is often due to expensive medical procedures, specialized treatments, or a general rise in the cost of living.

The competition among insurance providers also affects pricing. In highly competitive markets, insurers may offer more affordable plans to attract customers. Conversely, in less competitive environments, prices might be higher due to limited options.

Furthermore, the type of insurance plan chosen can greatly impact costs. Comprehensive plans offering a wide range of benefits and coverage typically cost more than basic plans with limited services. The level of customization and the inclusion of specific benefits, such as dental or vision coverage, can also affect the overall premium.

| Individual Factors | Market Factors |

|---|---|

| Age | Healthcare Costs |

| Pre-existing Conditions | Competition |

| Lifestyle Choices | Type of Insurance Plan |

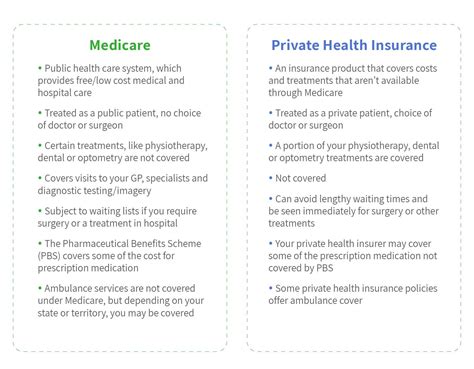

Comparing Private and Public Health Insurance Costs

When considering health insurance options, it's crucial to compare private and public (government-provided) insurance plans. The cost structure and coverage of these plans can differ significantly, and understanding these differences is essential for making an informed decision.

Private Health Insurance Costs

Private health insurance plans are typically funded by individuals or their employers. The costs of these plans are influenced by the factors mentioned earlier, including age, pre-existing conditions, and the level of coverage desired. Private insurance plans often offer a wide range of options, allowing individuals to customize their coverage based on their specific needs.

For example, a private health insurance plan might offer various tiers of coverage, from basic plans with lower premiums and limited benefits to comprehensive plans with higher premiums but more extensive coverage. These plans can include a variety of services, such as hospital stays, specialist consultations, prescription medications, and even dental and vision care.

However, it's important to note that private health insurance can be expensive, especially for individuals with pre-existing conditions or those seeking extensive coverage. The premiums can vary widely, and individuals may need to pay out-of-pocket for certain services or face deductibles and co-pays.

Public Health Insurance Costs

Public health insurance, often provided by governments, is typically funded through taxes or mandatory contributions. The cost to individuals can vary depending on the specific program and the country's healthcare system.

In some countries, public health insurance is entirely free at the point of service, meaning individuals do not pay any fees for healthcare. This is typically funded through general taxation. In other countries, there may be a mix of public and private funding, with individuals contributing a certain amount or paying for certain services out of pocket.

Public health insurance plans often have more standardized coverage, ensuring that all citizens have access to essential healthcare services. These plans may not offer the same level of customization as private plans, but they provide a safety net for basic healthcare needs.

Comparative Analysis

When comparing private and public health insurance costs, several key considerations come into play:

- Cost: Private health insurance costs can vary significantly and may be more expensive for individuals with specific health needs. Public health insurance, on the other hand, is often more affordable or even free, making it accessible to a wider range of individuals.

- Coverage: Private health insurance plans offer a broader range of coverage options, allowing individuals to tailor their plans to their specific needs. Public health insurance, while providing essential coverage, may not offer the same level of customization.

- Accessibility: Private health insurance can be more accessible to those with the financial means to afford it, especially for those with complex health needs. Public health insurance ensures that even individuals with limited financial resources have access to essential healthcare services.

Tips for Managing Private Health Insurance Costs

Managing the costs of private health insurance is crucial for maintaining financial stability while ensuring access to quality healthcare. Here are some strategies to help individuals navigate the complex world of health insurance and keep costs manageable.

Understanding Your Coverage

One of the most effective ways to manage health insurance costs is to thoroughly understand your coverage. This involves carefully reviewing your policy to know what services and treatments are covered, any limitations or exclusions, and the associated costs. By understanding your coverage, you can make more informed decisions about healthcare and avoid unexpected expenses.

Comparing Plans

Shopping around and comparing different health insurance plans can lead to significant cost savings. Each insurance provider offers a unique set of plans with varying premiums, deductibles, and coverage options. By comparing these plans, individuals can find the one that best fits their healthcare needs and budget.

Online platforms and insurance brokers can be valuable resources for comparing plans. These tools allow individuals to input their specific needs and preferences, providing a tailored list of options to consider. It's essential to consider not just the premium but also the overall value of the plan, including deductibles, co-pays, and the network of healthcare providers available.

Exploring Discounts and Subsidies

Many insurance providers offer discounts or subsidies to make health insurance more affordable. These discounts can be based on various factors, such as income level, family size, or the use of certain health services. For instance, some providers offer discounts for maintaining a healthy lifestyle or for using certain preventive care services.

