How Does Term Life Insurance Work

Term life insurance is a popular and straightforward form of protection that offers financial security to individuals and their families during a specified period. Unlike permanent life insurance policies that provide coverage for an individual's entire life, term life insurance policies have a defined term, typically ranging from 10 to 30 years. This article will delve into the mechanics of term life insurance, exploring its features, benefits, and how it can provide peace of mind during life's uncertainties.

Understanding Term Life Insurance

Term life insurance is designed to offer temporary financial protection to policyholders and their beneficiaries. It is often sought by individuals who are looking for a cost-effective way to safeguard their loved ones' financial well-being in the event of an untimely death. The policy provides a death benefit, which is a predetermined sum paid to the beneficiary upon the insured person's demise during the term of the policy.

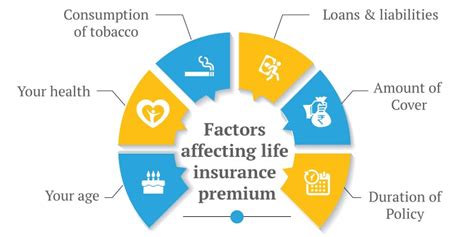

One of the key advantages of term life insurance is its affordability. Compared to permanent life insurance, term policies are generally more budget-friendly, making them an accessible option for many individuals and families. The lower cost is due to the limited coverage period and the fact that term insurance does not build cash value over time.

Key Features and Benefits

Death Benefit

The primary benefit of term life insurance is the death benefit. This is the sum of money paid to the policyholder’s beneficiary if the insured person passes away during the policy’s term. The death benefit can be used to cover various financial needs, such as funeral expenses, outstanding debts, mortgage payments, or providing for dependents’ future education and living expenses.

| Policy Type | Death Benefit Amount |

|---|---|

| Standard Term Life | $250,000 to $1,000,000 |

| Enhanced Term Life | $1,000,000 and above |

Renewable and Convertible Options

Many term life insurance policies offer the flexibility of renewal and conversion. At the end of the initial term, policyholders can often renew their coverage for an additional period, typically at a higher premium due to the increased risk associated with aging. Additionally, some policies allow conversion to a permanent life insurance plan, ensuring continued coverage without the need for a medical exam.

Simplified Underwriting Process

Term life insurance often has a simplified underwriting process compared to permanent life insurance. This means that applicants may need to undergo a medical exam and provide detailed health information. The process is designed to be efficient, allowing individuals to secure coverage relatively quickly, especially for shorter-term policies.

Level Premiums

Term life insurance policies typically offer level premiums, which means the cost of coverage remains the same throughout the policy’s term. This predictability allows policyholders to budget effectively and ensures that their insurance costs remain stable over time.

Who Should Consider Term Life Insurance

Young Families and Individuals

Term life insurance is particularly beneficial for young families or individuals with financial dependencies. It provides a cost-effective way to protect their loved ones’ financial future, ensuring that they can maintain their standard of living and cover essential expenses in the event of an untimely death.

Those with Short-Term Financial Goals

Individuals with short-term financial goals, such as paying off a mortgage or providing for children’s education, can benefit from term life insurance. By choosing a policy term that aligns with these goals, they can ensure that their beneficiaries receive the necessary funds to achieve these milestones even if the worst were to happen.

Budget-Conscious Individuals

For those on a tight budget, term life insurance offers an affordable way to obtain substantial coverage. The predictable premiums and limited coverage period make it an attractive option for individuals who want to prioritize financial protection without breaking the bank.

