How Much Is Insurance Car

Understanding the cost of car insurance is essential for every vehicle owner. The price of insurance can vary significantly based on numerous factors, and it's crucial to have a comprehensive understanding of these variables to make informed decisions when choosing an insurance policy. This article aims to provide an in-depth analysis of the factors influencing car insurance rates and offer insights into how you can find the best coverage at an affordable price.

The Cost of Car Insurance: A Comprehensive Guide

The cost of car insurance is a multifaceted topic, influenced by a wide range of factors. From your personal details and driving history to the type of vehicle you own and the location you live in, each element plays a role in determining the price you pay for insurance coverage. By breaking down these factors and exploring them in detail, we can gain a clearer understanding of how insurance companies calculate their rates and what steps you can take to find the most cost-effective policy for your needs.

Your Personal Details and Driving History

One of the primary factors that insurance companies consider when determining your insurance premium is your personal information and driving record. This includes your age, gender, and marital status, as well as your driving history. Younger drivers, for instance, are often considered higher risk and may face higher insurance premiums. Similarly, if you have a history of accidents or traffic violations, insurance companies may view you as a higher risk and charge a higher premium.

Here's a breakdown of how personal details and driving history can impact your insurance costs:

- Age: Younger drivers (under 25) and older drivers (over 65) often pay more due to higher perceived risk.

- Gender: In some regions, gender is a factor, with young male drivers often facing higher premiums.

- Marital Status: Married individuals may benefit from lower premiums, as insurance companies view marriage as a stability factor.

- Driving History: A clean driving record with no accidents or violations can lead to significant savings.

The Type of Vehicle You Drive

The make, model, and year of your vehicle are also crucial factors in determining your insurance premium. Insurance companies consider the cost of repairs, the frequency of accidents involving your vehicle type, and the likelihood of theft or vandalism. Sports cars, luxury vehicles, and SUVs often have higher insurance costs due to their higher repair costs and potential for accidents.

| Vehicle Type | Average Insurance Cost |

|---|---|

| Sports Cars | $2,500 - $3,000 annually |

| Luxury Sedans | $1,800 - $2,200 annually |

| Compact Cars | $1,200 - $1,500 annually |

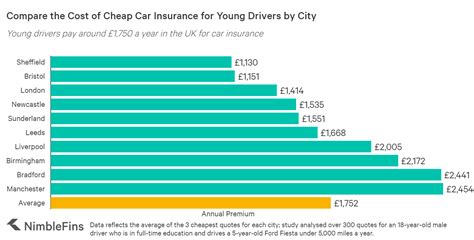

Your Location

The area where you live and where you typically drive your vehicle plays a significant role in determining your insurance premium. Insurance companies consider factors such as the density of traffic, the frequency of accidents, and the rate of crime in your area. Urban areas often have higher insurance costs due to increased traffic and the potential for accidents and theft.

Additionally, some states or regions have higher average insurance costs due to various factors, including state-specific laws and the overall risk profile of the area. For instance, states with a high rate of uninsured drivers may have higher average insurance premiums to compensate for the increased risk.

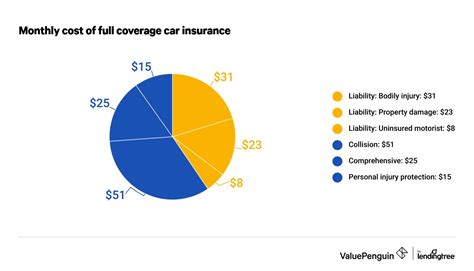

Coverage Options and Deductibles

The type of coverage you choose and the deductible you select can also significantly impact your insurance premium. Comprehensive coverage and collision coverage, which protect against damage to your vehicle, typically increase your premium. On the other hand, choosing a higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) can lower your premium.

It's essential to strike a balance between the coverage you need and the premium you can afford. While comprehensive coverage may offer more protection, it's crucial to ensure that the increased premium doesn't strain your budget. Similarly, while a higher deductible can lower your premium, it's important to consider whether you can afford the deductible in the event of an accident or claim.

Discounts and Bundling

Insurance companies often offer a range of discounts that can significantly reduce your insurance premium. These discounts can include safe driver discounts, multi-policy discounts (for bundling your car insurance with other policies like home or life insurance), and loyalty discounts for long-term customers.

Additionally, many insurance companies offer discounts for specific professions, such as teachers, military personnel, and government employees. Some companies also provide discounts for vehicle safety features like anti-theft devices, airbags, and advanced driver-assistance systems.

Comparison Shopping and Provider Reputation

Finally, it’s essential to shop around and compare quotes from multiple insurance providers. Different companies have different risk assessments and pricing structures, so getting quotes from several providers can help you find the best deal for your specific situation.

Additionally, consider the reputation and financial stability of the insurance provider. While cost is an important factor, it's equally important to choose an insurer with a strong track record of paying claims promptly and providing excellent customer service. Reading reviews and checking ratings from independent agencies like AM Best or J.D. Power can help you assess an insurer's reputation.

Conclusion: Finding the Right Balance

The cost of car insurance is influenced by a multitude of factors, from your personal details and driving history to the type of vehicle you drive and your location. By understanding these factors and exploring all available options, you can make informed decisions to find the best insurance coverage at a price that fits your budget.

Remember, while finding the lowest premium is important, it's equally crucial to ensure that the coverage you choose meets your needs. By striking the right balance between cost and coverage, you can protect yourself and your vehicle without breaking the bank.

Frequently Asked Questions

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies by state and can range from 500 to 1,500 per year. However, these averages can be significantly higher or lower depending on individual circumstances and the specific coverage options chosen.

Are there ways to lower my insurance premium without sacrificing coverage?

+Yes, there are several strategies to reduce your insurance premium. These include shopping around for quotes from multiple providers, exploring available discounts (e.g., safe driver, multi-policy, profession-specific), and considering a higher deductible. It’s important to balance cost savings with the level of coverage you need.

How does my credit score impact my car insurance premium?

+In many states, insurance companies use credit-based insurance scores to help determine your premium. Generally, individuals with higher credit scores are seen as lower risk and may qualify for lower insurance rates. However, the use of credit scores in insurance pricing is a controversial topic, and some states have banned this practice.

Can I get car insurance if I have a poor driving record?

+Yes, it’s possible to obtain car insurance even with a poor driving record. However, insurance companies may charge higher premiums or exclude certain coverage options for individuals with a history of accidents or violations. Shopping around and comparing quotes can help you find the best available rates in such situations.

Are there any discounts available for environmentally friendly vehicles?

+Some insurance companies offer discounts for hybrid or electric vehicles, as they are generally considered safer and more environmentally friendly. These discounts can vary depending on the insurer and the specific vehicle model. It’s worth inquiring about such discounts when obtaining quotes.