Additionally, individuals should explore government-sponsored programs that provide subsidies or tax credits for health insurance. These programs are designed to make insurance more accessible, especially for low- to moderate-income households. Understanding these programs and qualifying for them can significantly reduce the cost of private health insurance.

Optimizing Your Plan

Once you've selected a health insurance plan, there are strategies to optimize your coverage and potentially reduce costs. One approach is to increase your deductible. While this may result in higher out-of-pocket costs if you need extensive medical care, it can lead to lower premiums, especially if you're generally healthy and don't anticipate significant medical expenses.

Another strategy is to take advantage of preventive care services. Many insurance plans cover these services at little to no cost, and utilizing them can help identify potential health issues early on, potentially preventing more costly treatments down the line. This includes regular check-ups, screenings, and immunizations.

Lastly, staying informed about changes to your plan and the broader healthcare landscape is crucial. Insurance providers may adjust their plans annually, and understanding these changes can help you make informed decisions about your coverage. Additionally, keeping up with healthcare news and trends can provide insights into new treatments, technologies, and policies that may impact your insurance costs and coverage.

The Future of Health Insurance Costs

Looking ahead, the landscape of health insurance costs is expected to undergo significant transformations. These changes are driven by evolving healthcare technologies, shifting demographics, and policy reforms, all of which will influence the affordability and accessibility of private health insurance.

Technological Advances

The integration of advanced technologies into healthcare is poised to revolutionize the industry. From artificial intelligence-driven diagnostics to remote monitoring devices, these innovations have the potential to reduce costs and improve patient outcomes. For instance, AI-powered diagnostic tools can provide accurate diagnoses more efficiently, potentially reducing the need for costly specialized consultations.

Additionally, telemedicine is gaining traction, offering convenient and affordable healthcare services. Patients can now consult with healthcare professionals remotely, reducing the need for in-person visits and associated travel costs. This trend is expected to continue, making healthcare more accessible and cost-effective.

Demographic Shifts

The aging global population will have a profound impact on health insurance costs. As the proportion of older individuals increases, the demand for healthcare services will rise, leading to potential increases in insurance premiums. However, this trend also presents opportunities for insurers to develop specialized plans catering to the unique healthcare needs of this demographic.

Policy Reforms

Policy changes at the governmental level can significantly influence health insurance costs. Reforms aimed at improving affordability and accessibility, such as expanding Medicaid coverage or implementing subsidies, can make private health insurance more attainable for a broader range of individuals. Conversely, policy shifts that reduce government involvement in healthcare may lead to higher insurance costs for certain segments of the population.

Industry Innovations

The private health insurance industry is continuously innovating to stay competitive and meet the evolving needs of consumers. This includes developing new insurance models, such as value-based insurance, which links insurance premiums to the quality of healthcare outcomes. Such models incentivize healthcare providers to deliver high-quality, cost-effective care, potentially reducing overall healthcare costs.

Furthermore, insurers are leveraging data analytics to develop more personalized insurance plans. By analyzing individual health data, insurers can offer tailored coverage and pricing, ensuring that consumers pay for the specific risks they pose. This precision-based approach has the potential to make health insurance more affordable and equitable.

Conclusion

The cost of private health insurance is a complex topic influenced by various factors, including individual characteristics, market dynamics, and the type of coverage desired. Understanding these factors is crucial for individuals seeking to make informed decisions about their health coverage. While private health insurance can be costly, especially for those with specific health needs, there are strategies to manage these costs and ensure access to quality healthcare.

Looking to the future, the landscape of health insurance costs is poised for significant changes. Technological advancements, demographic shifts, policy reforms, and industry innovations will all play a role in shaping the affordability and accessibility of private health insurance. By staying informed about these developments, individuals can make proactive decisions about their health coverage, balancing their healthcare needs with financial considerations.

How can I find out the exact cost of private health insurance for my specific needs and location?

+The exact cost of private health insurance can vary greatly depending on your location, age, health status, and the level of coverage you require. To get an accurate estimate, it’s recommended to use online insurance comparison tools or consult with an insurance broker who can provide personalized quotes based on your specific circumstances.

Are there any ways to reduce the cost of private health insurance without sacrificing coverage?

+Yes, there are several strategies to reduce private health insurance costs while maintaining adequate coverage. These include increasing your deductible (the amount you pay out-of-pocket before insurance coverage kicks in), opting for a health savings account (HSA) or flexible spending account (FSA) to save on pre-tax healthcare expenses, and taking advantage of employer-sponsored wellness programs that may offer discounts or incentives for participating in healthy activities.

What are some common exclusions or limitations in private health insurance plans that I should be aware of?

+Private health insurance plans often have exclusions and limitations, which can vary depending on the provider and the specific plan. Common exclusions may include certain pre-existing conditions, elective procedures, mental health services, and alternative or complementary therapies. It’s crucial to carefully review the policy documents to understand what is and isn’t covered to avoid unexpected out-of-pocket expenses.