How Much Auto Insurance Do I Need

Determining the right amount of auto insurance coverage is a crucial decision that can significantly impact your financial well-being and peace of mind. With a myriad of options and varying state requirements, it's essential to understand your specific needs and the potential risks associated with driving. This comprehensive guide aims to provide you with expert insights and practical tips to help you navigate the complex world of auto insurance and make an informed decision tailored to your circumstances.

Understanding Your Auto Insurance Needs

The first step in determining your auto insurance coverage is to assess your unique situation and potential risks. Consider the following factors:

State-Specific Requirements

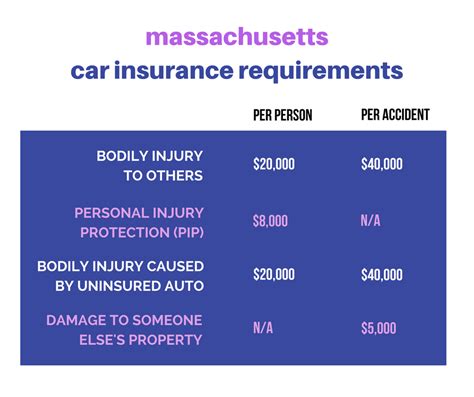

Every state in the US has its own set of mandatory insurance requirements. These typically include liability coverage, which protects you if you’re at fault in an accident. However, the minimum limits vary widely, and they might not be sufficient to cover all your potential liabilities. For instance, while the minimum liability coverage in Massachusetts is 20,000 per person and 40,000 per accident for bodily injury, and 5,000 for property damage, the limits in <strong>Florida</strong> are significantly lower at 10,000 for property damage and 10,000/20,000 for bodily injury.

| State | Bodily Injury (per person) | Bodily Injury (per accident) | Property Damage |

|---|---|---|---|

| Massachusetts | $20,000 | $40,000 | $5,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| California | $15,000 | $30,000 | $5,000 |

It's crucial to understand your state's specific requirements to ensure you're meeting the legal minimums. However, as we'll discuss later, these minimums may not provide adequate protection in the event of a serious accident.

Vehicle Value and Usage

The type and value of your vehicle play a significant role in determining your insurance needs. If you drive an older vehicle with a low market value, you might consider purchasing only the state-mandated liability coverage and forgoing comprehensive and collision coverage, which can be costly. However, if you own a newer or luxury vehicle, these additional coverages might be worth the investment to protect your asset.

Additionally, consider how you use your vehicle. If you primarily drive for pleasure or short commutes, you might not need as much coverage as someone who drives for work or long distances regularly. The more you drive, the higher your risk of being involved in an accident, which could impact your insurance needs.

Personal Liability and Financial Stability

Auto insurance is primarily designed to protect you from financial loss in the event of an accident. Therefore, it’s essential to consider your personal liability and financial stability when determining your coverage needs. If you have significant assets or a high income, you might want to opt for higher liability limits to protect yourself from potential lawsuits. Conversely, if you have limited financial means, you might need to strike a balance between adequate coverage and affordability.

Types of Auto Insurance Coverage

Now that we’ve discussed some of the factors influencing your insurance needs, let’s delve into the different types of auto insurance coverage available and how they can protect you.

Liability Coverage

Liability coverage is the most fundamental type of auto insurance and is typically mandatory in most states. It provides protection if you’re found at fault in an accident, covering the costs of injuries and damages you cause to others. This includes medical expenses, lost wages, and property damage.

While state-mandated minimum limits can vary widely, it's generally recommended to purchase higher liability limits. This is because the costs of a serious accident can quickly exceed these minimums, leaving you vulnerable to significant financial loss. For example, if you cause an accident that results in severe injuries or substantial property damage, the victims could sue you for amounts far exceeding the minimum liability limits.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional types of insurance that provide protection for your own vehicle. Collision coverage pays for repairs or the replacement cost of your vehicle if you’re involved in an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, covers damages caused by events other than accidents, such as theft, vandalism, natural disasters, or collisions with animals.

If you have a loan or lease on your vehicle, the lender will typically require you to carry collision and comprehensive coverage. Even if you own your vehicle outright, these coverages can be valuable, especially if your vehicle is still in good condition and would be costly to replace.

| Coverage Type | Description |

|---|---|

| Collision | Covers repairs or replacement costs for your vehicle if you're involved in an accident, regardless of fault. |

| Comprehensive | Provides protection for damages caused by events other than accidents, such as theft, vandalism, or natural disasters. |

Additional Coverages

In addition to the standard coverages, there are several optional add-ons that can enhance your auto insurance policy. These include:

- Medical Payments Coverage: This coverage pays for the medical expenses of you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Rental Car Reimbursement: Provides coverage for a rental car if your vehicle is being repaired or replaced due to a covered loss.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan if your car is totaled.