Performance and Real-World Examples

Case Study: Providing for a Family’s Future

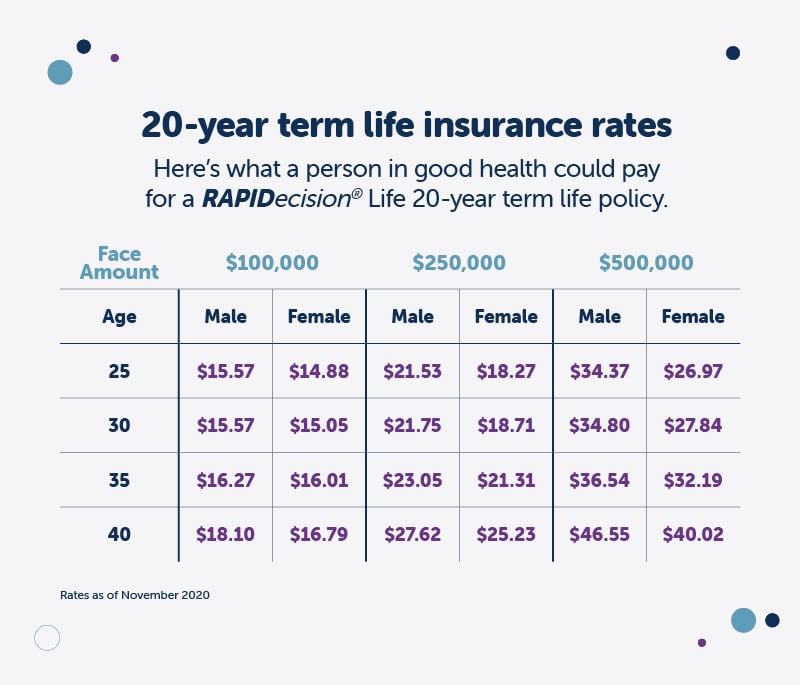

Consider the case of John, a 35-year-old married father of two young children. John and his wife, Sarah, realize the importance of financial security and decide to purchase a 20-year term life insurance policy with a $500,000 death benefit. Unfortunately, John passes away unexpectedly when their children are still in elementary school.

The $500,000 death benefit from John's term life insurance policy provides Sarah with the financial means to cover funeral expenses, pay off their mortgage, and establish a trust fund for their children's education. This real-world example highlights how term life insurance can offer crucial financial support during a family's time of need.

Performance Metrics

Term life insurance policies are known for their simplicity and efficiency. Here are some key performance metrics to consider:

- Claim Settlement Rate: Term life insurance policies typically have a high claim settlement rate, ensuring that beneficiaries receive the death benefit promptly.

- Policy Persistence: The persistence rate, which measures the percentage of policies that remain in force, is generally high for term life insurance, indicating that policyholders find value in the coverage.

- Premium Affordability: One of the most appealing aspects of term life insurance is its affordability. On average, term life insurance premiums can be up to 10 times lower than permanent life insurance policies, making it accessible to a broader range of individuals.

Future Implications and Expert Insights

Term life insurance continues to be a popular choice for individuals seeking temporary financial protection. Its affordability, flexibility, and straightforward nature make it an attractive option for many. As the insurance industry evolves, term life insurance policies are likely to become even more accessible and tailored to meet the diverse needs of policyholders.

Conclusion

Term life insurance is a vital tool for individuals and families seeking temporary financial protection. Its accessibility, affordability, and flexibility make it a popular choice for those looking to secure their loved ones’ financial future. By understanding the features and benefits of term life insurance, individuals can make informed decisions to safeguard their families during life’s uncertainties.

Frequently Asked Questions

Can I renew my term life insurance policy after the initial term expires?

+Yes, many term life insurance policies offer the option to renew coverage for an additional term. However, the premium may increase as you get older, reflecting the higher risk associated with aging.

Are medical exams always required for term life insurance applications?

+While medical exams are common for term life insurance, some insurers offer simplified issue policies that may not require a medical exam. These policies typically have a lower coverage amount and are designed for individuals with simpler health histories.

Can I convert my term life insurance policy to a permanent life insurance plan?

+Yes, many term life insurance policies allow conversion to permanent life insurance plans, such as whole life or universal life insurance. This conversion typically occurs without the need for a medical exam and can be a great way to ensure continued coverage as your financial needs evolve.

How do I choose the right term length for my term life insurance policy?

+When selecting a term length, consider your financial goals and dependencies. For example, if you have young children and want to ensure their financial security until they become independent, a term length that covers their education and early career years might be appropriate. Consult with a financial advisor or insurance agent to determine the best term length for your specific circumstances.