Determining the Right Amount of Coverage

So, how much auto insurance do you actually need? The answer depends on your unique circumstances and the level of risk you’re comfortable with. Here are some steps to help you determine the right amount of coverage:

Assess Your Risks

Start by evaluating your personal situation and the risks you face on the road. Consider factors such as your driving record, the value of your vehicle, your financial stability, and the frequency and distance of your drives. If you have a clean driving record and primarily use your vehicle for short commutes, you might not need as much coverage as someone with a history of accidents or who drives long distances regularly.

Set Your Liability Limits

As we discussed earlier, it’s generally recommended to purchase liability limits that exceed your state’s minimum requirements. A good rule of thumb is to aim for limits of at least 100,000 per person and 300,000 per accident for bodily injury, and $100,000 for property damage. However, if you have significant assets or a high income, you might want to consider even higher limits to fully protect yourself.

Evaluate Your Vehicle’s Value

If you own an older vehicle with a low market value, you might decide to skip collision and comprehensive coverage, especially if you can afford to repair or replace the vehicle out of pocket. However, if you have a newer or valuable vehicle, these coverages can provide essential protection.

Consider the cost of repairing or replacing your vehicle, and choose deductibles that you're comfortable paying out of pocket. Higher deductibles can lower your insurance premiums, but make sure you can afford the deductible amount if you need to file a claim.

Consider Your Budget

Auto insurance is a significant expense, and it’s important to find a balance between adequate coverage and affordability. Review your budget and determine how much you can reasonably allocate towards insurance premiums. While it’s tempting to opt for the cheapest policy, remember that it might not provide sufficient protection in the event of an accident.

Shopping for Auto Insurance

Now that you have a better understanding of your insurance needs, it’s time to start shopping for policies. Here are some tips to help you find the right coverage at the best price:

Compare Multiple Quotes

Insurance rates can vary significantly between providers, so it’s essential to compare quotes from multiple companies. Online quote comparison tools can be a convenient way to quickly get an overview of different policies and prices. However, be sure to also speak with insurance agents to understand the specifics of each policy and ensure you’re getting the coverage you need.

Understand Policy Details

When comparing policies, pay close attention to the coverage limits, deductibles, and any exclusions or limitations. Make sure you understand what’s covered and what’s not. Don’t hesitate to ask questions or seek clarification if you’re unsure about any aspect of a policy.

Choose a Reputable Insurer

While price is an important factor, it shouldn’t be the only consideration. Make sure to choose an insurer with a solid reputation for financial stability and customer service. Check ratings from independent agencies like AM Best or Standard & Poor’s, and read reviews from current and former customers to get a sense of the insurer’s reliability and responsiveness.

Conclusion

Determining the right amount of auto insurance coverage is a critical decision that requires careful consideration of your unique circumstances and potential risks. By understanding your state’s requirements, assessing your vehicle’s value, evaluating your personal liability, and shopping around for the best policy, you can ensure you have the coverage you need at a price you can afford. Remember, auto insurance is designed to protect you from financial loss, so don’t skimp on coverage just to save a few dollars.

How much does auto insurance typically cost?

+The cost of auto insurance can vary widely depending on several factors, including your driving record, the type and value of your vehicle, your location, and the coverage limits you choose. On average, drivers in the US pay around $1,500 per year for auto insurance, but this can range from a few hundred dollars to several thousand dollars.

What happens if I’m involved in an accident and don’t have enough insurance coverage?

+If you’re involved in an accident and your insurance coverage isn’t sufficient to cover the damages, you could be held personally liable for the remaining amount. This could result in significant financial loss, especially if the accident was severe and resulted in extensive injuries or property damage.

Can I get discounts on my auto insurance premiums?

+Yes, many insurance companies offer discounts to policyholders. Common discounts include safe driver discounts, multi-policy discounts (if you bundle your auto insurance with other types of insurance, such as home or renters insurance), and loyalty discounts for long-term customers. Some insurers also offer discounts for specific occupations or affiliations, such as teachers or military personnel.